Effective financial management is vital to the continuous operation of healthcare organizations and their ability to provide quality care to patients, but the process is long, arduous, and prone to human error.

Imagine a superhero clad in a lab coat, armed with calculators and spreadsheets, swooping in to rescue hospitals and healthcare organizations from financial distress – that's revenue cycle management (RCM).

By implementing revenue cycle management software, healthcare organizations improve financial success in the ever-evolving and competitive healthcare landscape.

What is healthcare revenue cycle management?

Revenue cycle management is the comprehensive process of optimizing revenue collection in healthcare. It encompasses patient registration, billing, claims processing, payment, and accounts management. Effective RCM practices lighten the burden of operations, improve revenue collection, and guarantee the sustainability of healthcare services.

If you're a healthcare provider aiming to optimize your finances and deliver quality care over the long term, this article is tailored just for you. It provides valuable insights and strategies to help you achieve financial stability and sustain high-quality patient care.

What is the purpose of revenue cycle management?

As a healthcare provider, you need an efficient revenue cycle management process for patient interaction, from initial inquiry to final payment. Without a well-defined process in place, you risk lower patient and clinical satisfaction scores and damage to your organization's reputation.

RCM involves multiple patient touchpoints:

- Collecting and documenting accurate information

- Confirming patients are billed only for services provided

- Contacting third-party payors

- Collecting payments on time

Tip: Patient engagement software is a valuable tool used in healthcare to enhance patient communication, involvement, and overall experience.

Regardless of the size of your hospital or clinic, by enacting revenue collection efforts using software, you can promise sustainable growth and safeguard your organization's positive reputation.

RCM strategies not only rehabilitate financial outcomes but also strengthen patient and clinical satisfaction, positioning your healthcare organization for long-term success.

Möchten Sie mehr über Medizinische Abrechnungssoftware erfahren? Erkunden Sie Medizinische Abrechnung Produkte.

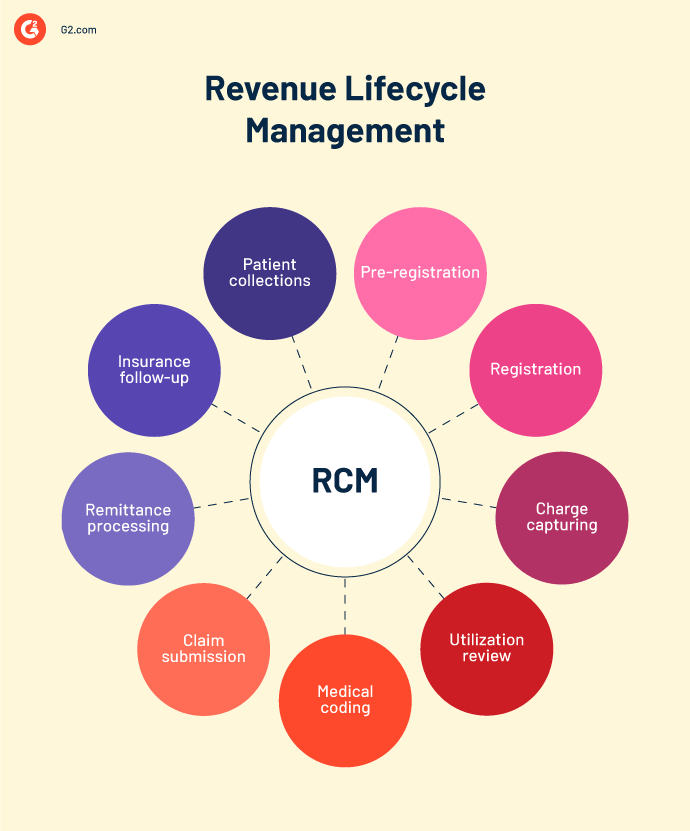

Revenue cycle management process

Revenue cycle management involves several essential steps your organization can follow to create efficient operations and timely insurance reimbursement.

Pre-registration

To establish a patient account, gather and verify the patient's financial health and insurance information, such as coverage, deductible, co-insurance, co-payment, and referrals.

You also have an opportunity to discuss financial expectations, payment timing, policies on no-shows, and cancellations. This upfront discussion clarifies the financial demands of the patient and reduces payment-related inquiries.

The information collected is then shared with the patient's insurance carrier and your revenue management system. This information has to be 100% accurate for proper case management, including preventing payment and claim denials. Make sure you get exact, up-to-date information to minimize errors and ineligible insurance issues.

Registration

During registration, you have to verify and update the patient's address, phone number, date of birth, and insurance information. Confirm this data at every patient visit to maintain consistency.

