Como propietario de una pequeña empresa en India, probablemente estés aquí porque la gran cantidad de opciones de software de contabilidad te abruma.

Te has encontrado con muchas soluciones a nivel empresarial, pero aún no las quieres. En su lugar, deseas opciones que puedan escalar a medida que tu negocio lo haga. Idealmente, estás buscando un software de contabilidad fácil de usar, gratuito o de bajo costo, que pueda manejar la facturación del impuesto sobre bienes y servicios (GST), el seguimiento de gastos y el escaneo de recibos. Además de las tareas contables cruciales, el software también debería analizar la información financiera para la toma de decisiones.

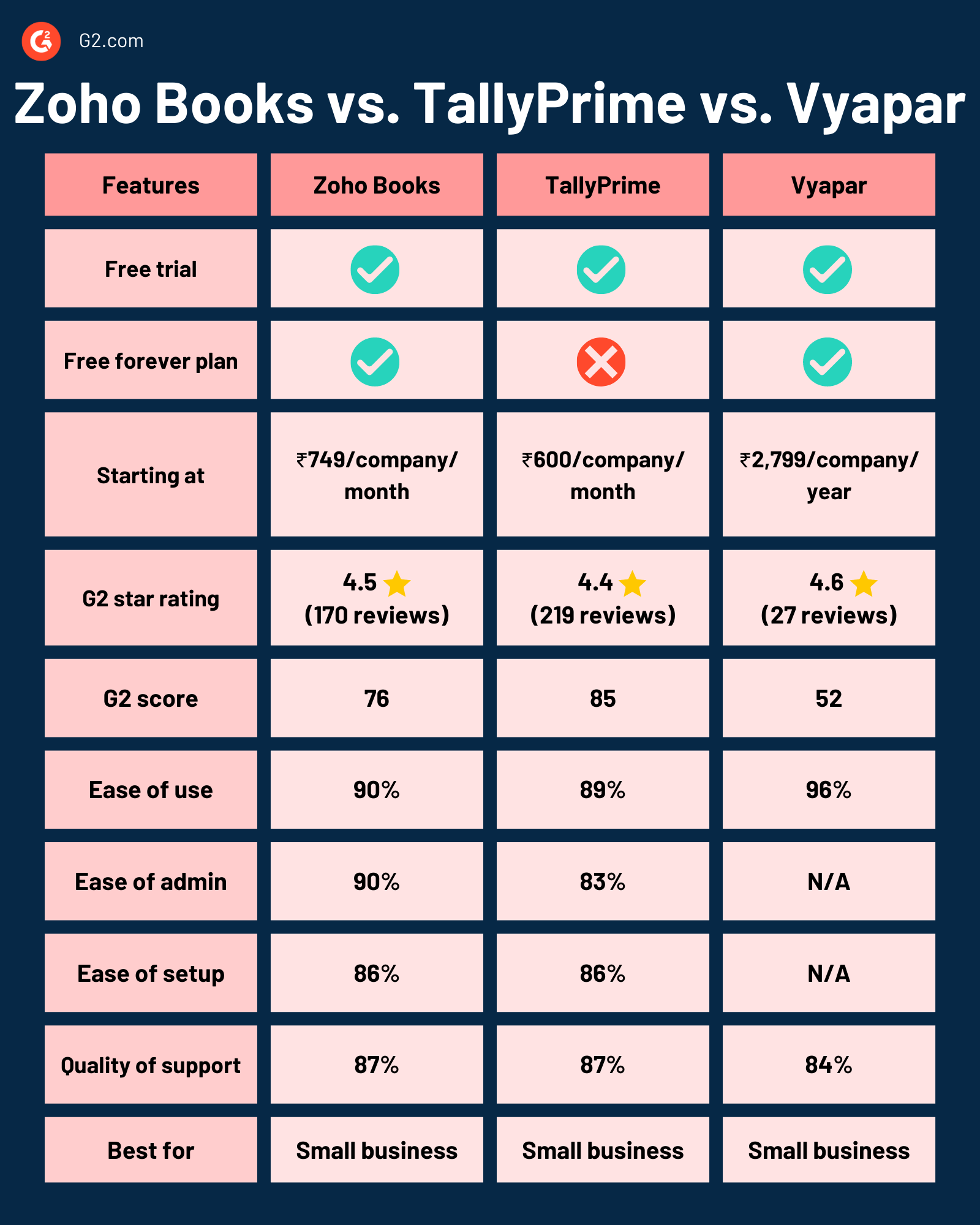

Si Zoho Books, TallyPrime y Vyapar — tres software de contabilidad populares para pequeñas empresas en India — están en tu radar, este artículo te ayudará a comparar sus características y precios.

