Video Reviews

240 TaxJar Reviews

Overall Review Sentiment for TaxJar

Log in to view review sentiment.

I love TaxJar as a tax reference. It makes it easy to cross check my tax accountant. Review collected by and hosted on G2.com.

It doesn't seem it works as well on its own - and recommend having a tax accountant to review alongside. Review collected by and hosted on G2.com.

Most important: pricing described by sales was the price charged when we signed up, and free filings at start helped us begin. The salesman was more than a salesman; he was great at technical support and explanations. He made it very easy to get started.

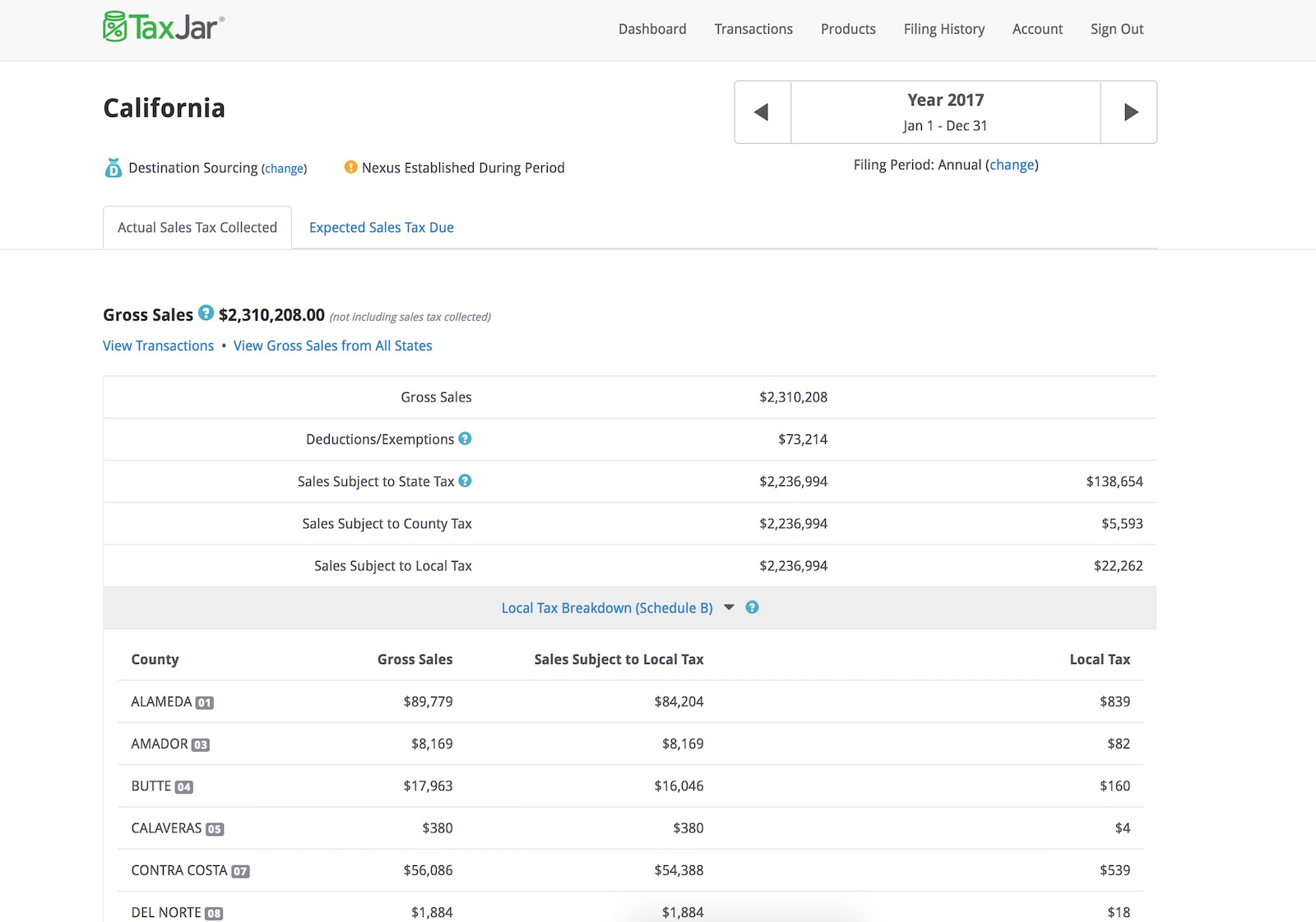

The service is reliable, the interface intuitive, and the dashboard easy to use. Support via email is rapid, concise, and helpful. Prompt communication of any changes and updates helps keep us "on top" of state regulations.