Tip: Implementing patient intake software offers several benefits that improve the registration process, reduce errors, and enhance patient privacy.

As part of the registration process, you can collect co-payments. For specialist visits, double-check that a referral approval is in place to treat the patient. Failing to complete this step can result in denying payment for the services rendered.

Tip: Using referral management tools efficiently tracks patient referrals and decreases out-of-network referral practices.

Patients also sign financial forms and assign insurance benefits during this step. Neglecting this paperwork can lead to financial repercussions if your practice undergoes an audit.

Charge capturing

This is the process of maintaining transparency and fairness in charging patients for your care. Verify that your billing is accurate to guarantee that patients don’t over- or underpay.

You can set up charge capture in two different ways. In one option, information flows seamlessly from documentation to billing software. The other option follows the traditional approach wherein the staff manually enters or sends the information to the billing department for input. Undoubtedly, the first method is less prone to errors.

Utilization review

Utilization review focuses on maximizing adherence to evidence-based standards of Medicare, along with its quality and efficiency. It requires a collaborative effort between healthcare professionals at your organization and health insurance companies.

Tip: Using a clinical communication and collaboration (CC&C) system can help coordinate activities and data flow among clinicians, nurses, physicians, and other healthcare professionals.

The stage includes steps to assess the utilization of healthcare services and ensure alignment when it comes to providing appropriate care for each patient.

The collaboration helps expedite the approval of prior authorizations from health plans so patients know their treatment plans are covered by insurance.

Medical coding

The medical coding process links your organization with insurance companies. The process helps you translate treatment notes into standardized medical codes, which can help determine insurance coverage and reimbursement amounts in the future.

Before submitting a claim, you must gather all the necessary patient information and verify insurance coverage. Evaluate the necessity and cost-effectiveness of prescribed medicines to give patients the most appropriate and beneficial care possible. Then, assign the correct codes that reflect the treatment provided. Insurance providers need them to determine reimbursement amounts.

Tip: In cases where multiple services are provided, separating and coding them accurately is crucial before the claim goes forward.

Your organization needs to practice accurate medical coding to receive appropriate reimbursement and avoid the need for lengthy claim investigations and appeals.

Claim submission

The team responsible for revenue cycle management carefully examines the charges, current procedural terminology (CPT) code, and diagnosis code to make sure that the billing supports the procedure. Once the fees have been added and coded, you must submit the claim to the patient's insurance company.

From improper International Classification of Diseases, Tenth Revision (ICD-10) coding to a missing signature on a patient's charts, insurance companies can easily deny claims based on technical or clerical errors. It helps to employ RCM software to review and validate healthcare claims.

This process, also known as claim scrubbing, catches mistakes before the claim is submitted. It is vital to ensure that claims are error-free and processed smoothly. Submitting a clean claim to the insurance carrier allows for timely resolution and faster payment.

The next step sends claims to different payors to emphasize the importance of open communication between your organization and the insurance company. Here, you can establish coverage levels, prevent errors, and expedite claim processing.

Once the claims are processed, expect to receive two reports: transmission and rejections. The transmission report provides valuable information about claims sent and received and those that may have been dropped.

The rejections report highlights incorrect codes that need attention. Reviewing both reports as part of the claim submission process moves things forward more quickly.

Tip: Using healthcare claims management software can help automate complex workflows associated with claim submission, processing, and reimbursement.

Remittance processing

At this stage, your organization can receive remittances for the submitted claims.

With electronic posting being the norm, companies may overlook errors if they fail to review remittances thoroughly. Incorrect setups or unpaid claims go unnoticed without regular analysis. Put a monitoring system in place to catch and correct any discrepancies promptly. Failure to do so may result in missed appeal opportunities and the inability to rectify mistakes.

Providers should also periodically review their fee schedules to align with adjusting rates, contracts, and allowable. Regular evaluation of fees helps prevent missed revenue opportunities and gives fair compensation for services rendered.

The remittance process also takes contractual and non-contractual write-offs into account.

Contractual write-offs are unavoidable and involve the contracted rates with carriers and payers. On the other hand, you can avoid non-contractual write-offs with an efficient remittance process. Non-contractual write-offs typically occur due to breakdowns, such as missing authorizations, lack of referrals on file, or untimely claim submissions. By closely monitoring reports and addressing red flags, your practice can prevent avoidable write-offs and protect your revenue.

Insurance follow-up

The step of ongoing insurance follow-up involves tracking outstanding claims and identifying any delays or issues in the reimbursement process. The follow-up helps address unpaid claims and minimizes revenue leakage.