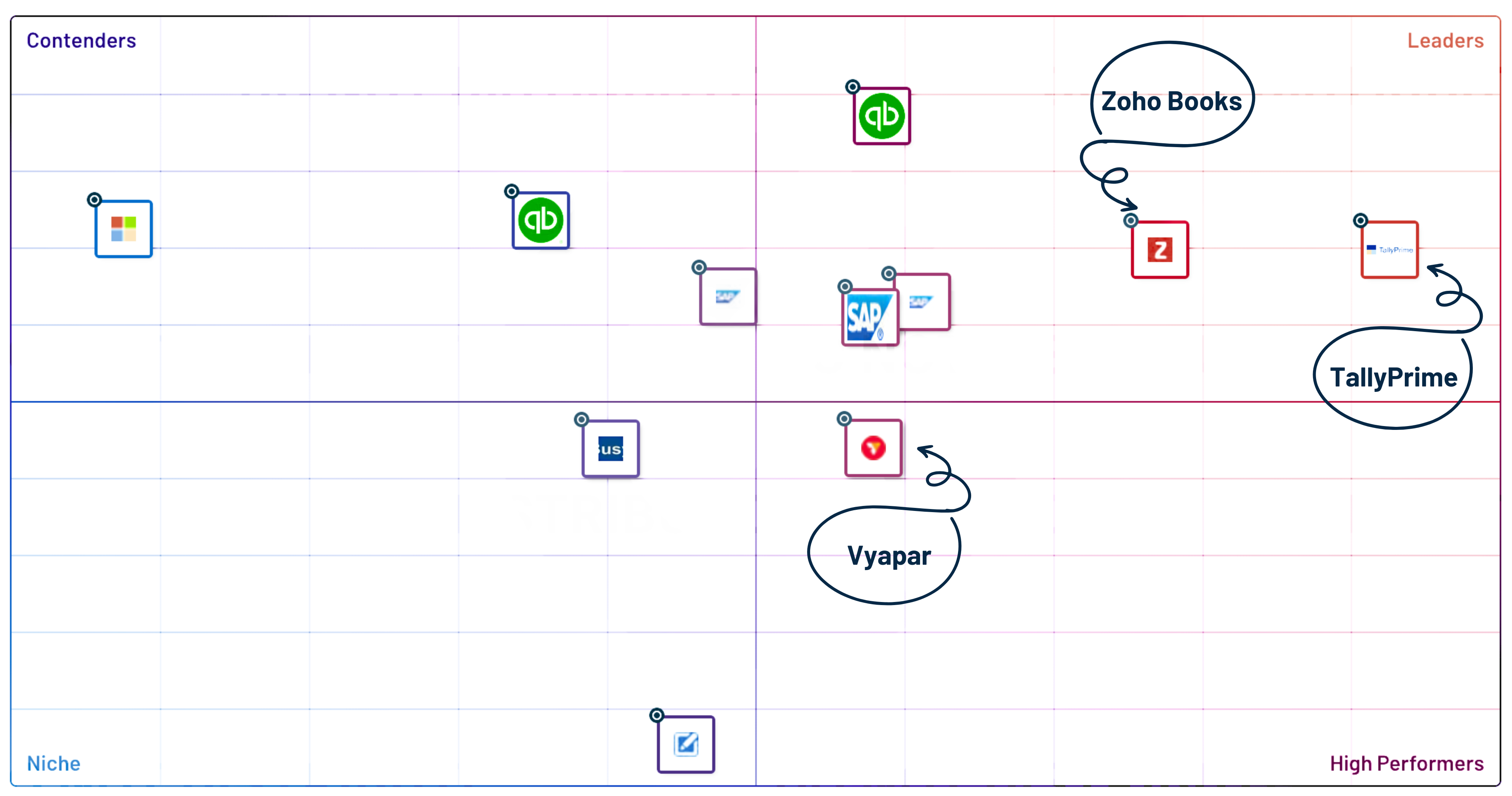

Informe Regional de G2 para Pequeñas Empresas en India sobre Contabilidad

Visión general de Zoho Books

Zoho Books hace que la gestión de cuentas para pequeñas empresas sea menos dolorosa con flujos de trabajo automatizados, informes financieros compatibles con impuestos y acceso basado en roles. Puedes establecer descuentos automáticos para facturas por encima de ciertos umbrales. El software también facilita el cálculo de informes de GST. La mejor parte es que puedes presentar declaraciones de GST directamente desde Zoho Books y mantenerte libre de estrés durante la temporada de impuestos.

