It takes a lot to run a business.

More than anything else, it takes money. I know that sounds cynical, and we all want the key factor of a successful business to be hard work and dedication, but it’s money.

What are the basic terms used in accounting?

- Asset

- Capital

- Liability

- Accounts Payable

- Revenue

- Accounts receivable

- Expenses

- Gross profit

- Net profit

- Gross margin

- Net margin

- Cash flow

- Inventory

- Valuation

- Depreciation

- Break-even point

- Liquidity

- Overhead

- Accounting period

- Cash flow statement

- Balance sheet

- Income statement

While money fuels almost every business activity, it doesn’t do it all on its own. It takes organization, care, and bookkeeping. Some people call it accounting.

Accounting is a loaded topic. To understand it, a good place to start is with some basic accounting terms that you will need to know to run a business. You'll likely encounter these terms if you're searching for accounting software as well.

The most common accounting terms

There are a lot of accounting terms that a business owner will eventually have to understand; however, getting a firm grasp on the basics is a crucial first step.

Let’s define each one.

1. Asset

An asset is anything owned by a company. So long as it has monetary value and can be turned into cash, it is considered an asset.

Examples of assets include cash, equipment, and land.

Quer aprender mais sobre Software de Contabilidade? Explore os produtos de Contabilidade.

2. Capital

Capital is a type of asset. Sources of capital provide an ongoing service to the business using it, resulting in wealth.

Examples of capital include software, facilities, and a brand name. While money and materials used to create a product or offer a service are important to any business, the keyword in the definition of capital is ongoing. Money and materials are used and then they disappear.

Typically, business owners are working with more than one source of capital at once, which can be hard to organize. Capital project management software can help manage operations and expenses related to those capital projects.

3. Liability

Liabilities refer to the money or service that one business owes to another party. If you borrowed five dollars from a friend, it is your liability to pay them back, buy them ice cream, or whatever you agreed upon when the money was borrowed.

Examples of liabilities in business include wages owed to employees or loan payments owed to the bank.

4. Expenses

Expenses are the costs associated with doing business. There are two separate categories of expenses: cost of goods sold (COGS) and operating expenses.

COGS refers to the direct cost of producing goods and services. Operating expenses are indirect costs of production, such as paying rent and selling.

If your business sells scooters, your COGS would include paying for wheels and compensating workers for producing the scooters, while your operating expenses would comprise of paying rent and distribution costs.

| Related: Learn how to calculate cost of goods sold to see how much it really takes to run your business. |

5. Revenue

Revenue refers to the amount of money a business makes by selling products or providing services. Whatever their business activity is, revenue is the money they make from it.

Note that revenue does not take expenses into account. It is solely the money made.

