Can you take a photo of the Mona Lisa at the Louvre and claim you own the artwork?

No, by no means! Same goes for any artwork you download from the internet. Even if you create perfect facsimiles with coding, you’ll never be able to prove their authenticity or show their digital provenance.

Wish you had digital property rights? Enter the world of non-fungible tokens (NFTs). They use blockchain smart contracts to record digital art or objects’ provable originality, ownership, and authenticity. By doing so, NFTs are changing the legacy concept of verifiable ownership of digital assets. That’s why NFTs are suddenly everywhere.

Usually, it doesn't mean much to the uninitiated when a little-known artist sells a painting at auction for almost $70 million. But everyone noticed one sale in particular because new assets don’t appear that often.

The little-known artist was Michael Joseph Winkelmann, professionally known as Beeple. He sold an artwork called Everydays: The First 5000 Days to Vignesh Sundaresan, aka MetaKovan, at Christie’s Auction House in 2021.

This event made everyone jump on the NFT bandwagon, from hotel heiress Paris Hilton to rapper Snoop Dogg to NBA superstar Stephen Curry. And now, digital creators use NFT platforms to create, launch, distribute, and sell NFTs. Buyers integrate these platforms with Bitcoin or Ethereum cryptocurrency wallets to purchase NFT assets.

What is an NFT?

A non-fungible token or NFT is a digital or crypto asset. Each NFT has a unique, non-interchangeable identification code and metadata for easy authentication and differentiation. NFTs tokenize tangible assets like collectibles, art, and real estate to ease digital asset trading and prevent fraud.

Having a hard time grasping what non-fungible means?

It's an economic concept that denotes items that aren't interchangeable. You can't interchange a laptop and a credenza since they have unique properties. However, fungible tokens or items are exchangeable. For example, you can trade one Bitcoin for another altcoin and have the same thing.

NFTs are different from cryptocurrencies because one NFT is never equal to another. This unique, non-transferable identity makes NFTs different from crypto. NFT owners or artists also embed metadata, asset attributes, or digital signatures for ease of identification and transfer between token holders.

You can make NFTs for any reproduced digital file. Recently, NFTs related to photography, motion artwork, fine art, music, or video have made the news. NFT creators have also created NFTs from memes and tweets.

NFTs are essentially digital items sold to buyers or holders who pay for files that contain proof of ownership.

What is NFT art?

NFT art is a collectible and non-transferable digital asset that is illegal to duplicate. As a result, NFT art assets are rare and limited. You can use NFTs to prove that you own the art.

What are NFT stocks?

NFT stocks refer to public companies that deal with NFTs in one way or another. These companies usually provide a digital platform for investors, dealers, and artists to create, list, track, or sell NFTs.

How does an NFT work?

To prove ownership, regardless of the item, you need a record.

As you already know, NFTs can represent tangible and intangible items such as deeds, tickets, invoices, documents, signatures, GIFs, collectibles, music, and videos. But, how do NFTs work from a technical standpoint?

NFTs use the immutability and transparency of blockchain ledgers to record ownership and locate files. In short, the blockchain ledger helps you verify an NFT’s identity, authenticity, and ownership. This ledger timestamps and records each time creators or owners make, buy, trade, or sell NFTs. These records can track NFTs back to their genesis.

You can’t just use any blueprint when it comes to creating NFTs. Most NFT developers apply established standards to save costs and streamline the creation process. Ethereum developed Ethereum token standards to make crypto tokens interoperable.

These token standards contain smart contract function sets to ensure that a newly created token is compatible with other tokens, platforms, and services. Developers use Ethereum request for comment (ERC) 721 and ERC 1155 contracts to deploy NFTs on the Ethereum blockchain.

Unlike cryptocurrencies, you can’t list, buy, or sell NFTs on any centralized or decentralized exchange. NFT traders can only use NFT marketplaces to list and trade assets.

Want to learn more about NFT Platforms? Explore NFT Platforms products.

NFT standards

NFT standards are guiding principles for building NFTs on a particular blockchain protocol. Below are the popular NFT standards.

- ERC 721 is the most popular token standard. This free, open standard allows users to set prices independent of other tokens. Many creators use ERC 721 because of this freedom. Also, no one can destroy or duplicate ERC 721 tokens.

- ERC 20 allows the creation of two tokens of the same type and value. This token standard implements an application programming interface (API) for tokens within smart contracts.

- ERC 998 is a composable token standard. You can use this standard to organize complex digital assets into an entity. Because of this flexibility, crypto enthusiasts use ERC 998 to create digital assets in a single place.

- ERC 1155 is primarily a gaming token standard that lets users register fungible and non-fungible tokens on the same smart contract.

Four token standards under the ERC 998:

- ERC998ERC721 are top-down composable tokens (store information about their child tokens) that receive, hold, and transfer ERC 721 tokens.

- ERC998ERC20 are top-down composable tokens that receive, transfer, and hold ERC 20 tokens.

- ERC998ERC721 are bottom-up composable tokens (store information about parent tokens) that attach themselves to other ERC 721 tokens.

- ERC998ERC20 are bottom-up composable and attach themselves to ERC 20 tokens.

You’ll also come across the Flow blockchain protocol and Tezos FA2 standard. Dapper Labs created the Flow blockchain protocol to help creators design digital games and collectibles. This protocol uses the proof of stake (PoS) consensus algorithm to create upgradeable smart contracts. Dapper Labs launched NBA Top Shot, a virtual trading-card platform, in partnership with the NBA in 2020.

The FA2 standard on the Tezos blockchain supports different token types, including fungible, non-fungible, and multi-asset contracts. Developers use FA2 to support complex token interactions and create their own NFTs.

Importance of NFTs

NFTs have forever changed the digital asset space.

Previously, there was no easy way to differentiate the ownership of two artwork copies – you had to hire experts to verify authenticity. Because the market needs clear property rights to identify or transfer ownership, NFTs are solving ownership and identification issues with smart contracts on tamper-resistant blockchains.

What is an NFT smart contract?

An NFT smart contract creates a sale agreement to assign ownership and manage NFT transferability. A smart contract is a self-executing program that doesn’t need an intermediary to check the fulfillment of contract terms.

Because of their existence within the blockchain, smart contracts can store NFT transaction information. NFT smart contracts also ensure immutability and transparency of information. This verifiable ownership enables NFTs to build new transaction types around products that no one could sell before.

NFTs are important because their location on public-facing digital ledgers simplifies ownership proof and prevents forgery. Owners can also transfer NFTs quickly. This ease of ownership certification and transfer makes NFTs important.

You can also equip NFTs with features to expand their purpose. There are many examples of programming blockchains for direct utility in the digital or physical world. NFTs can work like tickets, membership cards, or keys to online spaces, depending on how you use them.

