You have to spend money to make money. But spend too much money, and you might see red. That’s where your net working capital (NWC) comes in.

Your working capital is the difference between your company’s current assets and current liabilities. When your net working capital is in the green, it means you’re making enough money to meet your current financial needs.

Businesses use accounting and finance software to calculate net working capital, get an idea of a company's liquidity, and check their short-term financial health.

What is net working capital?

Net working capital (NWC) or working capital is the difference between a company’s current assets (inventory, cash, raw materials, finished goods, accounts receivable, and prepaid expenses) and current liabilities (debt, accounts payable, vendor notes, and unpaid accounts) on its balance sheet.

Checking your net working capital helps you assess your business's short-term liquidity. Plus, you can also use NWC to understand your company’s ability to use assets efficiently. You should aim for more current assets than liabilities for a positive net working capital balance.

Why is net working capital important?

Net working capital is important to gauge the liquidity of a business and if it has enough funds to meet short-term obligations. Working capital also portrays a company’s operational efficiency.

Businesses with zero or greater net working capital are able to meet current liabilities. When liabilities outweigh assets, companies experience negative net working capital. In such scenarios, companies may struggle repaying lenders and may even go broke.

A positive net working capital means a business is better prepared to take care of its short-term debts. Businesses with positive working capital are able to expand further for growth.

Why should you measure the change in net working capital?

Measuring changes in net working capital helps you:

- Set a business liquidity baseline and track how it improves or declines over time.

- Measure capital reserves that you can use for investing in operations and scaling business growth. Ideally, you want to aim for a 2:1 ratio of current assets to current liabilities to have sufficient net working capital.

Net working capital can be different from sector to sector, depending on what type of business the company operates. For example, manufacturing businesses with longer production cycles don’t have quick inventory turnover like retail companies. So, these businesses may need more working capital. Retail companies need lower working capital as they generate short-term funds faster because of daily interactions with customers.

Want to learn more about Accounting & Finance Software? Explore Accounting & Finance products.

Net working capital formula

You can find the net working capital by subtracting your company’s current liabilities from current assets. Public companies can easily find liabilities and assets in financial statements.

Net working capital = total current assets - total current liabilities

Here's a net working capital calculation example to help you understand better.

Imagine you’re the owner of a bakery. You’ve just had your most successful year in sales. You calculate your current assets at $60,000 and your current liabilities at $65,750.

So, your net working capital is ($65,750 - $60,000) = -$5,750.

Despite having your best year in sales, you still don’t have enough assets to offset your operating costs and liabilities. This means you should head back to the drawing board and find a way to get your negative working capital into the green.

A net working capital of zero means you’re breaking even exactly where you are. Any growth or change for your company could send you into the red if adjustments aren’t made first.

How to calculate net working capital?

Follow the steps below to calculate your company’s net working capital.

- Add all current asset line items from the balance sheet. These items include cash, cash equivalents, accounts receivable (AR), inventory, and marketable securities.

- Add all current liabilities line items from the balance sheet. These items include sales tax payable, interest payable, payroll, short-term loans, trade debts, and accounts payable.

- Calculate the net working capital by deducting current liabilities from current assets.

Components of net working capital

The balance sheet of a company contains all the components of net working capital, i.e., current assets and current liabilities.

Current assets

A company’s current assets include every company-owned liquid assets that can be converted into cash within one year. The company can convert these assets into cash with liquidation or sales.

- Cash and cash equivalents refer to the cash available with a company. These include foreign currency as well as low-risk money market accounts with low investment duration.

- Accounts receivable includes money balance that a firm is yet to receive for goods and services delivered on credit payment terms.

- Notes receivable are promissory notes that guarantee payment via physically signed agreements.

- Inventory refers to unsold goods, including raw materials, partially assembled inventories, and finished goods.

- Prepaid expenses are accrued expenses, including future expenses, like rent or insurance, paid in advance.

- Others may include other short-term assets that may reduce liabilities.

