Digitization has influenced every industry and banking is no exception.

With the shift from paper money to electronic solutions, the digital banking landscape is here to stay. And as an industry that affects every individual closely, it's essential to understand how digital transformation in banking is changing how we deal with money.

What is digital banking?

Digital banking brings traditional banking services and products online, offering features like mobile banking, virtual assistants, and automated transactions. Accessible through web browsers or smartphone apps, it removes the need for branch visits and paperwork, making banking faster and more convenient.

The rise in consumer demand for more efficient ways to access bank records and perform financial transactions resulted in the digitization of banking solutions. Digital banking platforms enable banks to digitize their operations by transitioning from brick-and-mortar branches to hosting paperless financial products and services across multiple channels.

Digital banking is a combination of online and mobile banking practices. Online banking involves accessing bank features through your bank’s website via a computer system. Mobile banking software provides access to the same banking products and services through mobile devices like smartphones or tablets.

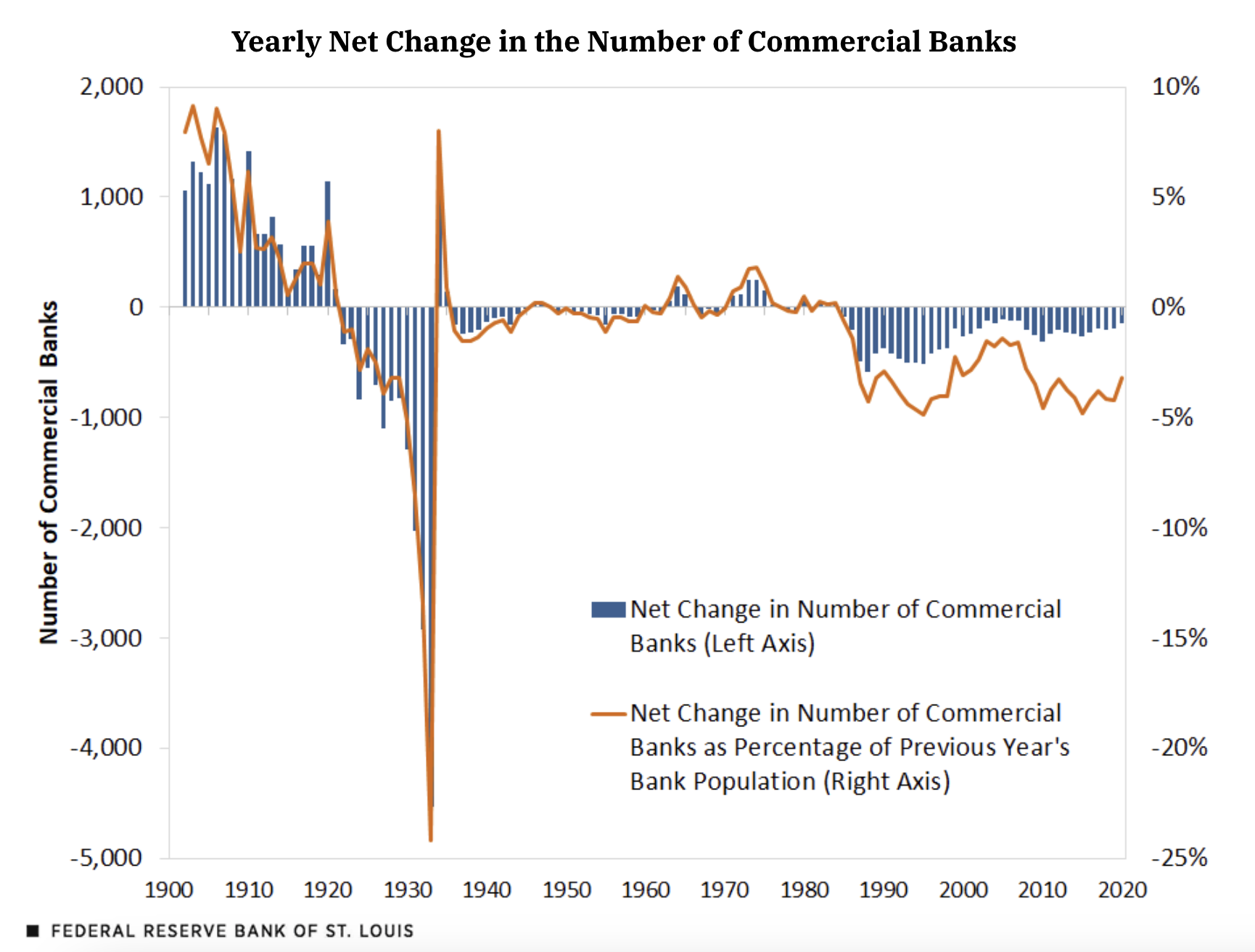

The climb of digital banking also overlaps with a drop in the presence of traditional banks. As per the data surveyed by the Federal Reserve Bank of St. Louis, there was a 70% decrease in the number of banks between 1984 and 2020.

Source: stlouisfed.org

According to Bankrate, the rate of branch closures was an average of 99 closures per month before March 2020. With the onset of the COVID-19 pandemic, the number reached 201 closures per month.

This steady decline raises the concern of more banks failing or ones that are at a greater risk of remaining profitable. But what makes businesses choose digital banking over traditional banking? And how do they judge which one’s better for their operational needs?

$2.05 trillion

is the predicted global market size of digital-only banks by the year 2030.

Source: Statista

Examples of digital banking services

You can access digital banking services through brick-and-mortar banks and online banks. Depending on your needs, you might find one more suitable than the other.

Digital banking through brick-and-mortar banks applies to everyday banking functions done through a website and a mobile app. Online banks either serve as an online division of a brick-and-mortar bank or operate independently.

