The products and services your company provides are your lifeblood.

They’re what gets you up in the morning to put in a full effort at work, and what drives the core of your business decisions. With all of this focus on providing quality output for your customers, you need to have an efficient and easily trackable way to manage the cash coming into and out of your business.

Cash basis accounting is one method you can use to do so.

Cash basis accounting definition

Cash basis accounting recognizes revenues and expenses at the exact time these are paid out, instead of when it is accrued or incurred.

We’ll examine some of the essential elements of cash basis accounting and how it can be beneficial to your business’s accounting needs

Cash basis accounting: benefits, drawbacks, and when it is right for your business

Cash basis accounting is not for every business. However, if you are part of a small business that conducts relatively simple cash-based transactions, it can be an easy way to keep track of money that is changing hands.

Benefits of cash basis accounting

The benefits of cash basis accounting primarily lie in its simplicity. Many small businesses choose cash basis accounting over other types because it’s easy to determine when transactions take place and there is no need to track receipts or payables.

Another benefit of cash basis accounting comes when taking stock of your company’s financials, as a glance at a bank account while using cash basis accounting shows the exact amount of money your company has. There are no future dues or expenses to take into account, nor is there any money reflected in your company’s account that is not present at the exact time of analyzing your business’s financials.

For these reasons, cash basis accounting is easier to manage than accrual basis accounting, as there is no need to track accounts receivable or accounts payable. The money your business has is in the bank.

Want to learn more about Accounting Software? Explore Accounting products.

Drawbacks of cash basis accounting

A disadvantage of cash basis accounting is that it can overstate the financial health of a company. How? If a business has a lot of cash in its possession but still has many accounts payable that it needs to pay out, it can appear that the company is in a better financial position than it actually is.

If your business has purchased items on credit or is owed money from a customer but has not received it yet, these elements of your finances will not be taken into account by cash basis accounting.

These aspects of cash basis accounting show why it may only be a good fit for smaller businesses that do not purchase or sell most products or services on credit.

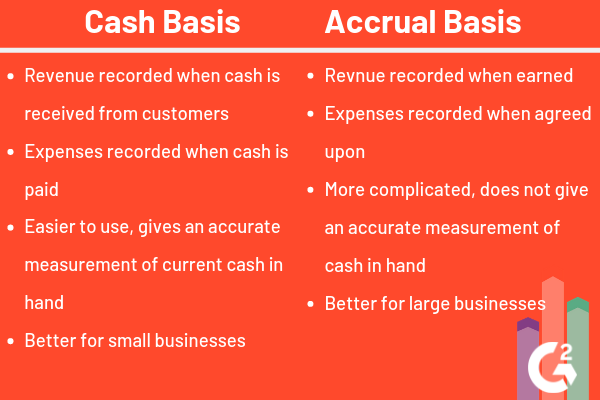

Cash basis vs. accrual

Here is one edge cash basis accounting has over accrual basis. Because accrual basis does not track cash flow, a company can look financially healthy in the long term using accrual basis while being at a major cash shortage in the short term. Essentially, cash basis accounting provides a realistic snapshot of exactly where a company is financially at a specific moment in time.

For example, let’s consider a company that sells $5,000 worth of products in October, but does not get paid until November. If this company uses cash basis accounting, it recognizes this sale in November, when it actually receives the funds that the products sold for.

If the company uses accrual basis accounting, it recognizes this sale in October, when the transaction was agreed upon. This same principle applies to expenses being paid out as well.

While accrual basis accounting is more typically used by larger companies because it provides a longer term picture of a company’s financial position, cash basis accounting has many upsides for smaller companies without a ton of their finances riding on accounts receivable or payable.

What types of businesses should use cash basis accounting?

If you are part of a small business, cash basis accounting should be your go-to option for keeping track of your finances. Cash basis accounting can benefit businesses with average gross receipts of less than $5,000,000 per year, non-publicly traded companies that do not need to disclose their financials to the IRS on a quarterly basis, or businesses where the majority of business operations are dedicated to the services you provide.

On the other side, some businesses are unable to use cash basis accounting because it would paint an inaccurate picture of their financial operations. Cash basis accounting does not allow for your company to account for future money that will be collected or paid, so if your business sells products or buys services on credit, you’ll need to use accrual accounting. You also are unable to use cash-basis accounting if part of your financial reporting includes reporting inventory at year end. Regardless of company size or preferred accounting method, accounting software can be a major asset for keeping track of a business's financial information.

Moving forward

Cash basis accounting can be a great fit for a small business looking for a simple way to keep track of its financial health. For more information on accounting for your small business, check out this guide to small business bookkeeping. Also check out our guide on how to calculate variance to make sure your books are ready moving forward.

Rob Browne

Rob is a former content associate at G2. Originally from New Jersey, he previously worked at an NYC-based business travel startup. (he/him/his)