No one should be surprised that Amazon owns the lion’s share of the cloud computing market.

In the age of digital transformation, cloud service providers (CSPs) are looking for new ways to tackle the digital goliath. Perhaps surprisingly—or not—CSPs have turned to some unlikely places to build their new edge...

Competitor of my competitor

...namely, their own competition. To understand their motivations, let’s first take a look into the company at the top.

The beast laid bare

Amazon—the online book retailer turned unmistakable market leader in (almost) everything it touches—currently overshadows every other vendor in the cloud market with its dominant arm, Amazon Web Services.

AWS closed out Q3 2019 just $5 million (a billionaire's pocket change) short of $9 billion in revenue, making up 13% of Amazon’s total 2019 Q3 revenue. AWS also generated nearly double the net operating revenue of Amazon’s e-commerce division, despite the latter dwarfing AWS at a 4:1 gross income ratio in Q3 2019.

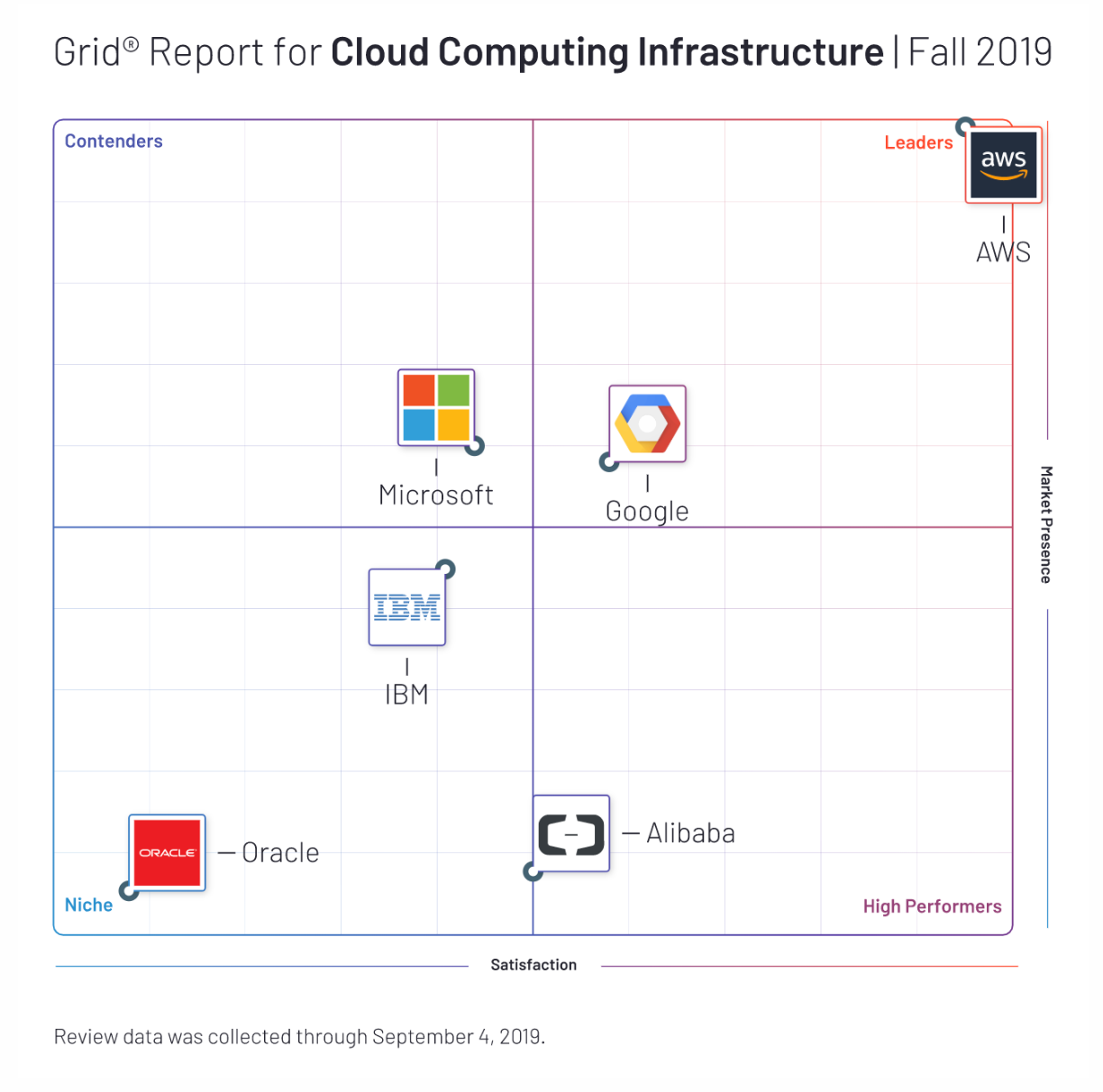

Those numbers speak for themselves, and customers and analysts alike have noticed—or, rather, are unable to ignore—AWS' substantial control over cloud computing. Sourcing data from thousands of real users reviews, G2’s Fall 2019 Cloud Computing Infrastructure report paints a clear and concerning picture of how customers perceive the current state of cloud infrastructure. Reviewers place AWS almost untouchably ahead of the competition.