Ultimately, digital banking has a lot to offer. All you need is a good internet connection and a smartphone. Check out these standard examples of digital transformation in banking.

Bill payments

You can pay all utility bills like electricity, water, and rent on an all-in-one digital platform like a mobile banking app or digital wallet. These applications also send alerts to remind customers of due dates so they never miss any payments.

Bank statements

Accessing bank statements is so convenient with digital banking. You can select a specific range of dates to view and easily download your bank statements on your device. Digital banking apps show you a quick overview of your past five or ten transactions without additional requests.

Cash withdrawals and deposits

Finding the nearest ATM to make cash withdrawals and deposits saves you from the hassle of standing in endless bank queues and filling out paperwork. The withdrawal limit might vary depending on your bank account settings and other guidelines.

Savings account

Digital banking has made opening a new bank account easy and fast, and that includes your savings account. It’s a breeze to get a reasonable interest rate, and you can conduct all savings activities through the mobile app.

Current account

Like other deposit accounts, you can also digitally open a current account. While savings accounts are more for personal uses, current account holders are mostly businesses as they indulge in multiple daily transactions. Current accounts don't charge any fees or earn interest.

Fund transfers

With digital alternatives for sending money, you can transfer funds to anyone anywhere in the world without visiting a branch and depositing a check.

Transaction alerts

Digital banks send notifications to the registered mobile phone number associated with a bank account. Instant alerts for withdrawals or deposits allow users to easily track their spending and income. It also helps draw attention to any suspicious activity.

Types of digital banking payments

It’s a sign of digital banking's ubiquitousness that you're probably already familiar with most of these digital payment methods.

- Banking cards: Debit cards, credit cards, gift cards

- PoS machines: Portable point-of-sale machines that read banking cards to authorize and complete payments

- Mobile wallets: Apple Pay, Google Pay, Samsung Pay

Want to learn more about Digital Banking Platforms? Explore Digital Banking Platforms products.