For example, the Bored Ape Yacht Club uses NFT ape images to offer community memberships. The project provides quality merchandise, social events, and yacht parties.

The programmability of NFTs continues to gain traction and enable NFT-based markets to create highly engaged communities.

Why are NFTs important?

NFTs are becoming a potent force of change because of their ability to:

- Drive market efficiency. NFTs enable creators to convert physical assets into digital ones without relying on agents. This efficiency allows creators to connect with audiences directly and streamline processes.

- Safeguard identities. Organizations can use robust blockchain security solutions and decentralization to protect passwords, biometrics, and passports.

- Democratize investing. For instance, an asset can have multiple owners. Each owner would own a fraction of a physical or digital asset. Democratizing investment opportunities like this will increase assets’ worth.

- Develop new markets. NFT projects leverage users’ shared agreements to build communities and create value. Once these communities start engaging, NFTs can build new forms of ownership. As an example, NFTs can simplify real estate trading by representing each property with an NFT.

NFT history

In recent years, NFTs have gained popularity due to viral network effects. Many people today associate NFTs with Ethereum blockchain. However, the concept of NFT goes back much further in history.

Colored coins

eToro CEO Yoni Assia and Ethereum creator Vitalik Buterin introduced colored coins in a 2013 whitepaper. Their idea was to color Bitcoins and use metadata to distinguish them. Assia and Buterin split these coins into two layers.

1. Fundamental layer uses cryptographic technology to process transactions

2. Open asset layer processes colored coins without changing the Bitcoin source code

Assia and Buterin created colored coins to help people use the Bitcoin blockchain to manage non-monetary, real-world assets such as collectibles, company shares, properties, and coupons.

Colored coins are regular Bitcoins but with specific use cases. For example, you can have one each for savings, bills, and miscellaneous expenses.

The crypto world never realized the full potential of colored coins due to Bitcoin’s limitations back then.

Counterparty and Quantum

In 2014, Robert Dermody, Adam Krellenstein, and Evan Wagner founded Counterparty, a peer-to-peer financial platform. This platform leveraged decentralized exchange so users could create tradable currencies with a distributed, open-source protocol built on the Bitcoin blockchain.

Counterparty was one of the most popular Bitcoin 2.0 platforms in 2014.

The same year, digital artist Kevin McCoy teamed up with technology entrepreneur Anil Dash to develop Quantum, the world's first NFT. Quantum is a pixelated octagon with shapes pulsing hypnotically.

McCoy and Dash referred to the technology as monetized graphics. They registered Quantum on the Namecoin blockchain and sold it later for over $1.4 billion in Sotheby’s ‘Natively Digital’ auction in 2021.

Etheria, the first NFT project

The release of Etheria took place at DEVCON 1, Ethereum's first developer conference, in 2015. Etheria was the first full-fledged NFT project and put 457 purchasable hexagonal tiles up for sale. No one purchased these tiles until 2021, when NFTs gained renewed interest. All the tiles were sold for $1.4 million within a day.

Rare Pepe blockchain project

Memes made their way into cryptocurrency in 2016 when people started adding assets to the Rare Pepe meme. Rare Pepes emerged from a comic character named Pepe the Frog and quickly became an internet sensation.

Artist Matt Furie created Pepe as a comic strip character in 2005. The bulge-eyed frog was the internet’s favorite medium to express ‘feels good man’ or ‘feels bad man’. When the 4chan website reappropriated the character with swastikas and Nazi numerology, Pepe became a symbol of white supremacy.

Crypto traders started trading Rare Pepes in early 2017. Louis Parker and Portion Founder Jason Rosenstein ran the first live Rare Pepe auction at the Rare Digital Art Festival. Developer Joe Looney created the Rare Pepe wallet around this time. This cryptocurrency wallet enabled creators around the world to sell their artwork.

The Rare Pepe project initiated discussions around the value of blockchain-secured art.

CryptoPunks

Matt Hall and John Watkinson of Larva Labs started the CryptoPunks project in 2017. This generative project used proof of ownership to store 10,000 unique collectible characters on the Ethereum blockchain. These characters were punk rock-looking pixelated avatars. CryptoPunks used ERC 20 and paved the path for ERC 721 standard that powers most digital collectibles today.

At first, they launched 9000 CryptoPunks. Anyone could claim them for free, but, initially, very few people did. That changed when Mashable published an article featuring them. Today, people can buy them from sellers on the CryptoPunks marketplace.

CryptoKitties

The Vancouver-based company Axiom Zen launched blockchain-based virtual game CryptoKitties in 2017. They released the game during ETHWaterloo, the world's largest Ethereum ecosystem hackathon. Axiom Zen later spun off CryptoKitties into Dapper Labs.

CryptoKitties NFTs use the ERC 721 standard to ensure unique token validity. CryptoKitties players use Ethereum to adopt, breed, and trade virtual cats. When two CryptoKitties breed, their offspring's appearance, biography, and traits result from each parent's 256-bit genome, leading to 4-billion possible genetic variations. This unique breeding and appearance system made the project viral.

SuperRare

The success of CryptoPunks inspired John Crain to create SuperRare in 2018. SuperRare charged a 15% commission to help artists sell digital art NFTs. The platform also offered artists a 10% royalty for each subsequent sale. SuperRare as an NFT art marketplace changed the meaning of royalty sales.

Decentraland

NFT gaming started gaining popularity following the success of CryptoKitties.

Ari Meilich and Esteban Ordano were the first to break ground in NFT gaming and metaverse space. In 2020, they launched Decentraland, a decentralized, open-world virtual reality (VR) gaming platform.

Players use the Ethereum blockchain to buy virtual plots as NFTs with MANA cryptocurrency. They can also build, explore, and collect items using blockchain.

Today, the nonprofit Decentraland Foundation oversees the Decentraland operations.

Axie Infinity (AXS) is another NFT example. This blockchain-based game emerged around the same time.

NFT explosion

2021 saw a massive surge in NFT supply and demand because of increasing interest from crypto enthusiasts, celebrities, and digital artists. Different blockchains like Solana, Tezos, Flow, and Cardano created their NFTs to represent authentic digital assets.

Murat Pak, aka Pak, a digital artist, sold the NFT called Merge for $91.8 million in December 2021. Merge contained thousands of pieces from collectors and was the most expensive NFT ever.

$24.95 billion

is the market size of decentralized exchanges (DeX) that trade both NFTs and cryptocurrencies.

Source: Statista

The future of NFTs holds endless possibilities as they go mainstream.

Top NFT projects

Below are the top ten NFT projects in 2022.

- Silks

- Doodles

- Moonbirds

- Women Rise

- VeeFriends

- Flyfish Club

- Fan Controlled Football

- NFT Worlds

- Axie Infinity

- Bored Ape Yacht Club

NFT features

NFT deployments have different variations and standards. However, they share some common characteristics as described below.

