What is payroll management?

Payroll management is an administrative process wherein employees are financially compensated for the work they have completed. Financial records such as employee gross earnings, payroll deductions, and tax liability are also governed by payroll management systems.

Most human resources (HR) teams use payroll software to manage these processes so employees receive their earned payments on time and for the correct amount. Once employees have been onboarded, payroll is typically automated through this software to maintain accuracy and efficiency.

Types of payroll management

Regardless of size, all businesses should consider using payroll management solutions to pay their employees accurately and to meet regulatory compliance requirements. Payroll personnel use four different types of management.

- Internally-managed. For small companies, taking care of payroll management in-house may be the best option. This involves more manual work than other solutions but can be successful for small teams.

- Professionally-managed. Bookkeepers and certified public accountants (CPAs) can oversee payroll for larger businesses or those without in-house staff. Outsourcing payroll management to experts can prevent discrepancies or tax issues.

- Software-managed. A more hands-off approach to internally-managed payroll, software management options typically have online portals that run payroll automatically. However, discrepancies can occur without regular supervision and become larger problems over time.

- Payroll service agencies. Unlike a bookkeeper or CPA, a payroll agency only handles this single aspect of a business. For businesses with an in-house accountant, this presents a good option.

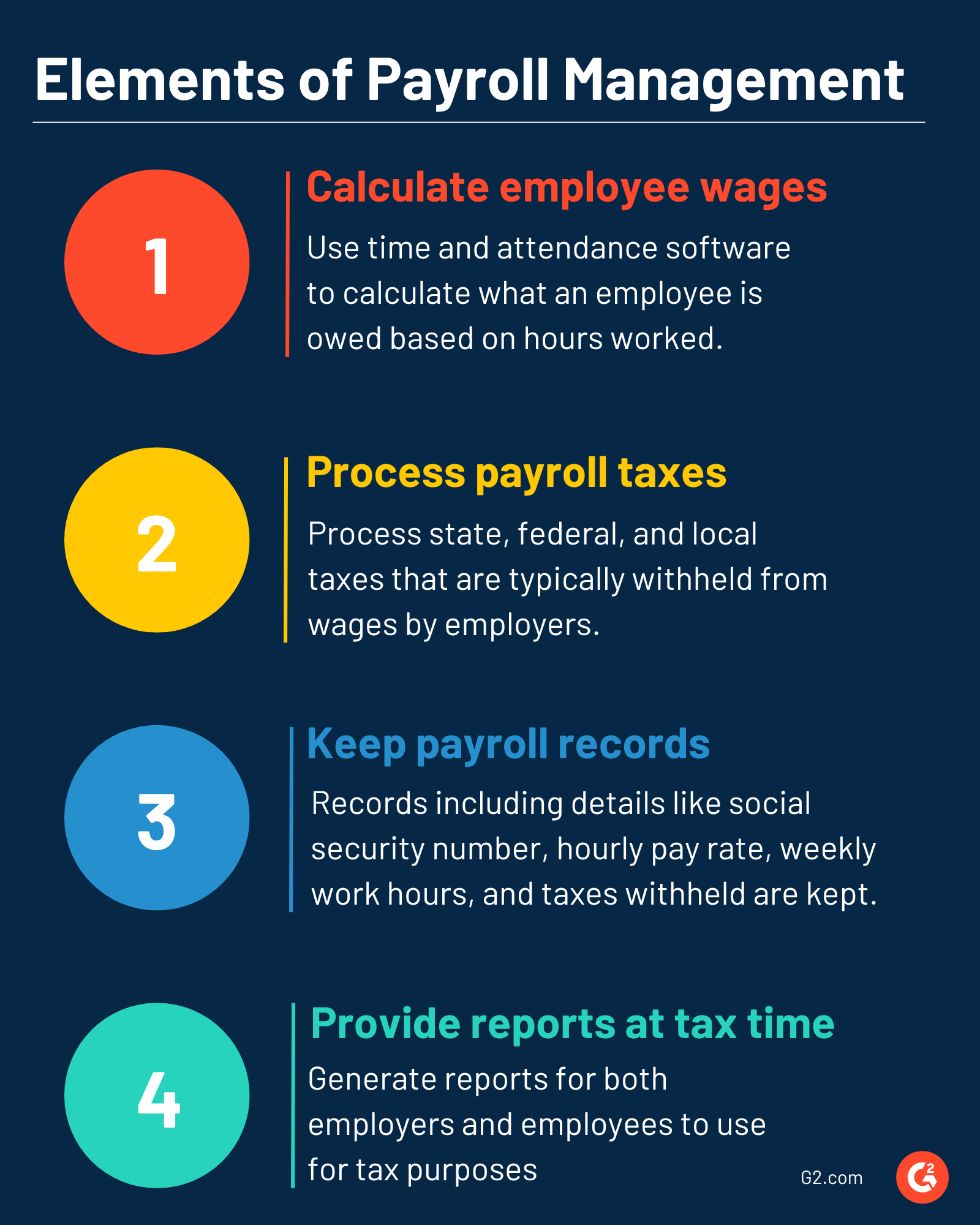

Basic elements of payroll management

In all forms of payroll management, certain elements must be accounted for.

This is the case for teams of all sizes with regard to maintaining compliance and ensuring that employees are paid what they’re owed at the right time.

- Calculating employee wages. Time and attendance sheets may be part of payroll management software or, if not included, should integrate into these tools. This calculates what a non-exempt employee is owed based on their work hours. It accounts for paid time off. The payroll management software also records any voluntary deductions on each paycheck, like retirement plan contributions or union dues.

- Processing payroll taxes. State, federal, and local taxes are typically withheld from employee wages by employers. This is all recorded and processed through the payroll management system.

- Keeping payroll records. Records must be maintained for every employee. This includes critical information like social security number, hourly pay rate or gross salary, weekly work hours, payroll deductions, and taxes withheld. Tax information for employees like W-4’s or state withholding certificates, must also be kept in payroll management systems.

