Avoiding risk could be your biggest risk yet.

In the world of finance, the fine line between risks and rewards is determined by how much you’re willing to put on the line.

Whether you’re new to investing or have been at it for a while, the foundation of a healthy portfolio depends on understanding your risk tolerance level. It fine-tunes your asset distribution and paves the way to diversifying your investments.

What is risk tolerance?

Risk tolerance is the degree of market risk an investor is ready to face, given the uncertainty in the value of financial investments. Whether you’re an entity or an individual investor, periodically reviewing and reassessing risk tolerance is crucial, as it’s bound to change over time.

Tools like investment portfolio management software are perfect for analyzing, tracking, and managing your portfolio while maintaining a holistic view of all financial activities. They optimize your portfolio based on your investment risk tolerance by offering performance tracking, asset allocation analysis, and risk assessment features.

Risk tolerance depends on several factors that are both personal and financial. Cognitive bias like loss aversion shows that the pain of losing is twice as powerful as the pleasure of gaining. Simply put, if you can't deal with the risk of losing, you'll have to settle for lower-risk investments that bring lower returns.

Importance of risk tolerance

Successful investing isn’t just about chasing profits. You also have to learn about effectively mitigating risk to be prepared for the volatility of the market, like facing a decline in the value of your investments.

Unfortunately, many investors panic and sell their investments when the stock market drops, resulting in selling at a loss. However, you can leverage situations like this if you recognize that market downturns offer excellent buying opportunities.

By carefully assessing your risk tolerance, you avoid impulsive and uninformed decisions. Risk tolerance encapsulates your willingness and ability to handle uncertainty and potential losses. This dual perspective is pivotal in guiding investment decisions and aligning your financial goals.

Want to learn more about Investment Portfolio Management Software? Explore Investment Portfolio Management products.

How risk tolerance works

The best time to assess your investment risk tolerance is when the market dips. When stocks are rising, having a high tolerance is much easier. But the key is staying calm when your investment value takes a hit.

Financial risk management tools are useful for conducting a detailed risk analysis of potential deals and investments. Online calculators that can gauge your level of risk are also easy to find and use.

Talking to a financial advisor who will also identify your investment style is another solution. Financial advisors use tools like investment portfolio management software to support your investment analysis and decision-making.

Best investment portfolio management software in 2023:

*These are the five leading investment portfolio management solutions as per G2’s Summer 2023 Grid® Report.

Risk tolerance also looks at an investor’s risk capacity, which represents the amount of risk you can afford to take and differs from the risk you’re willing to take.

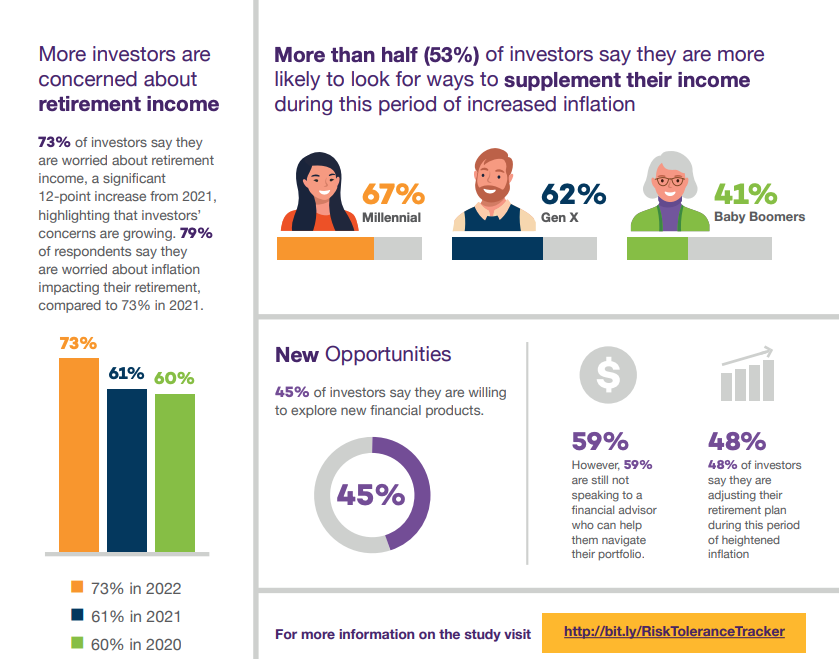

A study by F&G Annuities & Life, Inc. revealed that 78% of American investors have become more financially risk-averse due to problems like inflation and increased volatility.

