Is there anything more confusing or nerve-wracking than doing your own taxes?

The endless forms and confusing paperwork are enough to rattle even the most confident mathematician. And if you’re a small business owner, there’s a chance you’re dealing with some new paperwork you’re unfamiliar with.

While it may seem confusing on the surface, these tax forms very easy to understand once you know the difference. Moreover, with the right accounting software, you can streamline your tax preparation process, reduce errors, and save money.

Do you need a W-9 for a 1099?

Yes, a W-9 collects information from independent contractors, and 1099 records how much they’ve paid that independent contractor. You need both to file your taxes.

The difference between these two forms is simple at a very high level. The internal revenue service (IRS) uses a W-9 form to gather information about independent contractors so that their earnings can be reported at the end of the year. On the other hand, a 1099 form is the paperwork used to report how much that contractor earned at the end of the year.

When to use a W-9 vs. 1099

Now you know the difference between these forms, but when is the right time to use them? When you take on work with a client as an independent contractor, you should fill out a W-9 form. This form collects your Taxpayer Identification Number (TIN) and other relevant information.

The 1099 just needs to be completed along with your other tax paperwork before the end of January. It’s important to note that there are different types of 1099 forms, and you’ll want to select the right one for your work.

Purpose of each form

The W9 and 1099 forms serve distinct purposes in tax reporting:- W9 Form: This form is used by independent contractors and freelancers to provide their taxpayer identification number (TIN) to clients who will report their payments. The W9 form helps the payer collect the necessary information to file an information return with the IRS.

- 1099 Form: Used by businesses to report payments made to non-employees, such as freelancers, independent contractors, and other service providers. The 1099 form is submitted to the IRS and the recipient, detailing the income received.

Below is a deep dive into the differences between Form W-9 and Form 1099:

| Form W-9 | Form 1099 |

| Used to collect tax information from independent contractors | Used to record how much an independent contractor was paid over a year |

| Submitted once, and then again only if the contractor’s information changes | Submitted yearly any year the contractor has been paid more than $600 by the client |

| The contractor fills it out | The client fills it out |

| Provides client with contractor’s contact info and tax number | Provides contractor and IRS with a summary of how much the client paid the contractor |

| The client sends a blank copy to the contractor, who then returns it to the client | The client sends one filled-out copy to the contractor and one to the IRS |

| To be completed before the contractor begins working for the client | It should be sent to the contractor and IRS before the end of January |

These subtle differences between a W-9 and Form 1099 are important to note. Keep a close eye on who is responsible for each form, when it needs to be filed, and what information is needed. A simple mistake on one of these forms could cost you a fortune in back taxes.

Want to learn more about Accounting Software? Explore Accounting products.

What is an independent contractor?

An independent contractor is essentially a temporary employee. They sign a separate contract with a company to work for a limited period of time, often on a specific project.

Independent contractors don’t go through the same hiring process as employees and are not paid the same way employees are paid. For this reason, the paperwork filed for independent contractors is different from that of full-time employees.

Why you need different tax forms for contract workers

The IRS isn’t just sending out different paperwork for fun. As a business owner, you’re not required to withhold or pay taxes when doing payroll for independent contractors.

You are expected to gather, track, and report their earnings because the IRS requires them to pay taxes independently. Though you’re not responsible for ensuring your contractor pays their taxes, you do have to ensure they receive accurate earnings information by Jan. 31 of the following year.

Without this information, your contract workers can’t pay their taxes, and the IRS will likely find you liable if it’s decided you didn’t file the correct forms.

How to complete a W-9

If you’re a contractor, you’ll be responsible for completing a W-9 and returning it to the business owner upon completion. If you’re a client, you’re responsible for ensuring you have a complete W-9 from contract employees before they begin work.

