Digital transformation in banking has been nothing short of an evolution.

The banking industry has shifted from being digitally resistant and paper-based to fiercely competitive in a digitally disruptive market. However, compared to other industries, banks, and financial institutions have not been at the front of this shift.

As more and more people move to online shopping and other smartphone apps, digital banking platforms have had to adapt their operating models to gain a competitive advantage. Digital transformation in banking requires a comprehensive digitization strategy that covers everything from customer engagement to back-end operations.

What is digital transformation in banking?

Digital transformation in banking is the integration of technology into bank operations, leading to fundamental changes in the ways banks function and deliver value to customers. When executed successfully, banks are getting better at competing in a crowded market.

Digital banking platofrms allow banks to offer a host of digital financial products across multiple channels to meet customers wherever they are. Thanks to this software, the transition of traditional banks from brick-and-mortar to digital banks has been relatively smooth.

The pandemic accelerated this change, but digital transformation in banking started way before 2020. Of course, customers now expect seamless multi-platform access for any service they use – daily banking and financial services are no exception.

While banking hasn’t changed at its core, how the industry works with customers has. New players like fintechs and neobanks are offering personalized experiences so customers feel more in control of their finances than ever before.

The four areas of digital transformation

To begin digitizing banking, a business has to modify four main areas.

1. Process transformation makes company operations more efficient and effective. Methods like process mining help organizations identify areas of improvement.

2. Business model transformation reinvents the traditional business model for success. New business modeling allows organizations to create an efficient workflow that leads to growth and new opportunities.

3. Domain transformation creates value by tapping into new opportunities. The adaptation of technology can redefine products and services, paving the way for businesses to establish authority in other sectors.

4. Culture transformation for understanding, embracing and advancing digital change across the business. It Allows organizations to go beyond redesigning products by promoting the shift from within.

Importance of digital transformation in banking and financial services

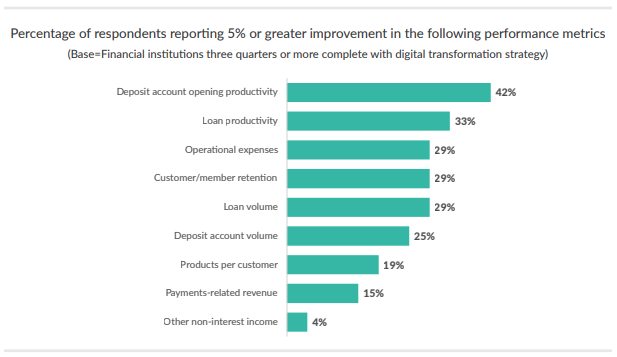

Digital engagement is key for optimizing the customer experience. Some banks have resisted shifting from their tried and tested methods, but most recognize the value of a digital strategy in financial services. From process competency to increased customer reach and satisfaction, digital transformation in finance industries has consistently optimized operations.

According to a survey conducted by Cornerstone Advisors, 42% of institutions said they’ve achieved a 5% improvement in deposit account opening productivity, and 33% said they’ve improved loan productivity by 5% or more.

Source: Cornerstone Advisors Report 2023

Source: Cornerstone Advisors Report 2023

Driving digital transformation requires eliminating the bottlenecks that restrict the ways banks provide new customer experiences and business capabilities. A holistic digital banking strrategy embraces the latest technologies that will make it easy to create a cohesive and personalized customer journey.

While these institutions think they’ve traveled pretty far down the digital transformation road, they have yet to deploy emerging tech like machine learning (ML), cloud computing, and robotic process automation (RPA).

Customer expectations are also bound to change with technological advancements and increased usage of digital services. If banks take the time to understand the changes, they can deliver a meaningful experience to their users. Behind the scenes, banks can empower their staff by minimizing repetitive manual efforts through automation, which offers them more space to focus on building relationships.

Vous voulez en savoir plus sur Fournisseurs de Financement d'Entreprise ? Découvrez les produits Finance d'entreprise.

