Revenue is the building block of all businesses.

It’s the most crucial component in a financial statement.

But what is revenue, anyway?

It’s the income from the sale of products or services. But different types of companies worldwide (private, public, small, and enterprise) may have different methods for revenue recognition. Companies typically manage revenue with revenue management software.

What is revenue recognition?

Revenue recognition is an accounting principle emphasizing that revenue should only be recorded when earned, not when payment is received. Revenue recognition isn't just for compliance. It helps companies recognize revenue consistently.

How can you determine when a business has actually “earned” its income? Through revenue recognition. Revenue is usually recognized when the performance obligations are fulfilled, and the company can easily measure the money. A performance obligation is a promise to fully deliver a product or service to a customer.

Revenue recognition is a crucial concept in accrual accounting. Unlike cash-based accounting, which recognizes revenue only when payment is made, revenue recognition records income once it’s deemed earned. Revenue recognition doesn’t apply to cash-based accounting.

How does revenue recognition work?

In the revenue recognition process, a company’s revenue is recognized when the product or service is delivered to the customer – not when the payment is made.

A company's bookkeeper or accountant records the revenue from its operations on a general ledger and reports it on an income statement. The generally accepted accounting principles (GAAP) suggest that two criteria need to be satisfied before a company can record revenue on its financial books:

- A transaction process triggered by a significant event

- The money incurred from the transaction needs to be measurable with some degree of reliability

The latter means that your buyer needs to transfer funds that exactly match the price tag of the product or service.

