What is a budget period?

A budget period is a particular time frame during which a business plans, implements, and evaluates budgets. It can vary in length and is based on the needs and preferences of the organization or individual creating the budget.

Budget intervals can be short-term or long-term. Organizations select a budget period based on its operations, the level of information needed for financial planning, and the capability of accurately projecting revenue and expenses.

Many organizations use demand planning software to foresee the budgets needed to meet future demands. Financial plans and goals, such as anticipated income, expenses, and resource distribution to various activities or divisions, are set throughout a budget period. Organizations track financial performance during this period and make modifications to stay on track.

Types of budget periods

Budgeting periods differ based on the needs and circumstances of the organization. Companies should choose a time frame that aligns with their financial planning cycle and enables effective monitoring and control over resources. Here are a few types of budgeting periods commonly used.

- Annual budgets include a thorough picture of the company's financial objectives, revenue forecasts, and projected costs for the entire year. They frequently serve as the foundation for decision-making and long-term planning.

- Monthly budgets divide the financial plan into separate months. They’re often employed by businesses that need to track revenue and costs more precisely on a monthly basis. For firms that experience seasonal fluctuations or erratic cash flows, monthly budgeting is especially helpful.

- Quarterly budgets split up the financial plan into four quarters. Compared to annual budgets, quarterly budgets allow for more frequent monitoring and adjusting of financial targets and offer a more short-term perspective. They’re by companies in fast-evolving industries or those with inconsistent revenue patterns.

- Rolling budgets update throughout the year. As each budget period is finished, a new one is added. A rolling budget may cover the next 12 months at any one time, moving forward one month at a time. It makes budgeting more dynamic by enabling continual forecasting and modifications depending on performance.

- Zero-based budgeting mandates that each budget line item be justified from scratch rather than using the preceding budget as a baseline. It encourages effective resource allocation by putting a heavy emphasis on weighing the advantages and disadvantages of each purchase.

- Multi-year budgets use a long-term approach for financial forecasting, capital expenditure plans, and strategic planning. They give organizations a bigger picture of expenses and support resource and financial goal alignment toward a business roadmap.

Benefits of a budget period

A structured budget period means companies can manage resources, adapt to varying situations, and work toward achieving financial objectives. Below are some more notable benefits offered by budgeting periods.

- Goal setting. During a budget cycle, businesses can set financial goals and objectives for a predetermined period. It offers a well-organized framework for allocating resources, setting goals, and focusing on achieving the intended results. Employees and departments can better concentrate their efforts and make decisions that support the organization's financial objectives.

- Planning and resource allocation. A budget period makes it easier to plan and allocate resources efficiently. It lets businesses anticipate costs and estimate future revenue to allocate resources appropriately. Organizations can then make strategic decisions about investments, cost-cutting measures, and funding distribution to various departments or initiatives by being aware of their financial constraints and priorities.

- Performance monitoring. Having a budget period allows for continuous monitoring and assessment of financial performance. Organizations can identify discrepancies or variances by comparing actual revenue and expenses with the projected figures. To ensure that a company is meeting financial targets, this monitoring assists in identifying potential problems early on, making appropriate adjustments, and taking corrective action.

- Decision making. Budget periods offer a framework for well-informed choices. Organizations can use the budget as a tool for comparing different possibilities, prioritizing initiatives, and determining trade-offs when faced with competing demands and limited resources. Leadership can make decisions that align with the organization's financial goals and restrictions.

- Communication and accountability. Better communication and accountability within an organization are made possible by budget periods. The budget is a point of conversation for all parties involved, facilitating open dialogue regarding financial goals and limitations.

- Stability and long-term planning. Organizations with longer budgetary periods, such as multi-year budgets, reap additional benefits. Multi-year budgets let businesses plan for investments, long-term initiatives, and contingencies by providing a more thorough view of upcoming financial requirements.