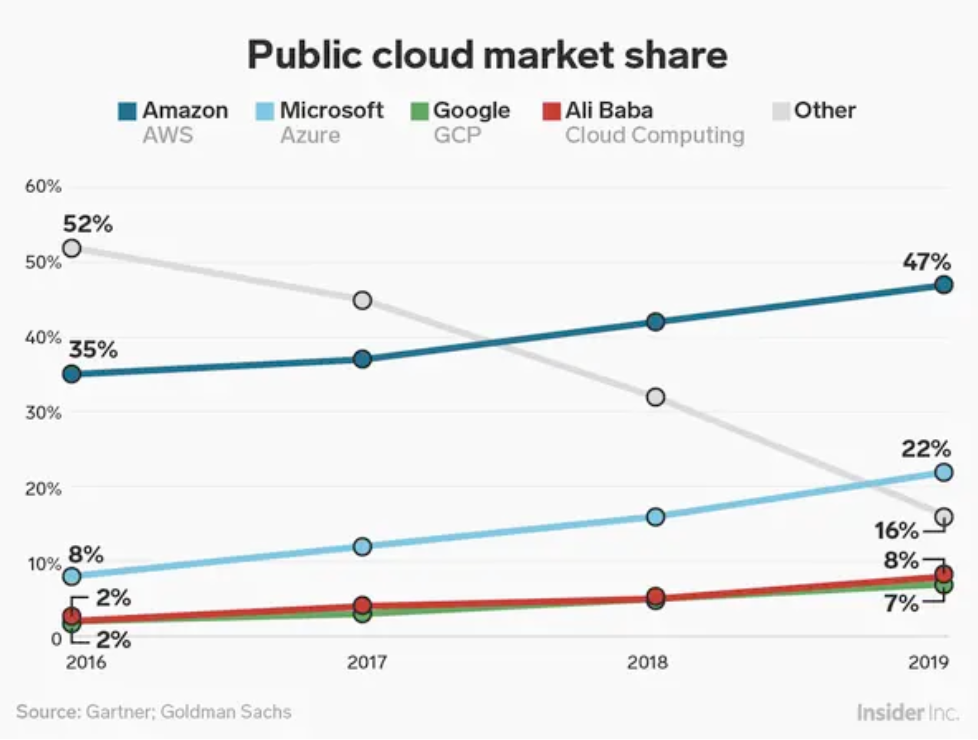

If we examine corporate cloud provision per CSP, we already had signs this was happening leading into 2019. Check out the evolution of public cloud market share in the past four years.

Source: Business Insider

CSP selection has grown to be distinctly less, well, distinct. Not too long ago, 52% of the public cloud was stored in servers outside of the big four (Amazon, Microsoft, Google, and Alibaba). That trend crashed and burned into a measly 16% over the course of just four years. Now, 84% of the public cloud is stored with those four companies—more than half of that belongs to Amazon.

The takeaway? AWS isn’t even the biggest thing happening at Amazon (although it brings in the largest net profit), but it is nearly uncontested in its own market.

Vous voulez en savoir plus sur Logiciel de sécurité cloud ? Découvrez les produits Sécurité du cloud.

Setting aside differences for a united front

The aforementioned data is deeply uncomfortable to every other company looking to compete with Amazon in 2020. Providers with previously tepid or contested relationships with each other are realizing that, to compete with or beat AWS, going solo simply isn’t an option.

When looking back on 2019, it's clear it was the year of cloud partnerships. Big ones. And while the following list is far from exhaustive, it does represent some of the largest contenders in cloud computing.

