In an underdog victory, the Toronto Raptors took home their first NBA championship trophy in 2019.

Everyone on the team played a part in the win, but forward Kawhi Leonard won the award and recognition of MVP.

Why? He proved to be the most valuable player to the team—racking up points and doing his part on defense.

You could call Leonard his team’s greatest asset.

What is an asset?

It’s true that people can sometimes be considered assets, but more commonly, things like cash, factory equipment, financial investments like stocks and corporate bonds, or trademark documents are considered assets. People own assets, big and small, more often than they are assets. For example, while not worth nearly as much as he is, Kawhi Leonard’s car is still considered an asset.

Asset definition

An asset is anything with economic value, or anything that can be sold for cash and is expected to financially benefit its owner in the future.

Assets are resources owned by a company, individual, or government/municipality. Depending on the type of asset, benefits of ownership include increased cash flow, reduced expenses, and/or a rise in sales.

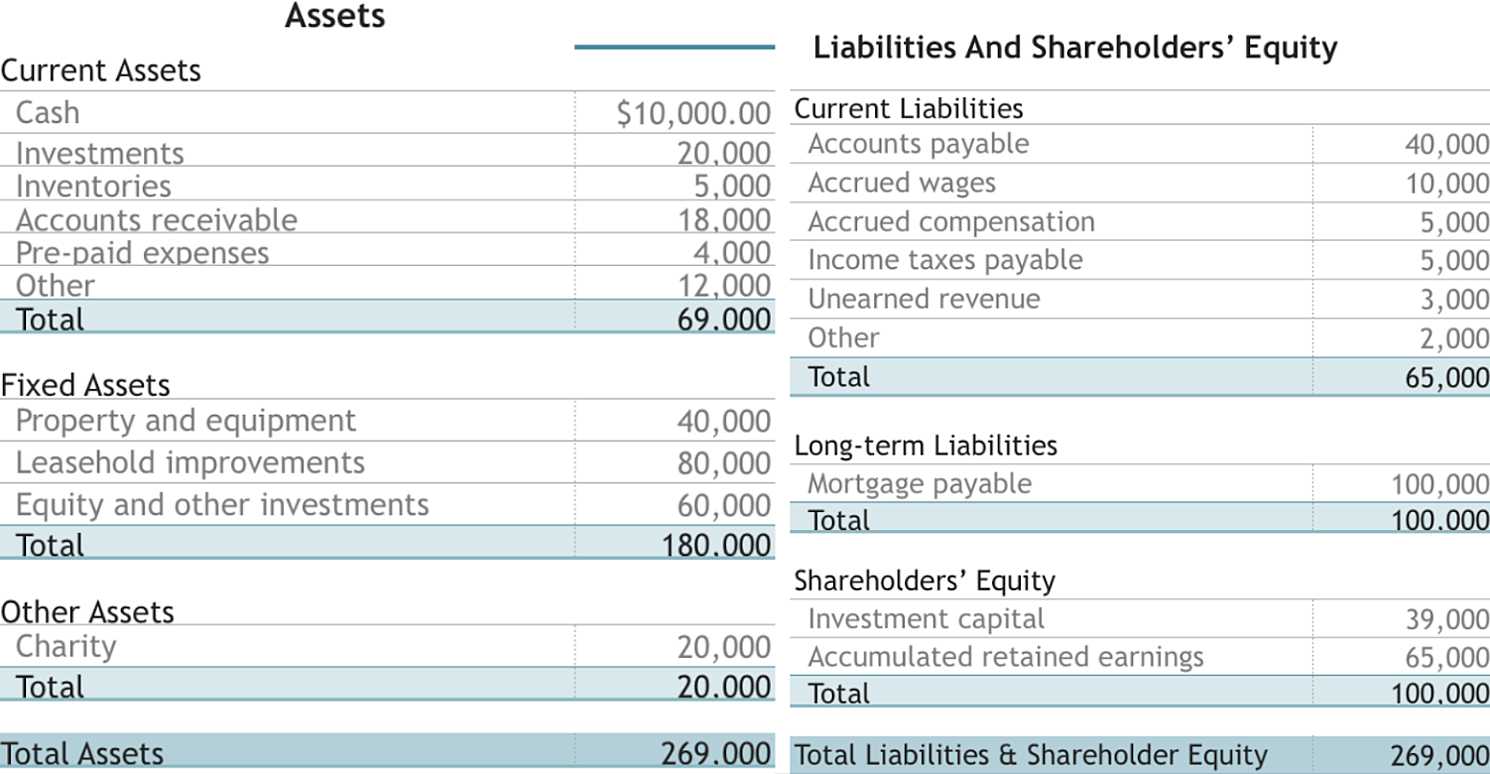

In personal finance, assets minus liabilities (debts owed) equals the net worth of an individual. In corporate finance, assets minus liabilities equal shareholder equity, or the complete value of everything a company owns minus the complete value of everything it owes to outside parties.

Assets = Liabilities + Shareholder equity

Along with liabilities and shareholder equity, assets are listed on a company’s balance sheet, where they are accounted for as either a “fixed” or “current” asset. At the bottom of the balance sheet, the value of all of the company’s assets is listed under “total assets.” See below for an example of what assets look like on a balance sheet, and read on to learn the difference between current and fixed assets.

Want to learn more about Asset Performance Management Software? Explore Asset Performance Management products.

Current assets

Current assets, sometimes called short-term assets, are categorized as such because they are assets a company expects to be converted into cash within the span of one year. Things like cash and company inventory are categorized as current assets. Accounts receivable, or short-term money owed to the company, are also considered current assets.

Fixed assets

Fixed assets, on the other hand, are assets that are not expected to be converted into cash in the span of one year. Things like buildings, vehicles, and factory equipment are fixed assets.

Because these assets remain in their owners’ possession for several years, they are bound to lose value over time. Think about it: a steam-powered locomotive might’ve been worth top dollar to the train company that owned it back in 1830, but it would’ve depreciated in value almost completely by 2019.

Tip: Enterprise asset management software helps keep track of the fixed assets a company has and the depreciation of those assets over time.

Tangible vs. intangible assets

Tangible assets are physical things you could touch (like materials or land), and intangible assets, on the contrary, while still valuable, have no physical form to touch or look at. Things like copyrights or patents are considered intangible assets.

Tip: Some assets have higher liquidity than others, meaning they can be bought and sold more quickly and easily.

Hey, nice asset!

Remember: anything with value can be considered an asset—from the millions of dollars in inventory owned by corporations to your own beater of a car. No matter what, accounting for assets is an essential part of balancing a budget and planning finances for the future.

Take a deep dive into how to implement software asset management into your business today.

Maddie Rehayem

Maddie is a former content specialist at G2. She also has a passion for music and cats. (she/her/hers)