The shift from traditional to online banks

Most traditional banks hopped on the bandwagon when they noticed the rise of digital banking development. More and more customers were using mobile apps for daily banking needs and transactions, making mobile banking a critical component in the digital banking landscape.

Statista says that the number of active online banking users worldwide will reach one billion by 2024. This shift has pushed the banking sector to become more customer-centric and tech-savvy since traditional banks need to embrace new digital technologies and models to stay in the loop throughout the customer journey.

Today, banks depend on omnichannel strategies to reinvent the customer journey. The transition to digital services has allowed financial service providers to improve process efficiency and generate growth by finding more prospects.

Banks have grown to understand that competing with fintechs is not ideal. Instead, the better solution is focusing on new ways of collaboration that bring value to customers. One example is the replacement of IT systems with cloud-based alternatives.

$13.9 Billion

is the projected growth for the global digital banking platform market size by 2026.

Source: MarketsandMarkets

Examples of digital transformation in banking

Digital transformation has changed how the banking industry works. Examples of digital banking include:

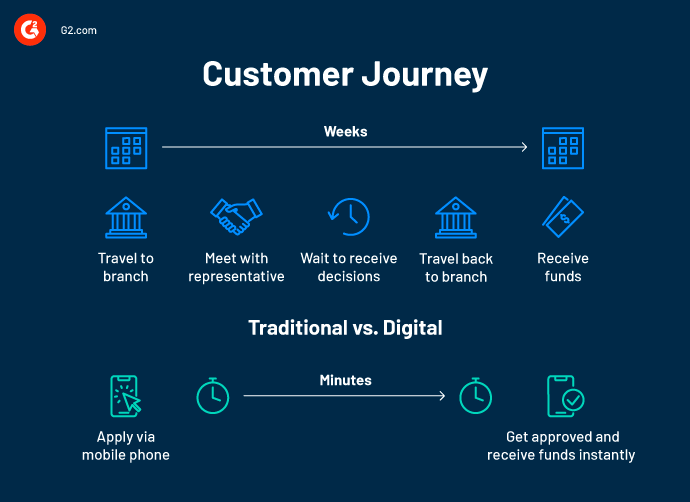

Digital account opening

By reducing the need to visit a branch in person, banks have automated the account opening process. Automation reduces the time it takes to open a bank account, and it minimizes the manual input needed from employees, allowing them to spend more time on other value adds for clients. This is a classic example of enhancing digital engagement in the customer journey.

Digital payments

Financial institutions have implemented digital payment systems like online transactions, mobile payments, and digital wallets. Customers can now execute transactions and money transfers using their smartphones or computers. Digital payments have brought mobility and convenience to a single platform, imparting control and transparency to customers.

Mobile banking

Digital transformation in banking goes beyond paying for things and sending money to friends. Mobile banking lets customers access their bank accounts and online banking activity through an app on their smartphones. This access includes viewing bank account information, daily transactions, investments, support services, and news.

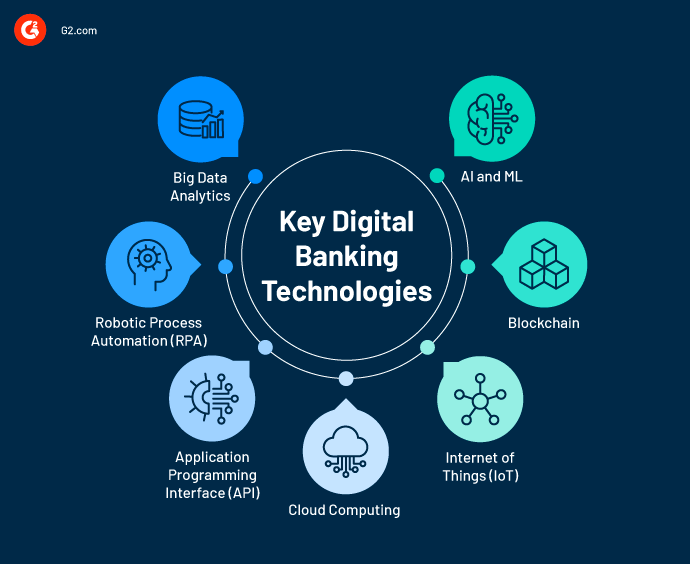

Technologies that drive digital transformation in banking

Implementing a successful digital transformation strategy demands using the latest tech. Here’s your chance to familiarize yourself with the existing trends in digital banking.

