Sorting out your financial needs is one of many building blocks to revenue growth.

Indian businesses run their accounting and financial processes in silos. Their reliance on spreadsheets and challans to send and receive payments lands them at a crossroads. While these traditional systems might work for some, it’s a wake-up spam alert for others.

Generating, distributing, and receiving payment invoices with billing software for small businesses reduces handwork and doubles operational efficiency. Specifically designed for small Indian businesses with a modest supply chain and vendor network, these tools automate bill processing, account transfers, ledger filing, and tax calculation.

Let’s learn how centralised billing software for small businesses can do away with the eternal cash registers that every startup owner in India maintains.

The best billing software for a small business at a glance

- Best for small business: Netsuite

- Best by user satisfaction: Zoho Invoice

- Best by the ease of use: PayPal Invoicing

- Best by the ease of setup: ZipBooks

- Best free billing software for small businesses: FreshBooks

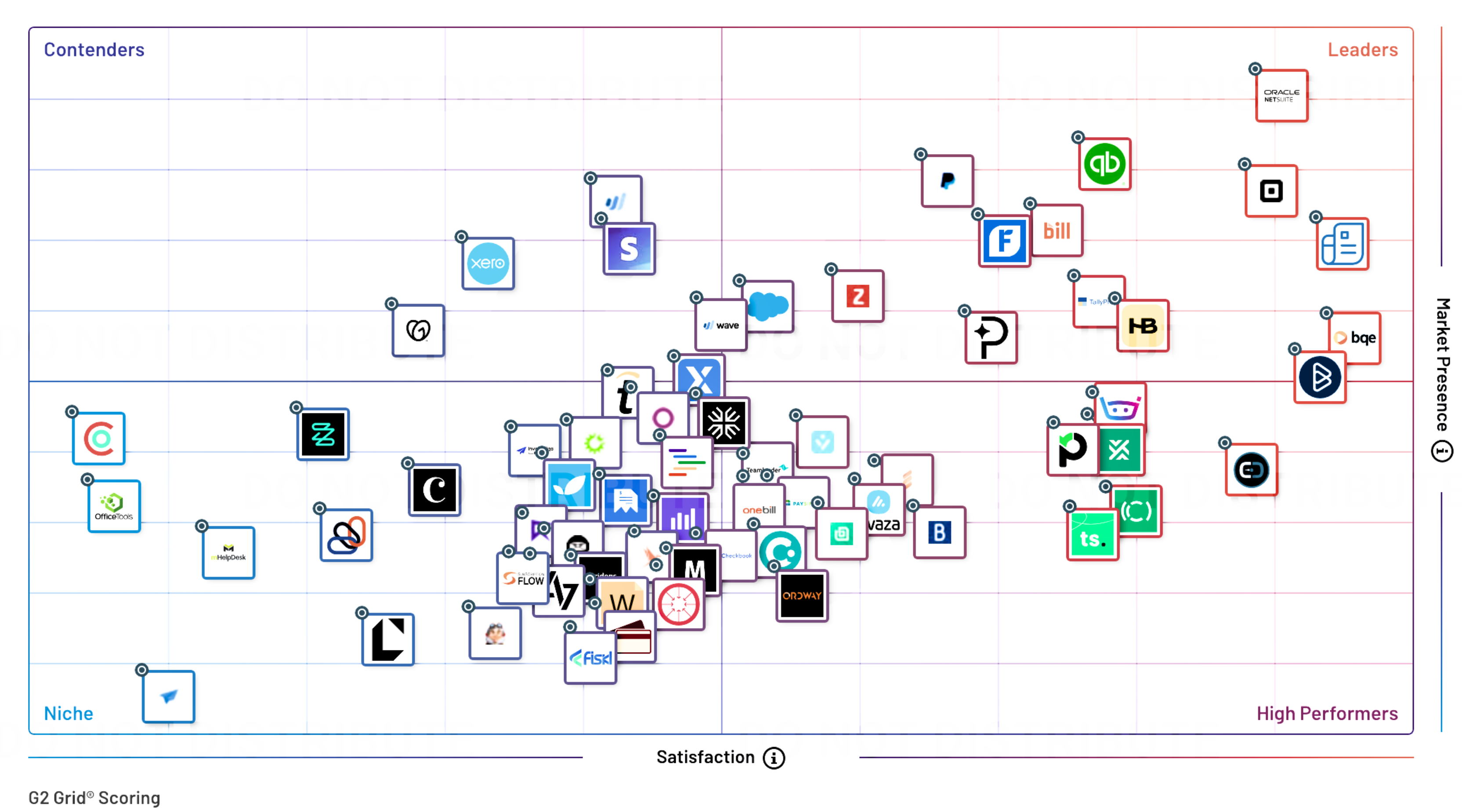

*These software solutions are ranked using an algorithm that calculates customer satisfaction and market presence based on reviews from our user community. For more information, please check out our G2 Research Scoring Methodology.

A billing software tool not only creates bills but also integrates previous client records to calculate billable and non-billable hours. It monitors your expenditures, audits payment records, and maintains transparency of the highest quality. With a billing portal, users can authenticate payment information, update records, and generate receipts in no time.

Be it an early Indian software as a service (SaaS) startup founder or an online retailer, billing software makes sending and receiving payments a breeze.

The best billing software for a small business in India

- Netsuite

- Square Invoices

- Zoho Invoice

- BILL

- PayPal Invoicing

- FreshBooks

- TallyPrime

- Zoho Books

- Stampli

- Invoices

- BlueSnap Accounts Receivable Software

* These are the leading billing software with accounting and finance capabilities that provide services to India as per G2’s Summer 2023 Small Business Grid Report.

At the outset of a production cycle, the manufacturing manager considers the total cost for shipping, batch inventory, order value, and raw material to prepare invoices. From production of goods to order fulfillment, a lot of payments need to be sorted out and updated.

