Morningstar Advisor Workstation is one of the most comprehensive financial analyzing tools I have used. It is a great tool for both experienced financial representatives and beginners. As a new user of this platform one of the most valuable features I have found is their webinars. The webinars are short, but always packed with beneficial information. Everytime I have watched one I have come away with something new to implement in my use of the platform. In addition to the webinars, their support team is excellent. Whenever I have run into an issue I have been able to contact a real person to help troubleshoot my problems and have had my issues solved within 24 hours. I would highly recommend using Morningstar Advisor Workstation! Review collected by and hosted on G2.com.

If there was one thing I could change about Morningstar Advisor Workstation it would be the layout of the platform itself. When starting out the layout was not super intuitive and use-friendly. It takes some time to get your bearing with where everything is and how to use it. Review collected by and hosted on G2.com.

173 out of 174 Total Reviews for Morningstar Advisor Workstation

Overall Review Sentiment for Morningstar Advisor Workstation

Log in to view review sentiment.

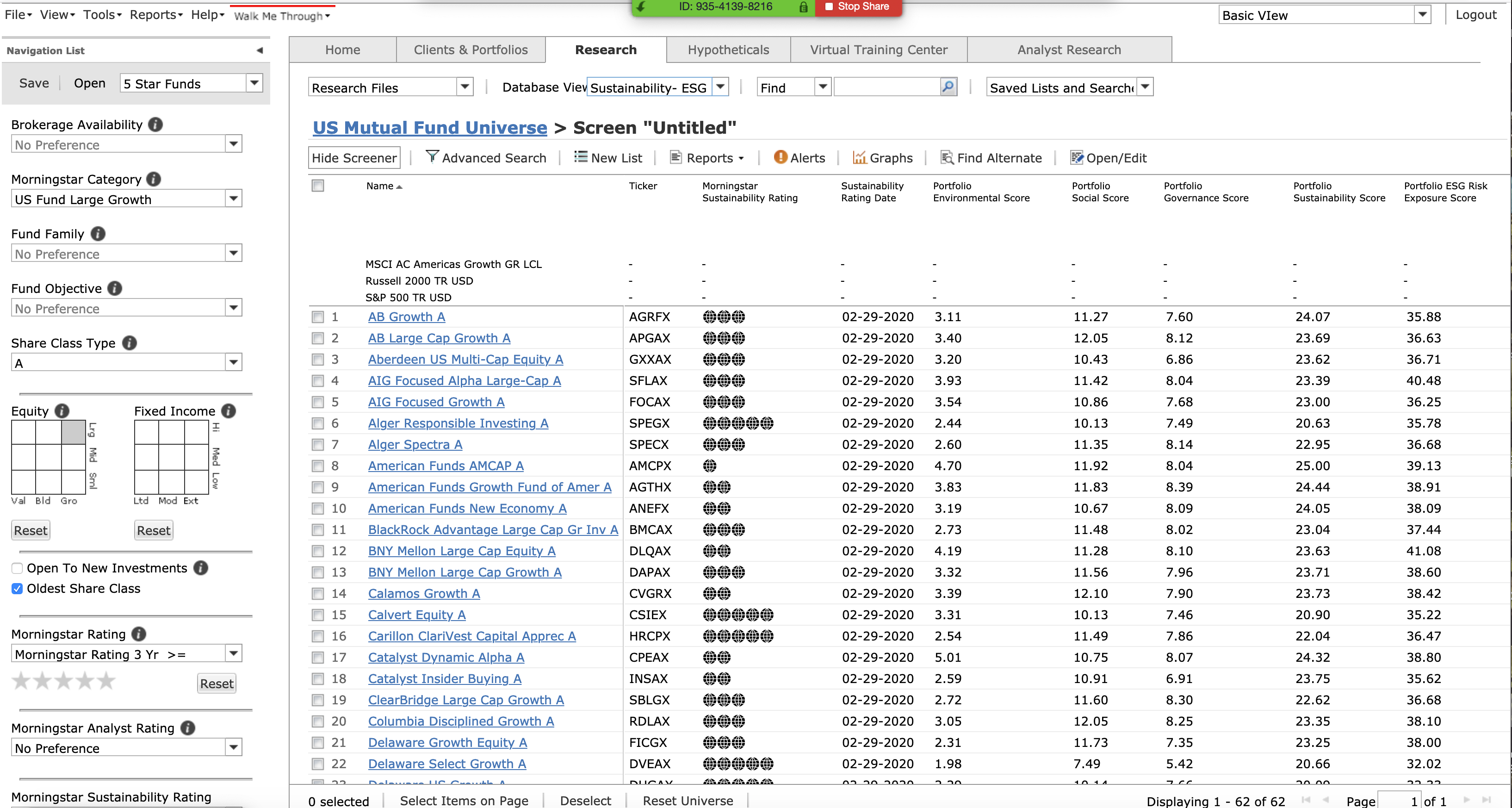

The breadth of the funds/stocks/etf's, etc. that are reviewed. It is nice to compare similar issues. The data sheets on individual funds are well stuctured and easy to understand. Most of the hypotheticalo portfolio information (such as the stock intersection and the risk/reward scatterplots) are very useful in helping construct the most appropriate portfolios for a given client. Review collected by and hosted on G2.com.