An essential tool in this process is the accounts receivable report, which provides insights into claims that have not been paid within a specific period. This report plays a crucial role in identifying areas where insurance follow-up may be lacking or delayed, shedding light on the reasons behind the payment obstacles.

Patient collections

Patient collection poses one of the trickiest aspects of the revenue cycle process. After the insurance company or a government program like Medicare or Medicaid approves the claim, they reimburse your organization based on the patient's eligibility and coverage. Any remaining balance is your responsibility to collect from the patient.

Encourage patients to pay when they’re on-site to increase the likelihood you’ll get your money. The billing team should be trained to handle payment collection during service.

To prevent a backlog, establish a standard policy for collecting payments that sets the financial expectations for the treatment in advance.

Design a statement cycle that ensures patients receive statements regularly, allowing for quicker follow-up and improved cash flow. It’s essential to prioritize creating viable patient collection systems to avoid resorting to bill collectors.

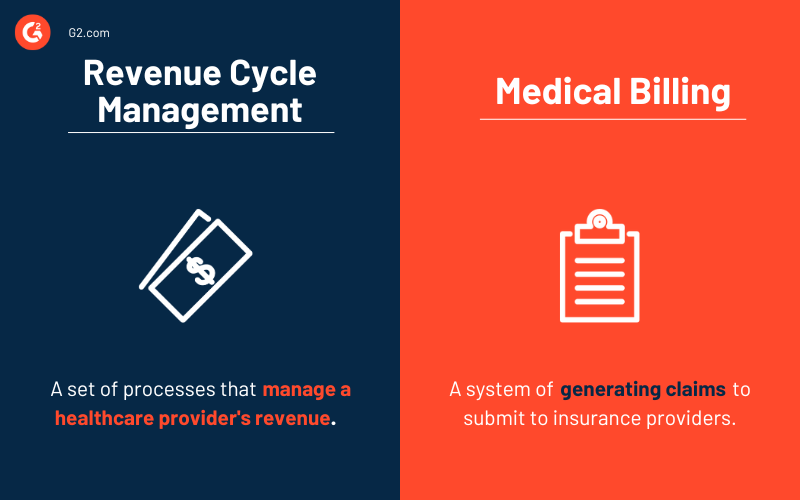

Revenue cycle management vs. medical billing

Revenue cycle management and medical billing are related but distinct processes within the healthcare industry.

Medical billing entails the accurate and timely submission of claims for services provided to patients. All components of medical billing include gathering necessary information from healthcare providers, documenting services, assigning appropriate medical codes, and submitting claims to insurance companies or government programs for reimbursement.

Tip: Medical billing software can help healthcare organizations streamline the billing process, improve accuracy, and enhance compliance, ultimately leading to faster payments and increased patient satisfaction.

But please note that it’s only one aspect of an organization's overall financial strength. Revenue cycle management covers various interconnected processes that go beyond medical billing alone.

In addition to medical billing, RCM handles patient registration, insurance verification, charge capture, coding and documentation, claims submission, denial management, payment posting, and accounts receivable follow-up. They all work together to get financial operations as close to perfect as possible.

The benefits of healthcare revenue cycle management

Effective revenue cycle management provides numerous benefits, not only to the organization but also to patients. You can count on RCM to:

- Identify coding errors. RCM finds coding errors so organizations can figure out how to fix what’s wrong. Identify and address coding errors. As a result, admins can reduce claim denials and avoid additional investigation costs, and at the same time, patients can receive timely reimbursements.

- Decrease administrative burden. RCM minimizes administrative duties by preventing claim denials. This frees up staff time and energy to focus on patient care.

- Prevent patient fraud. RCM detects patient fraud by verifying insurance coverage and detecting medical identity theft. Providers can better address inaccuracies and prevent financial losses by discovering them early.

- Maintain consistent revenue. RCM creates the most efficient revenue cycle possible, which fortifies financial performance and consistent reimbursements.

- Upgrade processes. Revenue cycle management solutions simplify procedures, helping Healthcare organizations appreciate RCM because it simplifies procedures, so managing evolving regulations and reimbursement insurance plans efficiently is painless.

By learning effective revenue cycle management, your organizations can enhance their financial performance, provide quality care, and make sure of long-term sustainability.

The challenges of healthcare revenue cycle management

Maintaining effective revenue cycle management policies is complicated, primarily due to the constantly transforming healthcare regulations. This is just one challenge you might encounter on a patient's healthcare journey.

- Complex billing and coding. The healthcare industry’s intricate coding systems and billing regulations test the administration’s resolve every day. Code procedures and medical services have to be executed accurately to avoid claim denials and delayed reimbursements.

