This post is part of G2's 2022 digital trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Tom Pringle, VP, market research, and additional coverage on trends identified by G2’s analysts.

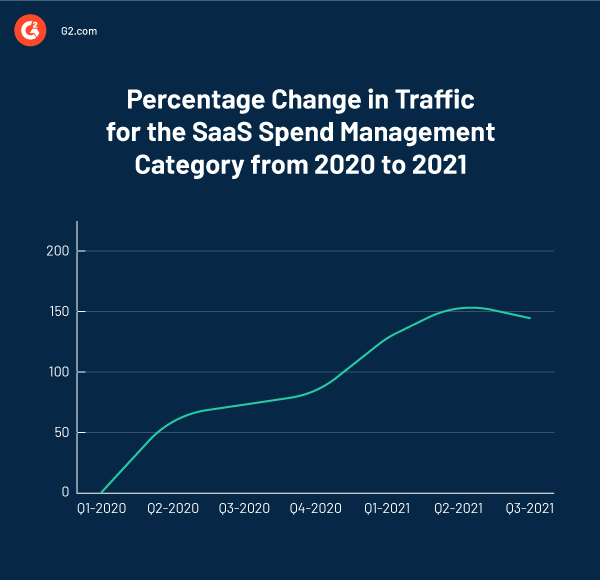

Growth in SaaS Spend Management category traffic

2022 TRENDS PREDICTION

As the demand for SaaS software continues to grow, the SaaS Spend Management category will grow significantly in 2022, but vendors need to address low software adoption rates to increase return on investment (ROI).

Since the beginning of the remote work era in 2020, companies are buying SaaS-based tools to empower employee management, access, and collaboration. With the increasing adoption of SaaS software, many companies are beginning to realize that SaaS spending needs to be managed. This is where SaaS spend management software comes in. They are tools that manage and control software as a service (SaaS) costs. These tools help centralize visibility over SaaS subscriptions and outline their utilization. Users can then compare utilization figures to the subscription cost and identify unnecessary spending.

According to the G2 category traffic data below, the SaaS spend management category traffic has increased by 147% since Q1-2020. The demand for this type of tool is high and it will continue to grow in 2022 as SaaS software adoption continues to rise.

Increasing vendor hiring growth

SaaS spend management software providers have more than doubled in 2021. At the beginning of 2021, there were only six vendors with high review counts. By Oct of 2021, there are now 14 vendors with high review counts.

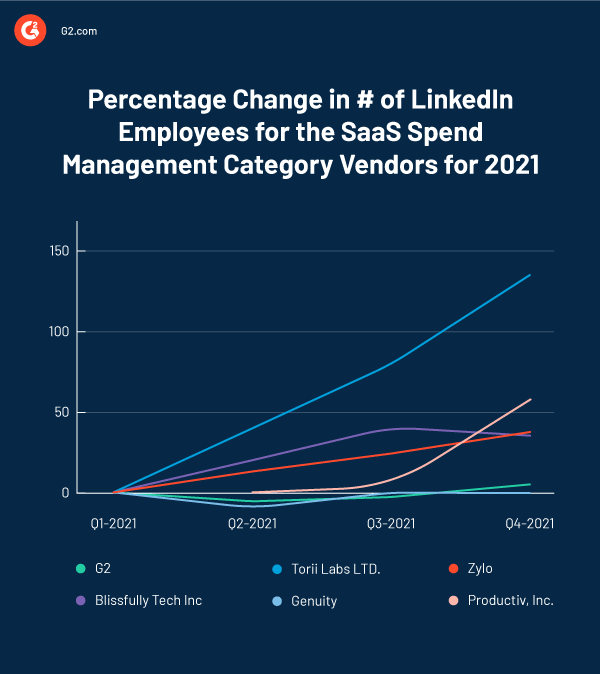

There are more vendors in this space now than ever. These vendors are also growing in size. In the employee count data below, the six original G2 vendors have increased hiring in 2021 according to their LinkedIn employee headcount. They are hiring to compete for increasing market share and developing new features. I expect that these vendors will continue to increase hiring for 2022 due to increasing SaaS software demands.

Low adoption rate and ROI

Despite this positive employment trend, not everything is roses for SaaS spend management software vendors. The average adoption rate for this category is 59% in Q4 2021, which is only an increase of 4% since Q1 2021. Why is this important? Because this software adoption rate shows that nearly 40% of the users did not or rarely use the SaaS spend management software. Companies that purchase the software will likely discontinue the software contract or decrease the number of accounts, which is bad news for the vendors and the industry.

This is also reflected in the software return on investment (ROI). The average contract period for SaaS spend management software is 12 months and the estimated ROI months is 9 months. In essence, companies that purchased this software will only get a net positive of 25% return on investment. I expect many companies will reduce the number of licenses purchased in 2022 due to the low adoption rates to increase ROI.

How to fix low adoption rate to increase ROI

There is no apparent reason for the low adoption rate. Out of the 14 vendors, almost all of them have a high rate for “Likelihood to Recommend,” “Meets Requirements,” “Ease of Admin,” “Ease of Doing Business With,” “Quality of Support,” “Ease of Setup,” and “Ease of Use” (G2 Simple Six Metrics). When we examine specific software features such as software tracking, contract management, spend forecasting, data visualization, and so on, almost all vendors have high ratings again. So if most buyers who reviewed this type of software are happy, what is causing the low adoption rate and ROI?

I suspect two reasons: deployment and training. Out of 14 vendors, only two vendors (Airbase and Torii) deployed their SaaS spend management software on-premise over 20% of the time in 2021 (Fall 2021 G2 Implementation Data). They are also the two (of three) vendors that have a high deployment rate of 70% or above. Deploying on-premise and on the cloud makes no difference in the implementation period since most SaaS spend management software has been implemented in less than a month (Fall 2021 G2 Implementation Data). So in this case, on-premise implementation improves convenience for the users because the IT teams have installed everything for them. So while most vendors opt in for cloud deployment, it may be worth examining on-premises implementation as an option to increase user adoption.

The other reason is training. Using SaaS spend management software can be complicated due to the cross-functional features. While average users would only use the software specifically for SaaS software purchase approval, IT, procurement, accounting, and finance teams have to do much more. For example, IT team leaders need to identify user access and approve those purchases. The accounting team needs to know how to eliminate expense reporting, manage card reconciliations, and consolidate all software spending. There are many additional use cases and steps that might require interdepartmental work.

One can say this is almost like a mini ERP, and we all know that ERP systems are complicated and require training. I highly recommend vendors provide additional training videos, guides, and use case demos for different departments. Vendors should also gather data on which personas have the least adoption rate and identify why this may be. This will prioritize which product features and training should be developed to boost user adoption and ROI.

|

Want to learn more about SaaS Spend Management Software? Explore SaaS Spend Management products.

|

The state of SaaS spend management software in 2022

2021 has been a great time for vendors and customers in this category. With increasing SaaS usage, companies are willing to spend more on SaaS spend management tools.

But the software and support in this category still need to mature for full adoption. We will likely see more related products and features developed in 2022.

Want to manage SaaS spending better in your organization? Sign up for the free forever plan of G2 Track, an all-in-one platform that helps you manage and optimize your tech stack.

Vous voulez en savoir plus sur Logiciel de gestion des dépenses SaaS ? Découvrez les produits Gestion des dépenses SaaS.

Tian Lin

Tian is a research analyst at G2 for Cloud Infrastructure and IT Management software. He comes from a traditional market research background from other tech companies. Combining industry knowledge and G2 data, Tian guides customers through volatile technology markets based on their needs and goals.