The over-abundance of disclosures, the constant presentations of "here's an example of how the world can end" and "here's how much it would cost you if you got charged an unrealistic, irrelevant amount". Customer support and account executives are EXTREMELY difficult to contact. In a typical mutual fund-only hypothetical the disclosures will be at least fifty pages. Review collected by and hosted on G2.com.

I enjoy how responsive this site is and, most of all, just how helpful the support staff is! I'm still fairly new to the industry and this tool. Each time that I've either messed things up or don't know where to start, the staff have been phenomenal! I couldn't do my reporting without their help!! Review collected by and hosted on G2.com.

While I am grateful for the wide array of different support options, I really wish that webinars could be offered on a monthly or quarterly basis. There are many times that, "you don't know what you don't know". Other times, I struggle to explain what I'm struggling with in a way that makes it easy for the support person to understand. This isn't so much of an issue with the tool, but one of the only thingds I can think of as a downside to using Morningstar. Review collected by and hosted on G2.com.

Analytics and ease of builiding a diversified portfolio. The detailed breakdown of portfolios. The portfolio snapshot is quite helpful. Review collected by and hosted on G2.com.

Two things:

1) It's expensive. If I can find an equivalent to Advisor Workstation that is less pricey, I'll make the switch immediately.

2) UX design. At times it can be difficult to navigate and customize. It's not intuitive.

3) It really bothers me that I pay for a service and am also targeted with ads that take up on screen real estate.

4) It feels like Morningstar is forgetting who keeps them in business. Review collected by and hosted on G2.com.

Independant reasearch that can be used to compare opinions and facts. Portfolio builder is something I frequently use. Review collected by and hosted on G2.com.

I think it would be a great addition to include other metrics such as Upside/Downside ratios and find a way to flag certain elements such as limited track record from management team (funds) or concentration risk in a sector and/or company. Review collected by and hosted on G2.com.

I use Morningstar to primarily for collecting data on client portfolios. On every review with clients we pull up to date data on their mutual funds & ETF's and run through the Morningstars Investment Detail Report. This data is represented in an easy to digest view that clients can better understand their investments. Review collected by and hosted on G2.com.

When first starting out on Morningstar it was overwhleming the access to available data, this made starting and utilitizing Morningstar a more daughting task than it seemed. With help from my co-workers and their self help resources I slowly overcame this and got more comfortable. I still believe the learning curve exists. Review collected by and hosted on G2.com.

MAW is an easy to use program. It helps me monitor the investments that I have chosen for clients as well as keeping me abreast of investments that I am considering adding to my "best in class" investments. In addition, if I do require assistance with the program, I can get help from Morningstar. Review collected by and hosted on G2.com.

I cannot think of any aspects of the program that I dislike. Review collected by and hosted on G2.com.

The best thing about it is :

excel in providing in-depth research and analytics tools that empowers advisor to make informed decisions.

example : having SD, sharpe ratio, alpha all calculated in easiest way to copare the portfolios.

Portfolio comparison is the great feature.

once you get use to it its easy to operate ( but definately need few months to get used to all the features). Review collected by and hosted on G2.com.

One downside is the steep learning curve for the new users, particularly for thise unfamiliar with investment analysis tools. it is comprehensive tool but can feel overwhelming sometimes ( specifically initially).

some features require time and training.

huge data base but still doesnt have ETF data base inclusion ( I think it is due to the company i work for and access is limited). so cant blame morning star for that.

it should be more appealing to see rather than more database software. too much info on one screen.

if there could be a way to intigrate AI in it which can suggest similar funds available in the portfolio created by user.

for example : if advisor has a portfolio created with 4 funds then can put restriction that show me similar asset allocation or geogrophical allocation , with high alpha and low beta ( just an example) and show me other few funds or one fund rather than having current 4 funds would be the greatest feature.

or if advisor put asset allocation and ask morning star feature to generate a portfolio by selecting funds ( from certain universe of funds only) Review collected by and hosted on G2.com.