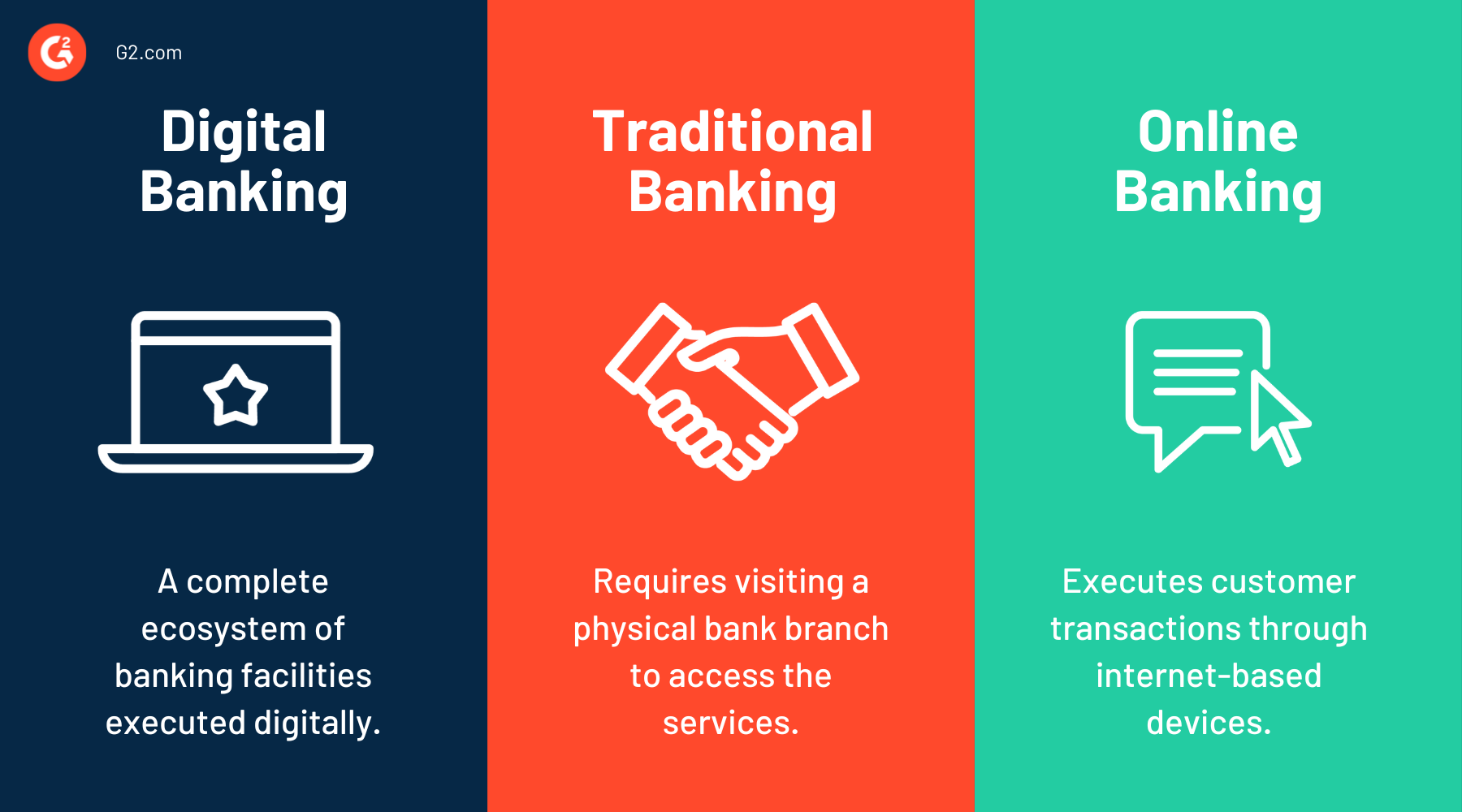

Traditional banking vs. digital banking vs. online banking

The primary difference between digital and traditional banks is how they’re built. Traditional banks operate from a physical location, and customers have to visit the local branch to receive banking services. Their branches can also be located across the country with multiple ATM services.

Digital banks, also called neobanks, operate entirely online. Their framework is built on the cloud and uses the latest technologies to provide a highly accessible platform for all banking solutions.

