Accounting is one of the most important, yet daunting and expensive departments in almost all companies.

Accountants oversee all financial operations of a business to help it run smoothly and efficiently. These include preparing and analyzing financial statements (e.g., cash flow, income statement, balance sheet), paying taxes on time, and maintaining the companies’ general ledger (GL). All these tasks require a great deal of human interaction that takes time and money; no matter how careful an employee may be, there is always the chance for human error, which could snowball and lead to devastating financial results in the future.

Recent trends have made artificial intelligence (AI) available in accounting software, which is making a significant impact on the accounting and finance sector, just like it has for every other industry. With the help of AI, accounting tasks that once took hours and days to accomplish can now be completed more accurately in just a fraction of the time.

AI saves time and money

AI is important in accounting and finance as it streamlines and optimizes many repetitive accounting processes. The overall outcome is that organizations can save more time and money as AI provides valuable insights to accounting and financial analysts and assists in analyzing large amounts of data fast, generating more accurate, actionable data at lower costs. This data can then be used to deliver insights and analytics, driving strategic decision making that affects the whole company.

Automation of repetitive tasks

AI in accounting and finance has the potential to uncover trends and additional insights by analyzing and interpreting data. As mentioned previously, the biggest impact of AI in these departments is the increased efficiency and accuracy that comes from automating repetitive and administrative tasks, helping accounting teams add real value to their company, customers, and both.

| Some of the tasks that AI can help automate and streamline are: |

|

AI also enhances several other accounting processes, such as accounts payable and accounts receivable, invoicing, billing, expense management, and procurement or purchasing. With AI, AP and AR teams can analyze large volumes of transactions to detect hidden errors or trends, while procurement and invoicing or billings teams can detect potential issues with future purchases, such as late payments, deliveries, and both.

| Related: The Importance of Accounts Payable (AP) Automation → |

Fraud protection, auditing, or compliance

Applying AI to data sets can also help in reducing fraud by providing continual financial auditing processes to make sure companies are in compliance with local, federal, and, if applicable, international regulations.

AI uses its algorithms to rapidly sort through large data sets and flag potential fraud and suspicious activity. It combs through past behaviors of different transactions to highlight odd behaviors, such as deposits or withdrawals from other countries that are sometimes larger than normal sums. AI also continuously learns from GL audits and corrections by humans or flagged transactions so it can make better judgments in the future. In addition, AI helps to reduce fraud with digital banking, especially as the volume of transactions and data increases. It looks for suspicious and dishonest payments that could have slipped through the cracks due to human error.

One of the most important, yet tedious jobs of accounting teams is auditing their data and records to be in compliance with government regulations. AI applies continuous GL or recordkeeping auditing and captures business activities and transactions in real time. By performing continuous reconciliations and adjustments to accruals, a company's books are more accurate throughout the month, while removing some of the burden of month-end close for finance and accounting teams. AI-enabled algorithms in this software use these audits to help ensure the company’s documents and processes are abiding by the laws and rules set forth by different government institutions.

AI in finance

The benefits of AI-powered finance are tremendous. In this month alone, there have been some interesting use cases and impressive interest in the market.

Tipalti raises $150 million to automate payment workflows with AI

Tipalti, a High Performer on G2’s Enterprise Payment Software Grid® (as well as a niche player in the AP Automation Software Grid®), is now valued at over $2 billion after they raised $150 million in Series E funding, which was led by Durable Capital Partners. The company uses machine learning to reduce risks and errors while uncovering workflows that could be streamlined. They have a component called “Detect” which tracks a range of data points, such as emails and payments, with the goal to uncover patterns that can point to fraudulent behavior. The timing of the funding is surely not coincidental, as businesses are especially focused on watching where the money is coming from and where it is going during the pandemic.

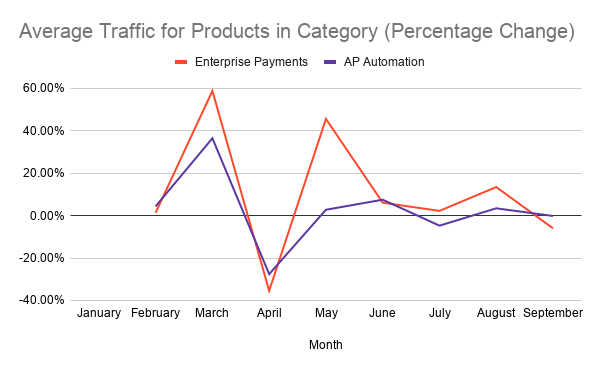

As can be seen in the graph below, G2 data reflects this thirst for software to help companies manage and automate their payment processes. This can be seen by the spike in traffic to the Enterprise Payments Software and AP Automation Software categories in March 2020 when the lockdown due to the COVID-19 pandemic began in the United States.