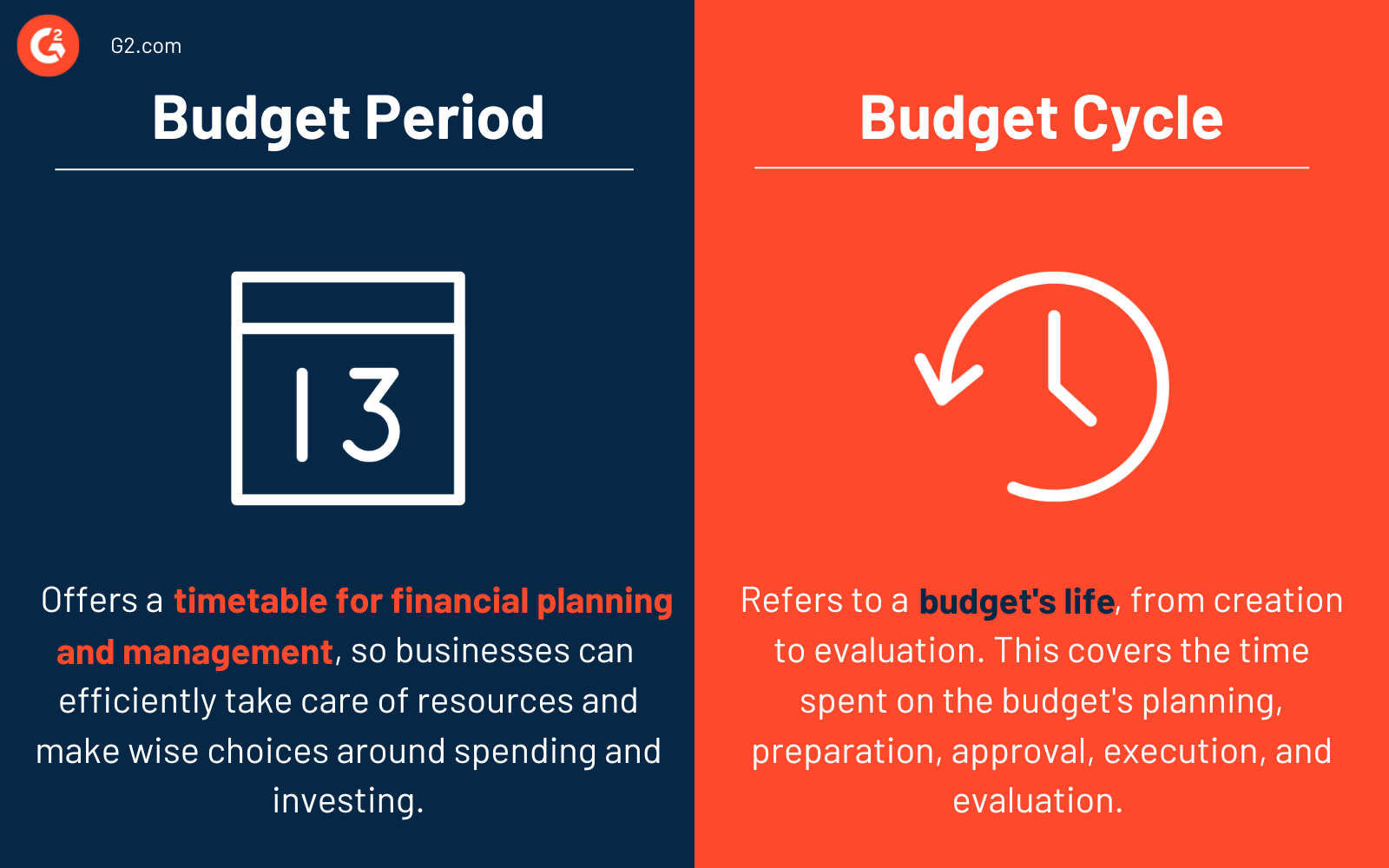

Budget period vs. budget cycle

It's common to confuse budget period with budget cycle, but the two are different.

A budget period offers a set timetable for financial planning and management, enabling businesses to efficiently take care of their resources and make wise choices regarding spending and investing.

A budget cycle refers to a budget’s life, from creation to evaluation. Small firms employ this process when they painstakingly go through the procedures necessary to create and implement a budget.

A budget period is typically shorter than a budget cycle. A budget cycle covers the time spent on the budget's planning, preparation, approval, execution, and evaluation. The actual period the budget applies to is known as the budget period.

Learn more about budgeting and forecasting software to plan the financials required to support future budgeting activities.

Sagar Joshi

Sagar Joshi is a former content marketing specialist at G2 in India. He is an engineer with a keen interest in data analytics and cybersecurity. He writes about topics related to them. You can find him reading books, learning a new language, or playing pool in his free time.