While traditional banks are licensed with a full suite of financial services, customers must pay premium charges to get those services. Digital banks, on the other hand, offer no-fee accounts and combine software with financial assistance to provide a complete online digital banking experience. The lower operating costs also allow digital banking to provide more benefits to customers.

Online banking falls under the ecosystem of digital banking. It involves using devices to conduct banking activities digitally. While digital banking is more personalized and focuses on customer preferences, online banking concentrates on executing daily customer transactions through the internet.

In earlier years, online banking was limited to computer systems and laptops. But with the advent of smartphone technology, online banking is more commonly used on mobile. Online banking, when done through smartphones, is what we call mobile banking.

Digital banking trends

Digital banking is becoming more popular than ever, especially with the growth of smartphones and mobile technology. Let’s take a look at some notable digital banking statistics.

- 71% of consumers prefer managing their bank accounts via a mobile app or computer.

- Nearly 45% of Millennials and Gen Z say digital banking is their only banking method.

- In a clear shift toward convenience, 85.2% of people said it would be helpful if their bills included a scannable QR code for direct payment through their bank app.

- Despite being the most digitally native generation, only 48% of Gen Z respondents use a mobile app for finance tasks daily, compared to 58% of Millennials.

- 36% percent of U.S. consumers consider managing balance or fraud alerts essential for digital or mobile banking.

Check out this article for more digital banking statistics.

History of digital banking

Digital banking can be traced back to the origin of ATMs and cards in the 1960s. But it didn't fully take off until the emergence of the internet in the 1980s when online services were offered to consumers for the first time.

In 1985, the Bank of Scotland pioneered electronic home banking services. Then in 1994, Stanford Credit Union launched the first website hosting banking services. From that point onwards, there was a rise in private customers utilizing digital services, making digital banking widely adapted across regions.

When Steve Jobs launched the first iPhone in 2007, it revved up the growth of mobile banking by facilitating access to banking services through smartphones. Cut to present times; fintech has taken the banking and finance industry by storm. While digital banking made traditional banks accessible through the internet, fintech allowed customers to send money worldwide

Between digital banking and fintech, most cash transactions can be done without visiting a bank. Ideally, the next step was to take cash online. And that is what led to the invention of cryptocurrency. Bitcoin was released in 2009 but only gained popularity recently.

Digital banks pose a threat to the existence of traditional banks as more customers go digital. The digital transformation in banking has resulted in embracing new technologies like artificial intelligence (AI), machine learning (ML), and blockchain. As these digital banking trends and technologies continue to develop, neobanks will continue to partner with third parties to provide banking as a service (BaaS).

Did you know? The term bank comes from “banchi”, an Italian word meaning benches used by merchants and money changers during the middle ages.

Benefits of digital banking

The digital banking industry is unstoppable and will only advance because it offers better and cheaper services than traditional competitors like:

- Round-the-clock access. The biggest benefit of going digital is that banks can offer their services anytime and anywhere. People can log in to their banking app or website in the middle of the night to execute online payments and other transactional needs.

- Unique banking features. Digital banking offers a variety of special features that go beyond what traditional banks offer. For instance, customers can invest in the stock market or buy cryptocurrencies directly through the mobile banking app itself.

- Innovative business solutions. The e-commerce sector is highly dependent on digital banking services. Increased competition in online shopping portals and marketplaces encourages businesses to engage with customers through innovative solutions.

- Personalized offerings. The digital transformation in banking has resulted in banks and financial institutions understanding customers' needs. Instead of making assumptions, they provide services based on their daily expenses and ease their experience.

- Added transparency. Since bank accounts are accessible with a few clicks, banks can provide extra transparency to customers on their banking activities. This includes any withdrawals, transfers, deposits, and bill payments.

Now is the time to get SaaS-y news and entertainment with our 5-minute newsletter, G2 Tea, featuring inspiring leaders, hot takes, and bold predictions. Subscribe below!

