Top Rated Orion Risk Intelligence Alternatives

The instantaneous results you obtain with a user friendly interface. Review collected by and hosted on G2.com.

The options, at times, can seem mind-boggling. Review collected by and hosted on G2.com.

Video Reviews

35 out of 36 Total Reviews for Orion Risk Intelligence

The out put reports are client friendly and very compelling. Review collected by and hosted on G2.com.

There is a learning curve and the software isn't exactly inexpensive. Review collected by and hosted on G2.com.

I like the investment risk scores along with the integration with Raymond James. I can quickly see how much risk is in a client's portfolio. The questionnaire is simple and easy for the client to understand. Review collected by and hosted on G2.com.

I dislike that it cannot comprehend certain investments like structured investments or annuities with their guarantees. Some UITs are also missed. This leads to a misleading risk score. I also dislike how the risk questionnaire scores all come back between 15 and 25 regardless of their answers; someone young and wants risk will come up with a 38 which is 75% stocks. I find that incorrect. Review collected by and hosted on G2.com.

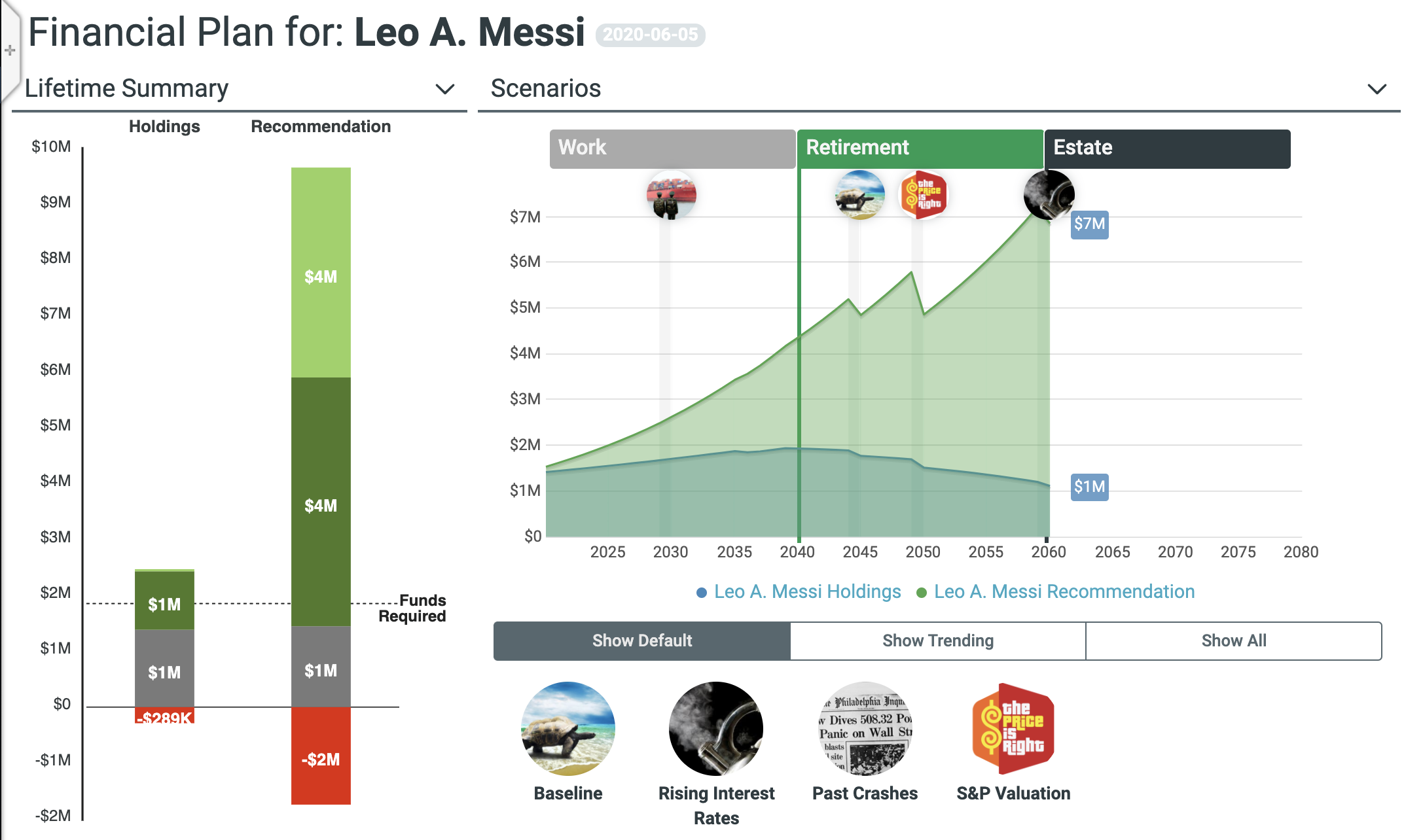

HiddenLevers has been an integral part of our process to ensure that client's portfolios are in line with their risk tolerance, time horizon, and goals. Reports produced by HiddenLevers are professional and enhance the client's understanding of their portfolios. Review collected by and hosted on G2.com.

Additional customization capabilities would improve the experience. Review collected by and hosted on G2.com.

I love HiddenLevers! It has helped me clearly show clients what is happening in their current accounts and what the possible futures can be for them. I have closed several sales with this program and the custom portfolio outputs it helps you with. Review collected by and hosted on G2.com.

The only thing that I found a little challenging was that it told a few portfolios to get used to the program's options. Review collected by and hosted on G2.com.

The different scenarios are a great talking point with clients and a differentiator from Riskalyze, although the "speed limit" they use is more relatable than a standard risk score. It would be cool to do something unique with the risk score to create a metaphor for risk/return (driving a car, etc.) Review collected by and hosted on G2.com.

The RTQ should consider showing the graphs for different equity allocations ending on a down market, as well as up markets. It's easy for someone to think they want to choose the aggressive option when the end result always shows it outperforming the S&P 500 during an up market. Showing the graph end on a down market might help explain the volatility better. Also the Orion integration is a little buggy sometimes, for instance I just tried to login and am not seeing holdings for any of the accounts through the integration. Review collected by and hosted on G2.com.

The stress test is an exceptional tool to demonstrate portfolio reaction to potential adverse market conditions. Also the ability to look at past portfolio performance side by side has proved very useful as well. Review collected by and hosted on G2.com.

Nothing. They seem to have too much fun at work?? Review collected by and hosted on G2.com.

The relevancy of outcomes for each scenario is what investors are really thinking about. If a client has real concerns over a specific event that could effect them from achieving their goals, we can see how each underlying investment would react, then at the account level, then at the entire portfolio level. Review collected by and hosted on G2.com.

Individual fixed income investments are not as accurate as stocks, ETFs, or mutual funds. It can be difficult to determine the best mix of scenario outcomes aligned with probably of them happening for Compliance to be in agreement as well. Review collected by and hosted on G2.com.

I find the risk profile comparison the most helpful feature. I like how HL puts a green box around the risk/return parameters that have the best numbers out of the portfolios that are being compared and contrasted. I like how they offer a menu of stress-tests ranging from pandemic shutdown to election uncertainty or S&P 500 decline of 20%. Review collected by and hosted on G2.com.

I wish the risk score numbers corresponded with other risk software such as Finemetrica and Riskalyze. Review collected by and hosted on G2.com.