- Providing reports at tax time. Along with keeping employee payment records, a crucial function of payroll management is generating quarterly or annual reports for employers and employees to use for tax purposes. These reports should outline wages paid for the given period, tax withholdings and any details on what an employee may owe in tax payments.

Benefits of payroll management

Paying employees is one of the most important responsibilities of the HR team. Effective payroll management systems mean that:

- Employees are more engaged. People want to be paid for the work they do. Payroll management is essential for tracking what is owed to employees and processing those payments on time. Consistency and accuracy in payroll help satisfy employees, so they’re more likely to stay interested in their work long term.

- Payroll errors are reduced. Repetitive manual data entry can lead to inaccurate information and quickly become difficult to address. Managing payroll through dedicated software can prevent these errors from occurring and flag potential inconsistencies for the HR team to review.

- Personal information is more secure. Payroll details contain highly sensitive and personally-identifiable information about employees. Using dedicated payroll management software with security measures like encryption, employee and business data stays safe from data breaches and theft.

Best practices in payroll management

Although payroll management is frequently changing as software becomes more sophisticated, there are ongoing best practices businesses should try to incorporate into their payroll processes.

- Creating standardized policies and procedures. Payroll management can become complex very quickly. By adhering to a standard policy across the whole company, businesses stay compliant and make processing payroll simpler.

- Adding notifications ahead of important deadlines. Every state and country has different tax requirements that must be met. Building alerts ahead of these deadlines keep HR teams stay organized and up to date.

- Reviewing work classification regularly. Due to their legal status around tax payments, full-time and part-time employees and independent contractors need to be categorized differently within the payroll management system. Companies can face significant taxation penalties if employees are misclassified and either owed additional pay or need to withhold additional taxes.

- Automating frequent payroll functions. Not only does automating tasks save time, but it also means that teams can avoid human errors throughout the payroll management process.

Ensure that employees are paid what they’re owed for the time they work with dedicated time tracking software.

Holly Landis

Holly Landis is a freelance writer for G2. She also specializes in being a digital marketing consultant, focusing in on-page SEO, copy, and content writing. She works with SMEs and creative businesses that want to be more intentional with their digital strategies and grow organically on channels they own. As a Brit now living in the USA, you'll usually find her drinking copious amounts of tea in her cherished Anne Boleyn mug while watching endless reruns of Parks and Rec.