Managing these invoices with a number of attributes can become daunting for financial teams. By integrating this data with a billing software platform, finance will be able to clear overhead costs and escape penalties.

Capture, verify, and create invoices in anticipation of your services without shelling out processing fees with the 16 best billing software tools for small businesses in 2023.

G2’s Summer 2023 Small Business Grid® Report

1. Netsuite

Netsuite by Oracle is a cloud financing platform that gathers all financial and accounting processes for small businesses. With one of the largest consumer bases – 36,000 across 217 continents – Oracle handles your accounts payable and receivable, manages payroll ERP, and processes balances in seconds.

Highest-rated features

Eliminate your financial go-betweens and cash accounting hassles with the best features from Netsuite.

- ERP

- Accounting

- Management

Netsuite pricing

Netsuite hasn’t revealed its pricing information to the general public. For more information, get in touch with their team via the website.

What users like best:

"NetSuite allows a lot of customization, ranging from custom dashboards to reports. We have the option to include lists, search forms, recent records, and trend graphs in our dashboards as per our needs. User permissions are supported for multiple levels. We have reports and dashboards with visibility specific to managers and above. Allows us to integrate client invoicing with the timesheets. This validation was much needed as it helps us in financial audits and reduces the need to use two separate applications."

- Netsuite Review, Abhishek A.

What users dislike:

"The interface of Netsuite needs to be upgraded, as it's complicated for new users to understand the widgets and access tools for different purposes. The users have to go through a long process to align everything."

- Netsuite Review, Yusuf Mustafa K.

Does Netsuite have a local presence in India?

Netsuite is currently operating from its only operational Oracle office in India, situated in Bengaluru.

Address: Oracle India Private Limited Prestige Technology Park, Venus Block 2C Survey #29, Sarjapur Marathahalli Ring Road, Varthur Hobli Bengaluru, Karnataka, 560103, India

Phone: +0008000402715

Email: in@oracle.com

Want to learn more about Billing Software? Explore Billing products.

2. Square Invoices

Square Invoices is an effortless financial tracking solution that lets you manage your supplier and distributor transactions from anywhere. Integrate your web portal with payment merchants, expedite vendor payments, send timesheets, and organize invoices under one roof.

