It’s funny to think about all of the fancy finance terms out there that can just mean money.

Capital, revenue, gross profit, net profit, net margin. While they all signify a different function of money, it really all falls back into that category: fuel in the business gas tank.

We can’t provide our own tanks with the fuel we need to embark on the journey of owning a business. The good news is there are business funding options that will not only provide your business with financial help, but they can also offer the knowledge, experience, and extra determination your business needs to grow.

One of them is private equity.

Private equity basics

Before we get into strategies, advantages, and disadvantages, let’s go over the basics of private equity.

What is private equity?

Private equity refers to investment funds that buy and restructure private companies. The capital provided by these investors can be used to restructure the business and help out with things like technology and acquisitions.

Typically, private equity is distributed so investors gain control of a private company, restructure it as they see fit, and then sell it for a profit. These investments will either come from a private equity firm, a venture capital firm, or angel investors. No matter where it comes from, the capital is used to make the business more profitable.

Private equity strategies

Like a lot of other business funding options, there are several different ways to apply private equity. Let’s go over each one in a little more detail.

Leveraged buyout

In a leveraged buyout, a business is acquired from its current shareholders with a combination of financial leverage and their equity. Simply put, the shareholders take on some debt to be able to invest more in a certain business, giving them more control and power to restructure it before potentially selling it for a profit.

Typically, the businesses acquired in leveraged buyouts have been in business for a little while and are generating decent operating cash flow.

The purpose of a leveraged buyout is for businesses to be able to make these acquisitions without committing a lot of their current capital. Instead, they use financial leverage.

Growth capital

Growth capital is another form of private equity where investments are made in businesses that need capital to expand, restructure, enter a different market, or finance an acquisition. This type of private equity is usually invested in companies that are mature and profitable but need extra funding to make significant transformations. In other instances, growth capital is simply another source of equity capital for a business.

Mezzanine capital

Mezzanine capital is considered a hybrid of debt and equity financing. It allows for smaller businesses to borrow more than they can from a traditional bank loan, to fully fund whatever venture they need financing for. Mezzanine capital is often paid off later than other debt, so the lender has the choice to convert their investment into equity, or ownership.

If a business is funded by mezzanine capital, it is joined by equity and other types of debt (bank loans) to make up the capital structure of a business.

Venture capital

Venture capital is a type of funding where a lender provides a business with financial resources and/or knowledge in exchange for equity. Smart venture capitalists only fund emerging businesses that show potential for long-term growth and profitability.

Eventually, the venture capitalist that invested in the business will make an exit. This usually comes along when the business goes public, if a merger or acquisition takes place, or if the venture capitalist sells their shares to another investor.

|

Reading this from the investor side? Check out G2’s best capital project management software to manage costs, operations, and anything else required to create and maintain capital assets. |

Distressed or special situations

Distressed or special situations in private equity are when investments are made to help out financially stressed companies.

There is “loan-to-own” private equity, where the investor will come in, restructure the business, and come out in control of the company’s equity. The other type of distressed or special situation is called “turnaround,” where an investor will provide “rescue financing” to a business that is going through operational or financial challenges.

Secondaries

Secondaries are the buying and selling of existing private equity investments. The transfer of these interests can be a real pain, considering there is no established trading market, like the stock market.

Want to learn more about Capital Project Management Software? Explore Capital Project Management products.

Advantages and disadvantages of private equity

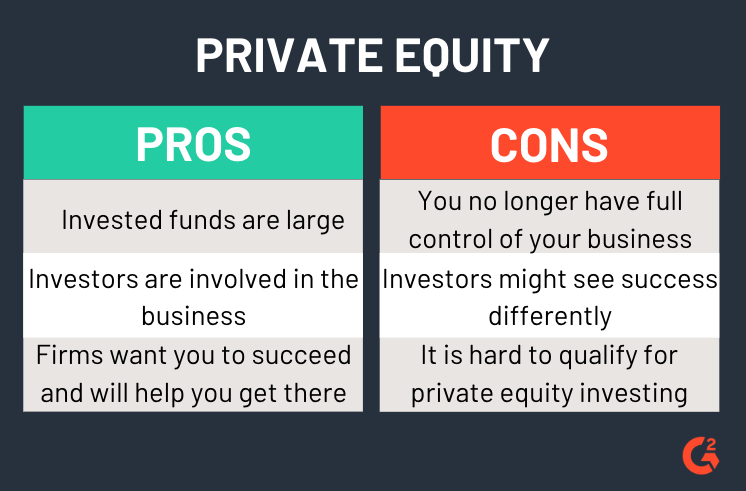

Every business funding option has its ups and downs. Let’s go over the advantages and disadvantages of private equity so you know what you are getting your business into.

Advantages of private equity

When funding your business, private equity sticks out as a good option because of the following advantages.

Concentrated funding

When we talk about private equity, we are talking large funds going into your business. Deals often hover around the $100 million range. Imagine the impact that amount of money can have on your business.

Involved investors

A lot of forms of private equity involve an investor not only funding the business but also sticking around to make sure their money is being put to good use. Private equity firms are hands-on in offering guidance.

The need to succeed

Because private equity firms are investing their money in your business, they share responsibility for the way it is used and what kind of return they will get. They need your business to succeed, so you can count on them to care and help in any way they can.

Disadvantages of private equity

It can’t all be sunshine and rainbows. While private equity as a business funding option has some convincing benefits, you will also need to consider these disadvantages.

Loss of control

This equity doesn’t come for free. When you accept funding from a private equity firm, you are giving them partial ownership of your business. Because private equity firms offer large, concentrated funds, they typically expect a good chunk of ownership, if not all of it.

This not only means you lose ownership but control as well. Private equity firms will want to be heavily involved in the managerial side of things as well, making decisions and calling shots you might not agree with.

Differing definitions of success

Private equity investors pour money into a business, make it profitable, and then get out. All they care about is the financial success of the organization.

This is not always a bad thing; the monetary status of a business is a key factor of success. However, if a business owner has other goals in terms of creating relationships and making a difference in the community, they can often get thrown to the side to make way for private equity investors’ financial interests.

Hard to qualify

Private equity firms are picky, and they have every right to be considering they are financially fueling your business. Typically, private equity firms invest in businesses that are already established or show potential for growth and a big return in a short period of time. Your business may not measure up.

It’s no secret

Private equity is a worthwhile option for businesses that need funding and are willing to give up a certain amount of ownership in exchange for it. Anything to fuel your dream of owning a business, right?

Learn more about equity in general, what it means for businesses, and the major types in 2019.

Mary Clare Novak

Mary Clare Novak is a former Content Marketing Specialist at G2 based in Burlington, Vermont, where she is explored topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)