Every investor likes a big payout from smart equity investments.

In fact, shareholders see equity as a great long-term strategy for growing wealth. More and more companies today are selling pro-rata ownership via shareholder equity using equity management software. But, how do you effectively build equity if you don't even know what it is? No matter what investment portfolio management software you use, this article walks you through A to Z of equity for shareholders.

What is equity?

Equity is the difference between total assets and total liabilities. Shareholders' equity or owner's equity is the amount of money shareholders get after deducting debt from the total liquidation value. Equity in case of acquisition equals company sales value minus debt and liabilities not transferred with the sale.

Assets are anything your business invests in and owns, such as computers, office equipment, vehicles, etc. Liabilities are things that your business must pay off, such as accounts payable, mortgages, and loans. Once you pay off all of the liabilities that you owe, you are left with the cost of equity.

Put simply, equity means the actual amount of money that you own in an investment. The main goal in obtaining more equity is that when you pay off all the loans and other expenses, you are left with capital gains.

Types of equity value

Two types of equity value are:

- Book value is the difference between assets and liabilities.

- Market value or market capitalization shows the total value of a company’s equity. You can find the market value of equity by multiplying the current stock price by the number of outstanding shares.

While it might be difficult to keep track of what you owe and own in your business, equity management can be as easy as utilizing accounting software to ensure that you’re consistently building equity and getting a great return on your investments.

How shareholders’ equity works

Stockholders’ equity or shareholders’ equity is the assets given to shareholders after the company's liabilities have been taken care of.

When you decide to invest in a company’s stock or earnings, then you essentially become a stockholder with a certain amount of ownership (shares) in the company. Over time, the company will report if it has made a profit or recorded losses. If the company has made a major profit, then the stockholders may have hit the jackpot.

That profit will then flow into the shareholders’ equity. The company then has to decide if it will use this profit (return on equity) to invest in the business or pay dividends to the stockholders. Dividends are just a fancy term for money that you, the stockholder, will receive based on how many shares you own.

Components of shareholders’ equity

Stockholders’ equity consists of the following:

- Outstanding shares represent company stocks sold to investors but not repurchased by a company.

- Additional paid-in capital is the money shareholders pay above the share price face value.

- Retained earnings are the income a company keeps instead of paying it out as a dividend to stockholders.

- Treasury stocks are the number of shares a company repurchases from investors.

Shareholders’ equity can be a fruitful investment for small business owners and individuals looking to participate in equity financing.

That being said, when you have stockholders’ equity in a company, it can prove very beneficial to both the company and the stockholder. As the company increases its retained earnings (a combination of its profits and investments) every year, your equity as a stockholder will grow incrementally, which potentially means more money in your pocket.

As the company’s profits increase yearly, this proves to the company’s investors that the company is financially stable with a high return on equity (ROE), proving the investors’ investment worthwhile. Investors look at a company’s balance sheet or financial analysis to find the ROE, which indicates whether a company is profitable and if you’ll make money from your investments.

Return on equity (ROE) = net income / average shareholders’ equity

For example, if you see that a company’s ROE is 1.50, that means that for every dollar you put into the company, you will receive $1.50 back.

As with all investments, however, there is also risk. If the company records losses, then this can mean a loss on your investment. So do your research, and make sure that the company you decide to invest in has a high return on equity. And as with all financial planning, make sure to utilize any investment accounting software to help you along the way.

Quer aprender mais sobre Software de Gestão de Portfólio de Investimentos? Explore os produtos de Gestão de Carteira de Investimentos.

How to calculate shareholders’ equity

You can use a company's financial statement or balance sheet to calculate shareholders’ equity. First, find the company’s total assets and total liabilities. Then, calculate shareholder equity by deducting total liabilities from total assets.

Shareholders' equity formula:

Shareholders’ equity = total assets − total liabilities

or,

Shareholders’ equity = share capital + retained earnings - treasury shares value

While both methods give you the exact same figure, the first method is more commonly used. Now, let’s look at an example of shareholder equity.