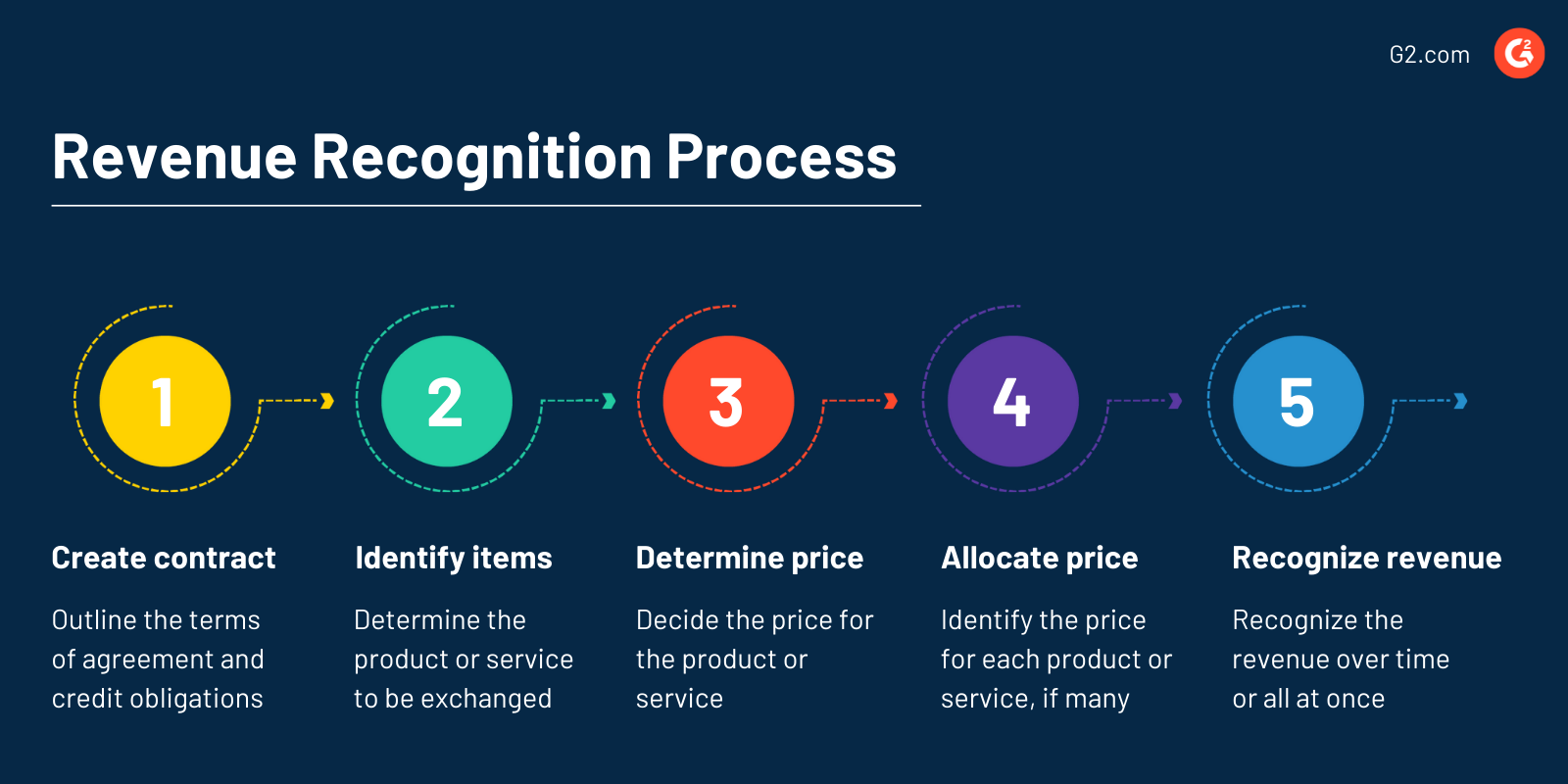

Companies generally follow a five-step process prescribed by the Accounting Standards Committee (ASC) under the ASC 606 rule to recognize revenue. The process was created by the financial accounting standards board (FASB) under GAAP.

Want to learn more about Revenue Management Software? Explore Revenue Management products.

Examples of revenue recognition

Different business models mean that revenue recognition happens in different ways. A subscription model means that a portion of the overall revenue is recognized every month, whereas a customer could pay the entire amount of money for a television, and the retail store would recognize it immediately.

Read on to learn about different examples of revenue recognition based on different business models:

Retail outlets

Consider the process of buying a mobile phone from a retailer. Once the customer pays for the mobile phone, the retailer records revenue. Here, the critical event is when the cashier scans the barcode on the product, which brings up the product details along with its cost. Revenue recognition here is complete after the customer pays for the mobile phone. If the customer returns the phone, the retailer records this transaction as a revenue reduction.

Subscription services

Take a fruit juice subscription company, for example. It charges $20 a month to send fruit juices to its subscribers. The company also charges a one-time $30 fee to assess the customer's preference for fruit juices. The $30 of revenue can be recognized immediately. The recurring fee of $20 cannot be recognized since the company delivers the fruit juices only in the middle of the month. This means that they have not technically earned this revenue yet.

Independent agencies

Independent agencies are also subject to a complex accounting situation since their pay periods vary. Suppose a company hires a marketing agency for some work. The company employs them for banners, logo creation, and creating ads. For simplicity, let’s say that each costs $5,000. The agency agrees to get paid after the delivery of each product. As soon as each product is delivered, the performance obligation is considered fulfilled.

SaaS

Software-as-a-service (SaaS) companies charge customers on a monthly, bi-monthly, or yearly basis until they stop using the product. Say a SaaS company charges $240 yearly for a solution. The company recognizes $20 every month since one customer paying the whole amount doesn’t mean that the vendor has earned the whole $240. With subscription-based business models, the vendor has to earn their revenue even if the customer pays the entire cost up-front. Put simply, the delivery of the service takes place throughout the year, and revenue recognition happens on a monthly basis. The rest of the revenue is considered to be deferred.

e-Commerce

In most cases, e-commerce businesses receive payment before delivering goods, but the revenue is not recognized until the product is delivered. The ASC 606 and IFRS 15 recommend that product shipment be the moment for recognizing revenue.

Financing

Lots of companies, such as retail stores, accept payments in part. Say you want to purchase a television for $999 but don’t want to pay the amount in full. Retail stores allow you to make payments in parts for a tenure of your choice. This is known as financing; the company recognizes the partial payment you make every month instead of the entire $999.

Pre-paid billing

Instead of a one-time cost, some companies charge customers on a metered basis, which allows customers to pay only when they use the services. For example, pre-paid billing happens when a person wants to use a streaming service for one day rather than committing to a monthly or annual contract. In this case, the customer pays a certain amount for that day only, and the company recognizes revenue accordingly.