- Uniqueness: No two NFTs are the same. Each NFT is individually identifiable and not interchangeable. You can differentiate two NFTs based on their metadata.

- Ownership: NFTs ensure secure asset ownership with token keys. Owners use these private keys to prove ownership and transfer NFTs to others.

- Immutability: Like any other blockchain-based token, NFTs are tamper-proof. However, a blockchain protocol compromise can affect this immutability with transaction reversal.

- Indivisibility: From a utility point of view, NFTs are indivisible. That is, you can’t buy or sell an NFT partially.

- Transparency: Buyers can verify the authenticity of NFTs because they live on decentralized and immutable public distributed ledgers.

- Interoperability: You can buy, trade, or sell NFTs on any centralized custodial service or decentralized bridge platform that uses distributed ledger technology (DLT).

- Scarcity: Rarity drives NFT values. Developers can generate more NFTs or limit them. Rarity can be artificial, historical, or numerical. Limited issuance creates an artificial rarity. A token's historical significance causes historical rarity, and its limited availability causes numerical rarity.

What is NFT rarity?

NFT rarity measures how rare and valuable an NFT is in a collection. Traders use the following NFT rarity calculation methods or rarity tools before investing in NFTs.

- Trait NFT rarity ranking compares the rarest attribute of each NFT.

- Average trait rarity considers the average of rarity traits present in an NFT.

- Statistical rarity shows an NFT’s overall rarity by multiplying all the traits.

Types of NFTs

The growing scope for innovation is driving diverse NFT use cases across sectors. Look at these popular types to understand the NFT variants available in the market.

Digital artwork NFTs

Most NFTs out there are digital works of art. Artists combine creativity and technology to create and represent programmable art on blockchain networks.

Crypto art derives its value from digital authenticity and ownership. Existing digital art formats like jpg can’t exclusively distinguish ownership and permanence. NFTs address this challenge with unique metadata.

Digital art NFTs are transforming how artists sell their work. NFTs enable digital artists to earn privileges that physical medium artists have enjoyed for years, such as creating scarcity by introducing limited editions. Today, artists use the ERC 721 token standard to mint NFTs.

Music NFTs

Musicians are also trying NFTs to avoid piracy, reach new audiences, and create a fan following. Some artists use NFT marketplaces to pre-release albums or offer shares to buyers. Once these albums release on traditional streaming platforms, buyers get a percentage of the profits.

The American rock band Kings of Leon was the first to release their album When You See Yourself as an NFT in 2021. They created three types of tokens for their NFT Yourself series: a special album package, live show perks, and exclusive audio-visual art. The band generated about $2 million with the NFT album sales.

Unlike record labels and streaming platforms, music NFTs allow musicians to keep 100% of their earnings. That’s why more musicians are trying NFT experiments. Listeners benefit from the premium experience and exclusive file ownership.

NFT tickets

Event organizers are leveraging blockchain platforms to mint and auction event tickets. Buyers take part in auctions to purchase those tickets and store them using cryptocurrency wallets.

NFT ticketing can significantly reduce forgeries. On the other side of things, attendees can store these tickets as collectibles and mementos.

Gaming NFTs

Game creators are using NFTs to create in-game items on gaming platforms. They rely on the immutability of NFTs to offer in-game item ownership and grow in-game economies.

Gamers use NFTs to buy and upgrade characters and customize accessories. Playable NFT creators earn money every time someone sells those NFTs. As a result, play-to-earn NFT games are becoming popular because they help gamers generate income.

Plus, the ease of money recovery pushes game developers and designers to create unique, playable NFTs for gamers.

What is the hot potato effect?

The hot potato effect in NFT gaming refers to when players buy assets to sell and make profits, but then suffer a massive loss because of market collapse.

Collectibles

Digital collectibles are the oldest form of NFTs. You can’t exchange or trade them for other virtual tokens. These collectibles act as one-of-a-kind trading cards.

Three types of NFT collectibles are:

1. Art collectibles are cryptocurrency-based artworks and offer proof of ownership to buyers.

2. Game collectibles are game NFTs that players can move between games or trade on secondary markets.

3. Sports collectibles include limited-edition sports videos, collectible cards, and other related items. Sports fans collect these items to engage with their favorite teams or be a part of historical moments.

What type of NFTs are selling?

Crypto enthusiasts and traders are selling the following types of NFTs:

- Profile pictures (PFP) are avatar collections. Generative art PFP projects randomly generate and combine these avatars’ attributes to create new ones.

- Metaverse lands virtually represent the real world. Users buy, develop, and sell land plots and experiences in the metaverse.

- Memes as NFTs portray an expanding futuristic ecosystem. The original Doge meme sold for $4 million in June 2021.

- Domain names refer to crypto domains users can use to link crypto wallets on a blockchain. Popular examples include Unstoppable Domains and the Ethereum Name Service (ENS). More than 500 domain extensions (the most sought-after is .eth) exist today, but major browsers don’t support them.

- NFTs for digital identity are gaining real-world traction because of NFTs’ non-fungibility and digital ledgers’ transparency. The identity management sector uses these NFTs to prove, verify, and provide identity records to individuals. Examples include self-sovereign identity and bridge protocols.