Además de eso, la plataforma permite la colaboración multiusuario, lo cual es útil si estás trabajando con consultores fiscales externos y auditores. Los propietarios de pequeñas empresas pueden recibir pagos en línea o configurar transacciones recurrentes a través de asociaciones con pasarelas de pago y bancos como Standard Chartered, ICICI y Yes Bank.

Zoho Books también facilita la conciliación financiera al hacer coincidir los estados de cuenta importados con las transacciones.

Fuente: Zoho Books

Características de Zoho Books

Maneja la contabilidad de pequeñas empresas como un profesional con las siguientes características de Zoho Books:

- Facturación y presentación de declaraciones de GST

- Recordatorios de pago automatizados

- Facturación personalizada multilingüe

- Seguimiento y categorización de facturas de gastos

- Extracción de datos de recibos con escaneo automático

- Informes contables avanzados y registros de auditoría

- Creación de facturas basada en el tiempo dedicado a tareas o costo fijo

- Documentación inteligente para convertir cotizaciones aceptadas en facturas

- Control de inventario con puntos de reorden personalizables y gestión de precios promocionales

| Características mejor valoradas | Características peor valoradas |

| Tableros de control | Capacidad de flujo de trabajo |

| Etiquetas/dimensiones | Nómina |

| Exportación de archivos | Depósito directo |

Precios de Zoho Books

Zoho Books ofrece cinco planes de precios. Las pequeñas empresas con ingresos inferiores a 25 lakhs por año pueden usar el producto de forma gratuita.

| Planes de Zoho Books | Precios |

| Gratis | Gratis para siempre |

| Estándar | ₹749 |

| Profesional | ₹1,499 |

| Premium | ₹2,999 |

| Élite | ₹4,999 |

| Ultimate | ₹7,999 |

* Todos los planes son por organización por mes y se facturan anualmente.

Lo que más les gusta a los usuarios:

“Zoho Books tiene todas las características necesarias para la contabilidad de pequeñas empresas. Se pueden generar facturas compatibles con GST y hacer asientos de diario automatizados cuando los clientes pagan las facturas. Los estados de cuenta bancarios se sincronizan automáticamente con Zoho Books, lo que facilita la gestión de los libros.”

- Reseña de Zoho Books, Suman B.

Lo que no les gusta a los usuarios:

“Capturar la depreciación de los activos de capital es un poco complejo. Solo se puede encontrar cómo capturarlo buscando en Google. Esta función recurrente necesita integrarse mejor en Zoho Books. Además, la depreciación debe estar vinculada a los activos para la posteridad en lugar de solo capturar el monto."

- Reseña de Zoho Books, Mohit Y.

Zoho Books vs. Tally: Diferencias clave

- Generación de facturas y facturación: Los usuarios aprecian las capacidades robustas de generación de facturas de Zoho Books, especialmente la función de facturas recurrentes, que simplifica los ciclos de facturación. Aunque TallyPrime ofrece funciones de facturación digital, algunos usuarios encuentran sus funcionalidades de facturación menos intuitivas que las de Zoho Books.

- Gestión de efectivo: Los usuarios de Zoho Books destacan herramientas superiores de gestión de efectivo que monitorean eficazmente las posiciones de efectivo. Aunque TallyPrime proporciona funciones de gestión de efectivo, los usuarios sugieren que Zoho Books ofrece un conjunto más completo.

- Asientos de diario: Zoho Books ofrece funciones confiables de asientos de diario pero con capacidades ligeramente menos avanzadas. TallyPrime sobresale en la funcionalidad de asientos de diario, proporcionando características más avanzadas para una gestión detallada.

Visión general de TallyPrime

TallyPrime, también conocido popularmente como Tally, es adecuado para propietarios de pequeñas empresas que buscan eliminar las complejidades relacionadas con la contabilidad, inventario, banca, nómina y cumplimiento normativo. Este software de contabilidad te ayuda a presentar declaraciones para múltiples GSTINs y evitar errores contables con la conciliación automatizada de GSTR 2A/2B.