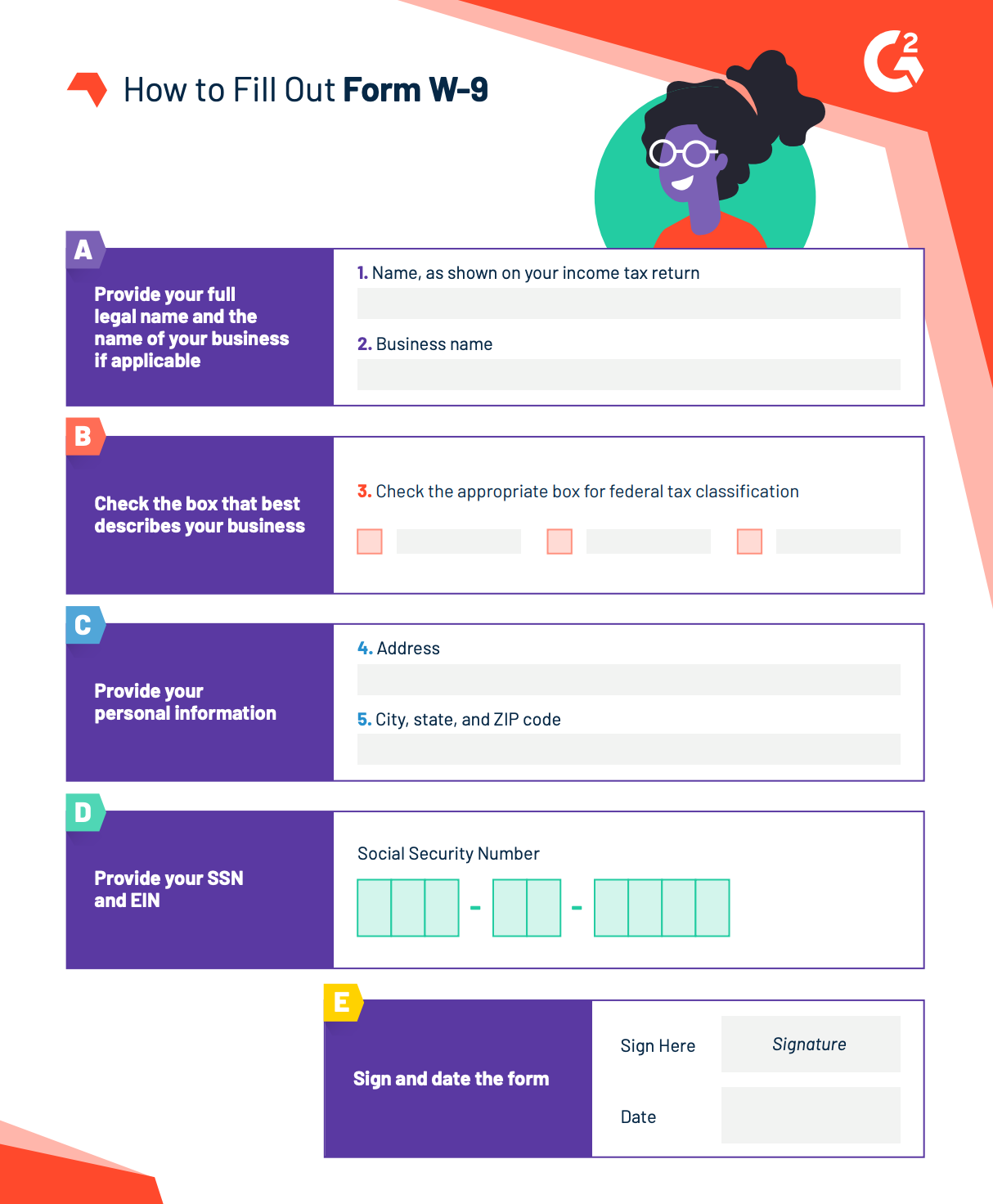

Here are five simple steps for filling out a W-9 form:

- Provide your full legal name and business name if you have one as an independent contractor. If not, you can leave the second line blank.

- Please check the box that most accurately describes your business. It will often be the “individual or sole proprietor” box, but there are exceptions.

- Provide your personal information and address.

- Complete your social security number (SSN) and employee identification number (EIN).

- Finalize with your signature.

Let's take a look at what that looks like on the form itself:

Once you’ve completed this form, you should return it to the business owner for whom you’re doing your contract work. If you own a limited liability company (LLC) or your own business as a contractor, you’ll want to pay close attention to the section of form W-9. If you're a business owner, keep a copy of the W-9 provided by your independent contractors. You will need this form to complete Form 1099.