Source: F&G Annuities & Life

Let’s take the example of two people, Harry and Styles. Harry is a 29-year-old with stable financial status and a long time horizon. He has high risk tolerance because he is comfortable with potential market fluctuations. As a young professional with a steady income, he chooses to endure that risk to gain higher returns.

On the other hand, Styles is 50 years old, closer to retirement, and has a limited investment time horizon. His risk tolerance is lower and is focused on preservation. He won’t take a risk for higher returns and sticks to safe and low-risk investment options.

Understanding risk tolerance helps both make informed choices and align their investment strategies with their comfort levels and goals.

Factors affecting risk tolerance

Many things need to be considered when thinking about how to measure risk tolerance.

- Financial goals play a big role in determining your priorities. Someone saving up as part of their retirement planning will have a higher risk tolerance for potentially higher gains.

- Investors' age affects risk tolerance immensely. A younger investor with a stable monthly income has more time to earn money and recover from losses, whereas someone nearing retirement age can’t endure the same risks.

- Investment time horizon refers to the time you plan to keep an investment. The longer a time horizon, the more flexibility you can recover from market downturns.

- Market conditions like economic downturns and volatility affect risk tolerance for investors. During challenging times, the market risks will be at an all-time high, whereas when stocks are up, the risk is also lower.

- Investor portfolio size also contributes to risk tolerance. A larger portfolio is more tolerant of risks because the loss percentage is much less than a small portfolio.

- Knowledge and experience of financial markets and investment principles go a long way in understanding an investor’s comfort with risk. Someone more experienced and knowledgeable will undergo risks much better than a novice.

Types of risk tolerance

Knowing your risk tolerance type ensures your investment decisions align with your long-term financial planning.

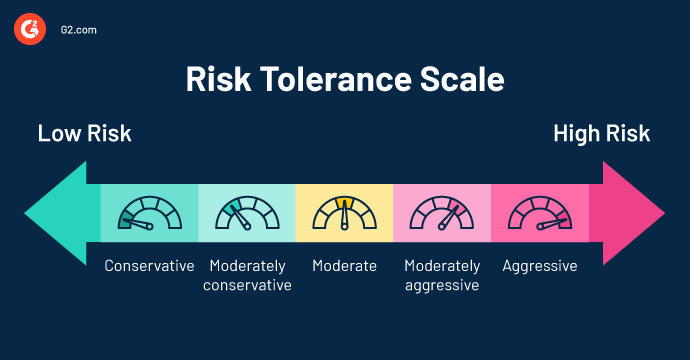

Different combinations of the factors shared above determine different types of risk tolerance. The main three types are:

1. Aggressive risk tolerance

An aggressive investor is comfortable with high levels of risk and stock market volatility in exchange for the potential of high returns. They’re focused on long-term growth and are ready to accept the significant fluctuations that might occur in the short term. Aggressive investors have a large portfolio mainly allocated to stocks and other high-risk, high-reward assets.

2. Moderate risk tolerance

Moderate investors are relatively less risk tolerant than aggressive investors. They tolerate reasonable levels of market fluctuations and strike a balance between higher returns and managing risks. They usually invest in a mix of assets like stocks and bonds that offer growth potential with some stability.

3. Conservative risk tolerance

Conservative investors take the least risk and prefer investments that prioritize capital preservation and stability. They aren’t willing to endure volatility and will prioritize preserving their principal investment amount over making no gains. These investors usually go for low-volatility assets like certificates of deposit (CDs), government bonds, and stable dividend-paying stocks.

