What is an insurance claim?

An insurance claim is a formal request made by a policyholder to an insurance company to compensate for losses covered in the specific insurance plan.

The compensation covers financial losses the insured person faces as per the policy. It offers a critical financial safety net when an unexpected event occurs.

As an insurance agency, managing and settling claims on time is pivotal to maintaining their reputation. Many agencies prefer using insurance claim management software to help insurers manage and evaluate claims.

Types of insurance claims

Insurance claims play a critical role in managing risk and providing financial stability during times of uncertainty. Below are common insurance claims agents deal with.

- Health insurance claims protect a person from enormous financial burdens caused by an illness or accident. Surgical procedures and inpatient hospital stays are often covered in the policy.

- Homeowners' insurance claims cover damages to properties. An insurance firm's representative investigates and assesses the damage to a property before paying their client.

- Life insurance claims must submit a claim form, the death certificate, and the original policy. Insurers conduct an in-depth examination if the insured's death falls under a contract exclusion.

- Travel insurance claims cover travel-related losses, such as trip cancellations or lost luggage.

- Disability insurance claims offer payments to policyholders who cannot work due to an illness or injury.

- Auto insurance claims deal with vehicle damages or losses.

Benefits of an insurance claim

Insurance claims support individuals and their families in times of tragedy. Below are some notable benefits of insurance claims.

- Reduces financial burden: The right coverage helps families reduce their financial burden during an unforeseen situation.

- Offers compensation: The victim of an unfortunate incident receives compensation settlement to rebuild after the tragedy.

- Stabilizes finances: The policyholder maintains financial stability despite experiencing significant damage or loss.

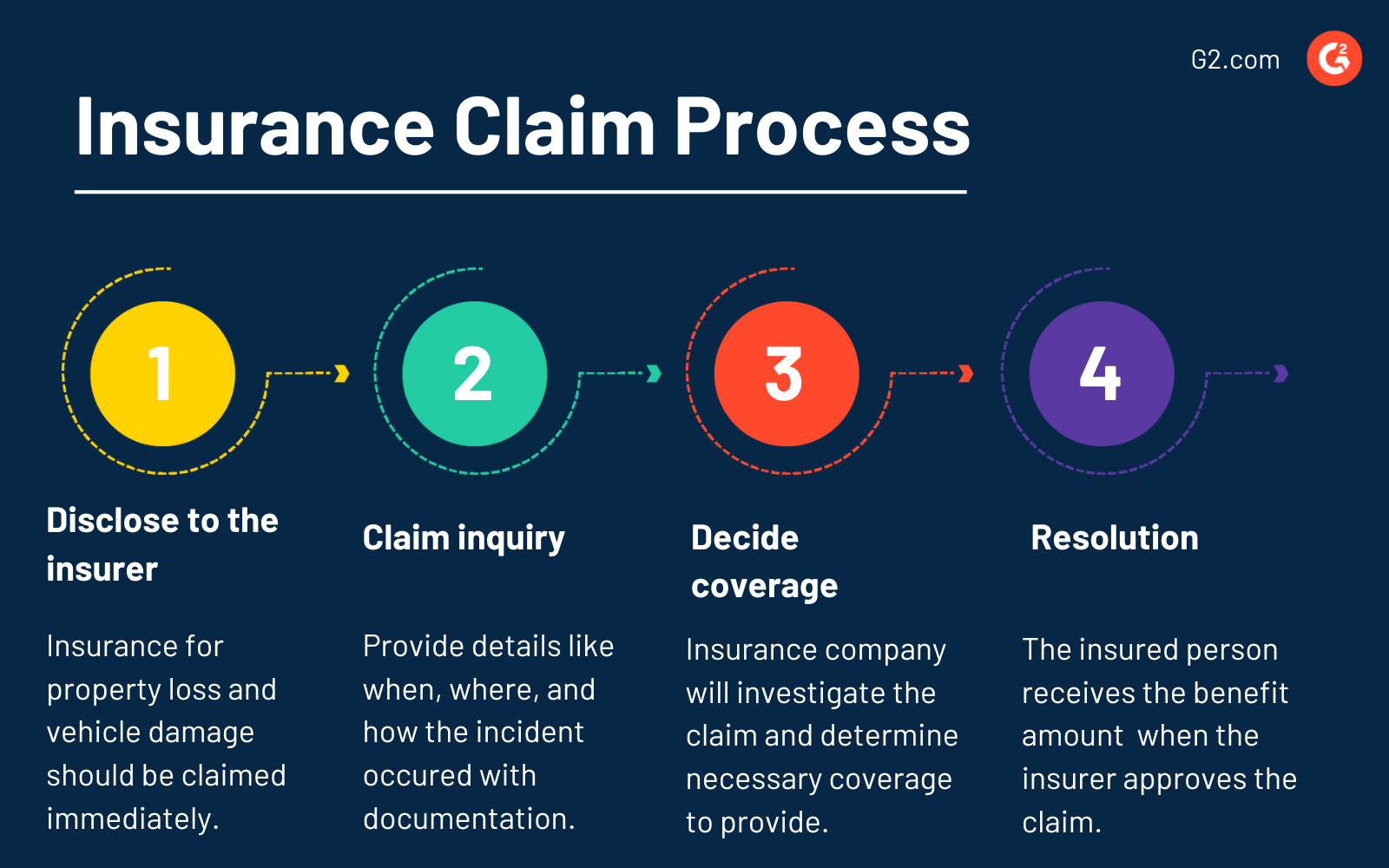

The insurance claim process

Often, an individual can claim insurance any number of times as long as the premiums are paid and don’t exceed the value of the coverage. However, it can vary from policy to policy.

Here’s the standard process for claiming insurance.

- Disclosure to the insurer: When an incident occurs for which an individual has taken insurance, the first step is to disclose the incident to the insurer. For example, property loss and vehicle damage insurance should be claimed immediately after the incident.

- Claim inquiry: This step details the incident to the insurer, including when, where, and how it occurred. The policyholder must keep all document proofs or receipts related to the insurance and the incident. For example, a photo of the damaged vehicle in case of auto insurance claims.

- Decide coverage: Once the insurance company receives the claim, they investigate and inquire about the coverage. They then determine how much coverage can be provided.

- Resolution: The insured receives the benefit when the insurer approves the claim. In certain conditions, the insurer can also reject the claim. For example, when the insurance does not cover the incident or if the insured person has not paid the premiums.

Insurance claim vs. insurance policy

An insurance claim is a formal request made by a policyholder to the insurance company to reimburse damages covered by the insurance. The insurance company can validate or deny the claim based on their investigation.

Any exclusion in the policy means they have the authority to cancel the claim. If the claim is approved, the insurance company will pay the amount to the policyholder, often minus a deductible, based on the policy terms.

An insurance policy is a formal contract between the insurer and the insured person where the insurer agrees to provide service or payout to cover an incident. It’s a legal document that states the terms and conditions of the policy and contains all relevant information for the user.

An insurance policy forms the contractual basis for insurance coverage, while an insurance claim is a payment request based on the terms and conditions outlined in that policy. The policy provides the framework for what is covered, and the claim is the action a policyholder takes when a covered loss occurs.

Learn more about underwriting and rating software to automate and streamline processes and meet compliance regulations.

Sagar Joshi

Sagar Joshi is a former content marketing specialist at G2 in India. He is an engineer with a keen interest in data analytics and cybersecurity. He writes about topics related to them. You can find him reading books, learning a new language, or playing pool in his free time.