I recently attended the Tableau Conference, where I indulged my nerdiness for four days. As a self-described data science evangelist, I was thrilled to see autoML, natural language generation, and other advanced automation features be added to Tableau, one of the world’s leading data visualization and business intelligence platforms.

While there, I met people who have also bought into the data revolution and are seeing immediate impacts on their businesses’ productivity and performance. As a tech worker, exposure to data science and analytics is an everyday part of the job, but it is certainly not in the industry I research: the supply chain. So I continue to ask myself, “Why won’t the supply chain just adopt artificial intelligence and data analytics software?”

In this article, I will break down the cultural and logistical barriers the supply chain faces in meeting the data analysis demands the pandemic brought on. I’ll also talk about steps that are being taken to address this and how G2 helps businesses create a modernized supply chain.

Artificial intelligence helps manage the supply chain. So what’s the delay?

I posed a question to Tableau’s chief product officer, Francois Ajenstat, about why the supply chain is so resistant to adopting analytics tools and artificial intelligence. He first prefaced his answer by stating some of the most powerful use cases he’s seen with Tableau have been with transportation and logistics vendors. He then suggested the underlying issue was not just the business itself but with mature industries and companies as a whole. Ajenstat believes industries and companies that have been around long enough are susceptible to becoming laggards with product adoption, as upgrading long-standing operating procedures requires a large-scale culture shift. In essence, if it ain’t broke, don’t fix it.

This sentiment is echoed by other C-suite professionals, including Bamboo Rose chief technology officer Kamal Anand. Due to inflexible cultures focused on doing things the same way for decades, disruptive technology and new business practices that could dramatically improve outcomes are not catching on. In addition, supply chain operations now involve frequent outsourcing to 3PLs, which means company data is often stored in multiple locations with different naming conventions and data governance policies. Because machine learning requires data to be cleaned and uniform before running it through algorithms, significant amounts of data preprocessing would be needed for the data to be useful. Thus, companies that don’t hire data scientists or invest in extensive training for existing supply chain analysts cannot use machine learning.

The needed technology exists, but it’s not being used

The issue at hand is not whether the technology exists but whether business leaders value innovation and efficiency enough to endure a period of uncertainty, steep learning curves, and risk management to yield a significant ROI. G2 lists a wide variety of supply chain categories, such as Inventory Control and Demand Planning software, that help automate inventory management, track product levels, and help supply chains allocate resources based on forecasted demand.

I spoke with Sime Curkovic, Ph.D., a professor of supply chain management at Western Michigan University, who echoes concerns about rigidity in the industry. According to Curkovic, data analysis still occurs in Excel spreadsheets with 22,000 rows and back-and-forth email conversations. This reluctance to use available technology is evidenced in G2 review data for the Analytics Platforms category, as only 2.7% of reviews came from professionals working in the supply chain industry. In addition, only 1.7% of reviews about data science and machine learning platforms came from professionals in the supply chain industries.

Even when logistics companies are adopting automation, they are not as savvy at using it.

It effectively is a tool that data-savvy people know how to use while most others do not. This disconnect makes cultural shifts toward automation difficult to execute.

“Supply chain professionals are making a lot of mistakes, and it’s because of a lack of using technology and it’s manually driven,” Curkovic said. “There’s a huge leadership void that lacks vision in technology, and it shows.”

Short-sighted leadership fails to see the big picture

99% of companies in a recent McKinsey & Company survey stated there was a labor shortage of digital talent for managing the supply chain. The idea that this can be remedied through hiring digitally native talent is a bottom-up approach to solving the issue, but Curkovic believes the true barrier comes from the top. Without leadership that fosters a culture of innovation and tech savviness, supply chain professionals will never be able to fully leverage the power of their data and overcome the significant challenges the supply chain has faced since March of 2020.

