The current state of the global supply chain is in an absolute whirlwind. With the coronavirus pandemic, the trade war between the United States and China, and the upcoming 2020 United States presidential election, supply chains across countless industries are facing unprecedented disruption.

Majority of these issues are arising since the Asia Pacific (APAC) region holds a number of key links in the global supply chain. Over the past two decades, the global supply chain has become increasingly reliant and centered around the APAC region, particularly China.

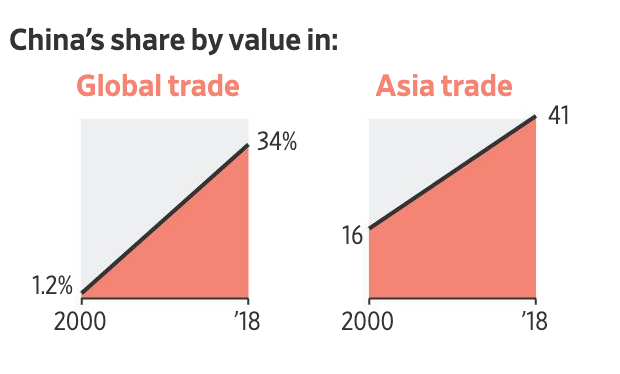

Image Source: The Wall Street Journal

Image Source: The Wall Street Journal

In 2000, China accounted for just 1.2% of global trade. By 2018, its share went up to more than one third.

The outsourcing of supply manufacturing to China has been cost efficient for North American vendors who want a wide range of skilled labor at a cheap cost. However, this over reliance has caused major issues in the past few years.

Below we highlight some of the main issues disrupting supply chains in APAC, and how these issues can be mitigated by leveraging the offerings of supply chain technology.

Issues in APAC causing supply chain disruptions

Back in July 2018, President Donald Trump imposed a series of tariffs on goods imported to the United States from China, with the goal to encourage consumers to purchase products that are manufactured in the United States. This move is also meant to mitigate the overall trade deficit that exists between China and the United States. This has sparked an ongoing trade war, resulting in both countries continually raising tariffs on imports against each other.