-

- Competitors Microsoft and Oracle removed a dividing wall (announcements here and here), bringing their cloud computing flagships—Microsoft Azure Compute and Oracle Cloud Infrastructure—closer together than ever before. Both companies are vying for increased adoption and usership by bolstering accessibility to each other’s tools and infrastructure via their own respective offerings. Clients of these two enterprise-focused vendors can now utilize their databases, public clouds, and more from a single source, with Microsoft and Oracle even offering a “unified single sign-on experience and automated user provisioning,” allowing users to access both companies’ cloud products.

-

- Salesforce has doubled down on cloud service partnerships over the past year, joining forces with both Google and Microsoft. With Google, Salesforce is integrating child company MuleSoft’s Anypoint Platform into Google Cloud Platform (GCP)—the combined platforms run Salesforce operations, and expand Salesforce's Marketing Cloud to increase GCP interoperability. The Microsoft partnership might be more surprising. Under the Salesforce-Microsoft partnership (something that previously might have been thought of as a somewhat contentious relationship), part of Salesforce’s Marketing Cloud will have dedicated hosting in Azure, boosting integration capabilities between Marketing Cloud and other Microsoft cloud products like Teams. (It should be noted that Salesforce has also struck up a partnership with Amazon, following the Salesforce-Microsoft alliance.)

-

- IBM is taking a proactive approach to the cloud, partnering with Cisco for hybrid clouds. The two giants are cooperating to implement IBM Cloud Private on Cisco’s hyperconverged infrastructure offerings, HyperFlex and HyperFlex Edge. Additionally, IBM’s Cloud Pak for Applications will be enhanced to handle HyperFlex-driven DevOps experiences. Both IBM and Cisco cited the partnership as leaning into their respective strengths: It “leverages Cisco’s enterprise-class data center, networking, and analytics” and IBM’s “hybrid cloud solutions and extensive catalog of enterprise software and open-source software, VMware services, and virtual and bare-metal servers.” For businesses who heavily utilize both Cisco and IBM tools and infrastructure already, this is a welcome convergence to simplify management and integrations. This also bodes well for companies using one company or the other, but were investigating the benefits of utilizing both.

-

- A few big names have drawn alliances to tackle public cloud expansion and stabilizing 5G with the hopes of pushing edge computing to new heights. IBM and Microsoft have both partnered with AT&T on this endeavor, albeit with slightly different focuses. In exchange for AT&T’s software-defined networking capabilities, IBM wants to broaden 5G’s horizons and raise its performance, ideally causing a major leap forward in edge computing’s potential and utilization. Microsoft shares a similar goal, with artificial intelligence (AI) on the brain: Microsoft hopes stronger, more direct access to AT&T’s expansive network will improve AI development, and application thereof, to the cloud. For both partnerships, edge advancement aims to bring higher processing power closer to the end user, improving computational speed and efficacy.

-

- In a move more unique compared to other CSPs, Google has turned to the open-source crowd to gain advantage in the cloud computing race. At Google Cloud Next 2019, the vendor announced partnerships with a slew of open-source providers—including data platform DataStax, search-based organization Elastic, graph database tool Neo4j, data streaming solution Confluent, key-value store provider RedisLabs, RDB tool MongoDB, and time series database InfluxData—citing a strong tenet to GCP is an “open cloud.” Google aims to leverage these familiar (and, often, free) data-oriented offerings with greater compatibility and capability on GCP to reach thousands of businesses utilizing these open-source solutions every day.

The future of cloud partnerships

Ultimately, the above partnerships—and numerous others not mentioned here—stem from one simple, pervasive, inevitable thought.

Amazon is too far ahead, and no one can compete alone.

To draw on Tolkein, it’s a lot like watching Rohan and Gondor, elves and dwarves. No longer willing—maybe no longer able—to take up the fight alone, CSPs are turning to new and sometimes unexpected allies to breathe life into the competition. (This is not to say, of course, that Amazon is Mordor; that’s unfair. End of metaphor.)

We don’t know how these new partnerships pay off in 2020, but I look forward to the potential innovation birthed by the combined willpower and technical prowess of these organizations.

Zack Busch

Zack is a former G2 senior research analyst for IT and development software. He leveraged years of national and international vendor relations experience, working with software vendors of all markets and regions to improve product and market representation on G2, as well as built better cross-company relationships. Using authenticated review data, he analyzed product and competitor data to find trends in buyer/user preferences around software implementation, support, and functionality. This data enabled thought leadership initiatives around topics such as cloud infrastructure, monitoring, backup, and ITSM.