Some companies, however, actively make decisions that undermine innovation. For example, Curkovic states an unnamed Fortune 500 company laid off its youngest supply chain analysts at the beginning of the pandemic out of fear that the world was going to halt to a grind. However, demand ended up soaring during the pandemic, which stressed supply chains to a breaking point and caused chronic product shortages. The short-sighted nature of this layoff led to the company floundering, as word of workforce reduction traveled and led to digital talent choosing businesses that prioritized innovation.

A business's ability to work with versus against seismic changes in the supply chain is an indicator of its ability to thrive in the new normal. In fact, companies that were already moving with the current of digital-first operations, such as viewing e-commerce as a core business function versus a necessary evil, were able to function better during the early phases of the pandemic.

The path toward cloud-based data analysis

Curkovic believes one of the most important solutions to supply chain dysfunction is moving away from hardware to SaaS which has the power to process large data sets and produce meaningful insights. He, however, pointed to the fact that job reshoring and moving manufacturing home was the decision leaders made instead to cope with the issues of visibility into supply chains and geopolitical conflict.

“Reshoring is a band-aid. They didn’t have to do that because we have available technology.”

Sime Curkovic

Supply Chain Management Professor, Western Michigan University

A better solution to this predicament is using cloud-based technologies, such as supply chain visibility software and transportation management systems, to help companies develop better insight into all the moving parts of their supply chains. With the conflict in Ukraine severely disrupting trade routes and leading to embargoes, insight into every step of the logistics process is more important than ever.

When supply chain professionals use machine learning and data analytics tools to solve business problems, it pays off. According to G2 data from July 14, 2022, it took 14 months on average for all companies to achieve ROI with data science and machine learning platforms, but logistics companies achieved it in 13 months. It also took the average company four months to fully implement the software, but it only took supply chain professionals less than half of a month.