TallyPrime también facilita la gestión de facturas electrónicas y guías de remisión electrónicas. También puedes compartir enlaces de pago con los clientes, gracias a las integraciones de pasarelas de pago de TallyPrime. Las capacidades avanzadas de informes te ayudan a mantenerte al tanto del envejecimiento del inventario, el movimiento y los niveles de reorden.

Fuente: Tally Solutions

Características de TallyPrime

Las siguientes características de TallyPrime facilitan cómo los propietarios de pequeñas empresas gestionan las tareas contables.

- Gestión de flujo de efectivo

- Gestión de cumplimiento fiscal

- Presentación de declaraciones en el formato prescrito

- Seguimiento de cuentas por cobrar y por pagar

- Análisis de "qué pasaría si" para verificar la precisión de las cuentas

- Comprobantes de diario para registrar múltiples tipos de transacciones

- Consolidación de gráficos de cuentas basada en grupos contables predefinidos

- Soporta instrumentos de pago como pago electrónico, cheques y giros bancarios (DD)

| Características mejor valoradas | Características peor valoradas |

| Exportación de archivos | Etiquetas/dimensiones |

| Seguimiento de flujo de efectivo | Automatización de cuentas por cobrar (AR) |

| Ingresos y gastos | Seguimiento/pedido de inventario |

Precios de TallyPrime

TallyPrime ofrece cuatro planes de precios. También puedes probar el producto de forma gratuita durante una semana.

| Planes de TallyPrime | Precios |

| Alquiler Plata | ₹600 |

| Alquiler Oro | ₹1,800 |

| Plata | ₹18,000 |

| Oro | ₹54,000 |

* Todos los planes excepto Plata y Oro son por organización por mes y se facturan mensualmente o anualmente.

Lo que más les gusta a los usuarios:

"TallyPrime ofrece una contabilidad rápida y precisa junto con instalaciones multifuncionales. También ofrece una función avanzada de facturación electrónica que no estaba disponible en Tally ERP 9. Puedes generar fácilmente facturas electrónicas, obligatorias para organizaciones que superan el límite de facturación prescrito, simplemente ingresando tu ID de usuario y contraseña. TallyPrime proporciona características contables más avanzadas que otros software y es un software de contabilidad fácil de usar."

- Reseña de TallyPrime, Mahesh Babu S.

Lo que no les gusta a los usuarios:

“Los problemas de conexión al servidor son muy comunes con TallyPrime. Se necesitan varios intentos para llegar finalmente a una solución. Además, el soporte en línea no está a la altura. En la mayoría de los casos, tenemos que depender de proveedores de soporte locales."

- Reseña de TallyPrime, Shyam K.

Vyapar vs. TallyPrime: Diferencias clave

- Asientos de diario: TallyPrime ofrece una gestión de asientos de diario más avanzada, mientras que Vyapar proporciona funcionalidad básica. Esto hace que TallyPrime sea una mejor opción para empresas con necesidades contables complejas.

- Gráfico de cuentas: TallyPrime permite un seguimiento financiero detallado, mientras que Vyapar tiene una estructura de cuentas más simple. Las empresas que requieren una categorización financiera detallada pueden encontrar TallyPrime más adecuado.

- Liquidaciones de pagos: TallyPrime admite un procesamiento de transacciones sin problemas, mientras que Vyapar tiene menos opciones de liquidación avanzadas. Vyapar es ideal para pequeñas empresas con necesidades de pago sencillas, mientras que TallyPrime maneja operaciones financieras más grandes.

- Generación de facturas: TallyPrime incluye funciones de facturación recurrente, mientras que Vyapar se centra en la creación de facturas estándar. TallyPrime es preferible para empresas que necesitan facturación automatizada, mientras que Vyapar funciona bien para facturación básica.

Visión general de Vyapar

Vyapar es un software de facturación GST con capacidades de inventario, facturación y contabilidad. Las pequeñas empresas y startups utilizan Vyapar para crear facturas GST, enviar recordatorios de pago y detectar artículos de inventario de movimiento lento. Puedes crear fácilmente informes GSTR 1, GSTR 2, GSTR 3, GSTR 4 y GSTR 9 basados en compras, ventas y gastos.