Challenges of digital transformation in banking

With the growing demand for digital banking solutions, banks might struggle to keep up with evolving customer behavior. Here we discuss this and some other standard digital banking challenges.

- Security issues: Customer data is highly sensitive for banking institutions. Hackers and scammers are constantly trying new ways to get that information. Cyberattacks expose the bank and its customers to financial fraud. Applying multi-factor authentication is one of the solutions to enhance fraud detection methods.

- Technical problems: Since digital banking is highly dependent on electronic communication, any technical error or lack of connectivity has severe consequences. Banks must amp with technology to find solutions that prepare them for such emergencies.

- Changing banking landscape and customer expectations: With digital-only banks providing efficient banking solutions, customer expectations and the industry landscape are changing rapidly. Merely having an online banking component is no longer enough for traditional banks.

“The challenge for banks isn’t becoming 'digital' – providing value perceived to be in line with the cost – or better yet, providing value that customers are comfortable paying for.”

Ron Shevlin

Director of Research at Cornerstone Advisors

Future of digital banking

The world is rapidly changing, and so is the finance industry. As they say, the future is digital.

With the demand for personalized services rising, personalized banking will become the next big thing. Using technologies like AI and ML will enable banks to analyze customer data and deliver services that meet their individual needs the best.

Digital-only banks will continue to grow. Since these banks don’t have to worry about a physical branch, they have the advantage of operating on a lower price model. Customers can continue to use these digital-only services at a cheaper rate.

Voice banking is also a trend on the horizon that is picking up its pace with voice assistants like Alexa, Siri, and Google Assistant. It allows customers to use voice commands to execute banking transactions.

The adoption of chatbots will allow banks to serve customer queries faster at any time of day or night. Chatbots mimic human interactions and add a personalized touch to 24x7 online support portals.

Open banking is another driving force of innovation in the banking industry. It's a great tool that helps lenders accurately understand a consumer's risk levels, resulting in more profitable loan options.

Banks might also pivot to cryptocurrency, but challenges like regulatory compliance and cybersecurity must be addressed before that shift happens.

Best digital banking platforms

Digital banking solutions drive the digitization of banking products and services across multiple channels. They allow customers to execute their banking needs from anywhere in the world without visiting a branch in person.

To qualify for inclusion in the digital banking software category, a product must:

- Be exclusive to bank use.

- Provide digital banking products and services through several channels.

- Support third-party integrations.

- Meet customer service and engagement expectations.

- Oversee lending and non-lending products.

* Below are the top 5 leading digital banking platforms according to G2's Fall 2024 Grid Report. Some reviews may be edited for clarity.

1. Nubank

Nubank is a digital banking platform that provides a range of financial products and services, such as credit cards, loans, savings accounts, and insurance. Its standout feature is its emphasis on simplicity and convenience, allowing users to access most services easily via a mobile app.

What users like best:

“I like the simplicity of the services, ease of opening accounts, and the processing speed of transactions and requests.”

- Nubank Review, Giovanni M.

What users dislike:

“There are several safety concerns; I have had many friends who have been scammed and lost significant amounts of money due to the lack of security features, and the support after such events were subpar at best.”

- Nubank Review, Daniel M.

2. TCS BaNCS™ Digital

TCS BaNCS™ Digital is a flexible banking solution for banks and insurance companies. It allows institutions to pick features like core banking and wealth management. BaNCS™ enhances digital services with an easy-to-use platform that works across mobile and web, supports multiple currencies, and offers personalized services. Plus, it can be deployed in the cloud for easy scaling.

What users like best:

“BaNCS Digital helps manage all banking activities and provides various customizable banking products for core banking. It is easy to install, use, and configure in any kind of organization. The customer support is also quick in providing responses.”

- TCS BaNCS™ Digital Review, Anushree V.

What users dislike:

“One needs to have proper training before working on TCS BaNCS. The cost is also on the higher side.”

- TCS BaNCS™ Digital Review, Pooja C.