Highest-rated features

Create personalized categories of payments and bolster the digital backbone of your revenue streams with a slew of best features exclusively presented by Square Invoices.

- Digital Billing

- Payments

- Recurring billing

Square Invoices Pricing

- Free trial: Not available

- Free plan: Available for 30 days (processing fees included)

- Plus Plan: ₹2402.23

* All plans are per user per month and billed annually. The price is $83 USD.

What users like best:

"I love the ease of use and accessibility of Square Invoice. It is user-friendly and makes the process of creating invoices a breeze. I love that it keeps track of when the customer views the invoice and simplifies collecting payments from customers. I especially like the estimate feature and how they are easily converted to an invoice with the click of a button."

- Square Invoices Review, Rivika B.

What users dislike:

"I do wish to find a way to learn about selling online more easily. I think that Square is exceptionally better than other sales platforms by far, and it could be that our learning style makes it difficult."

- Square invoices Review, Mackenzie W.

Does Square Invoices have a local presence in India?

Although Square Invoices doesn’t have a dedicated office in India, it has grown from coast to coast since its inception in 2009. It’s headquartered in San Francisco, California, USA.

For more details, get in touch.

3. Zoho Invoice

Zoho Invoice is a 100% cloud servicing invoicing platform that integrates your human resource management systems (HRMS), inventory bills, payroll, and client servicing in a centralized database. It is a core HR and time-tracking solution designed to meet the needs of businesses of all sizes.

Highest-rated features

Zoho Invoice is a GST-compliant software with selected features that stay competitive.

- Time tracking

- Credit and refund management

- Payment billing and recurring billing

Zoho Invoice Pricing

Zoho invoices offers all the functionalities of an advanced invoice generation tool but completely free of cost.

What users like best:

"Very, very user-oriented, powerful invoicing solution for people with no accounting background. I have been using Zoho Invoice for almost 10 years now, and they are amongst my favorite apps when it comes to invoicing and bookkeeping compared to Xero or Quickbooks.

The free version makes it even more attractive for small businesses and covers almost all aspects when it comes to running your invoicing and daily business transactions."

- Zoho Invoice Review, Antoine R.

What users dislike:

"Zoho Invoice has all the features an invoicing system requires, but there is room for improvement in integrating this tool with other CRM platforms. The taxation feature also needs to be simplified."

- Zoho Invoice Review, Sachin S.

Does Zoho Invoice have a local presence in India?

Zoho is headquartered in Chennai, India, from where it outsources its services to other countries and clients.

Address: Zoho Corporation Private Limited, Estancia IT Park, Plot No. 140 & 151, GST Road, Vallancheri, Chengalpattu District -603 202, India

Phone: +1 (888) 900-9646/ 1800-103-1123 (toll-free)

Email: sales@zohocorp.com

4. BILL

BILL is a leading fintech platform that aims to bring financial freedom to small businesses. Use it to control cash flows, work with vendors, and send transactional reminders for smooth payoffs. Hundreds of businesses all over the world use BILL.

Highest-rated features

BILL’s fully functional account automation platform ensures timely payments, uniform bill creation, and smooth workflows with the help of a bug-free platform.

- Recurring billing

- Accounting

- Financial auditing

BILL Pricing

- Free trial: Available for 30 days.

- Free plan: Unavailable.

- Corporate: ₹6551.67

- Team: ₹4561.29

- Essentials: ₹3731.96

- Enterprise: Custom pricing

* All plans are per user per month and billed annually. The converted price is $83 USD.

What users like best:

"The approval flow, real-time visibility for internal approvers, synchronization with QuickBooks Desktop, and the ease of accounts payable entry via the bill scan."

- BILL Review, Daniel H.

What users dislike:

"The only downside I've experienced is switching a client from the Desktop version of QuickBooks to online. My team's issues with the QB migration could have been mitigated with a bit more explanation, but we resolved it in the long run."

- BILL Review, Catherine G. T.

Does BILL have a local presence in India?

BILL’s corporate branch is located in San Jose, USA. To find out more, contact them at their official website.