How to complete Form 1099

As a business owner who employs independent contractors, you’ll be required to complete a 1099 for any independent contractors you have on your payroll.

Using the information you gave on form W-9, you’ll complete form 1099 and send a copy to the independent contractor and the IRS. This must be done before the end of January before taxes are due. It’s also smart to keep a copy for yourself in case an issue arises with your tax filing.

How to fill out Form 1099

To complete form 1099, you’ll need the following information: your Federal Tax ID number, which could be your SSN or EIN, and the contractor’s information, which includes their SSN or EIN. The contractor's information can be found on their completed W-9.

Here are four simple steps for filling out a 1099 form:

- Complete your personal details in the box in the top-left corner, including your full name, home address, contact number, etc.

- Fill in your tax ID number. If you're an independent contractor, use your social security number. If you're a business owner, use your business taxpayer ID number.

- As a business owner, enter the contractor's tax ID number and personal information under this box. Form W-9 provides all of this information.

- Enter the total amount you paid the independent contractor in box 7. If you're self-employed, you can enter the total amount earned from the employer in box 7 if it is not already filled out.

Here's how that might look on the form itself:

Each 1099 should include the amount paid to the contractor, entered in Box 7 under the title “Non-employee compensation.” If you withhold any earnings from the contractor, you must also fill in Box 4 or 11 about any federal or state income tax you withheld.

Finally, confirm that all the information the independent contractor provides is accurate. You’ll need to complete this process for each contractor you’ve worked with over the last year. Many enterprise companies with many contractors will employ a corporate tax software solution to automate the process.

These software solutions allow this information to be automatically generated and entered for you, saving you time and reducing any potential for human error. If you have enough contractors on your payroll, it could save you time and money.

How to file a 1099 form with the IRS

Once you’ve completed form 1099 for your contractors, it’s time to send everything to the right people. All of these forms must be completed and filed before January 31. The IRS and the independent contractor must receive a copy of Form 1099.

The process to file form 1099:

- To be sent to the IRS: Copy A

- To be sent to the state tax department: Copy 1

- To be sent to the contractor: Copy B and Copy 2

- To keep for your own records: Copy C

Finally, you must also submit a 1096 form to the IRS as a business. This form summarizes the 1099 forms you have submitted for each independent contractor. Form 1096 must also be submitted by January 31.

Common mistakes to avoid

Avoiding common mistakes when filling out W9 and 1099 forms can prevent issues with the IRS:

W9 Form mistakes

- Incorrect or missing TIN: Double-check the accuracy of your taxpayer identification number.

- Incomplete information: Ensure all required fields are filled out correctly.

- Not signing the form: Always sign and date the form to validate it.

1099 Form mistakes

- Incorrect payment amounts: Verify the total payments made during the tax year.

- Wrong recipient information: Ensure the recipient’s name, address, and TIN are accurate.

- Missing deadlines: Submit the form to the IRS and the recipient on time to avoid penalties.

FAQs about W9 and 1099 forms

What is the difference between a W9 and a 1099 form?

A W9 form collects taxpayer identification information, while a 1099 form reports non-employee payments.

Who is responsible for issuing a 1099 form?

The business making payments to an independent contractor or freelancer is responsible for issuing a 1099 form.

What happens if I don’t fill out a W9 form?

Failing to provide a W9 form can result in backup withholding of your payments at 24%.

Now let’s get inFORMation

The truth is once you complete one W-9 and 1099 combo, you’ll be a pro the next time you have to do it. These things can be tedious, but doing them correctly is important! You can always check the IRS website for more detailed information if you have doubts.

Explore the importance of Tax APIs and how they reshape how businesses handle their taxes.

This article was originally published in 2019. It has been updated with new information.

Lauren Pope

Lauren Pope is a former content marketer at G2. You can find her work featured on CNBC, Yahoo! Finance, the G2 Learning Hub, and other sites. In her free time, Lauren enjoys watching true crime shows and singing karaoke. (she/her/hers)