Current liabilities

Current liabilities include a company’s short-term debts or financial obligations payable within a year or a normal operating cycle. An operating cycle is a period between when a company purchases inventory and when it converts that inventory into sales.

- Accounts payable includes the amount a company owes to creditors. This item captures unpaid invoices for rent, supplies, utilities, property taxes, and raw materials.

- Accrued tax payable involves paying income taxes and other obligations to government bodies.

- Salary and wages payable refer to the staff payroll liabilities.

- Current long-term debt portion is the short-term payment amount a company needs to pay for long-term debt.

- Dividend payable includes authorized payments to shareholders.

- Unearned revenue is the capital a company receives before completing a job.

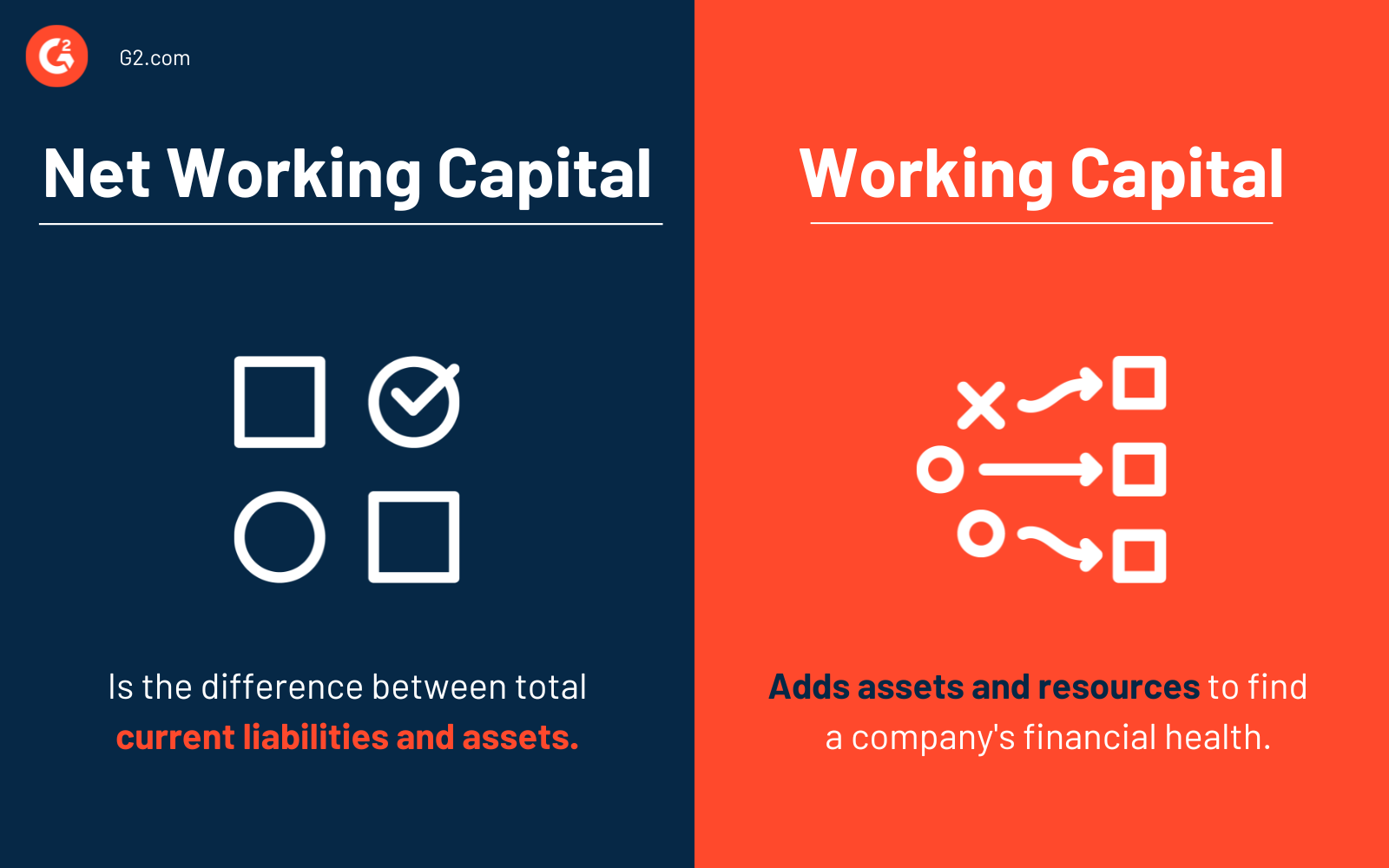

Working capital vs. net working capital

The key difference is that: net working capital takes into account current liabilities, whereas working capital considers account assets and financial resources.

Working capital or gross working capital adds all business assets and financial resources to reveal a company’s financial health. Strong working capital management shows a company’s ability to pay bills on time and free up cash for investment opportunities. However, working capital doesn’t consider liabilities.

Net working capital offers a more accurate view of a company’s liquidity. It takes into account all short-term and long-term assets and liabilities to calculate the financial health of a business.

Net working capital ratio

Once you’ve calculated your net working capital, you can pinpoint your networking ratio. Your net working capital ratio measures the percentage of a company’s current assets against its short-term liabilities.

A net working capital ratio between 1.2 – 2 is considered optimal. Any less than that, and you’re operating at a loss; an operating ratio higher than 2 means you’re not making the best use of your current assets and might need to strategize.

Did you know? A company’s net working capital ratio is also known as current ratio.

How to improve net working capital

There’s no need to panic if you find yourself in the red on your net working capital. There are plenty of ways to improve your net working capital. These strategies can help you get your NWC under control and set you back on track toward financial stability.

- Sell your long-term assets for cash

- Analyze your current fixed costs

- Reevaluate your vendor relationships