5. PayPal Invoicing

PayPal Invoicing is a renowned payment services provider and billing merchant that offers front-end and back-end financial services to businesses. It can be used as a web or mobile payment gateway to ensure clutter-free transactions. PayPal automates recurring invoices, traces transactions, and audits financial records in a smooth manner.

Highest-rated features

PayPal offers a slew of top features to its clients for invoice management and payment processing, which is why it’s the leading name in the fintech industry.

- Templates

- Recurring billing and fraud monitoring

- Digital payments

PayPal Invoicing pricing

Paypal hasn’t released its payment information to the public. To learn more or get a custom quote, contact a sales rep.

.

What users like best:

"Easy-to-use invoice option for my coaching business. I can also attach a copy of the agreement within the invoice, split the payments, and get a tip right from the invoice."

- PayPal Invoicing Review, Tamara B.

What users dislike:

"I don't have many needs. Maybe customization might be an issue in the feature, but for now, it works well for me. As a small business, we also need support here and there, but getting a hold of PayPal's support team is a headache, so they should definitely work on that."

- PayPal Invoicing Review, Matt B.

Does PayPal have a local presence in India?

PayPal has enigmatically invested in three of its tech and operational branches in India, namely Chennai, Hyderabad, and Bengaluru. The Indian headquarters of PayPal are located in Chennai.

Address: Futura Tech Park, 334, Rajiv Gandhi Salai, Elcot Sez, Sholinganallur, Chennai, Tamil Nadu 600119

Phone: +044 6634 8000

6. FreshBooks

FreshBooks is a business accounting and report generation platform that automates credit and debit journal entries, audits old records and initiates smooth payment transactions. It’s a simple, intuitive, user-friendly billing software that you can use without any prior knowledge.

Highest-rated features

FreshBooks is like an electronic ledger where you can set custom logic to enter records, integrate data, and generate invoices through embedded features.

- Recurring billing

- Digital billing

- Payments

FreshBooks Pricing

Currently, FreshBooks hasn’t listed pricing details. To learn more, get in touch with their sales representatives.

.

What users like best:

"The fact that FreshBooks is delivered on the web is great. No additional software to put on my machine. FreshBooks is one-stop accounting software for my micro-business. It’s easy to track project expenses through their project and tracking feature."

- FreshBooks Review, Gregory V.

What users dislike:

"Even with the simplicity and ease of use, it definitely is limited in its ability to paint a picture fully. If you are more financially inclined or have a larger business, this doesn't give you a deep dive into how the company is performing."

- FreshBooks Review, Christian M.

Does FreshBooks have a local presence in India?

FreshBooks was established in Toronto, Canada, and provides remote global workforce services. For further information, call their international toll-free number.

International toll-free number: 1-888-674-3175

7. TallyPrime

TallyPrime is an advanced invoice-building platform that offers plenty of features. With its help, you can integrate financial approvals, forecast budgets, and revenue allocations, and seek vendor updates from a centralized platform.

Highest-rated features

Generating company-wide invoices requires exhaustive back-end management and coding flexibility to run feature-based dashboards.

- Consolidation

- Batch Invoicing

- Digital billing

TallyPrime pricing

Free trial: Available for 30 days

Free plan: Unavailable

Silver Rental: ₹600 (+18% GST which is ₹108)

Silver: ₹18,000 (+18% GST which is ₹3240)

Gold Rental: ₹I,800 (+`18% GST which is ₹324)

Gold: ₹54,000 (+18% GST which is ₹9,720)

* All plans are per user per month and billed annually. The price is $83 USD.

What users like best:

"TallyPrime can automate many accounting tasks, including ledger creation, invoicing, and bank reconciliation. It provides support for GST, TDS, and TCS, making it easy for businesses to comply with tax law. TallyPrime also provides powerful tools for generating financial reports and analyzing business performance."

- TallyPrime Review, Aman Y.

What users dislike:

"The window of Highlighting Feature is not like when it was available in Tally ERP 9. Also, some features don’t display until we step into the window."

- TallyPrime Review, Mahesh Babu S.

Does TallyPrime have a local office in India?

TallyPrime’s head office is in Bengaluru, India.