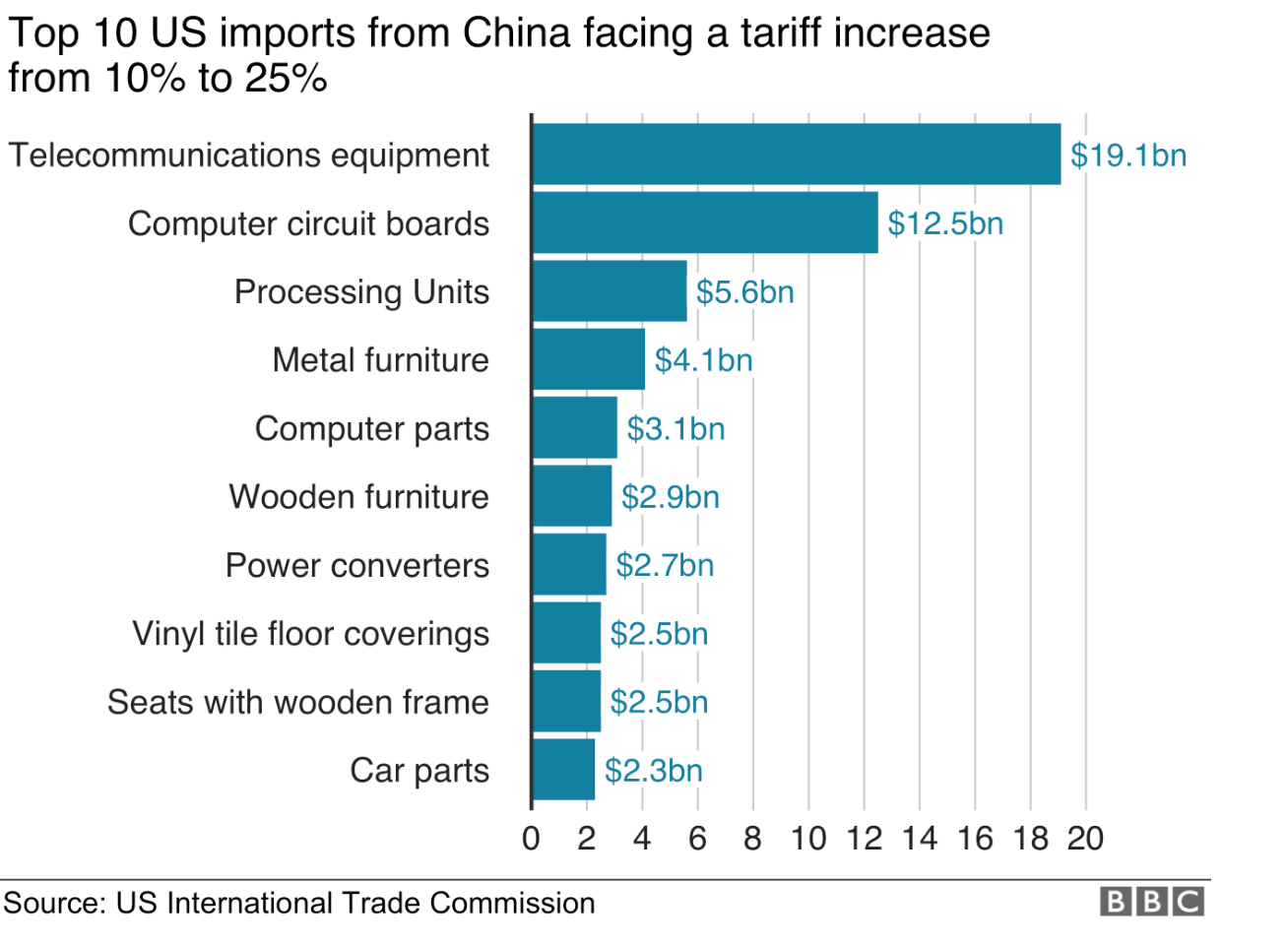

In total, President Trump has imposed tariffs on Chinese goods worth over $360 billion. While these goods range from machinery to clothing, the biggest imports that have been affected are telecommunications equipment and computer circuit boards.

Image Source: BBC

Image Source: BBC

Most technology companies rely on these goods for manufacturing which they import from China.

Apple, for instance, has greatly relied on China as a source for manufacturing and since the tariffs have been introduced, their stock position in the market has been extremely volatile. When China retaliated by placing a tariff of their own on the United States, the market was fearful that the latter would retaliate with even more tariffs on technology imports from China. In August, this speculation caused Apple stock to drop almost 5% in a single day.

Aside from the ongoing trade wars, the coronavirus pandemic has also had a major impact on the global supply chain.

| Related: The Impact of the Coronavirus on Tech Supply Chains → |

The coronavirus’ epicenter, China's Wuhan region, serves as a vital cog in the global supply chain. According to a report on the virus' business impact, 51,000 companies around the world have one or more direct suppliers in Wuhan and at least 5 million companies have one or more tier 2 suppliers in the Wuhan region.

As an increasing number of factory workers are kept away from the production lines, companies are not being able to produce at the same rate as they generally would. This has caused major disruptions for technology vendors that heavily rely on their direct suppliers in Wuhan and other nearby areas in China.

Top technology companies still counting on China

Even with all of the issues surrounding the trade wars and the coronavirus, some vendors are insistent on sourcing their supply chains in China.

Dan Panzica, a former executive at Foxconn (Apple’s top manufacturer in China) expands on the challenge of finding better sourcing opportunities in nearby countries:

“The population in China has allowed suppliers to build factories with a capacity for more than 250,000 people,” Panzica said. “The number of migrant workers in China, who do much of Apple’s production, exceed Vietnam’s total population of 100 million. India is the closest comparison, but its roads, ports and infrastructure lag far behind those in China.”