Vyapar facilita a las pequeñas empresas aceptar pagos mediante tarjetas de crédito o débito, interfaz de pagos unificados (UPI), billeteras electrónicas, códigos QR, transferencia de cuenta bancaria, transferencia electrónica nacional de fondos (NEFT) y servicio de pago inmediato (IMPS). Además, puedes ver actualizaciones críticas como flujo de efectivo, pedidos abiertos, estado del inventario y actualizaciones de pagos desde un solo tablero de control.

Vyapar también está disponible como una aplicación móvil para Android y protege tus datos contables con opciones de respaldo automático en la nube o local.

Fuente: Vyapar

Características de Vyapar

Las siguientes características facilitan a los propietarios de pequeñas empresas gestionar la facturación GST, la facturación y la contabilidad.

- Informes de negocios

- Respaldo seguro de datos

- Creación personalizada de guías de entrega

- Seguimiento de pedidos para el cumplimiento de pedidos

- Conversión de estimaciones y cotizaciones en órdenes de venta

- Seguimiento y gestión de pagos en línea y fuera de línea

- Seguimiento y registro de gastos para preparar informes de facturación GST

- Gestión fácil del flujo de efectivo con seguimiento de cuentas por cobrar y por pagar por parte

| Características mejor valoradas | Características peor valoradas |

| Ingresos y gastos | Automatización de AR |

| Seguimiento de flujo de efectivo | Nómina |

| Generación de documentos de salida | Gestión de usuarios, roles y acceso |

Precios de Vyapar

Vyapar ofrece dos planes de precios junto con una opción de uso básico gratuito de por vida.

| Planes de Vyapar | Precios |

| Gratis | Gratis para siempre |

| Plan Plata | ₹2,799 |

| Plan Oro | ₹3,499 |

* Todos los planes son por empresa por año y se facturan anualmente.

Lo que más les gusta a los usuarios:

“Este es un software realmente bueno para propietarios de pequeñas empresas. Te ahorra tiempo y hace que el proceso contable sea más fluido. También puedes instalar esta aplicación en tu teléfono para crear y enviar facturas y recibos. La mejor parte es que rastrea tus facturas y transacciones y te ayuda a gestionar el inventario."

- Reseña de Vyapar, Hritik W.

Lo que no les gusta a los usuarios:

"La sincronización de la aplicación no es adecuada. A veces, la aplicación se retrasa al ingresar el número de factura. Intenté conectarme con el soporte al cliente, pero no pudieron proporcionar una solución adecuada.”

- Reseña de Vyapar, Aviral G.

Zoho Books vs. Tally vs. Vyapar: ¿Cuál elegir?

Si estás tratando de elegir entre Vyapar, TallyPrime o Zoho Books, no existe una solución contable única para todos porque las pequeñas empresas tienen diferentes prioridades y necesidades.

Aquí tienes una tabla de comparación rápida que te dice todo lo que necesitas saber sobre estas tres soluciones de software de contabilidad.

Zoho Books es conocido por ser rico en funciones y ofrecer un plan gratuito además de todo. Cuenta con automatización integrada para ayudar a los propietarios de pequeñas empresas a automatizar tareas contables tediosas. Además, las capacidades avanzadas de informes financieros facilitan cómo obtienes información sobre áreas contables clave y tomas decisiones informadas.

La única pega es que cada plan limita el número de usuarios que puedes invitar. Por lo tanto, tendrás que pagar ₹150 por usuario al mes por cada miembro adicional del equipo. Aun así, Zoho Books es la primera opción entre los propietarios de pequeñas empresas que buscan un software de contabilidad lleno de funciones sin gastar mucho dinero.

TallyPrime es bastante popular entre las empresas indias de todos los tamaños. Además de ofrecer un diseño intuitivo, este software de contabilidad proporciona diferentes informes de negocios para que puedas tomar las decisiones correctas de crecimiento empresarial. Además, mantiene tus datos financieros seguros con una capa adicional de cifrado, TallyVault.

Si bien lleva más tiempo para los no contadores aprender Tally, y no hay una opción gratuita para siempre, sigue siendo la mejor opción para el software de contabilidad compatible con GST.

Vyapar es una solución contable rentable y compatible con GST. Su interfaz fácil de usar y su tablero de control empresarial facilitan la visualización del flujo de efectivo, el inventario y los pedidos. Además, genera más de 35 informes de negocios para la toma de decisiones informadas. Los propietarios de negocios también pueden usar Vyapar para configurar tiendas en línea con catálogos de productos y servicios. Vyapar es ideal para pequeñas empresas que buscan soluciones contables de bajo costo y fáciles de usar con capacidades de gestión de inventario.