Digital services

Online services such as books or music are downloadable assets. If a person purchases an eBook, the company recognizes revenue immediately after they download it. This applies to digital video games from an online store as well.

Why is revenue recognition important?

Revenue recognition directly determines the integrity of a company’s financial reporting. It further:

- Standardizes the company revenue policies

- Allows external entities, such as analysts and investors, to quickly compare the income statements of different companies in the same industry

- Facilitates investor relations. Revenue is a crucial factor for investors to consider while assessing a company’s performance. The financial statements should be consistent and credible to establish investor trust.

Revenue recognition principles are paramount for companies of all sizes to audit and gauge to meet compliances.

Types of revenue recognition

Revenue recognition before a sale

This applies to long-term deliverables such as building constructions, real estate, and roads. The contracts for these projects need to allow the seller to bill the customer at specific times in the project. There are two ways you can do this:

- Percentage of completion: This is a simple method to recognize revenue at specific completion portions of a project. For example, if a building is 25% complete in construction, the builder can realize a 25% profit on the contract.

- Completed contract: This method is used only when the completion percentage is not applicable. Under this method, revenue, profits, and costs get recognized only after the project is fully complete. Even if the company works on only one project for the whole year, if it’s unfinished, the business’ income statements will show that they have incurred $0 in revenues.

Revenue recognition after a sale

Revenue recognition happens differently in industries that make use of unrealized payments. There are three methods to apply in this situation:

- Installment sales: This method allows income recognition after a sale is made. Unearned revenues are deferred and recognized only when the cash is collected. For example, if a company collects 50% of a product or service’s price, it can realize 50% total profit on that product.

- Cost recovery: You can use this method when there is a probability of unrealized payments. In this method, revenue is not recognized until the amount of cash collected supersedes the seller’s product or service cost. For example, if a construction company sells a building worth $5,000 for $10,000, they can start recording profits only when a buyer pays more than $10,000.

- Deposit method: This method is used when a company receives a certain amount of cash before ownership.

Conditions and requirements for revenue recognition

Revenue recognition is simple in some instances and not-so-simple in others. It depends on the company’s industry. Some complex industries include technology, real estate, media, and healthcare. Revenue recognition in complex situations happens on a contractual basis.

Here are revenue recognition rules according to the international financial reporting standards (IFRS):

- The risk and rewards of ownership need to be transferred from the seller to the buyer.

- The seller loses control over the product or service sold.

- The collection of payment for the product or service is assured.

- You can measure the revenue.

- The costs of revenue can be measured.

The first and second conditions are known as performance conditions. These occur when the seller has done everything to expect payment for the product or service.

The third condition is known as collectability. The seller needs to have a reasonable expectation that they will be paid for the product or service.

The fourth and fifth conditions are known as measurability. The seller needs to be able to match the revenues to their expenses. Here, both the revenues and costs need to be reasonably measured.

Five-step model for revenue recognition

The FASB issued the ASC 606, also known as the five-step revenue recognition model, in 2014. It aimed to provide better clarity and standardization around the entire process by replacing different industry and transition-specific guidelines.

Here’s the five-step revenue recognition process:

1. Identify the contract with the customer

In this step, the buyer and the seller must be committed to fulfilling their obligations with a contract. The agreement's purpose is to outline both parties’ rights and payment terms regarding the product or service to be exchanged. Along with this, the customer’s credit risk is evaluated. Entities have to spot all the potential performance obligations in this step.

2. Determine the price

The exchange amount for the product or service is decided in this step. This doesn’t include components such as sales tax. This is a reasonably straightforward process since the seller receives the promised amount of money and the exchange of products or services.

Some factors can complicate this, such as:

- Variable consideration: This is the uncertainty surrounding the amount of consideration, such as discounts, refunds, credits, and incentives.

- Constraints of variable consideration: Both parties need to look at the potential of revenue reversal due to market volatility.

- Financing components: If there is more than a year between the contract signing and the actual receipt of the product or service, the contract could have a financing component.

- Non-cash factors: If the customer pays in the form of a product, good, or service, it implies a non-cash consideration.

- Components payable to the customer: These are instances where the company makes a payment to the customer, like slotting fees, advertising, buydowns, price protection, coupons, and discounts.