It is very easy to download transactions into Excel for further analysis, and in fact I often find TaxJar's transaction downloads preferable (easier to use) to the reports on the marketplace websites.

Prior to signing with TaxJar we talked with several other automation vendors, and we chose TaxJar. We have never regretted it. Review collected by and hosted on G2.com.

Very little to dislike! Voice support would be nice, but email works well. Review collected by and hosted on G2.com.

Once we set up Autofile, our entire sales tax filing was automated. Taxjar files 20 states for us, and we don't have to track it monthly after the initial setup it's set up. We've been using them for 3 years now and they have been filing out sales tax in multiple states without issue. Its also really affordable compared to paying accountants to file a return each month which is triple the cost. Review collected by and hosted on G2.com.

Tax Jar will not register each state you wish to file in for sales tax. You need to hire a third-party service or do it yourself. I wish they could do it in-house and set up Autofile. Taxjar also doesnt easily display the information you need to file returns on your own, its all there but you need to transcribe it to the sales tax forms if you dont use Autofile. Just using autofile and this wont be a problem. Review collected by and hosted on G2.com.

TaxJar is very simple and easy to get started without signing any long-term contracts. If you like it and want to keep using it the pricing can't be beaten either. Review collected by and hosted on G2.com.

I wish there were more categories but they have been adding them over the past year. Review collected by and hosted on G2.com.

Easy to use for the most part - data flows in and reports come out. Review collected by and hosted on G2.com.

Hard to reach someone to speak with about any questions or issues...long hold times if calling in and long waits for response to email inquiries. Review collected by and hosted on G2.com.

I like that the dashboard is ordered by return date so you know which returns need to be filed by when. I also like the filing history so that I can figure out if I've missed any filing periods. Review collected by and hosted on G2.com.

I would like it if it were easy to see historical periods for which you didn't file a return. That way it would be even less likely for a user to miss tax obligations. Review collected by and hosted on G2.com.

Taxjar allows us to sync our WooCommerce orders and calculate sales tax quarterly to be paid to the state. It is easy to setup, you input your company details on the TaxJar website, and the WooCommerce plugin will create tax codes for you automatically based on your determined nexus (which states you operate in or would have a responsibility to collect sales tax). They also offer automatic filing options for a reasonable fee, but I have not tried that feature yet. Review collected by and hosted on G2.com.

Not many complaints about it, maybe the fact that once an order enters the Sync Queue it doesn't sync right away. I believe there must be some type of interval when TaxJar initiates a sync, so I just leave and come back later and the sync is finished. The syncing happens automatically, so it is not usually an issue. Also, on the TaxJar website, their user interface can be difficult to find transactions for prior quarters, and so I have to click around a bit to remember how those are accessed. Review collected by and hosted on G2.com.

State/municipality sales tax compliance; it's an absolute headache to manage tax compliance when running an online business that sells real products. Some marketplaces are finally starting to do the collecting themselves, but I never would have gotten where I am today without TaxJar.

And of course, the sales tax submission! Calculating the rates and monies owed was one thing, but TaxJar files your payments quarterly for you. I never had to think about it. And if something happened, like there was a disconnect between the government tax agency and TaxJar, I received an email notifying me off the need to fix the issue. Review collected by and hosted on G2.com.

There could be more transparency about which marketplaces are collecting for you, eliminating the need to account for it in TaxJar. But this is more about marketing than function. Review collected by and hosted on G2.com.

Super easy to use. Takes the guess work out of doing my taxes. I'm am the least business oriented person ever. I'm not good with math. When I submit my taxes with taxjar I know it's done right. It only takes me a couple minutes to get it done which is key being a mother of 3 young kids. My husband set up quick an easy excel sheet that calculates things for and I just input that info into my taxjar. Review collected by and hosted on G2.com.

No dislikes so far. I was able to figure it out real easy. I'm not a fan of having to pay $20 a month for it when I only use it 4 times a year. I wish I could pay per use. Review collected by and hosted on G2.com.

Using the TaxJar API, we can calculate sales tax for all areas of New York which is tricky since NY sales tax is destination based. If we ultimately need to file taxes for more jurisdictions, it would be easy to expand to collecting for tax multiple states. Auto-filing is painless, no more late returns! Review collected by and hosted on G2.com.

Our initial implementation of TaxJar made too many useless API calls and we got charged a lot of extra money until we noticed and fixed it. Someone from TaxJar actually notified us that we were making many invalid calls and we were able to fix the problem once we were aware of it. I would like it if they added support for collection EU VAT taxes given the changes coming in the summer of 2021 for european VAT collection. Not sure if that is on their radar of not. Review collected by and hosted on G2.com.