Se recomienda encarecidamente evaluar los pros y los contras de cada solución junto con factores como el presupuesto, la industria, la facilidad de uso y otras necesidades comerciales. Además, considera registrarte para pruebas gratuitas, planes o demostraciones de productos antes de comprar.

Preguntas frecuentes: Zoho Books vs. TallyPrime vs. Vyapar

¿Todavía estás comparando Tally vs. Vyapar y Zoho Books vs. Tally? Consulta las respuestas a las preguntas más frecuentes.

P. ¿Cuál es más fácil de usar: Zoho Books vs. TallyPrime vs. Vyapar?

R. Aunque las tres son plataformas fáciles de usar, Vyapar es popular entre las pequeñas empresas debido a su interfaz moderna y visualmente atractiva. Hay poca o ninguna curva de aprendizaje para los usuarios que planean usar Vyapar por primera vez.

P. ¿Cuál es mejor, Zoho o Tally?

R. Tanto Zoho como Tally son excelentes opciones para startups, pequeñas empresas y pequeñas y medianas empresas (PYMES). Sin embargo, Zoho Books es comparativamente mejor en cuanto a interfaz de usuario, curva de aprendizaje, integraciones y precios. Además de ser rico en funciones y ofrecer un diseño simple, Zoho Books se integra perfectamente con otras soluciones de software. Además, puedes acceder a Zoho Books sobre la marcha sin pagar un precio elevado.

P. Vyapar vs. Tally, ¿cuál es mejor software de contabilidad para pequeñas empresas?

R. Vyapar y Tally ofrecen soluciones contables compatibles con GST. Vyapar está alojado en la nube y ofrece planes de precios anuales. TallyPrime almacena datos localmente y ofrece licencias perpetuas así como planes mensuales. Vyapar podría ser el camino a seguir si eres un propietario de pequeña empresa que maneja cuentas por tu cuenta, ya que es fácil de usar y asequible.

P. ¿Cuáles son las ventajas de TallyPrime?

R. TallyPrime es un software popular de contabilidad y gestión empresarial con múltiples capacidades. Algunas de las ventajas de usar TallyPrime son:

- Ahorra tiempo: TallyPrime automatiza tareas contables como cálculos de impuestos, conciliación bancaria y gestión de libros. Como resultado, puedes evitar errores y ahorrar tiempo.

- Ofrece acceso a datos en tiempo real: Puedes ver información financiera en tiempo real, informes y análisis para la toma de decisiones informadas.

- Garantiza una operación sin problemas: Esto es gracias a la capacidad de TallyPrime para integrarse con software de gestión de relaciones con clientes (CRM), sistemas de planificación de recursos empresariales (ERP) y sistemas de punto de venta (POS).

- Facilita la gestión de inventario y nómina: TallyPrime tiene módulos dedicados para el seguimiento de inventario, generación de informes de stock, seguimiento de tiempo, cálculo de salarios, deducción de impuestos y generación de recibos de pago.

- Simplifica el cumplimiento de GST: Este software te permite generar informes de GST y presentar declaraciones de GST con facilidad.

P. ¿Cuál es el mejor software de contabilidad para una pequeña empresa?

R. TallyPrime es una excelente opción para pequeñas empresas que buscan gestionar tareas contables, siempre que no les importe la curva de aprendizaje. Por otro lado, Zoho Books es perfecto para empresas que necesitan soluciones contables basadas en la nube, llenas de funciones y rentables. La aplicación Vyapar es adecuada para freelancers y propietarios de pequeñas empresas que desean comenzar a usarla de inmediato sin dedicar demasiado tiempo a aprenderla.

¿Buscas ahorrar dinero en costos de suscripción de software? Optimiza el gasto en software de tu empresa hoy con G2 Deals.

Este artículo fue publicado originalmente en 2023. El contenido ha sido actualizado con nueva información.

Sudipto Paul

Sudipto Paul leads the SEO content team at G2 in India. He focuses on shaping SEO content strategies that drive high-intent referral traffic and ensure your brand is front-and-center as LLMs change the way buyers discover software. He also runs Content Strategy Insider, a newsletter where he regularly breaks down his insights on content and search. Want to connect? Say hi to him on LinkedIn.