- Increase your inventory turnover

- Refinance your debt

- Take advantage of tax breaks

- Automate your payment monitoring

The most strategic thing you can do to fix your NWC is to keep track of it constantly. Don’t wait until the end of the year to realize you’re in the red. The right corporate accounting software can help you automate things on the

Now is the time to get SaaS-y news and entertainment with our 5-minute newsletter, G2 Tea, featuring inspiring leaders, hot takes, and bold predictions. Subscribe below!

Limitations of net working capital

Net working capital is one of the top financial metrics for modeling and assessing a company's financial health, but it isn’t free from limitations.

- Can be cash flow agnostic. The net working capital calculation formula doesn’t consider whether business owners have enough operating cash flow or not. So, businesses with large lines of credit may get negative net working capital.

- Doesn’t capture changing assets and liabilities. Net working capital also doesn’t give you a full picture of changing the working capital position of a company. For example, the current assets and liabilities of a fully operating business may change by the time you gather the financial information.

- Fails to consider underlying accounts for companies with 100% current assets in accounts receivable. These businesses may not have a great net working capital on paper but actually possess positive working capital.

- Relies on accounting practices. Net working capital takes into account debt obligations but can be misleading in companies that fail to follow accounting best practices. For example, NWC doesn’t consider the scope of missed agreements or incorrectly processed invoices, which may happen in fast-paced business environments.

- Net working capital doesn’t consider external forces. It also doesn’t take into account external threats such as inventory theft or customers with accounts receivable going bankrupt.

Don’t let the numbers crunch you!

You’re in charge of managing your working capital. Understanding how to turn a profit is just the first step.

Discover how technology has transformed accounting software and essential features worth investing in.

This article was originally published in 2021. It has been updated with new information.

Lauren Pope

Lauren Pope is a former content marketer at G2. You can find her work featured on CNBC, Yahoo! Finance, the G2 Learning Hub, and other sites. In her free time, Lauren enjoys watching true crime shows and singing karaoke. (she/her/hers)