Video Reviews

195 Authorize.net Reviews

Overall Review Sentiment for Authorize.net

Log in to view review sentiment.

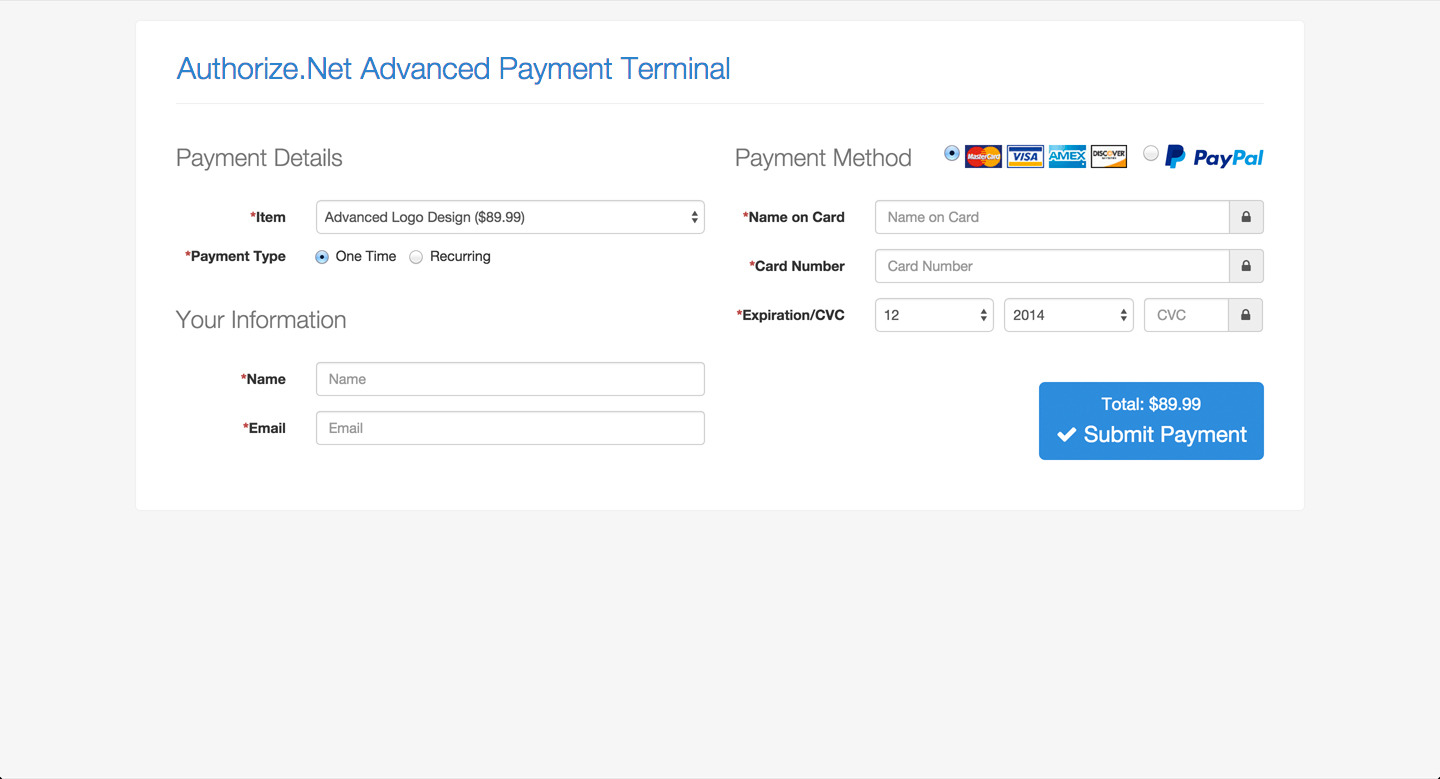

The API widget installed easy enough we've had zero issues and there's a portal for manual transactions. Review collected by and hosted on G2.com.

The portal doesn't keep repeat users info for faster processing which is probrably for security. Review collected by and hosted on G2.com.

I have only used authorize.net and PayPal for processing credit card payments, so I don 't have much to compare to. However, I like the fact that with authorize.net we are able to set up fraud detection to make sure certain parameters are flagged for fraud. Review collected by and hosted on G2.com.

I dislike that some payments have to be manually transferred to our client's accounts. On occasion, the funds will not transfer and our clients will ask where their money is. We will then have to look up the transaction and manually process the deposit into their account. This can be more work for us, but also an inconvenience to our clients. If this happens outside of our normal business hours, they must wait for the next business day to make a purchase. This can negatively affect the client as well as our sales. Review collected by and hosted on G2.com.

This came as a recommendation and we couldn't be happier. the online widget was easy to implement and offline charges are easy as well. Review collected by and hosted on G2.com.