Address: AMR Tech Park II, No 23 and 24, Hongasandra, Hosur Main Road, Bengaluru 560 068 India.

Phone: +91 80 66282559

Email: support@tallysolutions.com

8. Zoho Books

Zoho Books provides a clean and zen-like interface for storing your invoice, budget, expense, payroll, and tax data. It also provides cloud accounting services so that your servers don’t get backed up.

Highest-rated features

Zoho is a leading name in India because it’s jam-packed with features others charge a fortune for. Let’s look at some of them.

- Performance and reliability

- Income and expenses

- File exports

Zoho Books pricing

Free plan: Available

Free trial: Available for 14 days

Zoho standard: ₹749 per month

Zoho professional: ₹1499 per month

Zoho premium: ₹2999 per month

Zoho Elite: ₹4999 per month

Zoho Ultimate: ₹7999

* All plans are per user per month and billed annually. The converted price is $83 USD.

What users like best:

"Zoho is an excellent tool for simple and easy accounting. Even a non-accounting person can make an entry for transactions."

- Zoho Books Review, Ishwarya R.

What users dislike:

"When it is connected to other products, such as Zoho Inventory, all the settings have to align. For example, one product is linked, and we made a sale, but the inventory settings were not right, so the revenue wasn’t being recorded properly."

- Zoho Books Review, C. Mohammed Sannan S.

Does Zoho Books have a local presence in India?

Zoho is primarily headquartered in Chennai, India, with a digital presence in over 20+ countries.

Address: Estancia IT Park, Plot no. 140, 151, GST Road, Vallancheri, Chengalpattu District, Tamil Nadu 603 202 India.

Email: sales@zohocorp.com

Phone: 1800-572-6671

9. Stampli

Stampli is an electronic optical character recognition and bill generation software that helps edit, modify, and share non-editable bills and paper bills. Everything gets stored in an electronic library. It is mostly used for accounts payable (AP) automation, ledger filing, tax filing, and income sheet generation.

Highest-rated features

Stampli doubles your productivity quotient by automating manual paper-based entries and running database automation with smart recognition. A few key features are:

- Post-audits

- Scoring and analysis

- AP automation

Stampli Pricing

Stampli doesn't list its pricing information online. Also, it charges on a month-to-month basis, not an annual contract. To learn more, get in touch with the Stampli team.

What users like best:

"Stampli allows people to collaborate and separate tasks easily. Rather than having to enter every invoice manually, everything can live in one place. It helps save the company time and keep it organized when working with remote employees."

- Stampli Review, Amy D.

What users dislike:

"If using an older ERP system, Stampli can be a little clunky with the integration on the front-end."

- Stampli Review, Chris H.

Does Stampli have a local presence in India?

Currently, Stampli doesn’t have a branch in India. The main company HQ is located in Mountain View, California, USA.

10. Invoiced

Invoiced sets up autopilot for subscription renewals, upsells, cross-sells, and cross-border transactions. This cloud platform brings buyers and sellers on the same page by offering smooth invoice processing and ERP integration.

Highest-rated features

Invoiced offers a whole range of features for the automation of accounts receivable and accounts payable in a way that keeps you in control of your due liabilities.

- Digital billing

- Recurring billing and bill generation

- Management

Invoiced Pricing

Currently, Invoiced hasn’t put up its prices. To get a sales quote, get in touch with the sales team.

What users like best:

"My company recently switched to invoices, and I have found that things run much more smoothly, and you can see everything in one place. The chasing feature is amazing and probably one of my favorite aspects of Invoiced."

- Invoiced Review, Emily K.

What users dislike:

"Some limitations will come up here and there. I have found some workarounds. For the most part, everything you need is available, and then you can make suggestions for the one-off things. We found this week that when we added pending line items to clients' invoices, the client never saw these updated amounts on their reminder emails since they were pending line items. Other times we ran into clients only sometimes getting their reminder emails. It feels like sometimes email delivery is hit-and-miss when you send it from your email STMP."

- Invoiced Review, Zeke D.

Does Invoiced have a local presence in India?