AI and ML

From chatbots and online assistants to data analysis and predictions, artificial intelligence (AI) has changed how banking and financial sectors operate. Machine learning also works with data and helps detect fraud. It collects, stores, and compares customer data in real time to identify any abnormal changes and suggests timely preventive measures.

Blockchain

No conversation about digital transformation in banking and financial services is complete without discussing blockchain technology. Blockchain integration in banking services has resulted in added transparency, secure transactions with digital customer identities, and enhanced user interface.

Internet of Things (IoT)

IoT facilitates actions like authorizing processes through biometric sensors, tracking and monitoring assets, providing location-based services, and contactless payment. It tailors and personalizes customer experiences through real time data analysis. IoT also introduced risk management and access to multiple platforms through data exchange.

Cloud computing

Banks have gone from protesting cloud-based services to understanding its inevitability. Cloud computing allows banks to create solutions with applications and infrastructures that improve their operations. Moreover, cloud-driven services result in higher productivity and instant delivery of products and services.

API

Application programming interfaces (APIs) are essential in today’s banking world because they make data sharing possible and promote user experience, allowing banks to connect to new customers. Banks can reach new markets and drive innovation by exposing their APIs so developers can easily build integrations and applications for their systems.

RPA

Since banks have to deal with extensive data through standardized processes, robotic process automation (RPA) is the perfect solution for automating and lowering operating costs. It also reduces manual effort, thereby easing the workload for staff members. Plus, this technology can be implemented relatively quickly as it doesn’t interfere with old complex banking systems.

Big data analytics

Banks don't function like they used to a decade ago, and big data plays a significant role in that change. From examining customer expenditure to monitoring risk to managing feedback, big data technology has taken development in the banking sector to the next level.

Banks have also been keeping up with the changing and rising market demand because of this technology.

Top five digital banking platforms:

1. Nubank2. TCS BaNCS™ Digital

3. ServiceNow Financial Services Operations

4. NCR VOYIX Digital Banking

5. Finacle for digital-only banks

* These are the leading digital banking platforms as per G2’s Summer 2024 Grid® Report.

How to begin a digital transformation

Acquiring the right roadmap and resources to begin your digital transformation journey is going to challenge you, but the good news is you’re not alone. Many financial institutions incorporating digital banking strategies have faced this challenge, so let’s see what they’ve learned from the process.

1. Define your objectives and values

Before you embark on this journey, be sure of the destination. Map out what you want to achieve right from the start, and then create a plan to get there. Analyze the current state of your organization and evaluate the processes and technologies already in place.

You and your team should be asking lots of questions at this step. Which stage of digitization are we at? Do we want to enforce a digital-first mindset? Do we want to try to retain new customers with digital services? Once you have a clear understanding of your objectives and values, lay the groundwork for your business strategy and work on identifying the resources you need to execute it.

2. Set KPIs

All your planning and objectives should amount to something. You need to set targets and measure your progress by setting key performance indicators (KPIs). Unless you know what progress looks like, all your strategic initiatives will go to waste.

Tip: follow the SMART formula to set your KPIs.

- Specific. Don’t set vague goals and be clear about the desired outcome.

- Measurable. Pick a metric that’s accurate and easy to track in the long run.

- Achievable. Avoid setting unrealistic goals. Commit to things you can deliver.

- Relevant. Set KPIs that are related to your goals and vision.

- Timely. Define the timeline for every KPI to maximize effectiveness.