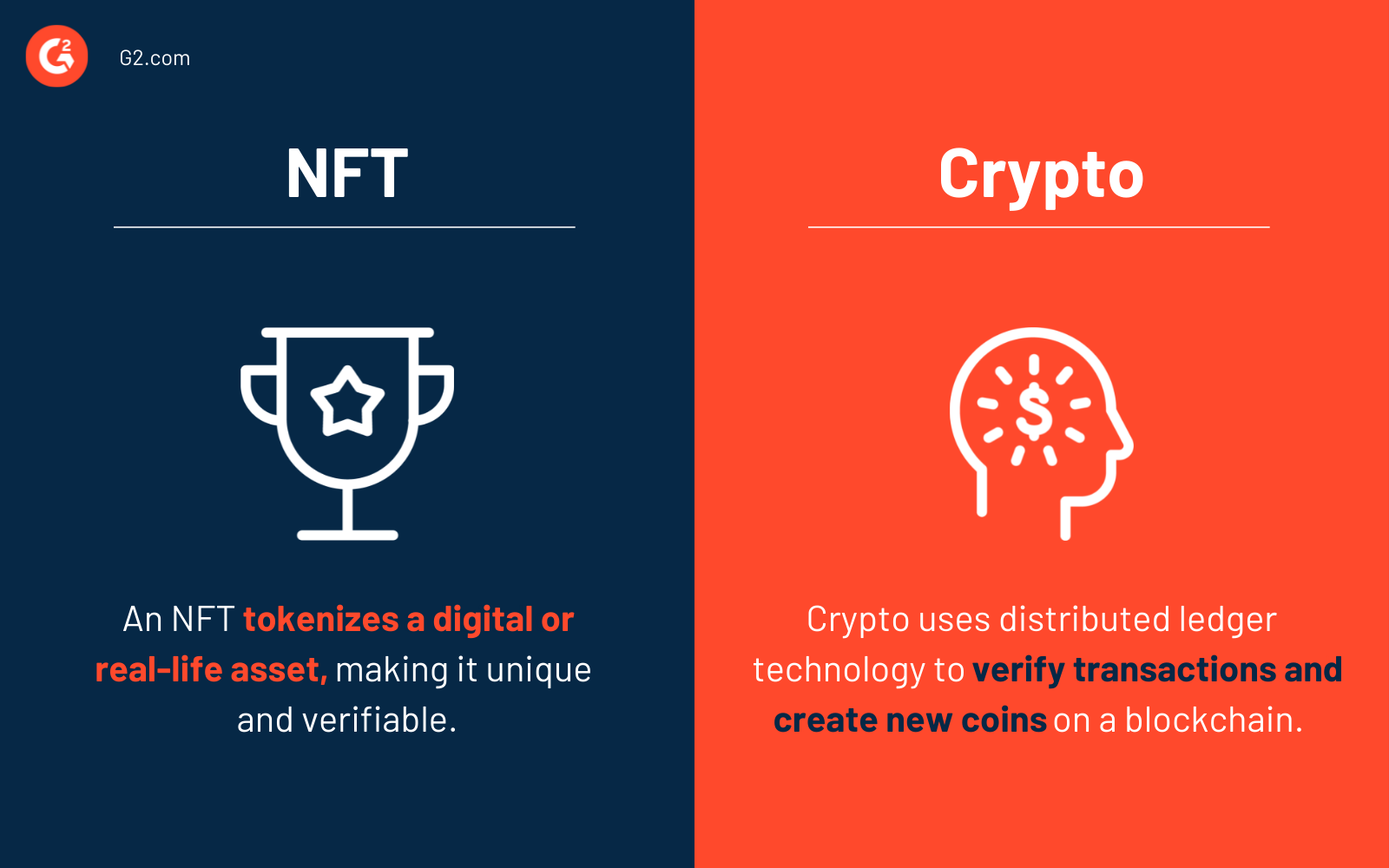

NFT vs. crypto

An NFT tokenizes a digital or real-life asset, making it unique and verifiable. The identifiable information in an NFT proves ownership. You can't forge this blockchain-based digital certificate containing transaction data and proof of ownership history. Popular NFTs derive their value from utility, rarity, and user interest.

Cryptocurrency or crypto is a digital currency that uses distributed ledger technology (DLT) to verify transactions and create new coins on a blockchain. Because they are decentralized, crypto-assets operate without any third-party interference.

| NFT | Crypto | |

| Purpose | Prevent asset ownership frauds | Facilitate trading |

| Volatility | Medium | High |

| Technology | Blockchain and cryptocurrencies | Blockchain |

| Buying | NFT marketplaces and blockchain applications | Crypto exchanges and brokers |

| Basis of value | Rarity, scarcity, uniqueness, and consumer interest | Regulation, use cases, accessibility, and blockchain |

| Use cases | Digital art, card trading, in-game collectibles, tickets, wearables, real estate, and loan collateral | Payments, investment, peer-to-peer transactions, and loan collaterals |

How to create NFTs

If the million-dollar NFT sales stories made you wonder if you can cash in on the craze, too, this section is for you. Follow the steps below to get into NFT minting.

Pick a concept

Deciding on NFT concepts is the first step in creating NFTs. While nothing's set in stone, you want your asset to be as unique as possible. That's why it's best to think about how you can offer NFT value with rarity.

Creators generally create tokens with custom paintings, memes, collectibles, music, GIFs, and tweets. Ensure you own the intellectual property rights to the asset you’re converting into an NFT.

Choose crypto wallet and NFT marketplace

Picking the most suitable crypto wallet and marketplace helps you streamline the NFT creation process.

A crypto wallet stores the NFTs and private keys you need to authorize transactions. If you haven’t used a wallet before, here’s a quick refresher on what crypto wallets do.

How do crypto wallets work?

Crypto wallets store private keys instead of crypto. These keys are essential for proving digital ownership and making transactions. Crypto wallets help you:

- Control private keys

- Manage digital assets securely

- Pay at stores accepting cryptocurrency

- Browse decentralized finance apps, aka “dapps”

- Make cryptocurrency transactions anywhere

Not sure how to choose an NFT wallet? Look for these signs to determine whether a wallet suits you:

- Multi-chain support

- Cross-device usability

- Strong security features

- Easy-to-understand user interface

- Compatibility with NFT marketplaces

An NFT marketplace is a digital marketplace that helps buyers and sellers connect for NFT transactions. Creators can store and showcase their NFTs on these platforms.

Once you have made wallet and marketplace choices, move on to making connections and building relationships.

Connect with communities

Successful NFT projects don't solely rely on sophisticated marketing tactics. They leverage NFT communities to build authentic relationships and share information. Over time, these communities become your most valuable marketing resource.

Active communities help you expand your reach and connect with interested stakeholders. For example, after launching in November 2021, the Women Rise NFT collection generated a trading volume worth 2,000 ether (ETH) by January 2022, without spending a dollar on marketing.

Most NFT blockchains have active communities that are more than willing to help newcomers and share great opportunities with them. Many private Discords open their doors for anyone who purchases one of the NFTs on their chain.

NFT creators also rely on the shilling, the act of dropping or sharing NFT links to create a community or find one that will value your NFT.

Design your artwork

To be ready to mint NFTs, you need to design your artwork first.

Creators usually use NFT creator software to design NFT arts. If you are creating an NFT for the first time, design with your audience in mind. You'll also need to invest in digital tools and technologies to translate your art.

Other things to keep in mind when designing NFTs include:

- File components: Choose audio, visual, or written elements. You can also combine some or all of them.

- File types: Most NFT platforms specify the file formats they accept. Common types include JPG, PNG, GIF, SVG, MP4, WEBM, MP3, WAV, OGG, GLB, and GLTF.

- File size: Check an NFT platform’s file size limit before creating your work.

- Accessibility: Consider accessibility factors to ensure your NFTs can reach as many as possible.

Once you create NFT art, you’re ready to mint and share NFTs.

Mint, share, and sell NFTs

Finally! The time has come for you to upload and mint artwork using the NFT marketplace of your choice. Once you mint NFTs, they are ready for sale.

Creators use decentralized smart contract platforms to access Ethereum blockchain transactions. Everyone can access these public records and see how much money you make. That's why some creators use pseudonyms and multiple wallets to protect documents.

