This post is part of G2's 2022 digital trends series. Read more about G2’s perspective on digital transformation trends in an introduction from Tom Pringle, VP, market research, and additional coverage on trends identified by G2’s analysts.

Contactless payments will drive increased adoption of digital wallets

2022 TRENDS PREDICTION

The popularity and adoption of digital wallets among merchants and consumers will continue to increase in 2022, driving further advancements in contactless and cashless payment platforms.

The number of transactions made using digital wallets is projected to be $5.8 billion in 2021. This is no surprise, as the COVID-19 pandemic led to an increase in contactless payments and advancements in digital wallet technology. As consumers moved to a contactless and cashless world faster than ever in the past two years or so, the popularity of digital wallets has exploded with no signs of slowing down.

What is a digital wallet?

A digital wallet, also known as an e-wallet, is a wallet in the sense that it “carries” money that can be used to pay for products, services, or both. It is a software or online service that allows users to conduct digital monetary transactions in a safe, reliable, and fast manner. Digital wallets are used to pay vendors and merchants through smart devices using apps, websites, or both that support a digital wallet service. Some examples of e-wallets are Google Pay, Apple Pay, and Venmo.

E-wallet features make transactions fast and convenient

According to NFCW.com, digital wallets already account for at least 27% of in-store purchases and 41% of e-commerce transactions. Due to a massive shift to online shopping since the start of the coronavirus pandemic, the percentage of e-commerce purchases via digital wallets is sure to increase, primarily due to several features that are becoming more popular in e-wallet technology.

Near field communication (NFC): NFC powers the technology in digital wallets that allow the user to tap a smart device or card to a point of sale (POS) machine to make a payment. This type of transaction is popular because it is fast, convenient, and instantly transfers encrypted data to the POS system, eliminating the need to enter a PIN. It is predicted that 36% of all payments will be made through NFC-enabled smartphones and contactless cards by 2027 due to the user friendliness of this payment method.

Quick response (QR) codes: QR codes make it simple to transfer money from one party to another. Here, a seller uses a unique code that customers can scan with a smartphone camera. This technology is safe, inexpensive, flexible, and accessible to vendors of any size.

Cryptocurrency wallets: Cryptocurrency digital wallets are a catalyst for contactless payments because they securely store and manage blockchain assets and cryptocurrencies, and allow users to trade, spend, and receive currencies such as Bitcoin, Ethereum, and Litecoin.

As cryptocurrency wallets were essentially nonexistent 10 years ago, their usage has increased nearly 700% in the past five years, to over 78 million users. The usage of cryptocurrency wallets and the blockchain technology that powers them will continue to gain popularity as more and more sellers accept cryptocurrencies as payment and buyers gain further understanding of the technology.

G2’s blockchain expert and research principal, Aaron Walker, adds:

“The cryptocurrency wallet market will continue to grow in stride with other decentralized finance (DeFi) technology. Blockchain tools of all kinds continue to emerge, existing businesses are accepting crypto payments, and the intimidation factor of blockchain’s complexity is dwindling.”

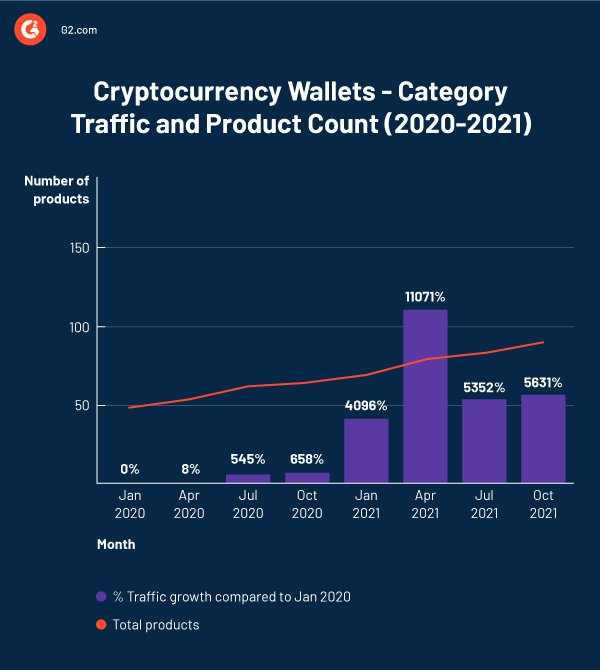

Less than two years ago, G2 had only 48 products in the Cryptocurrency Wallet category, and today there are 90, an 88% increase in just 22 months. As the number of offerings increased, so did category traffic. Compared to January 2020, unique traffic has increased on average approximately 4,200% per month, clearly highlighting the growing popularity of e-wallets and cryptocurrency. I believe this staggering traffic growth is the result of a combination of curiosity, further understanding and acceptance of crypto, and customers and vendors trying to stay on top of the current trends.

Artificial intelligence (AI) and machine learning (ML): AI plays a significant role in digital wallet technology. AI chatbots are now being used to automate transaction processes and handle voice instructions for payment processing and verifying figures.

The safety of e-wallets is always top of mind for all parties involved. The role of ML in these platforms will continue to drive the popularity of digital wallets by helping to track and prevent cyber frauds and theft and detecting threats to the system running the program.

The popularity of digital wallets will only go upwards from here

Recent buying behaviors of consumers and companies alike have proven that the ease, convenience, and safety of contactless payments will continue to drive the popularity of digital wallets, especially as the features behind e-wallets evolve. I believe there will be less and less resistance to this technology as users become less skeptical of it, and because sometimes it’s the only form of payment accepted!

Vous voulez en savoir plus sur Plateformes de commerce électronique ? Découvrez les produits Plateformes de commerce électronique.

Nathan Calabrese

Nathan is a Senior Research Analyst at G2 focusing on finance and accounting software and their respective markets. Coming from the world of finance, Nathan understands and is familiar with the importance of finance/accounting software, and the complexities, struggles, and nuances that come with them. He has over 15 years of analytical experience in industries ranging from health care and transportation logistics to food service and software. Nathan received his MBA in finance and international business administration from the University of Illinois, Chicago, and his B.S. in production and operations management from California State University, Chico.