3. Evaluate your culture

One of the biggest challenges with digital transformation is the change it’s going to bring to your company culture. You need to assess your company culture to ensure the changes improve the weak components without hampering the positive parts.

You need to consider factors like whether your culture can adapt to change, if you have leadership support, and what the culture could look like after the transformation.

4. Understand customer needs

When you develop digital products and services, tap into your existing customer base to identify who is likely to use the new tech and reach out to them with targeted marketing.

Conduct data analysis to segment customers into demographics, lifecycle, and product mix. Then you can see how your digital services align with these segments. Monitor customer behavior and preferences to ensure that what you introduce results in growth.

5. Prioritize and map your resources

Remember that digital transformation is a long journey, so start by breaking down your process into small steps. Once you have a focused list of objectives and goals, look at your resources and prioritize them for different tasks to make the best use of time, money, and people.

Identify quick wins and avoid tackling everything all at once. And when you have identified the priorities and workflow, make changes incrementally, starting with small successes.

6. Bring your people on board

After planning comes implementation, and that requires company buy-in. Promoting enthusiasm and participation on a large scale calls for open communication. Share your plan and relevant information with everyone, be open to addressing questions and concerns, and encourage employee feedback.

Taking these steps keeps your employees happy, creating a close-knit culture that fosters productive collaboration and output.

7. Analyze and modify

Once your plan is implemented and most of the transformation is complete, take a step back to analyze your efforts and check their impact. Would you consider it a success? If you gained what you had set out to achieve, then congratulations!

But if your transformation efforts have been left unappreciated, resulting in a negative outcome, you have to keep working on it. Make adjustments where needed, get more feedback from your team, and refine your processes to make sure the changes work.

Benefits of digital transformation in banking

Digital banking transformation is more than just instant money transfers and online services. It brings new opportunities that result in innovation, higher engagement, and improved competency. Some other benefits include:

- Digitization of investment banking. Digital transformation in investment banking has replaced investment banks with small investors, all available through one digital platform. Investment banks now focus on short-term goals and drive their technology-based decisions on customer needs.

- Advanced business innovation. Digitization has led to new business innovations like social channels, shopping websites, and mobile banking apps that make it possible for banks to meet their customers wherever they are.

- Easier customer acquisition. Banks need customers as much as customers need banks. Using digitization, banks have expanded their services with instant facilities and payment modes around the clock. This has made it hassle-free and cost-effective to bring new customers on board.

- Personalized banking. Digital transformation allows banking institutions to deliver precisely what their customers need. Gone are the days when operating on assumption was the go-to strategy. Now, banks know what customers spend money on daily and provide customized services to cater to their clients’ needs.

Challenges of digital transformation in banking

A successful transformation requires being aware of the existing and potential challenges, such as:

- Large-scale security obstacles. The bigger the transformation, the harder it is to keep up with technological advancements. As a result, tackling digital security obstacles becomes tricky for banks, which need advanced security measures to stay secure.

- Social media presence and communication. Banking is a sector that operates on trust, which is why maintaining a social media presence and communication channels is a must. Banks have to use a centralized monitoring system to track and secure these channels and avoid unintended cybersecurity issues.

- Need for local branches. Despite the trends and technologies bringing change in this sector, most tech-savvy customers still prefer visiting a local branch for critical financial matters.

Embrace the change.

Providing a digital-first customer experience is the need of the hour. By embarking on a digital transformation journey, you’re taking the first step toward becoming more innovative, agile, and competitive in the evolving financial world.

Don't settle for outdated banking methods. Explore leading mobile banking solutions.

This article was originally written in 2023. It has been updated with new information.

Washija Kazim

Washija Kazim is a Sr. Content Marketing Specialist at G2 focused on creating actionable SaaS content for IT management and infrastructure needs. With a professional degree in business administration, she specializes in subjects like business logic, impact analysis, data lifecycle management, and cryptocurrency. In her spare time, she can be found buried nose-deep in a book, lost in her favorite cinematic world, or planning her next trip to the mountains.