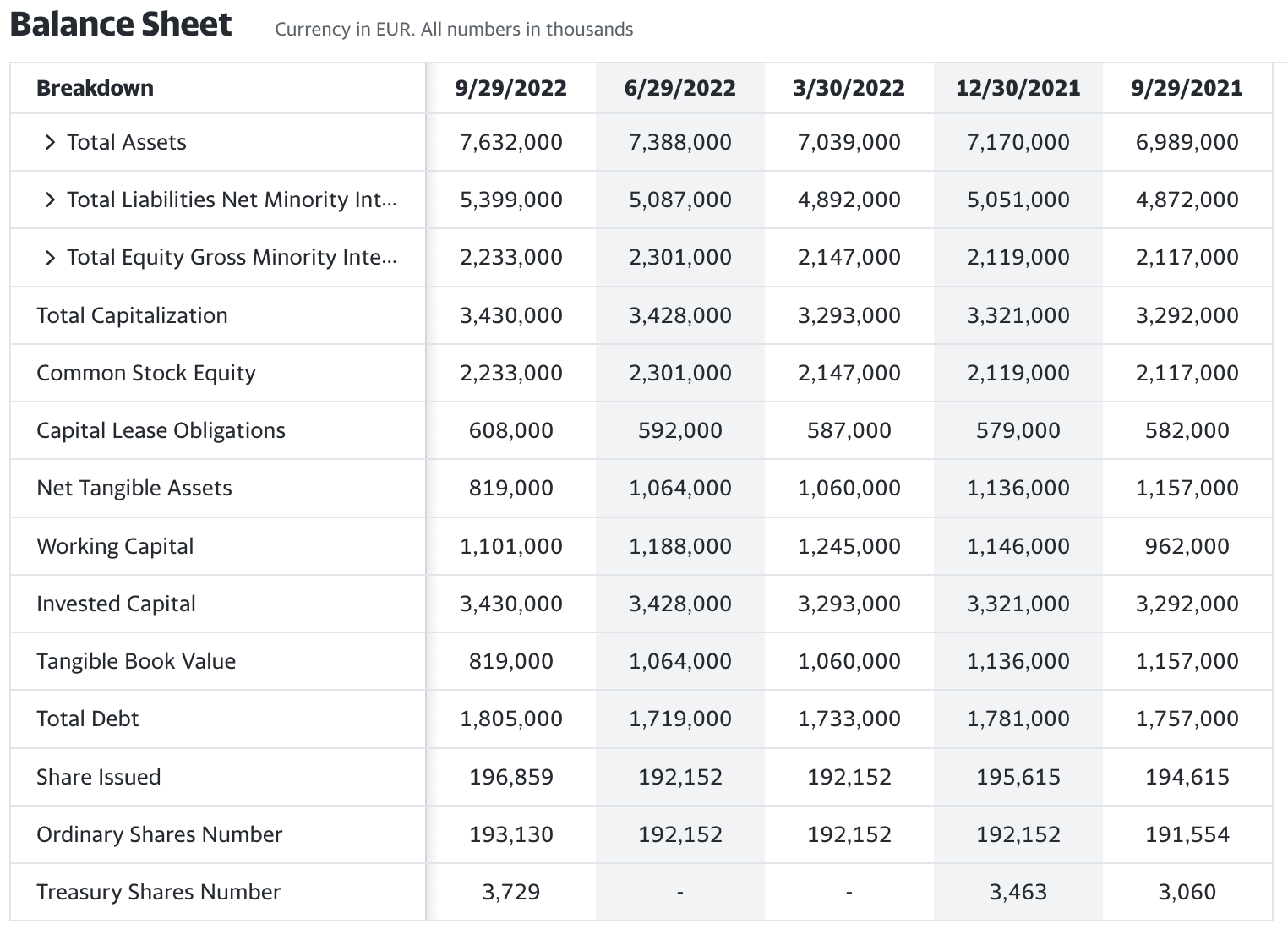

Below is Spotify’s Q3 balance sheet for 2022.

The key numbers as of September 29, 2022 are:

- Total assets = €7,632,000

- Total liabilities = €5,399,000

- Total equity = €2,233,000

The accounting equation considers assets as the sum of liabilities and shareholder equity. So, the calculation is as follows.

Shareholder equity (€2,233,000) = total assets (€7,632,000) - total liabilities (€5,399,000)

The concept of equity goes beyond figuring out company valuation. The term equity also refers to what remains after all debts have been paid off.

Different equity types

With a basic understanding of equity, you can start delving into the most lucrative and useful ways to utilize equity. The following types of equity are important to understand because these are investments that you can immediately make within your business and your personal life to improve your financial situation.

Types of equity accounts

Businesses use the following types of accounts to record equity on balance sheets.

- Common stocks are the shares you initially invest in a company at the par of face stock value. Multiply the face value by the number of outstanding shares to calculate the common stock.