3. NCR VOYIX Digital Banking

NCR VOYIX, now rebranded to Candescent, is a digital banking solution that offers simplified customer onboarding and account opening experience across a wide range of consumer and business banking products. It helps financial institutions of all sizes with customizable features and integrated fintech solutions.

What users like best:

“The platform is known for its strong integration capabilities, allowing seamless connections with a wide array of third-party services and internal banking systems. This facilitates a more holistic and efficient digital banking ecosystem.”

- NCR VOYIX Digital Banking Review, Mohamed E.

What users dislike:

“Some customers, especially older or less tech-savvy individuals, may find it challenging to adapt to digital banking platforms, limiting their access to certain services. I would also like to mention that its service downtime is quite high.”

- NCR VOYIX Digital Banking Review, Vamsi M.

4. ServiceNow Financial Services Operations

ServiceNow Financial Services Operations simplifies financial operations and boost efficiency. It offers tools like AI for case summaries, a standardized data model, automated workflows, predictive analytics, and self-service features to enhance customer experiences and support informed decisions.

What users like best:

“All the capabilities for handling the financials are easy to configure and use.”

- ServiceNow Financial Services Operations Review, Sanket M.

What users dislike:

“Needs some work on report building feature. It can be made more interactive with a better visualization.”

- ServiceNow Financial Services Operations Review, Gurpreet S.

5. FIS

FIS (Fidelity National Information Services, Inc.) is a global fintech provider delivering solutions across banking, payments, capital markets, and wealth management. The company supports banks with core banking systems and digital solutions, facilitates secure payment processing, and offers tools for trading and compliance.

What users like best:

"It provides an end-to-end view of the customer lifecycle across channels, making data-driven decisions easier. Its seamless API integration with downstream systems is great, and the platform’s scalable infrastructure worked well when we onboarded corporate clients."

- FIS Review, Saurabh S.

What users dislike:

“The user interface seems a little outdated. Not much has changed in the years that I have been using it. Additionally, the service appears to be unavailable rather frequently, though rarely for an extended period of time.”

- FIS Review, Shweta T.

Take that to the bank.

Technological innovations are the heart and blood of the banking and finance industry. Digital banks must rearrange their products around the customers. Innovative service providers will drive the industry forward and thrive with this expectation. In contrast, institutions that can’t keep up will find themselves left behind and lose their customers.

You can achieve so much with digital banking solutions, and we’re only at the tip of the iceberg. The appetite for better technology is increasing. The pace of change isn’t about to slow down, so if banks don’t make the most of it, the new players of fintech surely will.

Frequently asked questions

Want to learn more about digital banking? Check out the answers to some commonly asked questions.

Q. What is digital banking?

A. Digital banking allows bank account holders to access all products and services through electronic or online platforms. It eliminates the need to visit a physical branch by providing a round-the-clock online presence.

Q. What are the risks associated with digital banking?

A. Since everything in digital banking is processed online, there’s a high risk of data breaches and cyberattacks on sensitive customer information.

Q. What is a neobank?

A. Neobanks are digital-only banks or fintech firms that offer apps, software, and other technologies to facilitate online and mobile banking. They specialize in specific financial products and partner with traditional banks to provide federally insured accounts.

Q. Is there a difference between a digital bank and a digital-only bank?

A. Digital banks include brick-and-mortar banks that offer digital services. Digital-only banks are exclusively digital, which means they offer all banking services but don’t operate from a physical location.

Make your client onboarding processes completely digital! Use digital customer onboarding software for an end-to-end orchestration and automation of your onboarding processes.

This article was originally published in 2023. It has been updated with new information.

Washija Kazim

Washija Kazim is a Sr. Content Marketing Specialist at G2 focused on creating actionable SaaS content for IT management and infrastructure needs. With a professional degree in business administration, she specializes in subjects like business logic, impact analysis, data lifecycle management, and cryptocurrency. In her spare time, she can be found buried nose-deep in a book, lost in her favorite cinematic world, or planning her next trip to the mountains.