- Claim denials and rejections. Insurance claims denials and rejections occur for incomplete or inaccurate documentation, eligibility issues, or coding errors. These denials demand resolution time and resources, delaying reimbursement and impacting cash flow.

- Fluctuating reimbursement models. The shift from fee-for-service to value-based reimbursement adds complexity to revenue cycle management. Organizations must adapt to new payment models, quality metrics, and performance-based incentives. Changing up systems requires significant operational adjustments.

- Delay in patient collections. Securing patient payments, particularly with the rise of high deductibles and financial difficulties, poses a challenge in healthcare. Strategies such as flexible payment options, adjusted bad debt placement, extended payment terms, and payment delays have become vital, especially since the advent of COVID-19.

- Prior authorization processes. Providers and patients often face delays while waiting for health plans to authorize necessary services. The introduction of the No Surprises Act in 2022, aimed at protecting patients from unexpected billing, has further complicated revenue cycle management workflows, requiring providers to adapt their processes for compliance.

- Staff training. Maintaining evolving healthcare regulations, coding guidelines, and payor policies requires ongoing staff training. Limited resources and expertise in revenue cycle management can hinder organizations from maximizing revenue potential.

- Regulatory compliance. Healthcare regulations like Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA) impose strict requirements on data privacy, security, billing, and medical practices. Staying compliant with these regulations demands multifaceted processes and systems.

Tip: Using healthcare compliance tools guarantees your organization adheres to compliance guidelines and revises practices based on changing regulations.

How to succeed at healthcare revenue cycle management

Succeeding in healthcare revenue cycle management calls for constructive financial supervision. These key strategies will increase your chances of a positive outcome.

- Implement software. Revenue cycle management software is made to identify and possibly rectify claims issues before they’re submitted to insurance companies. RCM platforms certify that well-documented claims are presented accurately to reduce the claim denials rate and improve revenue cycle management. Use revenue cycle management software to deliver financial estimates before or at the point of service.

- Understand denied claims. While rejected claims often require complete reworking, some denied claims can be easily fixed. For example, resolving an issue might be as basic as updating medical coding or providing additional treatment history. Timeliness is crucial – making changes within 24 hours of receipt makes the insurance more likely to reverse the denied claim.

- Create payment plans. Let healthcare facilities communicate price estimates for routine clinical procedures to patients. Set up pre-service payment options. These simple steps enhance the patient experience and raise payment collections.

- Automate authorization and eligibility. Ease burden and cost by automating prior approvals and coverage eligibility analyses. Rules-based healthcare systems can perform these tasks instantly, giving time to healthcare providers and ancillary care providers to center patient care. Furthermore, manual authorization processes can cost clinics significantly more than automated electronic prior authorizations.

How technology drives healthcare revenue cycle management

Revenue cycle management constantly advances to adapt to changes in the healthcare ecosystem, such as rapid technological progress and the impact of global pandemics.

- Workflow management tools eliminate unnecessary processes, reducing manual errors and increasing efficiency.

- Electronic health record (EHR) systems centralize patient data to improve accuracy, accessibility, and the ability to provide value-based care.

- Advanced data analytics tools and reporting software provide insights into financial performance and identify areas that need correction.

- Digital payment solutions facilitate convenient and prompt transactions.

- Artificial intelligence (AI) tools revolutionize revenue cycle management, analyzing data to offer insights on claim denials and crucial indicators. It excels in patient-provider matching, cost estimation, claim coding, and prior authorization. With continuous enhancements, AI augments outcomes and makes administrative processes simpler.

Best revenue cycle management software

Using revenue cycle management software permits the integration of both the business and clinical aspects of healthcare establishments. It automates tasks and extracts data from electronic health records, electronic case report forms, and other hospital information management systems. It also simplifies financial procedures.

You’ve got many factors to consider when choosing the correct software, but to be included in our category, the software must:

- Allow integration with already existing IT solutions

- Support the relationship between hospitals, payment providers, and insurance companies

- Adhere to and adapt to healthcare industry regulations.

- Permit coding, charge capture, claims submission, and management

- Possess online patient payment portals and options for electronic payments

* Below are the top 5 leading revenue cycle management software solutions from G2's Summer 2023 Grid® Report. Some reviews may be edited for clarity.

1. Waystar

Waystar is a market-leading technology that simplifies and unifies the revenue cycle. Their cloud-based platform refreshes workflows and brings transparency to the patient's financial experience.