How to buy NFTs

The NFT market experiences extreme highs and lows. And the NFT buying process isn't too straightforward, either. Follow these steps to safely navigate the unknown waters of buying NFTs.

Open crypto exchange and wallet account

Cryptocurrency exchanges allow you to accept crypto payments and trade cryptocurrency. You can use these platforms to buy and sell different types of cryptos. That’s why you need a crypto exchange platform account to buy NFTs.

You’ll also need a crypto wallet account to store public and private keys. These keys give you access to digital assets. Remember to safeguard your seed or recovery phrase to access assets in the future.

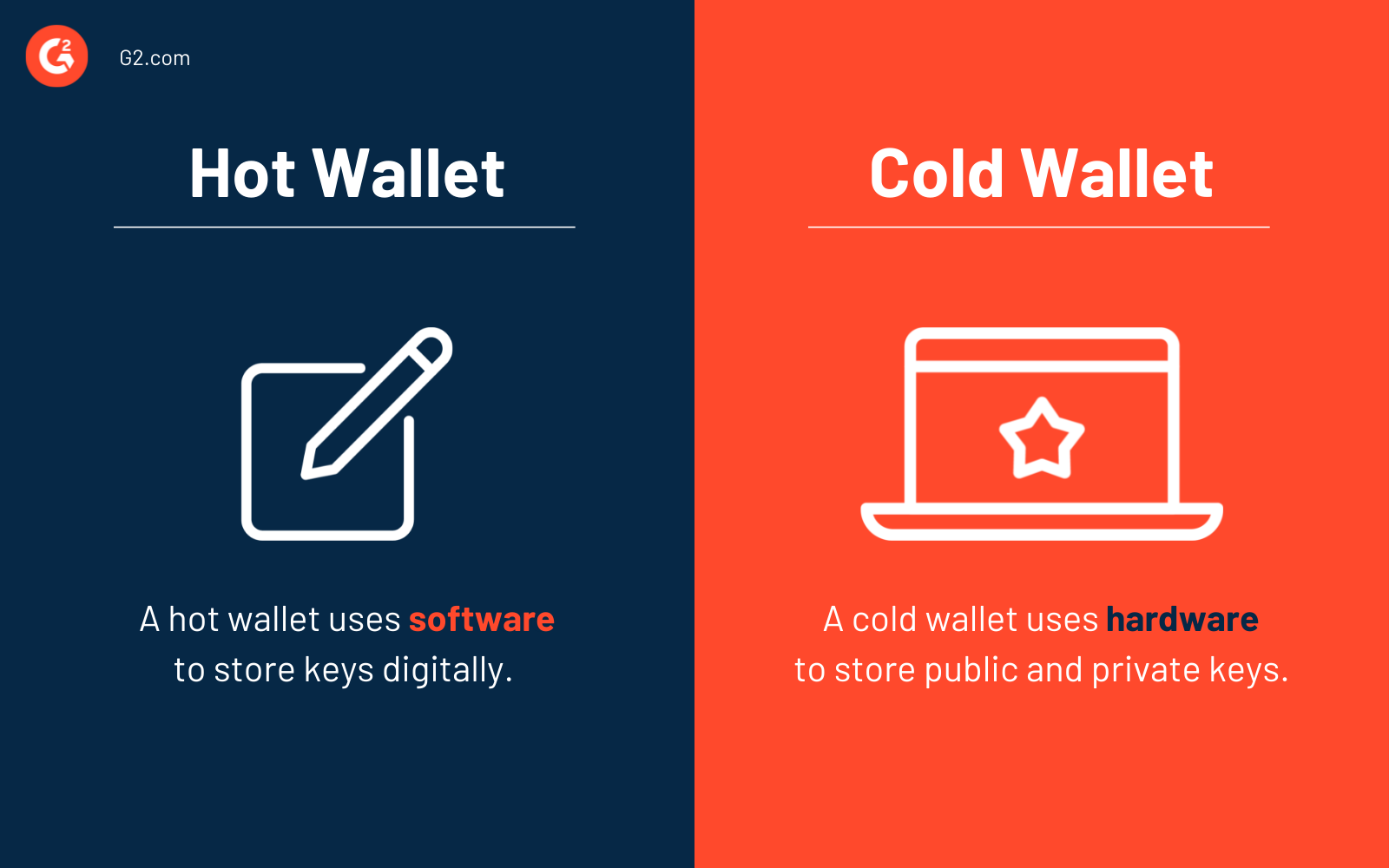

Hot wallet vs. cold wallet

A hot wallet is a web-based desktop app or browser extension that uses software to store keys digitally. Hot wallets are convenient and easy to access. However, they are also more vulnerable to cyber-attacks because of their connection to the internet.

A cold wallet is a physical device that uses hardware to store public and private keys. Cold wallets are more secure than hot wallets. However, the risk of loss is greater than hot wallets as there’s no backup in case you lose the seed phrase.

Also, choose a wallet that’s compatible with the Ethereum blockchain.

Buy Ethereum tokens

Most artists use the Ethereum blockchain to create NFTs. Plus, popular marketplaces showcase NFTs built on Ethereum. That’s why the exchange platform and wallet have to be compatible with Ethereum. NFT buyers often struggle with high gas fees (cost of performing network transactions) and slower transaction speed on the Ethereum blockchain.

However, you can also go for non-Ethereum NFTs using proof of stake blockchains like Flow, Solana, Cardano, and Tezos.

Transfer tokens to wallet

The next logical step is to transfer Ethereum tokens to your chosen wallet. If you're using a cold storage wallet, consider linking your wallet to the NFT marketplace of your choice.

Connect wallet to marketplace

Now it’s time to connect your crypto wallet to the NFT marketplace.

Types of NFT marketplaces

NFT marketplaces are digital platforms where you can buy and sell NFTs. Three types of NFT marketplaces are:

- Open marketplaces allow anyone to buy or sell NFTs. These platforms usually offer in-house NFT minting options, too.

- Closed marketplaces restrict NFT selling and trading to exclusive customers. These marketplaces also offer minting solutions.

- Proprietary marketplaces sell trademarked and copyrighted NFTs only.

Some marketplaces may require you to set up new accounts using their proprietary wallets. These platforms usually offer gas fee discounts when you do so. Remember to read the fine print whether you’re using a marketplace proprietary or third-party wallet.

NFT buyers prefer to create multiple marketplace accounts to receive NFT drop alerts and announcements.

Buy NFTs

Now you’re ready to buy NFTs. Consider acting quickly as well-known NFTs sell out fast. Not all platforms offer NFT copyrights as part of the direct agreement between you and them. That's why you have to review copyright restrictions and other regulations before buying NFTs.

