Video Reviews

2,079 Ramp Reviews

Overall Review Sentiment for Ramp

Log in to view review sentiment.

I love that Ramp combines the credit card with expense reporting so everything is consolidated in one place. It has also helped that our credit limit(s) are based on our checking account balances and do not have to be tied to one individual's credit history. We were able to quadruple our purchasing power when we switched to Ramp from a main stream credit card company. We also love that we earn cash instead of points as we are able to apply it to our balance and reduces our monthly payment. I love the fact that when we reach 80% of our credit limit, we can set Ramp up to automatically pay down our balance so we never run out of available credit. Review collected by and hosted on G2.com.

I did find it interesting that Ramp did not have an app until recently. I do not like the fact that when splitting a charge, I can't tab between fields - I have to move my mouse and click. I am very much a keyboard shortcut person. Other than that, there are not a lot of things that I dislike about Ramp. Review collected by and hosted on G2.com.

Ramp has been extremely easy to migrate to from our previous system. Cardholders love how easy it is to submit expenses and that it provides multiple integrations so they don't have to upload every receipt. The AI built in to Ramp is top notch. It has reduced the amount of time I spend managing corporate cards each month and has reduced the amount of time cardholders and approvers spend on corporate cards. Ramp is great for finance teams where you're juggling multiple hats. Ramp physical and virtual cards can be added to Google/Apple Pay and that's helpful. Ramp just makes life easier. Review collected by and hosted on G2.com.

There is really only one thing I can think of that is a drawback for us. Our previous system allowed us to issue multiple physical cards to one person when necessary. Ramp only allows for one physical card per person, but allows for multiple virtual cards per person. Review collected by and hosted on G2.com.

Ramp is easy to use to pay our affiliates and influencers. This is important since we pay our affiliates every week and we are constantly paying our influencers. We use PayPal for paying many of our affiliates but some people don't want to use PayPal and some international affiliates can't use PayPal in their country. It's easy to set up a new affiliate payment by creating a new vendor. We don't even need to have the affiliate's bank info because we can have Ramp request it directly from the affiliate. International payments are just as easy to set up. We have used Wise for some international payments since their international fee is negligible, but several affiliates had issues getting Wise set up to receive U.S. payments. Once the vendor is created it's easy to make additional payments as needed.

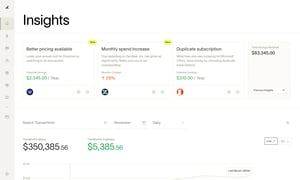

Our business credit cards are also through Ramp; we even earn cash back on purchases. With everything in one place and divided into categories, Ramp reports easily let us see where we are spending the most and compare to previous months.

We don't need customer support very often as most things are straightforward for what we are using. The occasional time we did have a question Ramp responded almost immediately and answered our questions. Review collected by and hosted on G2.com.

We are charged a $20 wire fee for each international payment. This price is consistent with our bank's fee but It would be nice if Ramp charged the same $4.99 as PayPal. It would also be nice if Ramp offered instant payments like PayPal. Review collected by and hosted on G2.com.

Ramp has been the best thing for our business since sliced bread. It makes life so easy to report transactions and capture receipts. Also issuing cards to new employees could not be easier Review collected by and hosted on G2.com.

Honestly, I haven't found much that we dislike about Ramp. I wish we could customize the cards more to match our branding as a company but that's small things. Review collected by and hosted on G2.com.

My favorite feature is the bill pay function and receipt forwarding as well as sync to QBO Online Review collected by and hosted on G2.com.

My lease favorite function is that bill pay is not sold separately and AP is not created real time for bill pay. Review collected by and hosted on G2.com.

This totally elimates the need for expense reports by the team. It can give you control over spend. The interface with Intuit is amazing. Best accounting time saver. Review collected by and hosted on G2.com.

Not much to dislike. Going well. We have not had any issues. Review collected by and hosted on G2.com.

Ramp is incredibly intuitive. It helps us seamlessly track our spending and onboard new team members quickly. Review collected by and hosted on G2.com.

Sometimes the suggested memos for purchases are incorrect, but it saves a lot of time when the suggested memos are correct! Review collected by and hosted on G2.com.

Our team loves the app and the easy notifications to approve expenditures, raise credit limited, and create virtual cards for recurring expenses. Intergration with Quickbooks is faultless. The Bill Pay feature has allowed us to go almost completely paperless. The approval process is all online and payments are made by ACH or mailed by Ramp. We can also add external approvers like a board treasurer to the approval flow.

I may only print and sign 2-3 checks a month now for local vendors who need immediate payment on delivery. For us, it's the total package.

PS You can lock credit cards for team members who don't fulfill the requirements within a set period of time like adding a receipt and a description of the expense. Talk about good motivation for sales people! Review collected by and hosted on G2.com.

Since approvals are made on each expense, it can be more time-consuming for managers used to simply reviewing a monthly statement. Review collected by and hosted on G2.com.