Invoiced operates from a centrally-located station in the USA, with members distributed across US time zones. At present, they do not cater to Indian software users.

11. BlueSnap Accounts Receivable Software

BlueSnap Accounts Receivable Software orchestrates your small- and large-scale billing demands and creates payment workflows based on client demographics. It facilitates bids and quotes, prepares invoices for cross-border transactions, and automates subscription renewals from a unified platform.

Highest-rated features

For a diverse range of clients and associated payments, BlueSnap acts like a single resolution. Its feature portfolio is one of the best in the billing software industry.

- Unified reporting

- Cross-border payments

- Chargeback management and fraud prevention

BlueSnap Accounts Receivable Software pricing

BlueSnap Accounts Receivable Software hasn’t shared its pricing details with the public. To learn more, talk to a sales representative.

What users like best:

"Sending emails with electronic signatures was never as simple because it is adaptable and easy to handle. There is less margin for error when executing it, and therefore you reduce expenses by not paying staff to do the work that the platform will now do. It has the best integration with other platforms."

- BlueSnap Accounts Receivable Software Review, Stephany M.

What users dislike:

"It would be great to have a feature that allows for a custom dashboard or widget configuration."

- BlueSnap Accounts Receivable Software Review, Brian H.

Does BlueSnap have a local presence in India?

Yes, BlueSnap operates one of its offices in India. Here are the address details of the corporate branch:

Address: BlueSnap India Private Limited, Unit-S 2213, Katha No. 287, Sy. No.-5, Hoodi Village, MahadevaPura, Hobli, Bangalore 560048, Karnataka, India

The importance of billing software for small businesses

Businesses or new startups run into confusion as they tinker with Excel spreadsheets or third-party invoice-creation platforms for financial operations. These simplistic tools aren’t powered with enough features to analyze cash metrics and calculate net profits. Proper billing software digitizes cash flow operations and evaluates current assets, net margin, EBIT (earnings before tax), and retained earnings to calculate closing cash.

Billing software isn’t only used to track expenses but also vendor and supplier payments. It maintains the fluidity of the entire supply chain, inventory control, and manufacturing network by disbursing payment, updating databases, and sending reminders for deadlines.

Integrating billing software with CRM software gives you a complete lead profile for your buyers and vendors, with payment histories, contract renewals, upsells, and onboarding and deboarding.

With billing software, you can make templates from your regular financial workflows, like invoice recording, transactional activations, and closing accounts. This helps keep the load off finance and accounting teams and groups all operations into one window.

Features of billing software for small businesses

There is a reason why businesses start off by investing in robust billing software as their sales gain momentum. Evaluating income and expenditure isn’t an easy process, and it needs a skilled system with the following features.

- Invoicing capabilities: Whether liaising with a supplier to source raw materials or estimating production costs, billing software can create invoices for all outward expenses.

- Customizable templates: Billing software comes with a predefined set of templates for different categories. The look and feel of a vendor invoice might differ from a customer invoice or a tax invoice. Billing software takes care of these nuances.

-

Recurring invoices: The software automates billing processes by updating vendor and business in real-time. It comes packed with different invoicing templates that can be used within an automated payment workflow. This way, a record of invoices is maintained, and production requirements become simple to track.

-

Automated payment reminders: During subscription renewals or wholesale deals, businesses need to send regular reminders to avoid late payments. Billing software helps you with crucial tasks like sending payment deadlines or bank notices to the proper parties.

-

Expense tracking: With reporting dashboards, businesses keep an eye on their implicit and explicit expenses. Expense tracking smartly allocates budgets toward employee-based HR activities, marketing and branding, and other obligations to help you monitor your expenditure in real-time.

-

Integration with CRM: Linking every client’s financial details to their lead profiles in CRM keeps teams on the same page. Recent payments, upcoming invoices, applicant tracking, bank account information, and upsell and cross-sell opportunities are all identified through CRM data.

-

Payment options: Different modes of payment are available in billing or invoice platforms. From making invoices to disbursing cash, everything is carried out in a comprehensive application. Users enter data from payment gateways like PayPal, Billdesk, and e-wallets into the billing software stack, which digitizes and secures online transactions.