- Preferred stocks offer stockholders better rights, such as higher dividend payments and claim to assets in case of liquidation. However, investors have no or limited voting rights.

- Treasury stocks or treasury shares are outstanding stocks that a company buys back from stockholders and keeps in treasury. Companies use treasury stocks to limit the number of shares in the open market.

- Retained earnings are equal to the difference between business earnings and dividends paid to shareholders.

- Additional paid-in capital (APIC) or contributed surplus shows the difference between a stock’s par value and the price investors actually pay for it. Investors buy shares above par value from a company during its initial public offering (IPO) to receive the APIC.

Home equity

Home equity is the value of your home minus the mortgage amount you owe.

Have you ever tried to flip a home for a profit? If so, then chances are you have built home equity before.

For example, if someone owns real estate i.e. home worth $100,000 (the asset) but borrowed $80,000 from a bank (which is opening a mortgage) to purchase the home (the liability), then you own $20,000 of home equity. Let’s plug it into the equity equation:

Home value ($100,000) - loan ($80,000) = home equity ($20,000, home equity you own at the time of purchase, 20% home equity)

Because you paid $20,000 upfront for a home that is worth $100,000, you own 20 percent of the home when you purchase it initially. Once you pay the bank back the $80,000 loan, then you reach full home equity.

Understanding your home equity is very important because it can be a major investment for any homeowner. Let’s say down the line that your home increases in value from $100,000 to $200,000. Not only has your asset value just doubled, but your equity stake has tripled from 20 percent to 60 percent.

Your home is $200,000, but you still only owe $80,000 from the home equity loan/mortgage. You just made a potential profit of $120,000 and could potentially keep making more money if your home keeps increasing in value.

The takeaway here is that building home equity has the potential to be incredibly lucrative. To keep building your home equity at a steady pace, it’s important to pay back the loans on your house so you can get closer to full ownership.

At the same time, building home equity can be as easy as purchasing a house and watching the market value naturally increase. While it may be challenging to manage your loans on your own, there’s plenty of loan software that can make sure you’re staying up to date with your loan payments.

Owner's equity

Owner’s equity is essentially the exact same thing as stockholder’s equity, except instead of stockholders getting those dividend payouts, those payouts would go to the owners of the company.

Owner’s equity applies to private companies or startups that are not traded publicly on the stock market. These companies have no stockholders, and thus all of the equity goes straight to the owners or partners.

Owner’s equity is important for a couple of reasons. It’s vital to look at an owner's equity to understand a company’s financial health. The owner’s equity is the best indicator of whether a company actually made a profit.

It’s important to keep track of owner's equity because it can also show future investors that a company is healthy because the profits are greater than the losses. As before, you will always want to keep your return on equity (ROE) high to attract new investors.

Attracting investors by showing them that your company is healthy is the best way to receive more funding for business expansion.

Private equity

Private equity is an alternative investment that relies on partnerships to buy and sell companies for profit. Both institutional and accredited investors fund private equity companies to evaluate and hold stakes in companies that aren’t publicly traded on a stock exchange. To meet the significant capital investment, private equity firms often raise funds from venture capital, hedge funds, and high net worth individuals (HNWIs).

Brand equity

Investors also look at a company’s intangible assets to understand the inherent value of the brand. This value premium, aka brand equity, comes from a loyal customer base, strong branding, and competitive advantage. Brand equity plays a key role in helping investors decide whether to invest in a generic or store-brand product.

The dilemma: buy now or later

Building equity can be as fruitful as it sounds. And while we are living in a generation that demands instant gratification, finding the right asset allocation brings you financial security and peace of mind.

Before you get your feet wet, make sure to get some help along your equity journey.

If you're considering investing in a company, make sure it keeps financial reports transparent and consistent according to the generally accepted accounting principles (GAAP).

This article was originally published in 2018. It has been updated with new information and examples.

Michael Gigante

Mike is a former market research analyst focusing on CAD, PLM, and supply chain software. Since joining G2 in October 2018, Mike has grounded his work in the industrial and architectural design space by gaining market knowledge in building information modeling, computer-aided engineering and manufacturing, and product and machine design. Mike leverages his knowledge of the CAD market to accurately represent the space for buyers, build out new software categories on G2, and provide consumers with data-driven content and research. Mike is a Chicago native. In his spare time he enjoys going to improv shows, watching sports, and reading Wikipedia pages on virtually any subject.