No matter what sort of business you operate, it’s always a bad feeling to run out of cash.

To know whether or not you’re about to hit a balance of $0 you’ll need to crunch some numbers. One is your current ratio. If you aren’t sure what a current ratio is, or how to calculate it, you’re not alone. Keep reading for more information!

What is a current ratio?

Before you can know if you have a good current ratio or not, let’s first break down what a current ratio even means.

What does current ratio mean?

A current ratio pertains to the liquidity ratio that measures a company’s ability to pay off its short-term dues and debts with its current assets in a span of 12 months or less.

A good current ratio is typically anywhere between 1.5 and 2, but it can sometimes depend on the industry your company falls within.

A current ratio lets a company know if it has enough cash flow to pay its immediate debts and liabilities, should it become necessary. In the finance industry, the term “current” reflects a period of less than 12 months.

If your current ratio is high, meaning anywhere above 1, then the company is capable of paying its short-term obligations. The higher the ratio is, the more capable they are of paying off debts. Big-name companies like Apple and Google can reach a current ratio has high as 15.

Did you know: A company’s current ratio can sometimes also be called the “working capital” ratio.

Want to learn more about Accounting Software? Explore Accounting products.

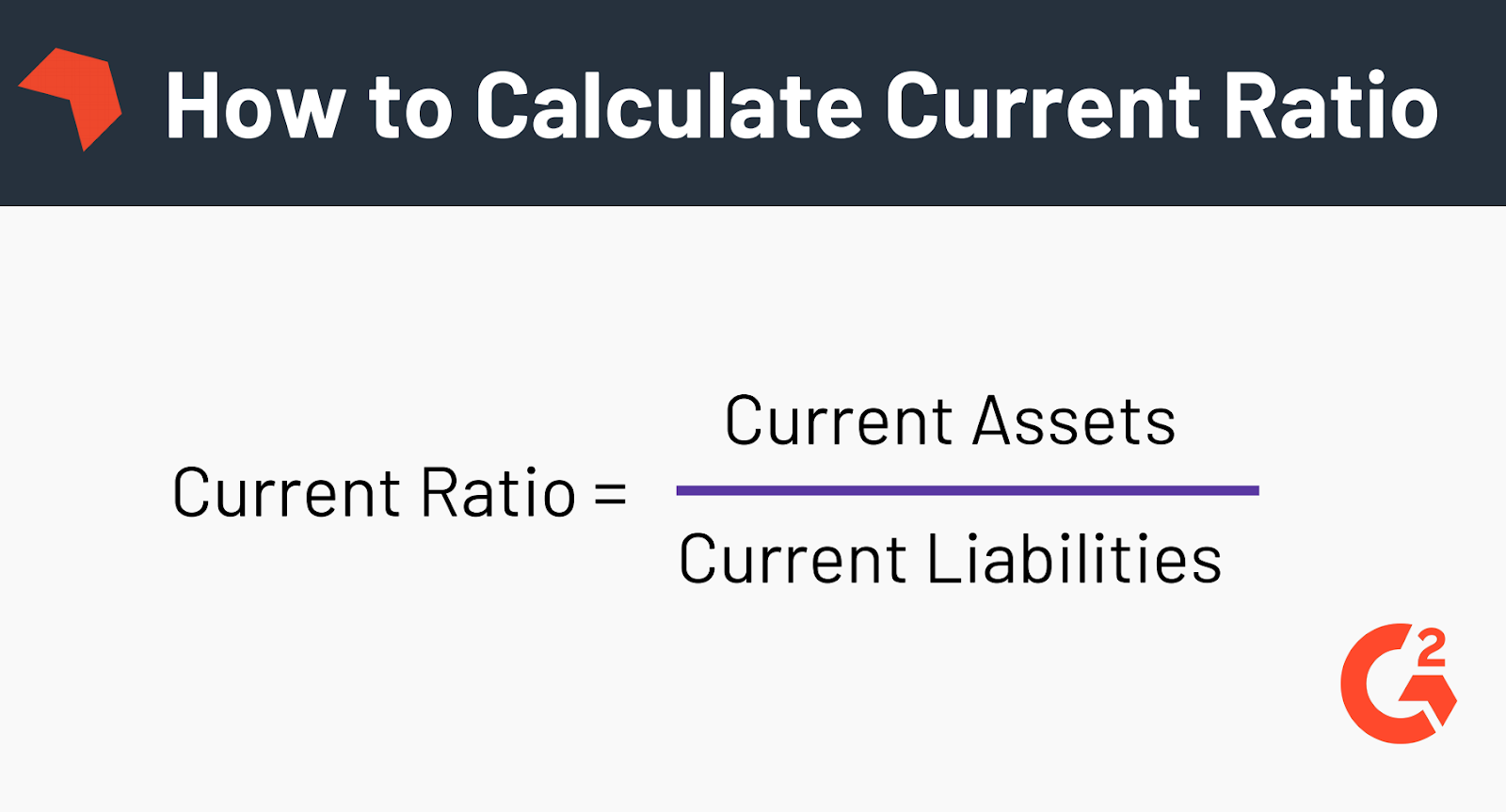

How to calculate current ratio

To calculate your current ratio, you would compare your company’s current assets to its current liabilities.

Current assets are listed on a company’s balance sheet and include items like cash, accounts receivable, inventory, or other items that are expected to be liquidated, or turned into cash, in less than one year.

Current liabilities include accounts payable, wages, taxes payable, and any current portions of long-term debt.

To find your current ratio, you would divide the current assets by the current liabilities.

Current ratio example

To help you calculate a current ratio, let’s consider an example.

| Say a company had $500,000 in current assets and current liabilities of $250,000. You would find the current ratio by dividing 500,000 by 250,000, which equals 2. |

This would mean that your company’s current ratio is 2, which is considered a good current ratio. In most industries, a good current ratio is between 1.5 and 2.

A ratio under 1 indicates that a company’s debts due in a year or less is greater than its assets. This means that your company could run short on cash during the next year unless a new way is found to generate faster.

On the other hand, if a company has a high ratio, like over 3, it may be an indicator that although the company can cover its current liabilities three times over, it’s not using its current assets in an effective manner or managing its working capital.

Why is current ratio important?