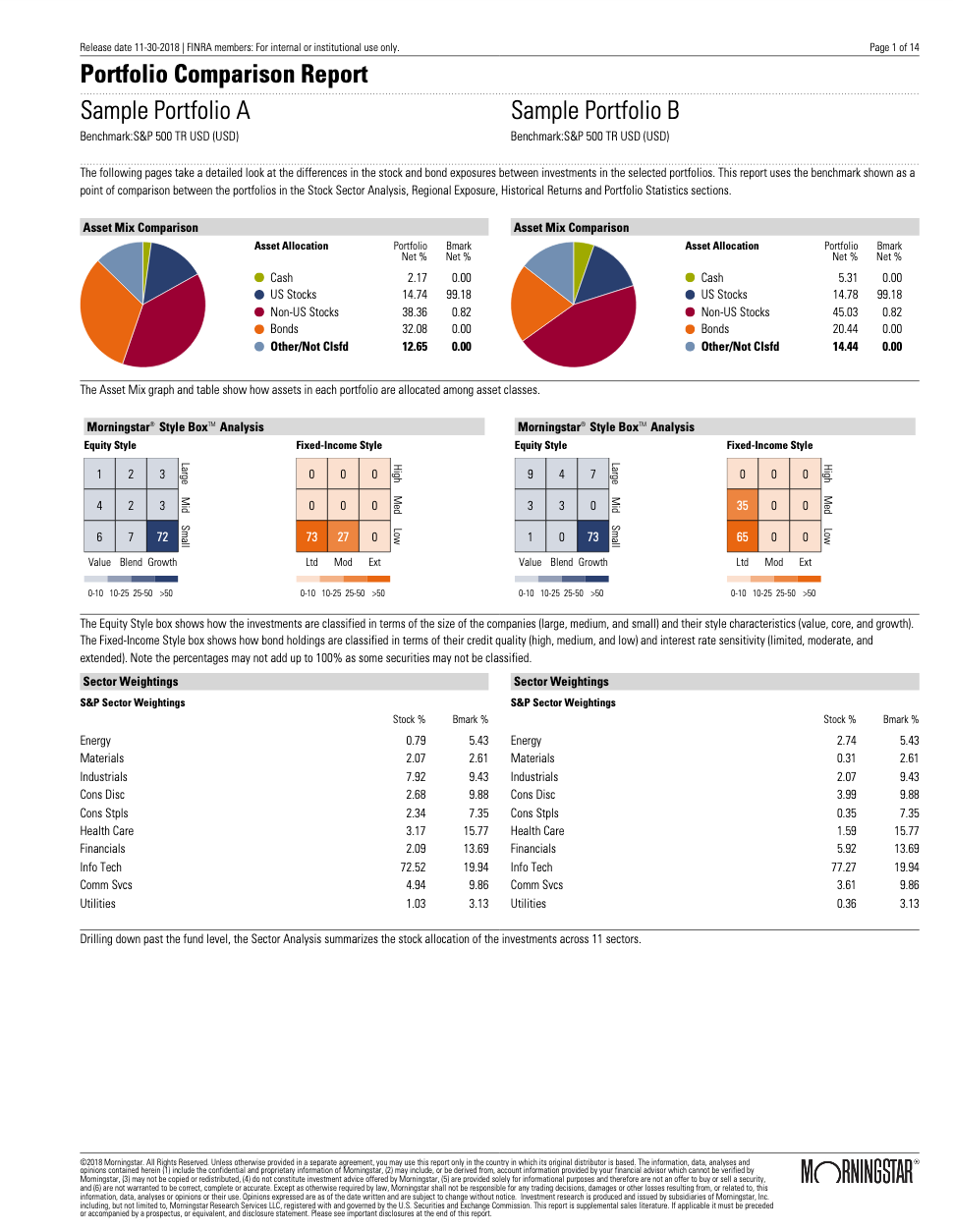

Morningstar Workstation works generally pretty well and does a great job of breaking down asset, sector, fixed income type, and other allocations. It has client-ready charts and graphs/pages that look great and are easy to explain to clients. Uploading portfolios can be a little bit of a pain and comparing portfolios versus models is not very intuitive. The interface can be tricky to learn, but once you do learn it, it is fairly efficient. Review collected by and hosted on G2.com.

Upload and comparing portfolios can be a bit of a pain. pulling up portfolios as "models" side by side is the only way I have been able to do a direct comparison. It would be nice if we could do this under clients. It is quite confusing uploading portfolios from their spreadsheet (formatting matters, when there is an error it doesn't explain why). you do need a decent amount of institutional knowledge on how to use the program. Review collected by and hosted on G2.com.

MorningStar advisory workstation is all encompassing. I can find everything I need with just a few clicks. I don't have to go to other websites or tools to find the information I need. Review collected by and hosted on G2.com.

It can be difficult to navigate, specifically the first few times you use it. Once you get the lay of the land, it is pretty user friendly. I joined a couple "Back to the Basics - MorningStar Advisor Workstation" webinars which really helped me understand how to use all the features. Review collected by and hosted on G2.com.

I feel between the screening tools and indepth analytical tools, you can really compare and contrast viable options while putting together portfolios for any need. Review collected by and hosted on G2.com.

I feel that morningstar could improve the employer plan option searches and hypotheticals for in office reporting. Specifically, regarding mutual fund to mutual fund compare and contrast reports. To view what could be a more suitable option based on the data sets, perhaps even reviewing 3-4 different fund options simultaneously. Review collected by and hosted on G2.com.