Note: Risk tolerance levels aren’t rigid, and it’s possible to fall on a spectrum between them. You could have a moderately aggressive or moderately conservative investment risk tolerance level.

Risk appetite vs. risk tolerance

Risk appetite and risk tolerance are related concepts. They both refer to the level of risk an investor is willing or capable of taking. However, they are distinct in their focus and implications.

Risk appetite is the first thing an investor should figure out. It’s the general degree of risk an investor is comfortable with taking on the journey to reaching their financial goals. This risk level is termed “comfortable” as no action is necessary to mitigate it.

Risk tolerance is more granular than risk appetite. It refers to the specific limits of acceptable risk a company can take without letting it affect its goals. Risk appetite focuses on taking risks, but risk tolerance is about controlling the risks you take.

How to determine risk tolerance

Risk tolerance is not set in stone, and just like the highs and lows of a volatile market, it’s bound to change over time based on different financial situations.

Nonetheless, when determining your risk tolerance, you need to check your financial goals, understand risk tolerance levels, and seek professional guidance.

Ask yourself:

- What are my investment goals and objectives? Am I going to invest regularly to grow my money? Or do I want to preserve the money I have and collect the income it generates? Both of these cases will have different risk tolerance levels.

- When do I need this money? Do I save it for my retirement? Or do I use it for renovating my home next year? The element of time horizon is vital in determining your risk tolerance. The shorter the time horizon is, the lower the risk tolerance should be.

- What would happen if I lost a good percentage of my portfolio? If the stock market dips and I lose 20% of my investments, would I panic and pull the plug, or invest more money and wait for it to bounce back to bring me higher gains?

Many financial institutions help investors build a diversified portfolio using robo advisors. They have you answer a risk tolerance questionnaire that assesses your investment needs and risk tolerance. Based on the responses, you get an automated portfolio that you can track and adjust as you work toward your financial goals.

FAQs: Risk tolerance

Have more questions about risk tolerance? Find your answers below!

What are the 3 factors of risk tolerance?

The three factors that drive risk tolerance for investors are financial goals, time horizon, and approach to handling market fluctuations. Factors like personal experience, investment knowledge, and financial circumstances also play a role in determining risk tolerance.

Are there different levels of risk tolerance?

Risk tolerance has three levels: aggressive, moderate, and conservative. An aggressive investor takes the highest level of risk, whereas a conservative investor takes the least. Moderate stays between the two stages and works with gaining reasonable rewards without increased risk. Based on your financial plan and investment needs, you can fall under either of these categories or a mix of them.

How do you measure risk tolerance?

One of the more common ways of assessing risk management is through risk tolerance assessment tools provided by financial institutions or advisors. They include questionnaires that cover different hypothetical investment scenarios and evaluate your investment needs and risk tolerance according to your responses.

Why is it important to understand risk tolerance?

Understanding risk tolerance helps keep your investment choices on track with your comfort level, financial goals, and time horizon, ultimately leading to a more balanced and suitable investment strategy.

Can risk tolerance change over time?

Risk tolerance can change due to many things, including financial circumstances, personal goals, and market experiences. Therefore, it's essential to regularly reassess your risk tolerance to confirm that your investment strategy remains aligned with your current goals.

Risk it like it's hot

When dealing with the uncertainties of the stock market, risk tolerance can be the compass guiding you to your destination. Risk tolerance isn’t about risk aversion but about learning and acknowledging your limits. It encourages you to take informed chances that foster a balanced approach between seizing opportunities and weathering storms.

Learn more about risk management and creating a plan to mitigate business risks.

Washija Kazim

Washija Kazim is a Sr. Content Marketing Specialist at G2 focused on creating actionable SaaS content for IT management and infrastructure needs. With a professional degree in business administration, she specializes in subjects like business logic, impact analysis, data lifecycle management, and cryptocurrency. In her spare time, she can be found buried nose-deep in a book, lost in her favorite cinematic world, or planning her next trip to the mountains.