Nym Health raises $16.5 million for its auditable machine learning tools for automating hospital billing

Nym, which has built a platform to automate revenue cycle management for hospital billing, has just raised $16.5 million including funding from Google’s venture arm, GV. Their machine learning tools help hospitals with the perennial problem of billing, which can be particularly difficult due to complicated coding. Their software converts medical charts and electronic medical records from physician’s consultations into proper billing codes automatically.

According to Nym, “the company uses natural language processing and taxonomies that were specifically developed to understand clinical language to determine the optimal charge for each procedure, examination and diagnostic conducted for a patient.”

Billing complications are a particularly difficult problem within the healthcare space and across other industries, such as financial services and retail. Technology based on natural language processing (NLP) can help finance departments in any of these industries make sense of bills, invoices, and more.

As we have seen across categories on G2, businesses have been keen to digitize and automate their work and workflows for a long while now. Due to the COVID-19 pandemic, businesses flocked to G2 since March 2020, looking for ways to work smarter. We saw a major uptick in traffic to the site, with businesses looking to shorten timelines and innovate quickly at scale. We saw this trend across our process categories, as well as within the finance space.

| Read More: The Impact of the COVID-19 Pandemic on Software Search → |

Businesses can choose between off-the-shelf solutions, like those of Nym Health and Tipalti, and end-to-end data science platforms. However, it is not necessarily an either-or scenario because of evolving technology and improved integration capabilities. In this case, data science talent can focus on specific projects and businesses can look to off-the-shelf solutions to automate other processes.

The view from G2: Build it versus buy it

We’ll take a slight detour to look at the use of AI within financial services from the bottom up, or how institutions are relying on data science talent to develop their own AI-powered solutions. Similar to the finance and accounting horizontal, AI in financial services is being used to automate repetitive tasks, such as gathering and sorting data, making sense of unstructured data, and detecting trends over time.

The build-versus-buy dilemma looms large in the AI space. With data scientists and other data experts being expensive and hard to come by, many businesses opt for more off-the-shelf solutions that they can use even with little to no data science experience.

These off-the-shelf tools range in their robustness and the degree to which they facilitate data science tasks in a comprehensive fashion. For example, machine learning software is more focused on point solutions, whereas data science and machine learning platforms allow businesses to facilitate their AI projects from end to end. Either of these approaches can be used to supercharge finance operations, whether that be within an organization or in financial services.

| Industry | Rank |

| IT | 1 |

| Computer Software | 2 |

| Higher Education | 3 |

| Education Management | 4 |

| Research | 5 |

| Financial Services | 6 |

| Hospital & Health Care | 7 |

| Telecommunications | 8 |

| Automotive | 9 |

| Marketing and Advertising | 10 |

Looking at G2 review data above, we can see how prolific AI use is in finance—financial services being within the top 10 industries using these platforms. Although the word on the street is that "AI is expensive", that need not be the case. Looking at the use of AI with financial services, G2 users reported paying anywhere from less than $1000 to upwards of $250,000 annually and from less than $1000 to upwards of $50,000 for one-time setup costs. Therefore, the price range varies greatly, which means that companies can invest in the technology based on their budget and the amount of ROI they are looking to get out of it.

Data, data, and more data

As companies amass more and more data, it’s important to organize and utilize the data to uncover trends and other important information. Regardless of the department, AI can assist in analyzing large amounts of data at rapid speeds, optimize workflows, flag irregularities, and help with overall decision making.

An example of accounting teams using this AI functionality is in cash flow analysis and forecasting. By sifting through endless numbers and transactions, AI can help predict if and when a company might run out of money and, therefore, allow the company to take the proper proactive action to reassess their situation.

AI can also quickly review invoices and bills to detect duplicates and cut down on over or double payments. Accounting firms use AI to proactively respond to clients’ challenges before they become too severe. With insight derived from AI, financial planners or accountants can adjust an investment plan or expenditures to better plan for the future and avoid possible financial miscues.

The rules of accounting stay the same, but the way accounting tasks and processes are being completed are changing rapidly. The industry agrees; based on a global survey of more than 3,000 executives, managers, and analysts performed by MIT Sloan Management Review, “Almost 85% believe AI will allow their companies to obtain or sustain a competitive advantage. But only about one in five companies has incorporated AI in some offerings or processes.”

The profession of accounting is becoming more sophisticated and streamlined, and it’s important that accountants and finance teams don’t resist these changes. They could end up being left behind by those who have adopted new software and services that harness the power of AI, to take advantage of the cost and time savings they provide.

This article is co-written by Matthew Miller, G2 research principal, AI & analytics

Quer aprender mais sobre Compra de Software? Explore os produtos de Compra.

Nathan Calabrese

Nathan is a Senior Research Analyst at G2 focusing on finance and accounting software and their respective markets. Coming from the world of finance, Nathan understands and is familiar with the importance of finance/accounting software, and the complexities, struggles, and nuances that come with them. He has over 15 years of analytical experience in industries ranging from health care and transportation logistics to food service and software. Nathan received his MBA in finance and international business administration from the University of Illinois, Chicago, and his B.S. in production and operations management from California State University, Chico.