6. Gross profit

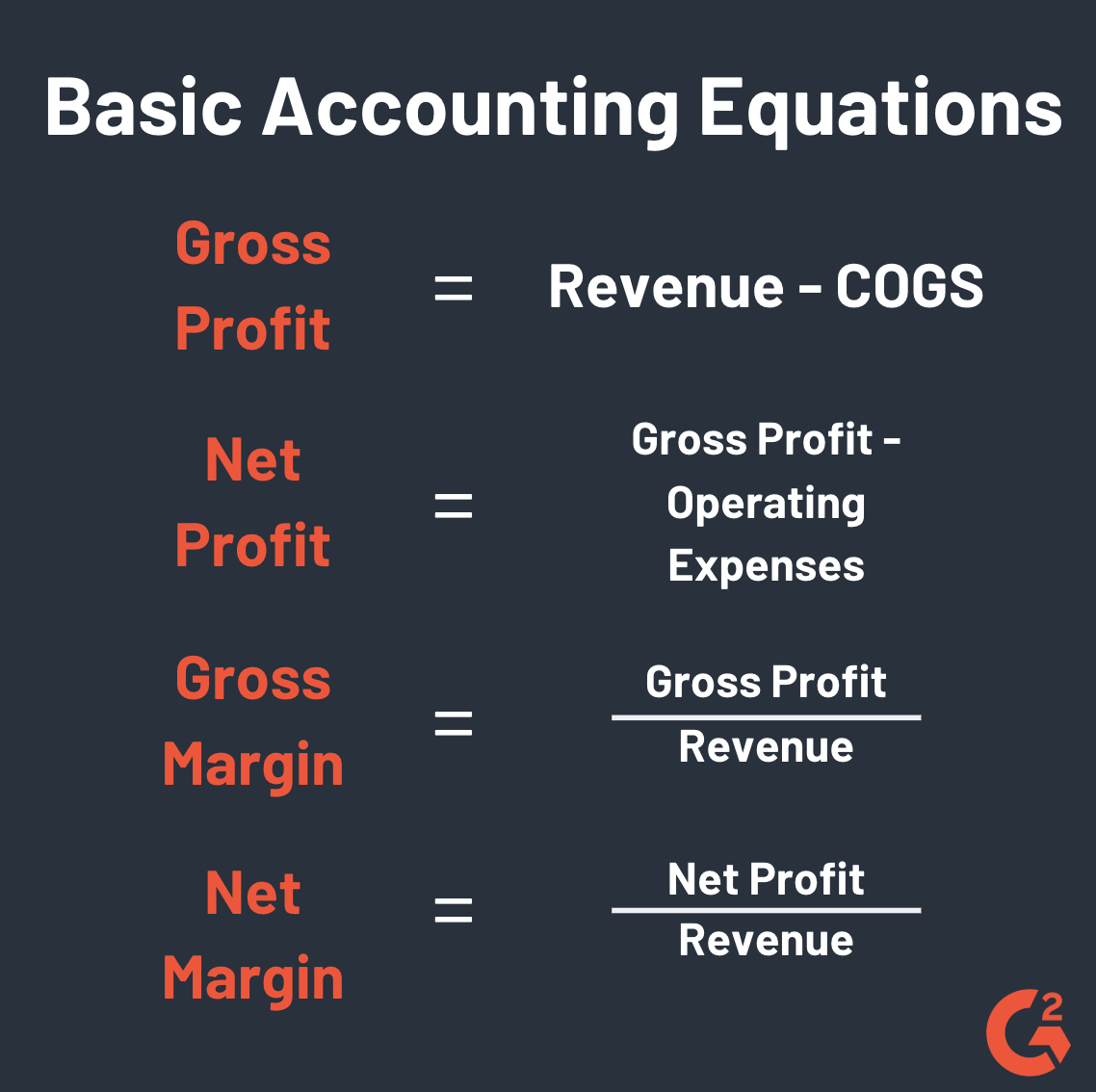

Gross profit is your business’ revenue minus its COGS. The result is a good indicator of how efficient a business is with labor and supplies.

7. Net profit

Net profit is your gross profit minus all other expenses. This term can also be referred to as your net income, net earnings, or bottom line.

Related: Learn how to calculate net income.

8. Gross margin

A company’s gross margin is their gross profit divided by revenue. This percentage shows the amount of money the business holds onto after they account for COGS. The higher the gross margin, the better.

| Related: Learn how to calculate gross profit and gross margin to determine part of your business’ wealth and health. |

9. Net margin

Net margin is an even better determinant of a business’ profitability, as it takes all expenses into account. To calculate it, divide your revenue by your net income.

10. Cash flow

Cash flow is the amount of money moving in and out of a business. A company’s ability to have a positive cash flow helps potential investors determine the health of the business.

11. Inventory

Inventory refers to the products available for selling and the materials used to produce them. It is one of the most important assets for a business. Without adequate inventory, a business cannot make a profit.

12. Valuation

Valuation is the process of determining the present value of a particular asset or even an entire business. The valuation process includes looking at capital structure, forecasted sales, and market value.

13. Depreciation

Depreciation refers to the cost of an asset’s declining value. Over time, certain things lose their spunk. Machines get worn out, and market value goes down.

Interestingly enough, depreciation isn’t always a bad thing. Business owners can expense the amount of depreciation instead of the entire cost of the asset, making their net income appear higher.

14. Break-even point

A break-even point is where total costs are equal to total revenue. It is a neutral point, as there is no loss or gain. Not a bad thing, but not necessarily good either.

15. Liquidity

Liquidity refers to the feasibility of turning an asset into cash. To determine the liquidity of an asset, the market is also taken into account: Is there a ready market for the asset at hand?

16. Overhead

Overhead refers to the ongoing expenses of operating a business. These costs are not related to operating expenses or COGS. Overhead is an important value to take into account when determining price, as it can often be forgotten and then unaccounted for.

17. Accounting period

An accounting period is the amount of time a company’s financial statements cover. (We will get into those statements in a minute). Accounting periods are often split into quarters, to break up the fiscal year.

18. Accounts payable

Accounts payable are the expenses that a business has incurred that they still need to pay off. They are recorded as a liability.

19. Accounts receivable

Accounts receivable contain all the revenue that a company has made but not yet collected. They are recorded as an asset, even though the revenue still needs to be gathered.

20. Cash flow statement

A cash flow statement is a financial statement that accounts for the amount of cash going in and out of a business. It is a good indicator of how well a company can pay off its debts and expenses.

|

TIP: Are you wasting your cashflow on unused software? Find out free with G2 Track.

|

21. Balance sheet

A balance sheet accounts for a company’s assets, liabilities, and shareholder's equity. This one basically breaks down how much a company owns and what they owe.

To break down that formula, it is essentially saying that all of the assets a business owns either come from borrowing or money from investors.

22. Income statement

The income statement breaks down how a business reaches its net income. It is a good indicator of the company’s management and operations.

Are you preparing for the end of the fiscal year? Download this income statement example to help guide you through the process.

Get studying!

Starting a small business is a long and intimidating process. And if you aren’t a fan of numbers, the accounting aspect can be a headache. However, understanding these basic accounting terms is the first step in handling the finances for your small business like a professional.

If you would rather invest in a software to make accounting more streamlined, check out G2's Best Accounting Software.

Mary Clare Novak

Mary Clare Novak is a former Content Marketing Specialist at G2 based in Burlington, Vermont, where she is explored topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)