Now that you know how to find a current ratio, you may be unsure as to why it’s even important.

Your company’s current ratio will let you know how liquid the company is and will provide further information as to the financial health of the business. This sort of information is typically of interest to potential investors, as it lets them the value of a company that is reflected by a number.

What classifies a current ratio as “good” or “bad” is how often it changes. Let’s compare two fictional companies, their current ratio, and how it has been changing over time:

We can see two things by looking at how these two current ratios are changing over time.

First, the trend for Vortex Coffee House is negative, which means investors may not be inclined to invest in them. They could be taking on too much debt or maybe their cash balance is being depleted.

On the other hand, Starry Night Brewery has a positively changing current ratio. This could reflect better collections, faster turnover of their inventory, or that the company is consistently able to pay their debt.

Creditors and potential investors consider a high current ratio to still be better than a low one. This is because a high current ratio means that the company is more likely to meet its liabilities that are due over the next fiscal year.

Tip: Unsure how current ratios differs from quick ratios? The formula for quick ratio is:

Cash + Cash Equivalents + Short-Term Investments + Accounts Receivable Divided by Current Liabilities

Keeping track of your current ratio

Your company’s current ratio is an element that you’re going to want to keep an eye on. To do so, make the most out of accounting software that will help to streamline and automate finance management processes.

Doing so will ensure you know exactly which direction your current ratio is headed and how you look to the eyes of potential investors. In addition, accounting software can also assist in automating accounts receivable and invoicing, tracking costs and revenue, managing cash and payment methods, and more.

Keep calm and crunch some numbers

Knowing whether or not you have a good current ratio is the first step in determining the overall financial help of your company. The next time you take a look at the balance sheet, make a note of the assets and liabilities, then pull out a calculator. Hopefully, you like the number you see!

Interested in crunching some other numbers? Learn more about the debt to equity ratio and how to calculate it!

Mara Calvello

Mara Calvello is a Content and Communications Manager at G2. She received her Bachelor of Arts degree from Elmhurst College (now Elmhurst University). Mara writes customer marketing content, while also focusing on social media and communications for G2. She previously wrote content to support our G2 Tea newsletter, as well as categories on artificial intelligence, natural language understanding (NLU), AI code generation, synthetic data, and more. In her spare time, she's out exploring with her rescue dog Zeke or enjoying a good book.