3. Transaction allocation to performance obligations

If contracts contain more than one performance obligation, the company has to allocate the transaction price to each separate performance obligation based on the product or service’s standalone selling price. Satisfaction of performance obligations is the final step where the revenue is recognized when performance obligations in the contract are met.

These could be:

- Transfer of control: It is considered wholly transferred when a customer completely receives the promised goods or services. The company can recognize the revenue now.

- Satisfaction of performance obligations over time: When a company transfers the control of a product or service over time, it recognizes the revenue.

4. Allocation of the transaction price to contractual performance obligations

Once the contract is ready, you can assign a price to each performance obligation. These prices need to be based on the relative standalone selling prices (SSP), which must match the prices of similar products or services. If the SSP cannot be determined, you can estimate the price.

5. Revenue recognition

Revenue recognition happens either over a period of time or all at once. If the revenue recognition happens over time, measure the progress for each performance obligation at the end of each reporting period. On the other hand, if the performance obligations are met immediately, you can recognize revenue once the product or service gets transferred to the customer.

Revenue recognition principle under GAAP

Revenue recognition principles are essential in accrual accounting, dictated by GAAP.

The core principle of revenue recognition states that:

“An entity should recognize revenue to depict the transfer of goods or services that reflects the consideration to which the entity expects to get in exchange for those goods and services.”

Simply put, it means that the GAAP-compliant companies need to recognize revenue when the product or service is fully delivered to the customer, not when the cash is received.

Revenue recognition exceptions

While it may seem straightforward, there are some instances where revenue recognition doesn’t follow the norm. Here are a few situations as examples:

According to the standard rule, the revenue from selling a product or service should be considered at the point of sale, not when the cash is received.

There are two exceptions to this:

- Buyback: A buyback implies that a company sells a product and repurchases it after a specific time. If the buyback cost is the same as the cost of selling, the product or service remains in the seller’s book, and there was no sale.

- Return: If a company cannot decide whether a product or service needs to be returned, it should recognize the revenue only when the right to return expires.

Problems with revenue recognition

Revenue is the most critical financial component. However, you cannot always compare it between different companies since reported amounts depend on when the company recognizes revenues as earned and not received.

Here are some issues involved in revenue recognition:

Projects completed over multiple years

Projects that take multiple years to complete, such as infrastructure, can have fixed or variable costs, changes to deadlines, and inaccurate cash receipts or expense payments. This makes it difficult to understand when the amount of revenue and when it should be recorded.

Projects with multiple deliverables

Take a phone, for example. Consumers buy it in one piece, sure, but it has different components that need to be delivered, like hardware, software, and support. These are primarily interdependent, so it can be challenging to measure the revenues they earn. You should correctly match revenues to the expenses, and for this to happen, the costs need to be fully known and measurable.

Incorrect identification of performance obligations

Remember, this is the second step of the revenue recognition process. This step includes two conditions to be met for a product or service to be considered distinct. The first needs to be considered for the second. The first condition is met when a product or service directly benefits the customer. The second condition states that the product or service needs to be distinct from other contractual obligations.

Put simply, the aim here is to figure out whether the company promises to deliver the product or service individually or in the form of combined items as a single performance obligation. Identifying these performance obligations correctly is essential since it’s difficult to change after identification.

Incorrect identification of contract modification

The standalone selling price (SSP) of a product or service is determined during contract creation. In some cases, when SSP cannot be determined, a company has to estimate its value. It’s important to make sure the modifications of the contract get properly accounted for. This can be done by treating the modifications as a separate contract, closing the current contract, creating a new contract, or as a part of the existing contract.

So, does it help?

Revenue recognition and its principles are not just for compliance. It helps companies recognize revenues consistently. Companies can maintain revenue recognition accuracy with standards, regulations, and exceptions. Following it allows companies to understand how they perform compared to their competitors quickly.

Learn more about how financial and accounting software can help you perform accounting activities and manage your books and money seamlessly.

Adithya Siva

Adithya Siva is a Content Marketing Specialist at G2.com. Although an engineer by education, he always wanted to explore writing as a career option and has over three years of experience writing content for SaaS companies.