You should also research security measures before setting up crypto wallets and buying NFTs. Be cautious of phishing sites and scammers trying to steal confidential information, including crypto wallet private keys.

Common NFT scams

Be aware of these common scams while buying, selling, or trading NFT marketplaces.

- Rug pull scams occur when an NFT project’s promoters stop backing the project after hyping it up on social media. They take back investors’ money, causing the NFT price to hit zero. You should review developers on social media and limit transaction funds with burner wallets to avoid these scams.

- Phishing scams steal private wallet keys or 12-word security seed phrases using phony advertisements, fake websites, and pop-ups. Scammers can hack into a wallet and steal NFT collections once they have those keys or phrases. That’s why you never enter wallet keys on suspicious websites.

- Bidding scams take place during NFT resale. During these scams, bidders change investors’ preferred currencies to low-valued currencies without informing them. Make sure you always double-check the currency before selling NFTs.

- Counterfeit NFTs refer to fake works of art. Scammers often auction counterfeit art on NFT marketplaces in hope of making quick money. Consider buying NFTs from verified sellers with blue check marks beside their usernames.

- Pump and dump schemes occur when scammers drive up NFT demand artificially. Once buyers bid more because of the increasing demand, scammers sell off the NFT profitably, leaving buyers with useless assets. Always review NFT transaction history and creator contact information before making purchases.

- Airdrop scams or NFT giveaways allure investors with prizes and try to steal their wallet credentials. Scammers pose as legitimate trading platforms and steal NFT libraries after gaining access to your account. Always verify the website link before making any transaction.

- Investor scams happen when scammers create pseudo projects that appear as viable investment opportunities to buyers. Dig deep into the creator’s background before making purchases.

- Customer support impersonation occurs when support teams with official-looking websites pose as blockchain marketplace employees trying to gain access to users' crypto wallets. Protect passwords and use secondary authentication to avoid these spear phishing scams.

How to sell NFTs

Selling NFTs is a great way to bankroll the viral NFT moment. But it’s smart to learn the ropes of NFT sales first. Follow these steps to learn how to sell NFTs.

Mint an NFT

The first step is to mint an NFT so that you have proof of ownership for your work. Creators usually mint art, music, video games, and writing as NFTs. Remember, the selling price depends on factors such as quality, creativity, and your reputation in the NFT world.

Choose a marketplace

The next step is to choose an NFT marketplace where you can list and sell your NFTs. Once you select one, remember to link your wallet, upload your digital file, and hit the ‘mint an NFT’ option. This process may look a little different across platforms, but most allow you to create NFTs with a few clicks.

Also, remember to set the royalty amount, in case you want to make money from subsequent sales.

List your NFT

Once you’re ready, click the sell button and follow the prompts shown on the platform. The marketplace usually calculates the gas fees at this point, depending on the business of the blockchain network. Marketplaces usually charge a percentage of the final sale prices as handling charges.

Manage listing

At this stage, your NFT is available for purchase on the marketplace of your choice. You can promote your NFT to relevant communities now. Be cautious of making listing changes as that may incur additional gas and platform fees.

Selling NFTs isn’t easy money, given the market volatility. Consider the overall market conditions, marketplace costs, and NFT buying patterns before you set out to monetize your talent.

Tips for trading NFTs

Keep the following tips in mind while trading NFTs.

- Verify the smart contract

- Skim and scan the artist’s social media accounts

- Be aware of fake Web3 wallets and phishing prompts

- Look for verified collection badges on marketplaces

- Reach out to the official support team when you need assistance

- Avoid collections with ridiculously low prices as they tend to be fake

- Reverse check on Google Image to find different variants of an NFT image

- Check smart contract spending limit frequently to prevent unauthorized transactions

Pros and cons of NFTs

Gamers, investors, artists, celebrities, and NFT enthusiasts are increasingly investing in NFTs. But what’s in it for them? Learn more as you explore this section on NFT pros and cons.

Pros of NFTs

NFT buyers, investors, and sellers look at the following benefits as they trade NFTs:

- Unique ownership: Traditional property ownership rules don’t apply to NFTs as they remain unique and unreplicated. Because of being made on blockchain, NFTs remain transparent and can prevent corruption.

- Value growth: NFT trading hit $17.6 billion last year, a 21,000% jump from 2020. Like any other investment, NFTs continue to attract more investors with increasing popularity and use cases. This potential value growth helps fuel NFT buying and selling.

- Secure asset licensing: Another benefit of NFT is that you can easily license digital assets in a secure and transparent manner. Each NFT token represents a one-of-a-kind asset, meaning you don’t have to worry about someone else owning a copy.

- Fewer chances of theft: Owning any asset comes with the risk of losing it. NFTs minimize the chances of theft with authenticity and chain of ownership records. Since all NFTs reside on the blockchain, they should never be subject to theft.

NFT cons

That said, NFTs aren’t free from cons. Take a look at these NFT disadvantages before trading:

- Speculative and illiquid investment: Because they’re a new asset class, NFTs are volatile. Plus, there isn’t much historical data to research about return rates. NFT prices depend on how much buyers are willing to pay for the uniqueness of the art.

- Limited income potential: NFTs don’t pay returns like bonds, real estate investments, or stocks. NFT investments pay off based on price appreciation. That’s why many consider NFT as a poor instrument for generating steady income.

- High environmental cost: Any record entry on the Ethereum blockchain consumes a significant amount of energy. That’s why there’s a growing debate on the negative effects of blockchain-based assets on the environment.

NFT use cases

If you follow Web 3.0 trends, you know how NFTs are seeing a ton of use cases in digital art, gaming, music, sports, and collectibles. But that’s not all. NFT utility is expanding to other arenas, too. Below are some use cases that the NFT world is gearing up for:

Membership exclusivity

NFTs are fueling frictionless membership experiences for many companies. Members can connect wallets to explore relevant content.

The smart contract does all the heavy lifting in terms of checking and unlocking accessible content based on the NFTs users hold. The benefit is a seamless user experience with no need to remember passwords to access the platform.

For example, Gary Vaynerchuk's VeeFriends uses NFT technology and smart contracts to offer community membership and access to the yearly multi-day event VeeCon.

You’ll also come across NFTs that provide access to entities like decentralized autonomous organizations (DAO). Holding NFTs with access to a DAO provides you exclusive rights to participate in platforms, projects, or dapps.

Clothing and wearables

NFTs are taking the fashion industry by storm. The NFT gold rush is encouraging many e-commerce fashion brands to evaluate the potential of digital collectibles.

Collezione Genesi

is the first luxury NFT collection that combined digital and physical items, helping the Italian fashion house Dolce & Gabbana generate sales worth $6 million.

Source: Statista

Apart from avatars wearing NFT clothing in video games, influencers are also using NFT wearables for photoshoots. As a result, they can stay eco-friendly by not buying new physical clothing for every shoot.

