With the power of math and hindsight, you no longer need to sell your soul to demonic forces in order to predict the future.

Of course, unlike the visions of yore that permeate great works of Shakespeare literature, the ability to forecast the future of any enterprise, be it your profits or sales, is an imperfect science.

Despite this, it is still a vital tool for any business. Being able to make a strong educated guess as to the performance of your organization serves as the basis for any and all future planning that you could hope to undertake.

How many people should you hire to support your new product launch? When does it make sense to move to that shiny new office you’ve been eyeing? All this and more is possible with the magic of financial forecasting.

What is financial forecasting?

Financial forecasting refers to the process by which a business estimates the future financial outcomes for their organization. Much like Xerxes I foreseeing his conquest of Greece, the goal of such predictions is to present a reasonable assumption of a given business’s future performance based on a careful analysis of current financial position and other relevant data points.

What is included in a financial forecast?

- Sales and revenue forecast

- Expenses budget

- Cash flow statement

- Balance sheet

- Profit and loss statement

A financial forecast isn’t a one-and-done thing.These projections are constantly iterated upon and updated on a quarterly or yearly basis. Business leaders need to remain agile in order to account for the many vagaries of the market and adapt to any unexpected problems that might arise.

Budgeting vs. forecasting

While both are important parts of ensuring that a business has a healthy financial pulse, budgeting and forecasting are quite different in terms of how they are conducted and utilized in high-level business planning.

In contrast to financial forecasting — which is intended for long term planning and solutions — budgeting is where a business creates a one-time financial plan in advance of the upcoming fiscal year.

While a financial forecast might have numerous contributing factors such as current market conditions that serve to iteratively inform the overall fiscal strategy of the business, a budget is merely set as the benchmark by which an organization’s performance is measured throughout the course of the year.

Often, this comes down to different department managers and how successful they are in adhering to the guidelines for their respective expenses passed down from upper management. It is an unchanging number that reflects a single goal rather than being an empirical prediction.

Tip: Learn how to take control of your SaaS spend with a SaaS budget.

Want to learn more about Accounting Software? Explore Accounting products.

How to create a financial forecast

Now that we know what a financial forecast is, hopefully the imperative for your business has been made abundantly clear. Let’s turn our attention to what needs to be done to gaze through the shrouded veil of the future and view what’s in store for your business.

1. Collect past financial statements

The past and the future exist in an inter-connected tapestry of cause and effect. In order to predict what could happen with even a shred of accuracy, you need to start by looking at where your business has been. The first thing you should do when setting the groundwork for your next financial forecast.

While this is a crucial part of the process, it shouldn’t be too hard to accomplish. Your accounting or bookkeeping software should generate financial reports for you that you can use to start planning for the future.

Tip: Learn more about how to expect the unexpected with business forecasting.