-

Credit card payments: Billing software supports credit-based lender approvals, equal monthly installments, and loans and credit financing. Using an efficient platform like this invites greater scales as consumers get curious about the impressive checkout process of business. Supporting credit financing lets businesses make more money by selling items on credit.

- Bank transfer support: For e-commerce and retail businesses, being flexible with online payments is important. Billing companies partner with leading banks to enable smooth checkout and direct revenue acquisition. Bank transfers are the most common mode people go for since they feel it’s more secure than e-wallets.

- Reporting and analytics: Billing software is characterized by an advanced reporting dashboard that helps you track resource allocation per task, budget spending, remaining income, and tax dues. Each metric is sorted purposefully, without any room for error.

-

Fraud detection: Auditing transactions is a big part of invoice generation that businesses often forget. Getting blindsided by these loopholes might result in financial scams. These platforms verify the authenticity of the user before initiating any activity on the bank account.

Best billing software for small business in India: Frequently asked questions (FAQs)

1. Can I integrate billing software with business accounting software?

Yes, you can do that. Once you link your billing account to accounting software, the software syncs products, invoices, customers, and payments. Businesses can monitor their activity logs, risk probabilities, available balance, transaction success or failure, and other processes without depending on any other entity for updates.

2. What is the difference between billing software and accounting software?

Accounting software maintains an overall general ledger for business transactions. It has accounting features like client databases and transactional summaries of different deals. They serve as a logbook and can be used for tax liability, equity financing, shareholder reporting, and business analysis. Billing software is only used to create and send invoices to maintain a steady chain of client and vendor payments.

Businesses depend on it to automate recurring payments, build timesheets, and supervise account payables. It comes pre-defined with invoicing templates, online invoicing manuals, and cloud-based productivity tools that make invoice generation fun and engaging.

3. Does billing software help with tax calculation?

A billing integration feature helps file TDS, income tax, GST,, excise, and other types of taxes on annual income. It also offers vendor communication, inventory management, and purchase order management, which can reduce paper-based heavy lifting.

4. What is subscription-based billing?

SaaS businesses often switch to subscription-based billing to make themselves more prudent to the masses. Basically, it’s a payment model where you get service in exchange for a monthly, quarterly, or yearly subscription fee. Subscription billing is initiated as the customer inches toward the end of the subscription before it needs to be renewed.

5. What is the best free invoicing software for small businesses in India?

Zoho Invoice has emerged to be the best free invoicing software in the Indian business segment, with 95% of buyers saying that Zoho Invoice is headed in the right direction. With a 96% rating for quality of support, Zoho is the brightest e-billing and invoice management system in India. Further, it’s free of charge and 100% on the cloud. Small business owners, freelancers, project management teams, and other entrepreneurs all find use for Zoho Invoice.

6. Why should I trust G2’s Grid Report for small businesses?

G2 Grid for small businesses heralds an unbiased comparison among different software for small businesses. Our billing software category has been analyzed by trusted market research experts on various grounds, like customer satisfaction, customer reviews, market presence, ease of use, ease of admin, and ease of budget. These impartial scores help genuine software prospects make authentic purchase decisions.

G2 also has one of its biggest workforce based out of the Asia Pacific headquarters in India. Find us here: 1st Sector, HSR Layout, Bengaluru, Karnataka, 560034

File away the manual spreadsheets for payroll calculation and learn about the best payroll software in India in 2023 to keep your employees happy.

Shreya Mattoo

Shreya Mattoo is a Content Marketing Specialist at G2. She completed her Bachelor's in Computer Applications and is now pursuing Master's in Strategy and Leadership from Deakin University. She also holds an Advance Diploma in Business Analytics from NSDC. Her expertise lies in developing content around Augmented Reality, Virtual Reality, Artificial intelligence, Machine Learning, Peer Review Code, and Development Software. She wants to spread awareness for self-assist technologies in the tech community. When not working, she is either jamming out to rock music, reading crime fiction, or channeling her inner chef in the kitchen.