What users like best:

"Waystar enables downloading and submitting all payments simultaneously to the electronic medical record (EMR), ensuring a smooth start to incoming payments. It is one of our favorites for its simplicity of verifications and reports. When checking for active insurance coverage, the results are nearly instantaneous. Waystar also simplifies payment verification and electronic printing of explanation of benefits (EOB)."

- Waystar Review, Sandeep A.

What users dislike:

"It's worth noting that Waystar's insurance information may have limitations. Although it shows a patient's coverage, it doesn't always provide accurate details for the specific payor we need to bill. This can make identifying the correct payor for billing in our EMR system a challenge."

- Waystar Review, Angela B.

2. Virence Centricity

Virence Centricity takes pride in its pragmatic financial management solutions encompassing software, professional services, and ecosystem partners.

This powerful combination optimizes revenue cycle operations, facilitates the implementation of risk-based payment models, and improves payor connectivity for healthcare organizations.

What users like best:

"This EMR is highly user-friendly, and the support provided is exceptional. Providers appreciate the ease of finding the necessary information. The merit-based incentive payment system (MIPS) integration is a valuable tool"

- Virence Centricity Review, Jeramy F.

What users dislike:

"To enhance the system, having a comprehensive control dashboard that can identify gaps and trends would be beneficial."

- Virence Centricity Review, Dhruv S.

3. NextGen Healthcare EHR

NextGen Healthcare EHR’s cloud-based solution saves time and supports practice growth with award-winning solutions and dedicated support for ambulatory practices.

Optimize workflows, improve patient engagement, and manage revenue cycles effectively – all with just one software tool. It helps empower your care team and patients with user-friendly technology and convenient online apps.

What users like best:

"The user inbox is a remarkable asset for end users as it consolidates tasks, appointments, pre-acquisition questionnaires, and the portal into one convenient location. Compared to my experience with Avatar, NextGen is much more user-friendly."

- NextGen Healthcare EHR Review, Brant S.

What users dislike:

"Multiple clicks are required to access specific functions, which slows down the workflow. Enhancing the interface to simplify the selection of specific functions would enhance efficiency and user experience."

- NextGen Healthcare EHR Review, Edwind W.

4. Allscripts Revenue Cycle Management Services

Allscripts Revenue Cycle Management Services is an exceptional administrative and financial management solution. Its fully integrated, end-to-end approach elevates operational efficiencies and polishes the revenue cycle.

What users like best:

"I appreciate the spreadsheet layout and the medical records document management program offered by Allscripts Revenue Cycle Management Services. The ability to easily delete irrelevant notes is a valuable feature. Additionally, the denials management functionality of the system is particularly beneficial."

- Allscripts Revenue Cycle Management Services Review, Leeann W.

What users dislike:

"One of the least helpful aspects of Allscripts is how the AR notes/previous follow-up notes posting tab is accessed under the right-click menu in encounters. This functionality should be improved so that users can review the notes without the need to right-click."

-Allscripts Revenue Cycle Management Services Review, Aadithya M.

5. Raintree Systems

Raintree Systems is a versatile software solution designed for physical rehabilitation practices and pediatric and adult therapy., Offering a range of features such as patient scheduling, documentation, reporting, billing, and patient engagement, it has a reputation as an all-in-one solution that organizes workflows, enhances efficiency, and improves revenue generation.

What users like best:

"Raintree boasts great reporting capabilities and ensures a seamless front and back-of-house workflow. Having transitioned companies from WebPT and Clinicient, the feedback regarding Raintree's benefits has been positive from a business, clinical, and administrative standpoint."

- Raintree Systems Review, Corey Z.

What users dislike:

"The system is complex and lacks intuitive design. Settings are scattered, workflows are disjointed, and tasks require navigating through multiple screens."

-Raintree Systems Review, William G.

Calibrate your financial GPS!

Without proper revenue cycle management, financial operations will always overwhelm you. Billing errors, prolonged reimbursement cycles, inefficient cash flow management, a higher burden, and limited performance insights – these are the headaches that make you wish for a hero.

Give revenue cycle management a chance to save you and your company’s success. By letting the revenue cycle be all it can be, you can increase profit while spending less time on administrative and clinical tasks. Its implementation benefits you, patients, and the overall healthcare ecosystem.

To take your medical practice to the next level and reap the rewards of modern technology, consider investing in a reliable medical practice management software solution.

Devyani Mehta

Devyani Mehta is a content marketing specialist at G2. She has worked with several SaaS startups in India, which has helped her gain diverse industry experience. At G2, she shares her insights on complex cybersecurity concepts like web application firewalls, RASP, and SSPM. Outside work, she enjoys traveling, cafe hopping, and volunteering in the education sector. Connect with her on LinkedIn.