Traditional clothing brands like the GAP started leveraging NFT to create a gamified experience earlier this year. They launched a digital hoodie art series with different rarity levels and price points. Customers could buy four common and two rare NFTs to get the chance to buy an epic collection once.

Digital identity

Just like storing virtual tickets, NFTs can also create and store virtual identities. The built-in authentication of these NFT-based identities will reduce the dependence on government and other centralized institutions.

Keeping identities secure in digital and physical environments continues to be a challenge. NFTs can safeguard identities with self-sovereign identities (SSI).

SSI applications create new identity architecture by using public-key cryptography. NFTs extend NFTs’ value beyond tokens and allow creators to sign off on digital or physical assets they created.

6 common NFT use cases:

- Real estate

- Medical records verification

- Intellectual property protection

- Academic credential representation

- Supply chain tracking

- Voter fraud elimination

NFT taxes

The Internal Revenue Service (IRS) launched IRS Notice 2014-21 to help investors, buyers, and sellers understand virtual currency tax treatment. Holding virtual currency investments or using them to pay for goods and services results in tax liability.

Are NFTs taxable?

Creating NFTs doesn’t incur taxes. However, any crypto-to-crypto transaction is taxable. Below are the taxable capital gain or loss NFT activities:

- Buying NFT with cryptocurrencies

- Trading NFTs for other NFTs

- Selling NFTs for fungible cryptocurrencies

NFT taxes aren’t the same for hobbyists and professionals. Professional NFT creators’ transactions come under ordinary income and are subject to different NFT tax regulations.

Shane Brunette

CEO, CryptoTaxCalculator

As Brunette explains, NFT taxes can be complicated. Depending on your situation, you may have to pay ordinary income or capital gains tax. That’s why it’s best to consult a local tax professional to meet tax obligations.

Take a look at the following scenarios to understand whether you have to pay taxes:

Buying NFTs

Investors using cryptocurrency to buy NFTs are liable to pay capital gains taxes once that cryptocurrency’s value increases.

Selling NFTs

Investors selling NFTs directly or on cryptocurrency exchanges must pay capital gains tax on any increase in the NFT value. The tax rate depends on the amount of time you hold an asset. Short-term rates apply to those who hold assets for a year or less, and long-term rates for more than a year.

NFT selling is also taxable for NFT creators. If you create and sell NFTs for livelihood, you’ll have to pay taxes on self-employment income and profits.

NFT minting and royalty

Minting an NFT isn’t a taxable event. Creators minting NFTs are likely to pay self-employment taxes.

There’s little guidance on the tax treatment of NFT royalty income. You can mention passive income on Form Schedule E for royalties from a one-off sale.

NFT donation

Donating or auctioning NFTs don’t attract taxes when you meet the following criteria:

- The donation took place more than a year ago

- You directly donated the NFT to a 501(c)(3) organization

However, if you don’t auction an NFT for charity without transferring it to the 501(c)(3) organization first, you’ll owe capital gains taxes on the auction proceeds.

NFT and DeFi

NFTs are changing many traditional operations. Finance isn’t an exception. Many decentralized finance (DeFi) projects use NFT tokens to store value and offer proof of immutable ownership.

Traditionally, centralized finance relies on governing authorities to oversee transactions, investments, and trade contracts. Verification and approval can be extremely lengthy with this approach. Plus, the tangible expenses and chances of fraud are high, too.

DeFi offers a transparent and efficient means to solve all these problems while safeguarding security and privacy.

What is DeFi?

DeFi or decentralized finance democratizes financial transactions using infrastructure, processes, and technologies. This emerging financial technology uses smart contracts to enable people to trade, lend, or borrow money.

DeFi uses blockchain smart contracts to remove third parties from financial transactions. Many projects are leveraging the NFT foundation in DeFi.

For example, Uniswap, an automated liquidity DeFi protocol, uses non-fungibility liquidity pools to tackle impermanent loss. Thus, liquidity providers are able to reduce risk and increase exposure to desired assets.

What is NFT lending?

NFT lending is the process of offering NFT-backed loans with NFTs as collateral. Popular NFT lending platforms use on-chain smart contracts to disburse, track, and close loans.

The NFT lending sector relies on four operating models:

1. Peer-to-peer NFT lending uses the classical lending marketplace model of matching borrowers with lenders. Popular peer-to-peer NFT lending platforms include NFTfi and Arcade.

2. Peer-to-protocol NFT lending lets borrowers borrow directly from the protocol. These lending platforms rely on the crypto funds of liquidity providers. The protocol locks borrowers’ NFTs in smart contract-powered digital vaults before letting borrowers access liquidity.

3. Non-fungible debt position (NDP) is an early-stage DeFi revolution by JPEG'd. Users can leverage the JPEG’d platform to take out a loan for a portion of the NFT they deposit as collateral.

4. NFT rental is another NFT lending protocol that connects NFT tenants and renters. Lenders can determine the rental price and period before renting out NFTs to a smart contract. Once borrowers key in how long they want to own the NFT, they pay the rental cost along with the collateral amount to receive the NFT.

NFT use cases for DeFi

Wondering how else can NFTs benefit DeFi? Take a look at these NFT use cases in DeFi to learn more:

Loan collateralization

Traditionally, banks or financial institutions come up with the collateral amount for borrowers. DeFi changes this tradition by letting lenders decide the collateralization amount.

DeFi projects use NFTs to secure collateralized loans. Borrowers present tokens to lenders to reduce loan risks. Now, lenders make calculated decisions after checking NFTs ’current value, market trends, and asset type demand.

Some platforms also allow lenders to change interest rates, depending on NFT type, loan-to-value ratio, and loan duration.

Fractional ownership

Some NFTs are expensive and may not get buyers right after launch. However, the asset becomes more liquid when you fractionalize it. Everyone can buy a fraction of the asset.

For example, Fractional generates ERC 20 compliant fractions, thus making it possible for owners to buy collectibles that they couldn’t afford otherwise.

Medical and device insurance

Some DeFi projects are also transforming traditional insurance products and crypto-assets. These projects usually convert insurance policies into NFTs, making them ready for purchase, sale, or exchange.

Since NFTs don’t come with expiry dates, you don’t have to worry about renewing documents every year. These DeFi projects help you save time and make the insurance renewal process seamless.

For example, CoverCompared is the first DeFi insurance marketplace where you can buy policies with a host of cryptocurrencies. The platform significantly reduces insurance-related transactional and administrative costs for buyers and insurance providers.

Debt management

Another finance area that is using NFT and DeFi is debt management.

Debt management involves financial planning and budgeting to keep debts under control. Bigger companies need more people to manage financial analysis and operations. NFTs are helping companies solve debt issues with smart contracts.

