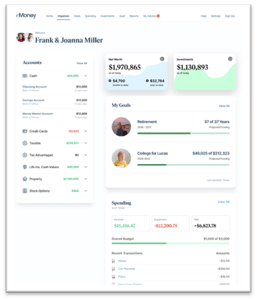

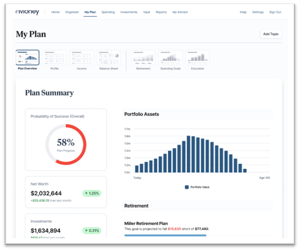

It's a cash flow-based planning software which (I believe) is the most useful and effective kind. The "Decision Center" is extremely cool and hugely helpful when building and then presenting plan options to clients. And I love the various optimizers built in. Perhaps most of all, I love how useful it is in doing tax planning — things like automatically showing you the impacts of filling up certain tax brackets with Roth conversions and what the net lifetime tax impact is. Clients also appreciate the visibility they get in their client dashboard. Review collected by and hosted on G2.com.

It's powerful, but it takes a lot of work to learn how to use it effectively. There are a lot of places to click and a lot of things to learn. Review collected by and hosted on G2.com.

44 out of 45 Total Reviews for eMoney

Overall Review Sentiment for eMoney

Log in to view review sentiment.

In my 11 years as a financial planner, eMoney is my favorite planning platform out of more than 5 others I've tried. The pricing is also competitive. It's very user-friendly for both me and my clients. Because of its versatility, it's also my clients' favorite. The ability to address all aspects of financial planning in one tool really communicates how those aspects are interrelated. How a particular investment or transaction affects taxes and goals is critical for my clients to understand. My clients and I love the ability to analyze how being underinsured affects their family's future well-being, or how the projections suggest that a client might be living too much for tomorrow instead of living in the moment.

eMoney is also always looking for ways to improve the client's experience as well as the planner's experience. Platform updates and improvements come regularly, but I never find myself wishing they would have left it alone. Each update is a legitimate upgrade. Recent improvements have come to their Decision Center, which has really increased my client's understanding of how changing strategies or assumptions affect their future finances in terms of retirement, goal funding, taxes, etc.

The platform is intuitive to the extent that I rarely have to seek out support from their tech team. But when I do, their staff is always able to assist in a timely manner. They're very familiar with the underlying logic, and they're often financial planners too. This means that not only do they understand what I want to model, but also why I want to do it.

The data aggregation feature of the platform is a big time-saver for me and my clients. No data aggregation is perfect, but this one gets close. When I find a flaw, submitting a ticket is easy and the response is quick. Their tech team is also very good about keeping me updated with progress.

Finally, my clients and I appreciate all the types of reports and simulations the system can perform. When my clients ask for some sort of analysis or projections, I feel like eMoney always has the right tool or report to resolve the need. Review collected by and hosted on G2.com.

While eMoney's phone support is great, its user resources are not intuitive. I have found myself spending too much time searching through their knowledge base, unable to find what I need. So I have to call sometimes to get my information.

I understand that supporting data aggregation is an immense challenge. While they do a good job, my clients are sometimes frustrated with the troubleshooting process to fix a connection. Maybe that's a third party handling the data aggregation, but my clients feel like they have to jump through a lot of hoops, sometimes with no resolution.

There's really not much I dislike about eMoney so beyond those complaints, anything more would just be nitpicking. Review collected by and hosted on G2.com.

Emoney is the most comprehensive piece of planning software I have used. It strike a balance between its ease of use and full set of planning features. If you are trying to do a simple plan, you can enter basic client information into Emoney in a few clicks and have both a good understanding of the overall financial picture and a number of reports to share with them. If you need more complex planning, Emoney can drill down and provide a very detailed or nuanced analysis of almost any financial situation. Review collected by and hosted on G2.com.

