Fintech that facilitates financial inclusion may be one of the more altruistic applications of fintech. In truth, many banks and fintechs are looking at financially excluded demographics as a potential windfall.

Historically, banks have had little reason to engage with rural, low-income populations. The ROI wasn’t large enough to warrant opening branches in those areas. This lead to entrenched financial exclusion. This is when people lack access to basic financial services like a bank account or credit. According to the Global Findex Database, in 2017 there were nearly two billion unbanked individuals worldwide. This presented a massive financial opportunity for banks, estimated by Accenture to be around $380 billion.

Fintech’s expansion to the underbanked

It’s helpful to know the difference between unbanked and underbanked, because the two terms are sometimes used interchangeably when they are different.

Unbanked definition:

An unbanked individual is an adult who does not have a bank account and does not use basic financial products like loans or credit. In 2018, there were around 1.7 billion unbanked individuals worldwide.

Underbanked definition:

An underbanked individual is someone who may have a checking or savings account, but does not use other financial services, instead preferring to manage the bulk of their finances using cash transactions. Underbanked individuals might use check cashing services or payday loans, which tend to be far more expensive than traditional loans and credit cards.

South America is a prime example of a region where the number of unbanked or underbanked individuals is quite high; multiple companies are trying to address the core issues behind that. Lack of financial inclusion leads to less ability to gain access to the middle class; wealth gaps widen, and the issue becomes more ingrained.

As a result of this exclusion, most unbanked individuals have not achieved upward socio-economic mobility. Access to financial products spurs economic activity, a key indicator of prosperity and the ability to create wealth.

Financial inclusion-focused VC funds

There are multiple VC funds, like Quona Capital and Accion, and companies dedicated to funding inclusion-focused projects. These funds primarily look at technology such as mobile banking software that leverages the proliferation of smartphones in the region. Everyone has a smartphone, even in rural areas, so why not use that access to allow people to connect to financial products?

Financial inclusion-focused VC funds are partly driven by altruism, or trying to lower the barriers to enter the financial services world, which constitutes access to many other opportunities as well. These funds want to align their profit with their purpose; additionally, their portfolio companies are selected if their mission aligns with the fund. These funds will be an important catalyst for driving financial inclusion going forward.

Issues with financial inclusion

One of the key issues with financial inclusion is identity verification. With smartphones, there is easy access to multi-factor authentication (MFA) software and entire digital identities that individuals can use to broker the necessary trust to start using a bank’s financial products.

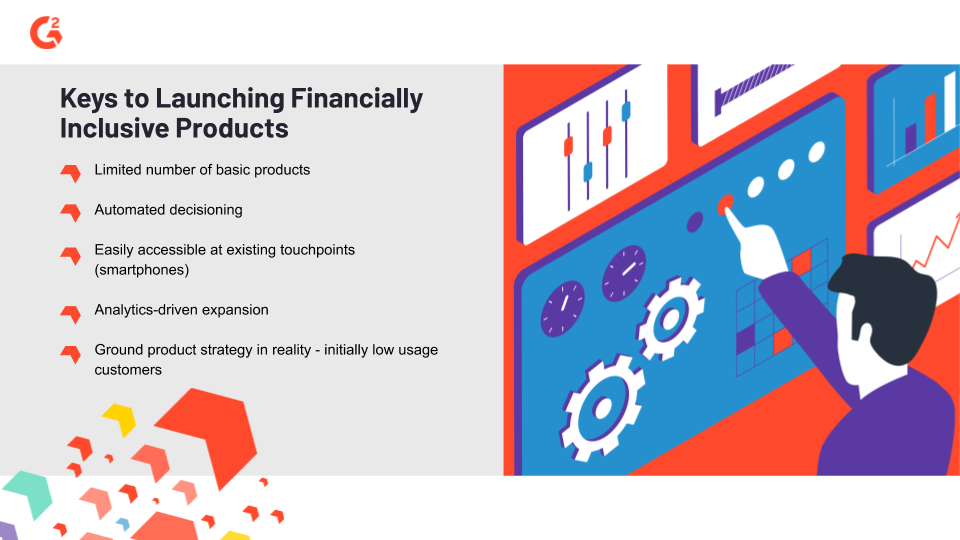

Another issue is the low margins financial services firms will deal with when working with financially excluded individuals. Initially, they will use the bare minimum of services available, generating the service provider less income. The key to overcoming the reticence associated with lower margins is to launch products intelligently, possibly in a lightweight pilot format to accrue evidence as to the profit potential in these areas. Financial services firms that are able to secure an early foothold and acquire customers in the unbanked demographic have an excellent chance of developing customers that will use more financial products as they leverage their financial inclusion to improve their socio-economic position.

What the future of financial inclusion looks like

The easiest method of increasing the number of financially included individuals in an area with little infrastructure is via mobile applications. Worldwide smartphone proliferation includes rural areas and those historically underserved by financial services institutions. The way to financially include this group of potential customers is by creating and pushing a mobile banking application.

Limiting the amount of resources spent on products in low-income, low-engagement areas ensures a financially viable operation. Automation comes in handy here; if there is any part of the operation you can sensibly automate, you should. This includes loan and credit decisioning, anti-money laundering, digital identity verification, and other areas where regtech tools can help. The margins on each customer will be low, so ensure that customer acquisition strategy is analytics-driven and based in reality. The goal is widespread product adoption, with a focus on increasing engagement at later stages in the bank-customer relationship.

Banks have historically neglected the financially excluded, but are starting to wake up to the possibility of leveraging mobile devices to carry out banking activities. Fintechs and neo-banks (digital-first institutions with a focus on mobile banking) are the vanguard in the war for financial inclusion, but big banks are taking notice. The end result will likely include a muddled landscape of different parties, with localized flavor, morphing into partnerships and collaborative relationships to flesh out financial inclusion in the future.

Financial literacy programs are a smart way for banks to gain widespread adoption in areas where there are large numbers of unbanked individuals. There are financial wellness applications out there, but banks should launch free financial literacy programs and weave financial literacy education into their products in underbanked or unbanked areas. Ensuring their target market knows the technology is available and that it’ll help reduce the cost of moving money in their daily lives is vital to gain traction.

In the next couple years, we’ll see if any big banks make the necessary moves to increase the number of financially included individuals and turn them into customers.

Quer aprender mais sobre Software de Serviços Financeiros? Explore os produtos de Serviços Financeiros.

Patrick Szakiel

Patrick is a Senior Market Research Manager and Senior Analyst (Fintech and Legaltech) at G2. Prior to G2, he worked in a variety of roles, from sales to marketing to teaching, but he enjoys the opportunity to constantly learn and grow that the tech industry provides. Outside of work, Patrick enjoys reading, writing, traveling, jiu-jitsu, playing guitar, and hiking.