Besides the lack of nearby sourcing opportunities, many countries have simply made too big of an investment on establishing major production centers in China to be deterred by the trade wars or the coronavirus pandemic.

It is also possible for some companies to perceive the issues affecting the APAC region as simply circumstantial. Certainly, the coronavirus scare has the capacity to slow down, and some technology vendors may also wait for the 2020 presidential election to see if trade policies between the two countries change.

| Related: How to Choose the Best Supply Chain Software for Your Business → |

Supply chain technology has become increasingly important

If top technology companies continue to source most of their supply chain in China, then supply chain management technology becomes the need of the hour for vendors.

Vendors (especially North American vendors) should at the very least recognize the inherent risks associated with sourcing all the manufacturing from halfway across the world. There is less visibility, less communication, and ultimately less control over how and when products get manufactured and shipped.

Supplier risk management software can help vendors evaluate and monitor suppliers in the APAC region, assisting them with risk identification and risk mitigation. Whether it’s a geopolitical cause or natural disaster, supplier risk management will allow companies to minimize the risk of financial, geographical, and political disruptions.

If there is a predictive risk analysis already occurring, then companies can make preparations to source their supply chains in tier 2 or tier 3 supplier locations that are not affected by the current crisis. The ability to rapidly shift production and sourcing to different countries can be costly, but it will offset the cost of otherwise continuing production in the area that is affected.

These are uncertain times for global trade, and hence, another important piece of technology to monitor the global supply chain is supply chain visibility software. It allows companies to track raw materials, parts, components, and finished goods from suppliers to manufacturers, retailers, distributors, and finally to the customer.

When an unpredictable event like the coronavirus outbreak occurs, businesses who map their supply chain more effectively will be able to know which production lines are being impacted.

Jim Hull, senior industry strategies director for JDA, a provider of AI-driven supply chain management services, elaborates on the importance of good supply chain visibility during this time in APAC:

“I suspect the biggest area that shippers (and their customers) need to be really solid on right now is inventory visibility across the supply chain. As the outbreak continues to develop, companies that source from affected areas will have to make hard decisions on where to position the inventory that they already have. The first step in this is knowing what you have and where it is.”

A supply chain makeover?

The current supply chain issues in APAC will certainly leave top technology companies thinking about potential ways to restructure their global supply chains. However, we shouldn’t expect these changes to occur overnight. As stated, some companies will wait out the coronavirus scare as well as monitor the status of the trade war after the 2020 presidential election.

Instead of swift changes, we should see gradual changes to supply chain planning as vendors look for various tier 2 and tier 3 suppliers that can support their supply chains in moments of unpredictability.

In fact, some global vendors outside the technology world are already making adjustments. Honda auto parts maker F-TECH made up for the lack of brake pedal production in Wuhan by increasing production in its plant in the Philippines. Honda was prepared with a tier 2 supplier, which will potentially lessen the effects of the coronavirus pandemic on their supply chain.

As we continue to monitor the currency state of the supply chain in APAC, we will see various global vendors focus on supply chain risk management and search for future solutions in order to mitigate future disruptions like the one we are seeing now.

Quer aprender mais sobre Software de Planejamento de Demanda? Explore os produtos de Planejamento de Demanda.

Michael Gigante

Mike is a former market research analyst focusing on CAD, PLM, and supply chain software. Since joining G2 in October 2018, Mike has grounded his work in the industrial and architectural design space by gaining market knowledge in building information modeling, computer-aided engineering and manufacturing, and product and machine design. Mike leverages his knowledge of the CAD market to accurately represent the space for buyers, build out new software categories on G2, and provide consumers with data-driven content and research. Mike is a Chicago native. In his spare time he enjoys going to improv shows, watching sports, and reading Wikipedia pages on virtually any subject.