2. Decide how you’ll make your projections

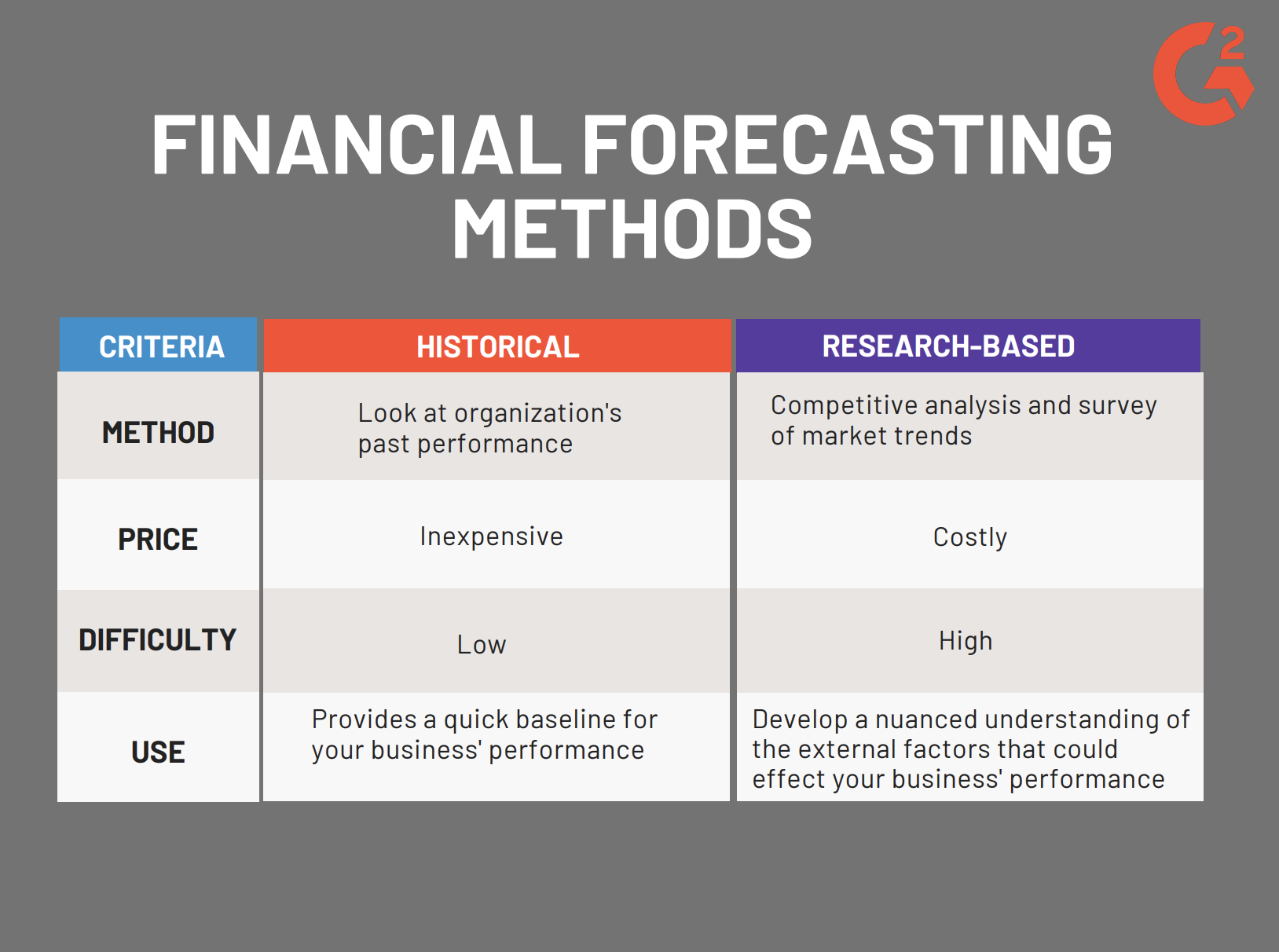

All financial forecast has two primary methods that are deployed to varying degrees in order to generate an accurate look into what the future might hold for your enterprise. Historical forecasting is where you look into the past in order to plot the future based on past performance. Researched-based forecasting, on the other hand, is where you use contemporary research into market trends in order to understand the broader effects that the state of the industry could have on your organization.

A good financial forecast will make use of both of these methods to some degree. The amount to which you do can depend on a variety of factors, such as time, budget, and availability of data and materials.

3. Prepare your pro forma statements

With all your past documents collected and having decided on what methods to use to approach your forecast, it’s time for the final piece of the puzzle: preparing a pro forma statement.

A pro forma statement is just a fancy term for a normal income statement that uses a special method — the pro forma calculation method — to draw the readers focus to specific aspects of the business when a company issues a profit announcement.

How to create a pro-forma statement

If you’ve never created a pro forma statement before, you might be a little lost as to where to start. Here’s a quick overview of what that process looks like:

1. Set your goals

The first part of creating the pro forma statement for your financial forecast is to set a projected goal for the timeframe you wish to forecast for. This can be just the next fiscal year, but you can even take it as far as several decades from now (though, of course, the farther you forecast, the less accurate you will likely be.) This goal should be informed by both your historical perspective into your own business’ performance as well as the market research you’ve conducted in preparation for your forecast.

2. Set your schedule

After deciding on a target number, your next step is to set a projection schedule for hitting that goal and how you’re going to get there. This could involve a plan to increase sales revenue, cut expenses, or something else entirely. This part is what’s entirely up to you and your instincts as a business owner.

3. Track your progress

Following this, you need to factor in the financial losses you will inevitably have on your way towards hitting your goals. This can be everything from rent for office space to salary for your employees; it’s crucial that you factor in every possible expense you might have so you get the most accurate picture of your organization’s future performance. With all this completed, your pro forma statement should show how long it will take to reach your financial aspirations and what you’ll need to spend to get there.

Best tools for financial forecasting

There are a lot of moving parts when it comes to building a truly comprehensive financial forecast.

Luckily, G2 has a monumental list of all-in-one sales analytics software to help guide your analysis for future forecasts. This software category will help you familiarize yourself with new software to help make your forecasting faster, cheaper, and more reliable while providing you with hundreds of verified, real user reviews so you have all the information you need to make the best decision possible.

Mirror mirror on the wall

Now that you know everything that goes into making a financial forecast, you should be ready and able to set realistic goals for your organization that can be the north star for operations for years to come. Ensuring you balance this goal with your companies history alongside the trends and realities of the industry in which you work will go a long way to making sure your predictions are accurate and reliable moving forward.

Want to learn more about keeping impeccable financial records for your next forecast? Check out our guide on bookkeeping for everything you need!

Piper Thomson

Piper is a former content associate at G2. Originally from Cincinnati, Ohio, they graduated from Kenyon College with a degree in Sociology. Their interests include podcasts, rock climbing, and understanding how people form systems of knowledge in the digital age. (they/them/theirs)