While Emoney is a grea tool, it is very siloed and does not allow for easy integration with most CRMs today. While my custodian, portfolio aggregator, and Salesforce all speak to one another nicely, Emoney stands separate from them. (It does pull in account information, but only in one direction and with limited information.) Emoney also used to be way ahead of its peers with its interface, but now it seems like it maybe could do with an update. Review collected by and hosted on G2.com.

11 years ago we began with the initial adoption of eMoney. We fully dived into the adoption of the software and since the beginning, eMoney has become an integral tool to our processes firmwide. eMoney was invlved in the implementation process and did a great job all along the way. It has been nice to watch eMoney grow as we have grown. My Team is in the software throughout the day. The software continues to evolve and mature while simultaneously adapting to new tax law changes. I like the customer service the most about eMoney. In the day and age of horrible customer services, it is not true for eMoney. They will always pick up the phone and almost allways resolve the issue immediately. From a customer service standpoint, they are a Company that exemplafies what customer service should be. Review collected by and hosted on G2.com.

It can be complex, but it is what is needed to prepare an accurate financial plan. I would like to see more and deeper integrations with other software in the future. Review collected by and hosted on G2.com.

Best product on the market for building financial plans. The cashflow is the most detailed. The decision center is also great for showing the impact of client decisions. Review collected by and hosted on G2.com.

The client website could be better, specifically the spending area. We always mention that as a value add, but clients have to go in and link up accounts. Also, I feel like the customer support quality has declined a bit. I feel like, I'm having to get passed around a lot more, and feel that the reps on the phone aren't' as knowledgable as they were a few years back. Review collected by and hosted on G2.com.

eMoney is very user friendly! Any time I have any questions with specifics in the software, I've used the chat box and have been guided step-by-step through finding the resolution to my questions. It is easy enough to update in real time during client meetings. Generating reports is quick and they are easy for the clients to understand. We use eMoney on a daily basis with multiple clients. Review collected by and hosted on G2.com.

The only downside is that sometimes it can be tricky to keep accounts that are held away linked properly. They may require "repairs" to update properly. Review collected by and hosted on G2.com.

Great service and they are always advancing their technology. The ability to get help with any client situation is very valuable. Plus it is easy to create a client and implement even a basic plan. I use it for all of my clients in some form or fashion every day. Review collected by and hosted on G2.com.

The only issue, which is an issue with any technology is getting the connections of accounts to stay consistent. But, there team is always there to help and most of the time the issue is with the other company they are trying to connect to, not them. Review collected by and hosted on G2.com.

eMoney offers a wide variety of report options, making each financial plan custom to each client. This allows the plan to be personalized to the adviser's wants and needs. The software has so many capabilities I am always learning something new, even after using it for three years. Review collected by and hosted on G2.com.

One thing I do not like about eMoney is the debt analyzer tool is a little confusing to use and, in my opinion, not as clear for a client to read. Review collected by and hosted on G2.com.

The planning capabilities of eMoney are tremendous. You can get as granular as you desire on the back end and the client portal brings it all to life on the front end. The tools are also supported by people who understand what you are trying to accomplish and how to help you get to the finish line. Review collected by and hosted on G2.com.

If you focus on cash flow, it can be very difficult for clients to provide all of the information needed to complete a comprehensive plan. Review collected by and hosted on G2.com.

I love the what if capabilities. I deal with a lot of real estate investors who have pretty compled financial planning needs and the ability to show them all of the alternatives is a huge help Review collected by and hosted on G2.com.

It can be a lot of information for clients and somewhat overwhelming if not presented in small chunks. I think it's more of a failure of the advisor than of the software Review collected by and hosted on G2.com.

E money has great aesthetics and the user interface is smooth. The clients love the portal and it takes complicated, subject matters and deliveries them, and then easily digestible manner. Review collected by and hosted on G2.com.

The product needs a little more teeth behind it. While it looks great it doesn't cover every topic that a financial plan should cover nor does it provide much guidance on how to improve a plan with prescribed planning techniques. Review collected by and hosted on G2.com.