On March 10th, 2023, G2 launched its new Tax Credit Providers category, which falls under the Business Finance Providers parent category. G2 created this category to represent the abundance of service providers aimed at helping businesses claim tax credits for various government-sponsored programs.

Maximizing government incentives with tax credit providers

Tax credit providers are companies or organizations that help businesses take advantage of government tax credits. Tax credits are incentives that reduce the amount of taxes an organization owes (not to be confused with tax deductions which lower the amount of taxable income). These credits are offered by various levels of government, from local to federal. They can be available for various reasons, such as promoting certain behaviors or investments, supporting specific industries, or incentivizing energy-efficient technologies.

Tax credit providers typically work with their clients to identify the tax credits for which they are eligible, help them gather the necessary documentation, and sometimes file the appropriate forms with tax authorities. They may also advise on structuring financial transactions to maximize tax benefits.

Some examples of tax credits that tax credit providers may assist with include research and development (R&D) tax credits, employee retention credits (ERC), and work opportunity tax credits (WOTC). These providers charge a fee for their services, but the savings clients can realize from taking advantage of available tax credits often outweigh the cost.

What are the advantages of using tax credit providers?

- Work directly with the client's staff to better understand current and historical project data.

- Summarize and document findings in a report that supports and substantiates the tax credit in case of an audit.

- Evaluate business financials, such as expenses, W-2s, and 1099s, to determine if a company is eligible for tax credits.

- Calculate any tax credits based on local and federal guidelines.

Why are tax credit providers important now?

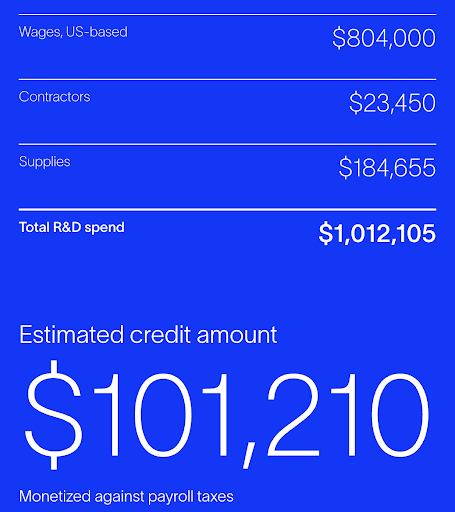

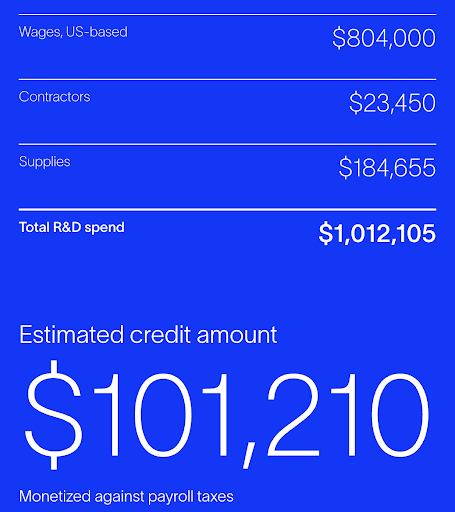

Tax credit providers are now necessary because tax laws and regulations constantly change. Businesses need help to keep up with these changes and understand the full range of tax credits available. Additionally, some tax credits require extensive documentation and can be challenging to apply for without professional assistance. Like the visual below, tax professionals can display their findings in a straightforward, easy-to-understand narrative that outlines what expenses are eligible for credits and how much tax credit a company might receive.

What a typical tax credit scenario might look like

Source: clarusrd.com

Furthermore, as governments worldwide increasingly focus on reducing carbon emissions and promoting sustainability, tax credits for investments in renewable energy, energy efficiency, and other green initiatives are becoming more prevalent. Tax credit providers can help businesses navigate these complex tax incentives and ensure they take full advantage of available opportunities.

In many cases, working with a tax credit provider can also result in significant cost savings. By identifying and claiming all eligible tax credits, businesses can reduce their tax burden and reinvest those savings into other areas of their operations.

Looking ahead

There are 43 providers in G2’s Tax Credit Providers category, with more sure to be added as companies continue to look for cost and time savings while taking advantage of these firms' tax expertise. Tax credit providers can help companies reduce their tax burden and increase their bottom line while saving them time and resources that can be better allocated to other areas of their business. You can use G2 to find the best service for your organization to better navigate the complex and ever-changing landscape of tax laws and regulations and to maximize your potential tax savings.

Edited by Shanti S Nair