This is a simple solution there have been no downside aside from the bill. lolz Review collected by and hosted on G2.com.

We had a couple issues with, address verification. I got on the phone with them and they got it taken care of quickly. Review collected by and hosted on G2.com.

Some of the reports are different to get to and use. Review collected by and hosted on G2.com.

We have had nothing but problems with Authorize.net Review collected by and hosted on G2.com.

We’ve used authorize.net for handling payments and subscriptions for our software company since 2009. In October 2017 I turned on their account updater feature which updates expiring credit cards with the new card number or expiration number so the subscription stay active. Instead of updating active subscriptions like is supposed to happen, Authorize.net re-activated cancelled subscriptions. Their mistake increased our chargeback rate by 500% in one month. Our chargeback rate skyrocketed so high our merchant account was shut down and now we cannot get another merchant account to process the subscriptions because the previous merchant account’s chargeback rate was so high. Authorize.net told me they have no way to reverse their mistake. Each card thats updated costs 25 cents, when I requested a refund for the fees Authorize.net denied my request.

Even one of Authorize.net’s customer support people stated this was a violation of PCI compliance rules. So it doesn’t make sense they want to charge us for something they agree is against processing rules and also against the law

On November 7, 2017 we were charged $5,385.90 for this feature.

When I saw how high our chargeback went and we started getting complaints about customers subscriptions being reactivated and charged after they were canceled I turned off the account updater feature on November 27. Unfortunately Authorize.net charged us again on December 4 for this feature that was turned off and updated even more cancelled subscriptions. Below are the charges they placed on December 4, after I cancelled the account updater feature on November 27:

$1,111.73

I emailed authorize.net on December 4, 2016 asking for a refund. On December 6 I received a response that did not answer my question. On December 6 I asked for a supervisor, the supervisor called Melissa responded on December 7 and stated they are aware of the problem with Authorize.net updating canceled subscriptions but won’t fix it or refund our fees.

Their error, that they claim they know about, is illegal and a violation of Visa/Mastercard rules. You cannot reactivate customers subscriptions after they cancel them, that is not legal to charge customers when they canceled their subscription and don’t authorize the charge. Their mistake cost us six figures in losses, so the very least they can do is reverse the fees they charged us for their mistake.

Authorize.net has a terms and conditions that are required to authorize before turning on the feature, but nowhere in their terms do they state they will reactivate cancelled subscriptions, so I never agreed for this to happen as its not legal.

I disputed the $6,497.63 in charges for the account updater feature with my credit card company and we won our dispute.

I filed a complaint with Mastercard and they opened an investigation.

I filed a complaint with the Utah Attorney General and they agreed its illegal, but they only investigate claims filed by consumers, not by businesses, so they did not open an investigation for that reason alone.

After we won our credit card dispute, Authorize.net sent our account to a collection agency. Now the collection agency is emailing our companies employees stating they are going to put the matter on consumer and business credit reports and want us to pay $6,497.63 in charges for something that Authorize.net, the Utah Attorney General and Mastercard all agree are illegal charges. The collection agency hasn’t responded to our disputes regarding their alleged debt claims and Authorize.net only tells me to contact the collection agency

Review collected by and hosted on G2.com.

The best thing I like about using Authorized.net is the ability to create recurring billings for the transactions taking place on the gateway makes it more unique and even the users love this feature as they don't need to give their card details every time when the renewal takes place. Review collected by and hosted on G2.com.

We can generate the transaction report only for upto 90 days (3 months), if we need the transaction data for the last 1 year then we need to generate the data every quarter and then merge it to one file which is a very big restriction. Review collected by and hosted on G2.com.

Easy API widget for the Website got us up and running fast Review collected by and hosted on G2.com.

They do not store data for repeat charges. You have to fill it in every time. Review collected by and hosted on G2.com.

Authorize.net connects with Form Assembly and Salesforce really well. We use Authorize.net on a daily basis to collect deposits and payments from volunteers. Searching for transactions is user-friendly and easy to do based on the search options. The invoice function is also really handy. Review collected by and hosted on G2.com.

The downloadable reports of transactions is terrible, the formatting is not user friendly and does not convert to excel. The website for merchants is very dated and has a TON of text on it. It took me a while to learn how to navigate the website. I enjoy the invoice function, but I do wish there was a way to business's to personalize/brand it. It does not work with international credit/debit cards. Review collected by and hosted on G2.com.

The best payment gateway to handle the customer needs and it helps in creating financial values to the company.

Also, the payment gateway is useful for the customers in making credit card transactions which in turn helps us in creating recurring profiles Review collected by and hosted on G2.com.

We will not be able to generate reports from Authorized.net for the last 6 months, we can generate only the last 90 days transaction at once.

This restriction should be lifted for easy use. Review collected by and hosted on G2.com.