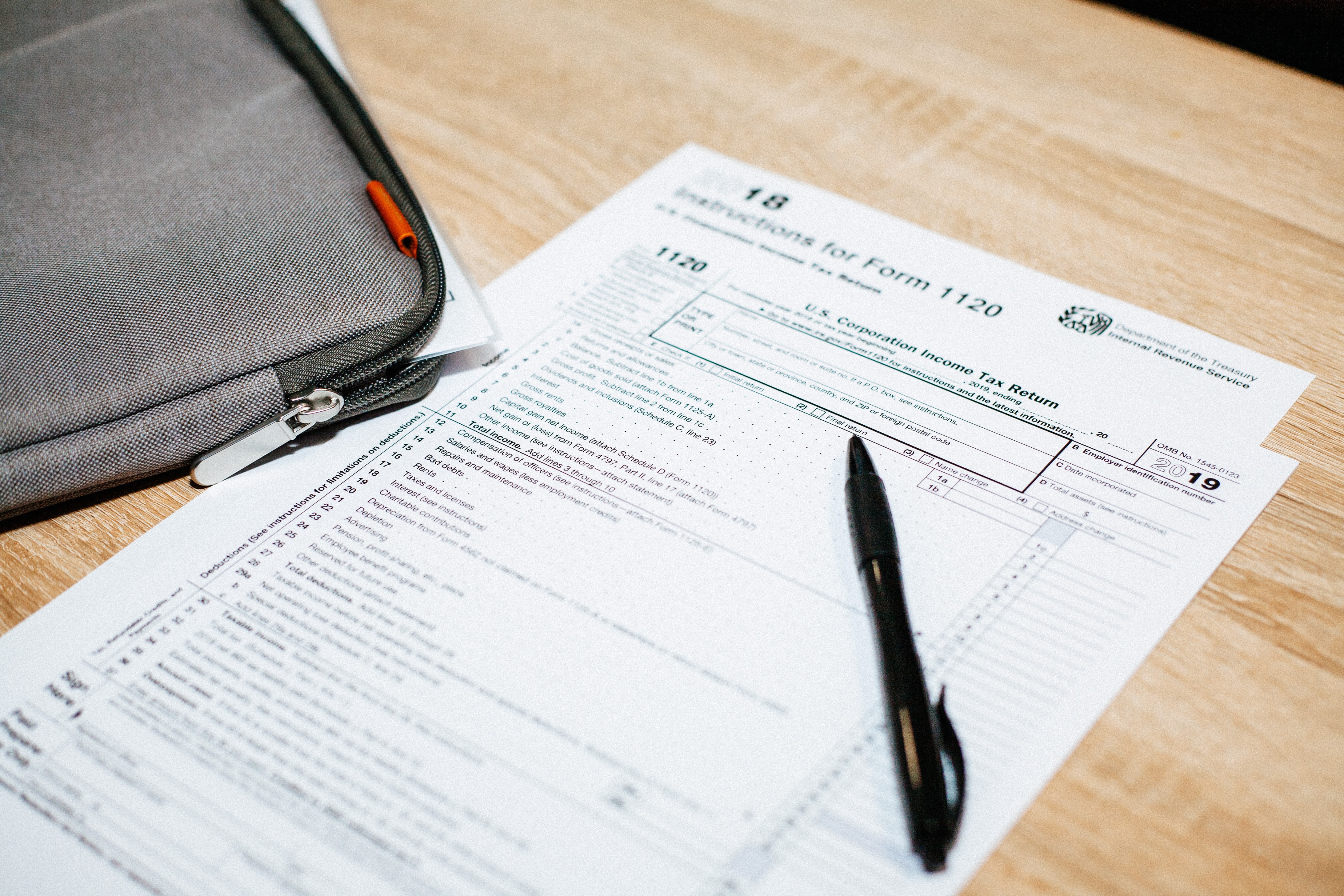

Corporate Tax Software Resources

Articles, Glossary Terms, Discussions, and Reports to expand your knowledge on Corporate Tax Software

Resource pages are designed to give you a cross-section of information we have on specific categories. You'll find articles from our experts, feature definitions, discussions from users like you, and reports from industry data.

Corporate Tax Software Articles

The Importance of Tax APIs

With the US Tax Day once again come and gone, there is no better time than now to discuss the necessity of application programming interfaces (APIs) in sales tax, value-added tax (VAT), and goods and services tax (GST) software. No matter the size of a company or the breadth of its products and services, they all need tax software that can bridge disparate and siloed data to manage the tax compliance process end to end. Having reliable APIs is the first step in achieving this goal.

by Nathan Calabrese

2021 Trends in Accounting and Finance

This post is part of G2's 2021 digital trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Michael Fauscette, G2's chief research officer and Tom Pringle, VP, market research, and additional coverage on trends identified by G2’s analysts.

by Nathan Calabrese

Corporate Tax Software Glossary Terms

Corporate Tax Software Discussions

0

Question on: Avalara

Has anyone using Avalara experience issues with this service recently 2021?Website issues? Customer Support Issues? Cancellation Issues? Better yet, does anyone have any solutions that have helped them solve any of these issues?

Hi Jeanette, if you're experiencing issues, we'd like to know and work to assist. You may contact Avalara Support (https://help.avalara.com/Contact_Avalara) or your customer account manager. You may also contact customercare@avalara.com to connect with our VP of Customer Excellence, Bobby Sands.

There is nothing we haven't had an issue with regarding Avalara. Website goes down randomly, customer support is the worst, wanted to cancel a service, but didn't receive a notice our annual term was up so it auto renewed. We'd had so many problems with them that they credited us for part of the renewal cost. Our only resolution is to learn how do to all of this in house.

Comment deleted by user.

0

Question on: Sovos

Are there any third-party evaluations of Sovos solutions like from Gartner, IDC or Forrester?IDC MarketScape names Sovos a leader in sales tax and VAT automation applications 2019 vendor assessment

Yes, IDC conducted an extensive vendor assessment of the major market players in sales tax and VAT (including GST) automation and deemed Sovos a leader in the category. You may download the vendor assessment brief at this location: http://bit.ly/gettheIDCbrief

0

Question on: Trolley

Can I use this for receiving money from clients?At The University of Tennessee Knoxville, it is used to send money to students. We use Flywire to receive funds.

Corporate Tax Software Reports

Mid-Market Grid® Report for Corporate Tax

Winter 2025

G2 Report: Grid® Report

Grid® Report for Corporate Tax

Winter 2025

G2 Report: Grid® Report

Enterprise Grid® Report for Corporate Tax

Winter 2025

G2 Report: Grid® Report

Momentum Grid® Report for Corporate Tax

Winter 2025

G2 Report: Momentum Grid® Report

Small-Business Grid® Report for Corporate Tax

Winter 2025

G2 Report: Grid® Report

Enterprise Grid® Report for Corporate Tax

Fall 2024

G2 Report: Grid® Report

Small-Business Grid® Report for Corporate Tax

Fall 2024

G2 Report: Grid® Report

Mid-Market Grid® Report for Corporate Tax

Fall 2024

G2 Report: Grid® Report

Grid® Report for Corporate Tax

Fall 2024

G2 Report: Grid® Report

Momentum Grid® Report for Corporate Tax

Fall 2024

G2 Report: Momentum Grid® Report