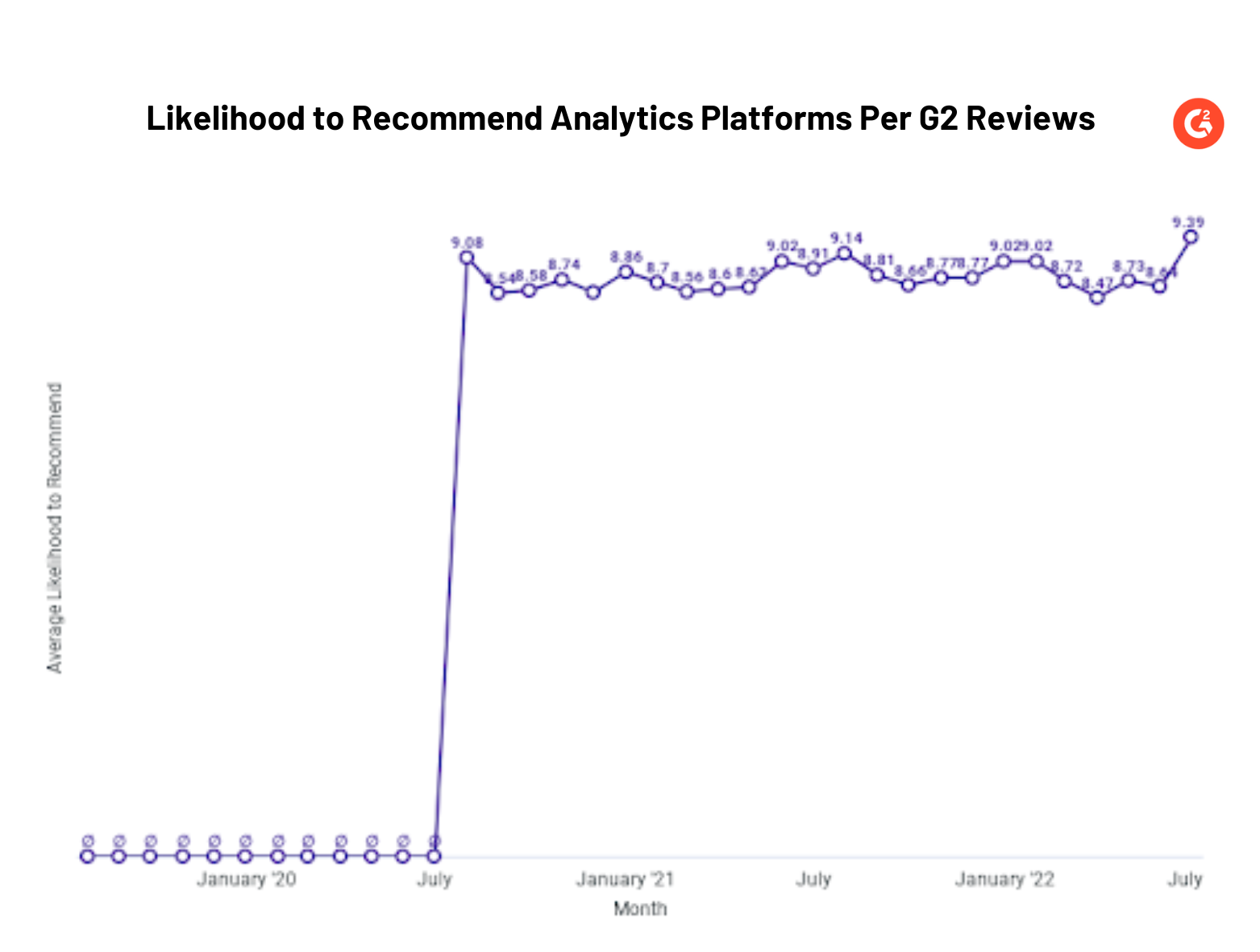

Signs of SaaS working are also seen with G2 data from July 14, 2022, on the Analytics Platforms category that covers the past 36 months. Throughout the end of 2019 and the first half of 2020, not a single review was written by a logistics professional about one of the category’s business intelligence tools. However, the urgency supply chain analysts felt in resolving COVID-related issues is evident by a sudden and steady flow of reviews that reported a very high likelihood to recommend the analytics platforms. Overall, reviewers from the logistics business are rating their business intelligence tools on this metric around 9 out of 10, indicating strong satisfaction and value derived from the purchase.

After running review data through a language analysis tool on July 12, 2022, several themes emerged on how business intelligence tools helped solve business problems. Reviewers who worked in the supply chain most frequently cited improved reporting, especially in evaluating performance metrics and the efficiency of business operations, as a key advantage of using this software. Better reporting, in turn, helped them draw interesting insights to assist in decision-making and track progress toward goals. Other common themes were automating data analysis to move out of spreadsheets and increased visibility into supply chain processes, such as inventory levels and warehouse performance.

SaaS is the solution

The bottom line is that software works, and it has the power to alleviate much of the chaos currently happening. In order to facilitate the transition toward cloud-based computing, Curkovic ensures the curriculum at his university adequately trains students in the principles of programming, computer science, and statistical analysis.

“There aren’t enough professionals trained in data science,” Curkovic said. “If students learn the skill sets of a data scientist, how could you go wrong?”

As I’ve said before, the supply chain will unlikely have a radical transformation but rather a deliberate upgrade. The transition toward fully functioning data science departments at logistics companies will likely occur at a much slower pace compared to other industries, so we’re lucky to have people like Curkovic putting in the work to make this a reality. However, when a company is ready to level up its logistics strategy, G2 is home to dozens of supply chain categories with thousands of user-authenticated reviews to help it pick the right software based on its business needs.

Onward in the fight for a data revolution!

Möchten Sie mehr über Bedarfsplanung Software erfahren? Erkunden Sie Nachfrageplanung Produkte.

Anthony Orso

Anthony is a Market Research Analyst specializing in supply chain and logistics, as well as data science applications in the industry. Prior to joining G2, Anthony worked in the research and strategy department of advertising. When Anthony isn't studying for his master's program in data science, he enjoys film criticism, true crime, and playing classical music on his violin.