Smart contracts help you streamline resource allocation and minimize human error. Plus, all the data stays on the blockchain, meaning you don’t have to worry about losing it. If a borrower can’t repay you, you’ll automatically receive the NFT, without legal intervention.

NFT environmental impact

The climate controversy around NFTs is sparking debates worldwide.

While NFTs themselves don’t negatively impact the environment, NFT production does. The NFT creation process is energy-intensive. Solo miners and some mining pools use a proof-of-work operation method that relies on huge amounts of electricity. This demand for electricity causes carbon dioxide emissions.

Miners use large numbers of computing devices to increase the chances of solving crypto puzzles and validate transaction blocks. When miners worldwide validate crypto transactions, they collectively consume an extensive amount of electricity.

178.59 kilowatt hours

is the electrical energy every Ethereum transaction uses –equivalent to the power consumption of an average U.S. household over 6.04 days.

Source: Digiconomist

Some blockchain platforms tackle this problem by using proof of stake algorithms. These platforms produce comparatively less electricity because of their operating methods.

Proof of work blockchain users consume more electricity to discover blocks. On the contrary, proof of stake users must adhere to the staking guidelines. Staking requires validators to secure blockchain without excessively consuming energy.

Now that you know how NFTs harm the environment, here are a couple of ways to mint NFTs without negatively impacting the Earth.

- Renewable energy: Proof of work miners can use alternative energy sources such as solar power, wind-, or hydro-generated electricity to reduce carbon emissions.

- Experimental technologies: NFT projects can potentially invest in experimental technologies such as carbon capture and storage (CCS). This process of capturing and pumping carbon dioxide emissions into the ground can help tackle climate change.

- Carbon offset credits: NFT investors can also purchase carbon offset credits to minimize the environmental impact. These credits directly don’t reduce carbon emissions; they incentivize others to minimize their total carbon emissions.

Want to buy energy-efficient NFTs? Consider purchasing NFTs from proof of stake blockchain platforms such as Solana, Algorand, Tezos, and Cardana.

Predictions on future of NFT

NFTs have become extremely popular across industries and professions. But what’s the future of NFTs? Check out these NFT future predictions to understand what’s possible.

- The NFT market slowly stabilizes

- Evey sector adopts NFT tokens for virtual transactions

- The NFT bubble bursts and causes a market downfall

- New NFT rules emerge to protect buyers and sellers

- NFT utility becomes mainstream with adoption across daily transactions

Researching NFT platforms for asset tokenization along with NFT sale and distribution? Keep reading.

Top NFT platforms

Individual creators and businesses use NFT platforms to generate, market, sell, and distribute assets. Some platforms also feature launchpad functionality to help creators raise funds before public release.

A platform must meet the following requirements for inclusion in the NFT platforms category:

- Enable NFT creation

- Offer a marketplace or launchpad platform for sales and fundraising

- Sell and distribute NFTs using integrations or native e-commerce capability

*Below are the five leading NFT platforms based on G2 data collected on June 14, 2022. Some reviews may be edited for clarity.

1. OpenSea

OpenSea, the world’s first and largest NFT marketplace, helps people collect, sell, and discover NFTs. The platform aims to create vibrant new economies using ERC 721 and ERC 1155 standards.

What users like:

“OpenSea is the world's biggest NFT Marketplace. It allows you to buy and sell a variety of NFT custom art, such as domain names, digital art, and collectibles using Ethereum wallets.

It’s easy to create my own original NFT collections and sell on the primary marketplace. Plus, the platform is easy to use and cheap for creating NFT collections. You can easily start an NFT collection without any knowledge of blockchain or coding skills.”

- OpenSea Review, Himangshu D.

What users dislike:

“OpenSea's main limitation is that it only supports a few blockchains, currently Ethereum, Polygon, Klatyn, and Solana. It’d be nice to see a lot of other blockchains supported, especially those with low gas and environmental impacts. Tezos and Immutable come to mind as nice possible additions.”

- OpenSea Review, Ben H.

2. Mintable

Mintable is an NFT platform built on top of the Ethereum blockchain. Users can create, buy, sell, trade, and distribute digital files on Mintable.

What users like:

“The best thing about this platform is that you can mint NFTs for free. There is no gas fee for creating and sending NFTs.”

- Mintable Review, Tuğçe N.

What users dislike:

“The bad thing is that anyone can use this platform to take the images from the internet and sign them as NFTs randomly. Also, the user interface could be better.”

- Mintable Review, Tuğçe N.

3. Rarible

Rarible is a community-centric NFT marketplace that enables users to discover NFT drops and track NFT portfolios. This multichain marketplace currently supports Ethereum, Flow, and Tezos.

What users like:

“Rarible is a super easy platform to mint new NFTs. You can simply connect your Metamask wallet and you are good to go.”

- Rarible Review, User in Insurance

What users dislike:

“The platform is sometimes unable to handle the load and lags as a result. Also, there is no specific reporting page like OpenSea where you can see NFT market trends.”

- Rarible Review, User in Insurance

4. Venly NFT Tools

Venly NFT Tools is a native solution that offers digital wallets for blockchain projects to store assets. Venly Market is the first peer-to-peer NFT marketplace on Polygon. It lets users trade NFTs in a compliant environment.

What users like:

“Their salesperson was very responsive. They structured an agreement appropriate for what we were doing as their standard packages didn't meet our needs. We were able to get things up and run quickly.”

- Venly NFT Tools Review, Executive Sponsor in Computer Software

What users dislike:

“As we began using the APIs more, we realized that some of the things were not ideal. First, the API was built on ERC-1155. This was causing us to create a token type first and then have another function call to Mint. This was going to use more gas than we wanted. Metadata attributes showed some things that we didn't want shown. We were a small account for them, but we didn't get much help from their support.”

- Venly NFT Tools Review, Executive Sponsor in Computer Software

5. Bitbond

Bitbond uses blockchain technology and tokenization to streamline NFT issuance, settlement, and custody. This peer-to-peer marketplace is suitable for online sellers and small businesses.

If you use Bitbond to create or transact NFTs, feel free to submit a review.

Earn Monty NFTs from G2

G2 recently launched the ‘Monty Genesis’ project to help users discover authentic and vetted Web3 product reviews. Acclaimed artist Zach Flaman created 100 unique Monty NFTs for G2.

Want to earn Monty NFTs? Do your bit in fueling Web3 innovation and receive an exclusive NFT today.

Sudipto Paul

Sudipto Paul is a Sr. Content Marketing Specialist at G2. With over five years of experience in SaaS content marketing, he creates helpful content that sparks conversations and drives actions. At G2, he writes in-depth IT infrastructure articles on topics like application server, data center management, hyperconverged infrastructure, and vector database. Sudipto received his MBA from Liverpool John Moores University. Connect with him on LinkedIn.