What are personal income tax calculations?

Personal income tax calculation is how employees estimate their income tax during the year without completing a tax return. Tax calculators are often used to estimate bills, determine the proper withholding amount, and assess how IRA contributions and significant life events affect income taxes. Employees can also use person income tax calculations to estimate their refund after filing their taxes each year.

To ensure all tax information is accurate, companies typically take advantage of corporate tax software to streamline the tax filing process. Accountants within an organization can use these solutions to calculate taxes for company-wide transactions, file returns electronically, and store tax-related forms for both employees and the company itself.

Types of personal income tax calculations

There are many types of calculations, each covering a different stage of the filing process. The most common types are:

- IRA contribution: Indicates how much a person can save on their income tax by contributing to a retirement fund through a Traditional IRA or Roth IRA. Calculations are made using annual earnings and filing status to show which type of fund a person should contribute to for the most savings.

- Major life events: Marriage, having a baby, and purchasing a home can affect income tax savings. For example, information like income, filing status, mortgage interest, and real estate taxes can show how much an individual can save on income taxes by purchasing a home.

- Refund: Helps employees predict the refund amount they will receive from their taxed income.

- Tax withholding: Payroll software can show much income tax should be withheld from employee paychecks and claimed on a W-4 form. The employee completes this form to inform the employer of their tax situation and how much to withhold from their paycheck.

Benefits of personal income tax calculations

Calculating personal income tax before completing a full return can help individuals understand what they owe. Proactive individuals can expect the following benefits:

- Be prepared: Employees who calculate their taxes know what to expect come tax season. They know how much they owe, a return estimate, and how their life situation will affect their income tax.

- Maximize savings: Employees can save on their income tax by taking actions like contributing to a retirement fund or purchasing a home. Calculating potential savings reveals the most efficient way for employees to use their money for maximum savings.

- Ensure proper tax withholding:If the correct withholding calculations aren’t made, employers may have to withhold the maximum amount possible. This can have ramifications on an employee's financial situation throughout the year.

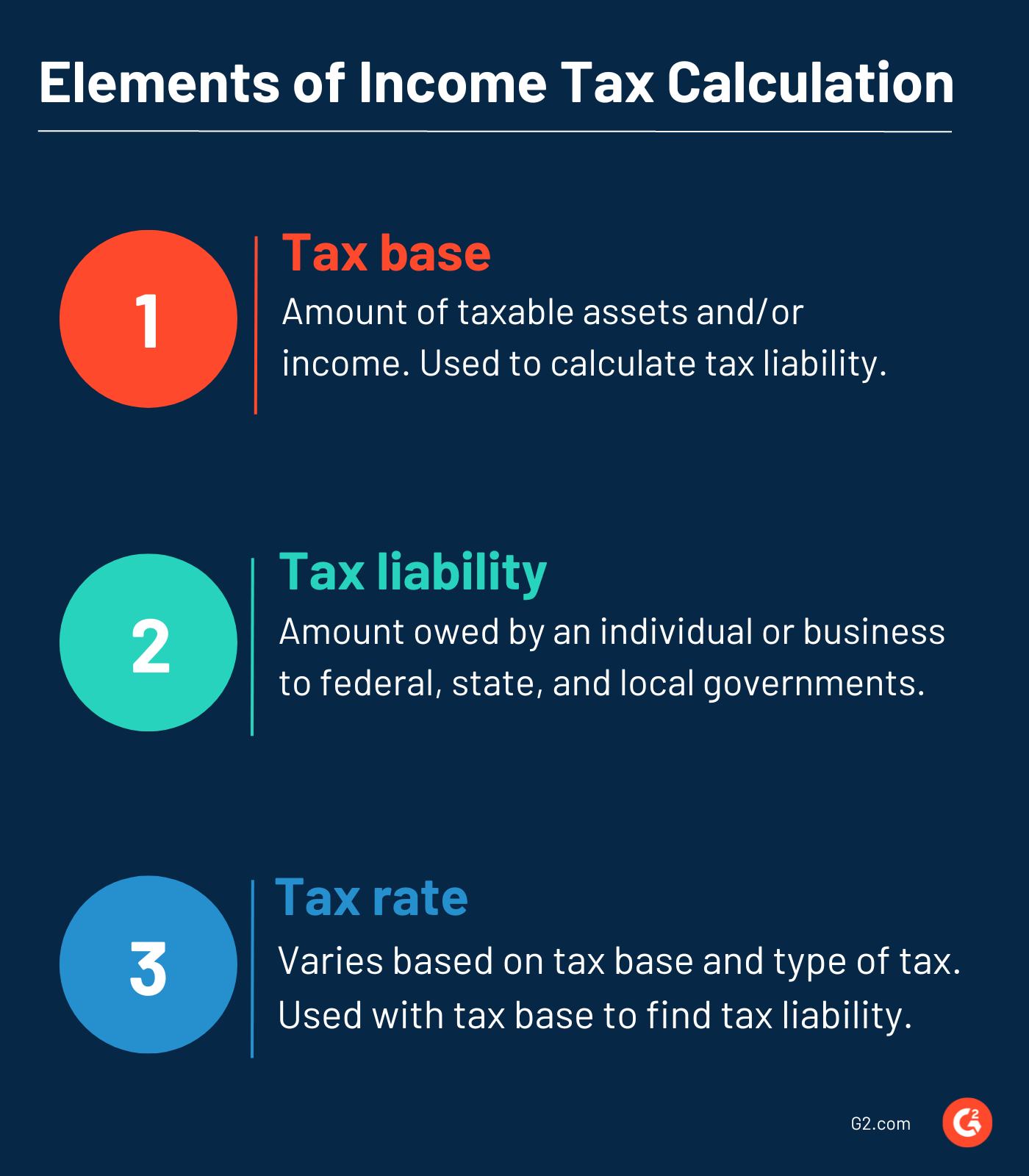

Basic elements of personal income tax calculation

Taxes are calculated by multiplying the tax rate by the tax base.

The basic elements of this formula include:

- Tax base: Total amount of taxable assets and/or income. This number is used to calculate tax liability.

- Tax liability: Total amount owed by an individual or organization to federal, state, and local governments.

- Tax rate: Varies based on the tax base and the type of tax. This number is used with the tax base to calculate tax liability.

Personal income tax calculation best practices

Personal income tax can sometimes be complicated. For calculations to be helpful, individuals must adhere to the following best practices:

- Enter accurate information: Results are only as precise as the information used to calculate them. Entering the right information is crucial for reaching a correct estimate.

- Know your bracket: Tax brackets are decided based on the individual’s income and dictate the applicable tax rate.

- Understand tax credits and deductions: Tax deductions lower the individual’s taxable income, while credits are subtracted from the income tax owed, dollar for dollar. Distinguishing the two and staying aware of which are applicable can help individuals save on income tax.

- Itemize just in case: Individuals can itemize deductions or take the standard deduction for their income level and filing status. To see which is higher and will result in the best savings, deductions should be itemized and compared to the standard deduction.

Martha Kendall Custard

Martha Kendall Custard is a former freelance writer for G2. She creates specialized, industry specific content for SaaS and software companies. When she isn't freelance writing for various organizations, she is working on her middle grade WIP or playing with her two kitties, Verbena and Baby Cat.